Indiana Jones (A.K.A. Mark Skousen) Enters the Temple of Doom and Gloom!

“If you want to be a good archeologist, you gotta get out of the library!” — Indiana Jones’s advice to students

As many of you know, in addition to writing my investment newsletter, I have been a part-time teacher at major universities for the past 35 years, including Rollins College, Columbia University, Mercy College and now Chapman University.

Last year, I was appointed the first Doti-Spogli Endowed Chair of Free Enterprise at Chapman. Adjunct does good!

Last week, one of my students came up to me and said, “You’re the Indiana Jones of Economics.”

Maybe so. Like Indiana Jones, I teach part-time, one class a semester, because I’m busy most of the time being a financial economist and businessman — writing my newsletter, speaking at conferences, meeting with top business leaders and government officials and traveling the world, all in search of financial treasure. Just like Indiana Jones in the famous movie series.

What’s even more amazing is that, in 1993, I dressed up as Indiana Jones at the Orlando MoneyShow! Let me explain.

Indiana Jones (a.k.a. Mark Skousen) at the Temple of Doom and Gloom, Orlando MoneyShow, March 1993

The Value of Practical Experience

Indiana Jones rightly told his students, “If you want to be a good archeologist, you gotta get out of the library!” I feel the same way with regard to economics.

If you want to be a good economics professor, you gotta get out of the classroom! Too many academic professors have little or no experience in the real world, making payroll, hiring and firing people and seeing first-hand the thrill of victory and the agony of defeat in business. They learned economics from a textbook.

After getting my Ph. D. in economics at George Washington University, I started working in the business world as the managing editor of an investment newsletter, being an author and book publisher, consulting with major corporations (including IBM) and traveling the globe (77 countries and counting).

It was a real eye-opener. I discovered that the economies of many nations were very different from what I learned in the textbooks. For example, academic economists reported that Japan was stagnating. The reality was different — the Japanese people were wealthy and busy as bees.

Many of the Textbooks Lacked Real World Experience

I was told by Paul Samuelson in his popular textbook that Communist Russia “is proof that, contrary to what many skeptics had earlier believed, a socialist command economy can function and even thrive.” In the late 1980s, I visited the Soviet Union with my wife and two children, and we found just the opposite — the stores were empty of basic goods and full of cheap products that nobody wanted. The Russians were fed up. The end was near.

It was because of my business experience that I realized that economics textbooks needed to start with the profit-and-loss (P&L) income statement, not just supply and demand curves. I think “Economic Logic” is the only textbook that starts with a P&L statement, and business students love it.

My GO Breakthrough

In the Indiana Jones series, Indy’s curiosity led him to find the Holy Grail. My business background helped me make my biggest breakthrough in economics: the top line in national income accounting — Gross Output (GO). In accounting, there is a “top line” (sales/revenues) and “bottom line” (profits) in the financial statements of all publicly-traded companies. I discovered the same thing in economics. For years, economists focused on the bottom line — Gross Domestic Product (GDP) measures the value of final (finished) goods and services of a country in a year. But GDP leaves out a critical part of the economy — the supply chain. When you add in the value of the supply chain, you get Gross Output (GO), a measure of total spending in the economy. I labeled it the top line in national income accounting.

GO is the missing piece of the macroeconomic puzzle; one can learn a lot about the ups and downs of the economy by examining GO. Moreover, GO is a good predictor of the next quarter’s GDP. (To read my latest press release, go to www.grossoutput.com).

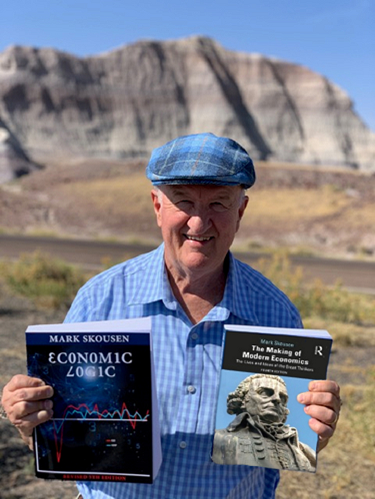

Note: My “Economic Logic” textbook is the first to fully integrate GO into national income accounting. I’m working on the sixth ed. of “Economic Logic,” which will be released next month. The fifth edition, published in 2017, is available as a paperback and on your Kindle on Amazon.

My other textbook, “The Making of Modern Economics,” is now in its 4th edition and available at the discounted price of $35 at www.skousenbooks.com.

Taking on the Prophets of Doom and Gloom

As long-time subscribers know, I’ve dressed up as famous people from time to time as a part-time actor, including Benjamin Franklin and General George Patton. It’s been a lot of fun and a good way to offer memorable advice to investors.

Throughout my some 40 years speaking at the MoneyShow, the New Orleans conference and FreedomFest, I regularly take on the permabears, gold bugs and Cassandras who predict bear markets and crashes.

