Three Success Stories: Proof That Supply-Side Economics Works

“Little else is required to carry a state to the highest degree of opulence from the lowest barbarism, but peace, easy taxes and a tolerable administration of justice.” — Adam Smith

Earlier this month, I had the pleasure of spending time with Finn Kydland, the 2004 Nobel laureate in Economics. I arranged to have him speak at the Mont Pelerin Society meetings in Oslo, Norway. He gave a great presentation on the need for a stable, long-term government policy that includes a low flat tax.

In 1977, he and Edward Prescott wrote an influential paper entitled, “Rules Rather than Discretion,” where they concluded that “active” intervention by the federal government “may very well be dangerous and it is best that it not be attempted.” Instead, they argued, “Reliance on policies such as a constant growth in the money supply and constant tax rates constitute a safer course of action.”

For this paper and another one, “Time to Build,” Kydland and Prescott were awarded the Nobel Prize in Economics in 2004. It was well deserved!

The Best of the Rest: Three Examples of the Triumph of Supply-side Economics

Kydland gives three examples of countries that have outperformed their regional peers because of what he termed “time consistency”: Hong Kong in Asia, Ireland in Europe and Botswana in Africa.

Most economists were surprised by these choices. Their achievements were not predictable, but supply-siders will be impressed.

Let’s look at each case:

Hong Kong #1 in Asia (Red Line)

Why did Hong Kong slowly but surely leap into #1 among Asian economies in terms of per-capita gross domestic product (GDP)?

There are lots of reasons but its status as the #1 country in the Economic Freedom Index is paramount, including an independent judiciary, rule of law, sound fiscal and monetary policy (no national debt) and free trade when it comes to government policy.

The rules of the game in Hong Kong have remained constant over the years (until the Chinese Communists took over, sadly). It has a progressive tax that starts at 2% and goes to a 16.5% flat tax after HK$50,000. It also do not tax capital investment (in the form of interest, dividends or capital gains). Unlike the United States, Hong Kong does not change its tax policy every few years. It has been more or less the same since 1960! So, businesses can plan for the long term.

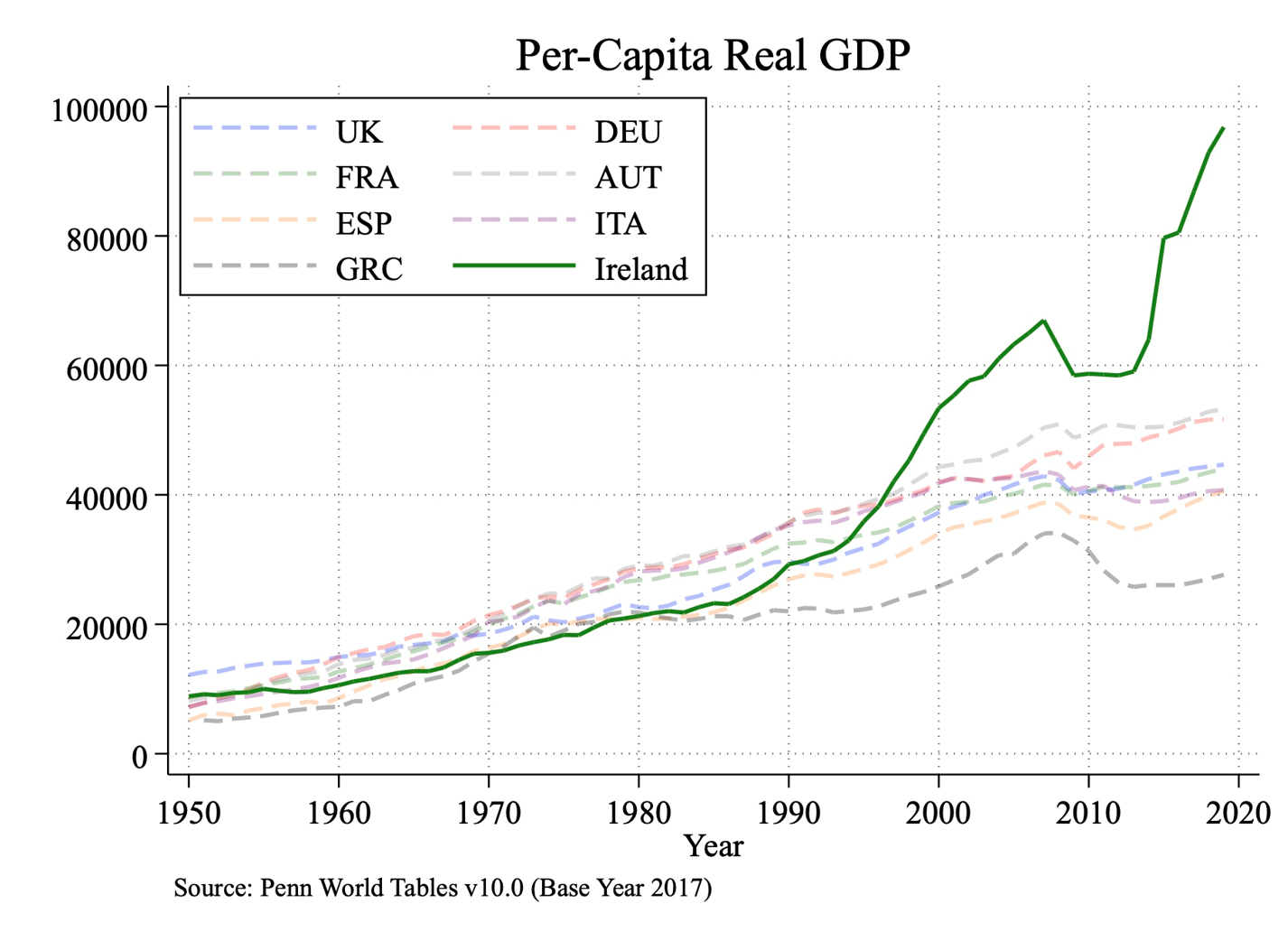

Ireland #1 in Europe (Green Line)

Ireland has now catapulted itself into the position of being #1 in Europe (see chart).

Ireland was an unlikely choice, but in 1999, the government reduced its corporate tax from 32% to 12.5%, and kept it there. Multinational corporations noticed and have been calling ever since.

It should also be noted that Ireland does have a 23% value added tax (VAT). It also has a substantial national debt, so the country is not in as good shape as Hong Kong.