I wrote about my confrontation with the doomsayers in 1985 a few weeks ago in Skousen CAFÉ.

In the summer of 1989, I was in a debate with a financial guru who predicted a collapse in the economy and the stock market in the 1990s because of the AIDS crisis. In that debate in Orlando, I argued for prosperity in the 1990s and made two predictions: The Berlin Wall would be torn down, and the federal budget will achieve a surplus in the 1990s. The audience laughed out loud when I made them, but both came true.

Why I Dressed Up as Indiana Jones

At the Orlando MoneyShow, I appeared as Indiana Jones and entered the “Temple of Doom and Gloom” at the conference, which was full of bearish sentiment. Everyone seemed to be pessimistic about the future after a Democrat, Bill Clinton, became president, and we were suffering from a mild recession. To them, the sky was falling.

A year later, in 1994, Congressman Newt Gingrich and the Republicans took over the House. It was a turning point in politics.

Soon after, I was at another conference and listened to a panel of technical analysts, four of the top chartists in the country, debating the outlook for the economy. All four were either bears (advocating shorting the market), or timidly cautious about the market. Other investors were on the sidelines and were heavily invested in cash.

Not me! Ironically, the panel discussion occurred on the day the Dow Industrials rose sharply. That’s the problem with most technical traders. They’re fine when the trend continues, but they have a hard time adjusting to a fundamental change.

With the Republicans taking over Congress in the mid-1990s, I predicted a recovery in the stock market. It was a political paradigm shift. I predicted a major bull market, especially in Nasdaq stocks. I boldly predicted “By the year, 2000, the Nasdaq Index (currently around 730) would double and then double again!”

It actually did better than that, hitting 5,000 in March 2000, before crashing. (No, I didn’t predict the 2000-2003 bear market in the Nasdaq.)

‘Bears Make Headlines, Bulls Make Money’

Over the 43 years that I’ve written my investment newsletter, Forecasts & Strategies, I’ve learned a big lesson: As long as America remains fundamentally a free-market capitalist economy, the stock market will continue to move higher in the long run. It will suffer corrections from time to time (like 2022), but they should be viewed as buying opportunities.

As Sir John Templeton said, “If you are a long-term investor, you will view a bear market as an opportunity to make money.” (“Maxims of Wall Street,” p. 110)

Sometimes, when the government raises taxes, causes inflation and imposes new regulations and mandates, Wall Street can go through lengthy bear markets, like it did from 1966 to 1982 and the period from 2000 to 2010.

Could we be facing something similar now?

Perhaps. I see slow growth ahead, punctuated by recessions from to time, with the world being burdened with a growing military-industrial complex, a bloated bureaucracy, excessive government debt, more debilitating regulations, a permanent welfare state, an incredibly complex tax system and politicians falling all over each other to spend more on their pet projects. We also have a Fed that overreacts to everything.

New technologies can mitigate these burdens, but not entirely. Perhaps there is a white knight out there coming to put America back on a sound fiscal and monetary basis, but I fear Humpty Dumpty has fallen and can’t be put together again. I don’t see America becoming another Venezuela, but neither do I see it as another Singapore.

It’s easy to become pessimistic. But perhaps we can learn something from Adam Smith, who was the ultimate optimist. Nearly 250 years ago, he wrote, “The uniform, constant, and uninterrupted effort of every man to better his condition… is frequently powerful enough to maintain the natural progress of things toward improvement, in spite both of the extravagance of government, and of the greatest errors of administration.”

Even with all the bad news out there, I remain optimistic.

My Story Now Told in ‘We Three Boys’

I’ve kept a journal for most of my life, and at some point, I’ve intended to write a full-length autobiography.

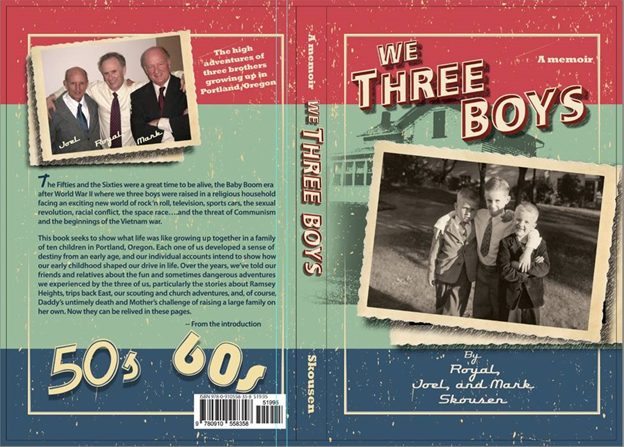

Actually, I’ve already started in the form of the recent privately published book, “We Three Boys: A Memoir” of the high adventures of my two older brothers, Royal and Joel, and me growing up in Portland, Oregon, in the 1950s and 1960s.

The book covers the first 20 years of our lives, plus a summary of our lives after leaving Portland. It is 244 pages long and is fully illustrated with over 76 photographs. Royal is a retired professor of linguistics at Brigham Young University and is considered the genius in the family; and Joel is a former Marine, an expert in designing survival homes and editor of The World Affairs Brief.

The book tells the story of our parents and ancestors. My parents raised 10 children. My father, Leroy Skousen, was like his older brother, Cleon Skousen, an FBI agent who was “available for dangerous assignments.” Sadly, he died at age 46, leaving behind 10 children. My mother grew up in Pittsburgh and knew Senator Orrin Hatch as a child; It is through her that I’m related to Benjamin Franklin. I tell that story in the book, too.

The ’50s and ’60s were a great time to be alive, as it was the Baby Boom era after World War II, and we three boys were raised in a religious household facing an exciting new world of rock ‘n roll, television, sports cars, the Sexual Revolution, racial conflict, the space race…and the threat of communism and the Vietnam War.

I’m selling each copy for only $17. They are autographed and mailed at no additional charge if mailed inside the United States. To order, go to www.skousenbooks.com. It’s a keepsake.

Meet Me This Saturday in Fountain Valley, California

Note! This Saturday, Jan. 14, at 9 a.m., I will be speaking at the Orange County, California, chapter of the American Association of Individual Investors (AAII). My topic is “Investing in 2023: Should You be a Bull, Bear or Chicken?” The address of the meeting is The Center of Founders Village, 17967 Bushard St., Fountain Valley, CA, 92708. To reserve a spot, email Stephanie at sdavis388@gmail.com. There is a nominal charge for attending. I will be bringing copies of “The Maxims of Wall Street” and “The Making of Modern Economics” — my two biggest bestsellers. If you can’t make it, go to www.skousenbooks.com, and I will send you autographed copies!

IMPORTANT ANNOUNCEMENT: We are having our Eagle Virtual Trading Event on Thursday, Jan. 19. If you haven’t signed up for this yet, there’s still time. Just click here now to sign up for free. Believe us, you won’t want to miss this online event — as we bring together all of Eagle’s investment experts at the same time to reveal our Top Six Picks for 2023. Reserve your seat now by clicking here.

Good investing, AEIOU,

![]()

Mark Skousen

You Blew It!

’60 Minutes’ Resurrects Climate Alarmist Paul Ehrlich

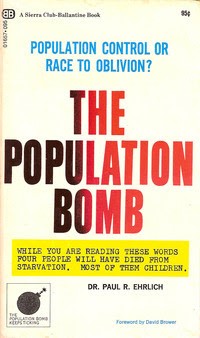

“In the 1970s and 1980s hundreds of millions of people will starve to death.” — Paul Ehrlich, “The Population Bomb” (1968)

Remember Paul Ehrlich and his alarmist book “The Population Bomb”? He’s long been discredited for his Apocalyptic predictions, but “60 Minutes” brought him back to life.

This past week, “60 Minutes” interviewed the 90-year Paul Ehrlich, and he hasn’t much repented. He and his colleagues now warn about the “mass extinction” of the species. You can watch the interview here.

According to Ehrlich’s colleagues, the Earth is facing an alarmist trend of 70% of species becoming extinct. Is this true? They specifically mention the grizzly bear in California, which now only exists on the state flag. But what they don’t say is that the grizzly bear became extinct in California over 100 years ago!!!

They blame it on humans, which, they say, have “taken over” 70% of the planet. I don’t know about you, but when I drive or fly across America, I’d say that over 70% of the land is empty.

Here’s a review of Paul Ehrlich and how wrong he has been over the years. It states that he’s not only wrong, but also very destructive.

Have you seen this short video of Paul Ehrlich back in the 1970s regarding his alarmist views about overpopulation? At the end, he says if we can’t persuade people to have only one or two children, we should put them in jail. China must have been listening. They say Ehrlich is the one responsible for China’s disastrous one-child policy. Here’s the video.

On Twitter, Paul Ehrlich responded by saying, “’60 Minutes’ extinction story has brought the usual right-wing out in force. If I’m always wrong so is science, since my work is always peer-reviewed, including the POPULATION BOMB and I’ve gotten virtually every scientific honor. Sure I’ve made some mistakes, but no basic ones.”

I question Ehrlich’s claim that he’s made “no basic mistakes.” Did billions of people die because of “overpopulation,” as he claims? No. That seems like a “basic mistake.” Was his urging putting people in jail for having more than two children a “basic mistake”? It was for China. How about this prediction by Ehrlich: “If I were a gambler, I would take even money that England will not exist in the year 2000.”

Has he won “virtually every scientific honor”? Yes, he received the MacArthur Fellowship (the “Genius Grant”) in 1990. But he has still not won a Nobel Prize! Of course, winning prizes does not make you right.