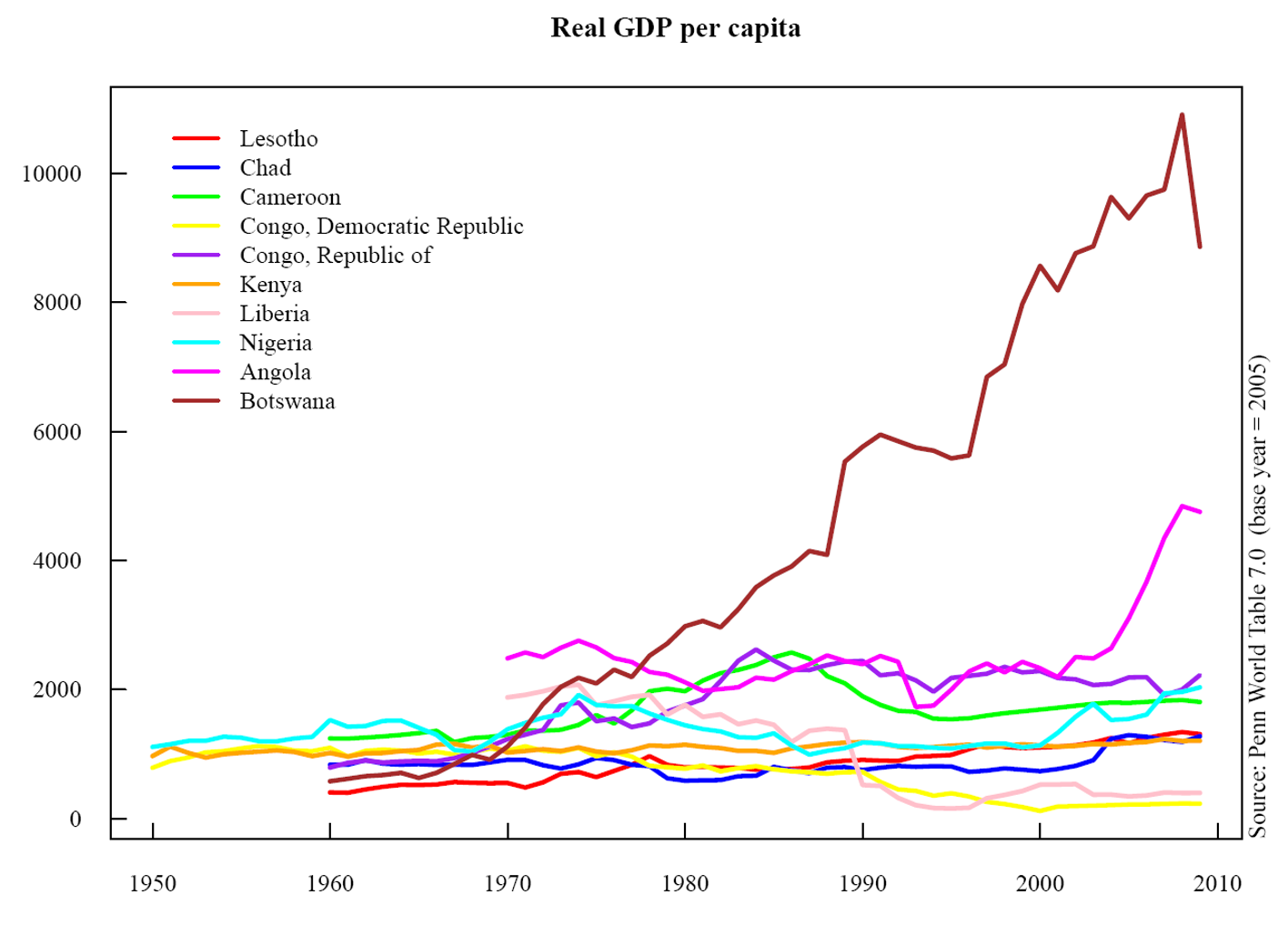

Botswana #1 in Africa (Brown Line)

In Africa, most nations have been basket cases since they declared their independence from colonial rule. One exception is Botswana. After gaining its independence in 1966, it held free elections and its democracy has worked well since.

Botswana enjoys a “tolerable” administration of justice; the corruption index is low compared to its neighbor Zimbabwe. It encourages foreign investment and minimizes trade barriers. It has a value added tax (VAT) of 12%, a flat corporate tax of 22% and a personal income tax of 25%. It’s ranked as the #49 freest country in the world by the Fraser Institute’s Economic Freedom Index.

In sum, it pays to adopt limited government and laissez faire policies that include low taxes, the rule of law, an independent judiciary, free trade and sound money — and to maintain this policy for the long run so that business can flourish.

America in Decline: Can We Turn It Around?

The United States has had a long tradition of peace, prosperity and liberty, thanks to the Constitution, but its policies have been gradually eroded over the years, and now we are suffering stagflation, bear markets and political instability.

The United States has gradually declined in terms of the Heritage Foundation’s Economic Freedom Index, and it is now ranked #25.

What America needs is a good dose of supply-side economics and a balanced budget for the long run.

‘The Crash that Ended All Crashes’

Yesterday was Oct. 19, the 35th anniversary of the stock market crash in 1987, when the Dow Jones Industrial Average fell 22.5% in just one day (known as Black Monday).

I have a special offer at the end of this edition Skousen CAFE in celebration of “the crash that ended all crashes.” See below.

As long-term subscribers know, I issued a “sell all stocks” alert six weeks before the crash. October 19, 1987, turned out to be my 40th birthday.

However, my second big prediction has also held up. I’ve argued that bear markets will come and go, but we won’t see any actual stock market crashes in the future, as defined as a case where the market tanks 10% or more in a day.

I offer two reasons:

1. The federal government established the Plunge Protection Team (comprised of the Treasury Secretary, Fed Chairman, Securities and Exchange Commission (SEC) and other financial regulators) that will intervene by cutting interest rates and aggressively buying financial assets to keep a crash from developing.

2. Circuit breakers are now in place. When the market falls 7%, 13% or 20% in a day, trading will be halted.

So far, my prediction has come true, at least in the United States. We’ve witnessed declines of 5% in the market in a day (such as in 2008 and 2020) but no more than that. Stocks have declined as much as 50% over several months, but never that much in a day.

We are currently in a bear market, engineered by the Federal Reserve’s decision to aggressively raise interest rates. Stocks are down 20% to 35%. These days, investors are looking for bargains. Even so, Wall Street will remain volatile, given the growing possibility of an inverted yield curve.

The Bears Come Out of Hibernation: Report from the New Orleans Conference

Last week, I returned to New Orleans for the first time in two years for the annual “gold bug” conference. It was great to see a vibrant French Quarter — nobody was wearing masks or engaged in social distancing on Bourbon Street!

The turnout was surprisingly large, given that precious metals are in a bear market, along with stocks. Gold is down 10% this year, despite a 40-year high in price inflation.

But the gold bug crowd was anxious to hear what the prophets of doom think about the future and to see bargains in the exhibit hall of penny stocks. They were not disappointed. Jim Rickards predicted a deflationary depression 2023. Jim Grant, editor of Grant’s Interest Rate Observer, saw much more inflation ahead. His speech title was “One Quadrillion Dollars an Ounce”! George Gammon, the “Rebel Capitalist,” predicted that we are near the beginning of a new “supercycle” in commodities. And Rick Rule’s workshops on private placements in mining companies were standing room only.

My talk was on “Seven Danger Signs for Investors,” especially panic selling and investing too much in high-risk penny stocks.

I did stick my neck out and predict that Fed Chairman Jay Powell would be forced to cut interest rates after a dollar debt crisis emerged in 2023. Stocks and commodities would take off at that point.

Funny Line at the Closing Panel

The closing panel at the Saturday night banquet was memorable. Gary Alexander, the moderator, interviewed all the old-timers at the conference: Rick Rule, Adrian Day, myself and Brien Lundin, the conference producer.

Rick Rule, Brien Lundin, Gary Alexander, Adrian Day and Mark Skousen (standing).

Brien came up with a clever line, “I can prove any trend if you allow me to pick the beginning and the end.”

In response, I said that I’d add that to the next edition of my book “The Maxims of Wall Street.”

Suddenly, all the other panelists handed Adrian Day a $20 bill. He had just won a bet that I would mention my book within the first 10 minutes of the panel discussion! The audience laughed, and so did I.

Special ‘Birthday’ Offer This Week

Admittedly, I’m a big fan of the “Maxims” because, as Dennis Gartman says, “It’s amazing the depth of wisdom one can find in just one or two lines” in the book.

During this bear market, here are a few:

“In a bear market, the winner is he who loses the least!” — Dick Russell

“Nobody is more bearish than a sold-out bull.” — Anonymous

“Nothing can make the spirit fly higher than finding a bargain when you’re the buyer; and nothing can make the spirit sink deeper than finding it later a whole lot cheaper.” — Wendell Brock

“The hardest thing to do is hold onto your stocks during a bear market.” — Mike Turner

Dennis keeps it on his desk and refers to it daily. No wonder nearly 50,000 copies have been sold.

The book has become a collectible. I noticed that an autographed copy was recently sold on eBay for $60!

In honor of the Oct. 19 stock market crash and my birthday, if you order my book, “The Maxims of Wall Street”, this week, each copy will be dated October 19, 2022, and numbered. Who knows, it may be a collector’s item someday!

A Perfect Gift for the Holidays

I offer a bargain price for the “Maxims”: only $20 for the first copy, and $10 for all additional copies. They make a great gift book during the holidays. If you order a box (32 copies), the price is only $300. I number and autograph all copies, as well as mail them with a birthday stamp at no additional charge if mailed inside the United States.

To order, go to www.skousenbooks.com.

My next stop is the Orlando MoneyShow.

Join me at the Orlando MoneyShow, Oct. 30-Nov. 1, Omni Hotel Champions Gate, Florida. Other guests include Steve Forbes, Ed Yardeni, Bob Carlson, Bryan Perry, Bruce Johnstone, Terry Savage and Keith Fitz-Gerald. For more information, go to Skousen.MoneyShow.com and use code 057734 for special subscriber pricing.

Good investing, AEIOU,

![]()

Mark Skousen

You Nailed It!

Rejecting Identity Politics

“There is no left or right, only up or down.” — Ronald Reagan

Back in February, I wrote a Skousen CAFE column on my decision to stop using the divisive political terms “left” and “right.” You can read it here.

Senator Orrin Hatch speaks to the American Enterprise Institute.

Recently, I read that the late Senator Orrin Hatch said something similar in his retirement speech to the Senate on December 2, 2018. He said:

“To achieve unity that is our namesake [United States of America] we must reject the politics of division, starting with identity politics. Identity politics is nothing more than dressed-up tribalism. It is the deliberate and often unnatural segregation of people into categories for political gain. This practice conditions us to define ourselves and each other by the groups to which we belong — in other words, the things that divide us rather than unite us.

“When institutionalized, identify politics causes us to lose sight of our shared values. In time, we come to see each other not as fellow Americans united by common purpose but as opposing members of increasingly narrow social subgroups. And thus begins the long descent into intersectional hell.

“Our better angels call on us to resist identify politics by recommitting ourselves to the American idea, the idea that our immutable characteristics do not define us. It’s the idea that all of us — regardless of color, class, or creed — are equal, and that we can work together to build a more perfect union. When we heed this call, we can achieve unity. And ideas — not identity — can resume their rightful place in our public discourse.”

Amen! That’s why we focus and debate on individual issues at FreedomFest instead of labeling people into various categories. When labeling begins, the thinking stops.