How Most Investors LOST Money in the #1 Best Performing Mutual Fund Ever!

“Nothing is more difficult than holding on to your stocks in a bear market.” — Mike Turner (“Maxims of Wall Street,” p. 109)

Even though he retired 34 years ago in 1990, Peter Lynch is a legend on Wall Street.

He started off as the manager of a tiny mutual fund at Fidelity Investments in 1977, and by 1990, when he retired, his fund was known as the #1 best-performing mutual fund during a 13-year tenure.

Lynch still holds the record for the best performing mutual fund in history. His Magellan Fund averaged 29.2% annual return, more than double the S&P 500 Index.

He failed to beat the market in only two years; the rest of the time, he overperformed, even while his portfolio consisted of over 1,400 stocks that he personally selected through intense research. As Lynch once said, “Investing without research is like playing stud poker and never looking at the cards” (“Maxims,” p. 71).

How Did He Do It?

His favorite strategy to beat the market was to “buy what you know” (p. 72). He added, “If you like the story, buy the stock” (p. 116). If you see a product that you like and everyone else likes, buy the stock. It is a simple but powerful strategy. And most of the time, it works.

Over the years, my wife and I have bought lots of automobiles and trucks of different makes — Chevrolet, Ford, Chrysler, BMW, Volvo, Honda, even an MGB back in the day… But for years now, we have been buying Avalons, built by Toyota Motors. Today, we have three cars, all Avalons, and find them to be both comfortable, safe and reliable.

So, last November, I recommended Toyota Motors in one of my trading services. It worked out pretty well. Our Toyota stock is up 17% so far, and our call options have advanced over 440%! It’s not quite a “ten bagger,” as Lynch calls it, but we’re on our way.

Peter Lynch Abruptly Retires

Peter Lynch quit at the top of his game in 1990 to spend more time with his wife and three children and has never looked back at how much money he gave up. Maybe he read “The Importance of Living,” by Lin Yutang (See last week’s column, Attention, All Busy-men. Take a Break for Five Minutes to Read This Story – Mark Skousen)

Lynch and I have one thing in common: Both our fathers died of cancer when they were 46, leaving us to become independent. It made a difference in his life, and mine.

He wrote two bestselling books about his experience: “One Up on Wall Street” (1989) and “Beating the Street” (1993). You can see from the titles that he believes it’s possible for investors to beat the market, rare as that is. I have read both of his books and highly recommend them.

Under his leadership, the assets of the Magellan Fund went from $18 million to $14 billion. The fund has increased in size to $25 billion under management today, but it has never performed as well as it did under Lynch’s leadership.

The Thrill of Victory… and the Agony of Defeat

After managing the fund for 13 years, Peter Lynch confessed a shocking fact — one of the greatest ironies in Wall Street lore.

Despite his incredible track record, most investors in the Magellan Fund lost money!

How is this possible? Simple. A Fidelity study showed that the majority of investors in this open-ended mutual fund did not stay invested during the entire 13-year period. They often bought the Magellan Fund at the top of the market and then panicked during a downturn and sold their position.

Their actions were understandable. From 1977 to 1990, Wall Street went through several bear markets: From November 1980 until August 1982, the Dow fell 27%… Then it crashed 22% in one day on Black Monday, October 19, 1987, and recovered slowly… And then, just when Peter Lynch retired in 1990, the stock market unexpectedly turned south by 20%… I’m sure some investors followed Lynch and got out, fearing the worst.

Investors were simply too undisciplined and afraid to stay invested in an open-ended fund that they could sell at any time without penalty.

Emotions, what John Maynard Keynes called “animal spirits,” often drive investors to act irrationally, buying at the top and selling at the bottom, instead of holding on through thick or thin.

As Lynch himself warned, “Everyone has the brainpower to make money in stocks. Not everyone has the stomach” (“Maxims,” p. 51).

Roger Babson said, “Perhaps the foremost lesson which I have learned is that emotions rule the world, rather than statistics, information or anything else” (p. 64).

Paul Getty Gives Sound Advice

What should investors have done? J. Paul Getty said it best: “The seasoned investor buys his stocks when they are priced low, holds them for the long pull rise and takes in-between dips and slumps in his stride… The big profits go to the intelligent, careful and patient investor” (p. 136).

In his classic work “Stocks for the Long Run,” Jeremy Siegel demonstrated that in over 200 years of history on Wall Street, stocks have always come back and moved to new highs. It pays to be patient.

Following Peter Lynch’s Unique Advice Can Make You Rich

Peter Lynch is a wise and experienced investor, and that’s why I quote him 14 times in the “Maxims.” I also quoted this statement in my “Financial Economics” class at Chapman University this week: “Although it’s easy to forget sometimes, a share of stock is not a lottery ticket, it’s part ownership in a business.” (p. 156)

You can see why Dennis Gartman says, “It’s amazing the depth of wisdom one can find in just one or two lines from your book. I have it on my desk and refer to it daily.”

I have just completed publishing the new 10th edition, with over a dozen new quotes. I offer copies at a substantial discount over the retail price if you order from my website, https://www.skousenbooks.com.

The price is only $21 for the first copy, and only $11 for all additional copies. They make a great gift item for friends, clients and relatives. I autograph and number each copy, and mail it at no extra charge inside the United States. Order your copy today!

I’ll be talking about and signing copies of the “Maxims” at the Las Vegas Money Show. Kim Githler, president of the Money Shows, calls it “my favorite book. Every quote is a lesson in finance.” I hope to see you there: Skousen, Mark (moneyshow.com)

You Nailed it!

What is Left? What is Right?

“There is no left or right, only up or down.”–Ronald Reagan (1964)

At last year’s FreedomFest in Memphis, we had a fiery 30-minute debate on “Left, Right, Liberal, Conservative, Progressive: Do These Labels Help or Hinder the Fight for Freedom?”

I hosted the debate with panelists John Fund (National Review), Floyd Brown (Western Journal), Andrew Koppleman (Northwestern University) and Hyrum and Verlan Lewis, authors of “The Myth of Left and Right.”

Good news. The debate is available on FreedomFestTV on Youtube. Check it out here. It is fun to watch (only 30 minutes).

‘Left-Right’ Book Wins Leonard E. ‘Read This Book’ Award

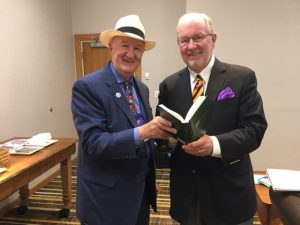

Mark Skousen presents “Leonard E. Read Book Award” to authors Hyrum and Verlan Lewis.

After the session, I presented Hyrum and Verlan Lewis the Leonard E. “Read This Book” Award for their work, “The Myth of Left and Right: how the Political Spectrum Misleads and Harms America” (Oxford University Press, 2023). It is available on Amazon here.

The Lewis Brothers demonstrated that the political left and right have meant different things over time. For example, so called “leftists” used to favor free trade; then under Reagan, “rightists” supported free trade; but now under Trump, they support protectionism and “America First” doctrine.

Unfortunately, in today’s divisive world, political operatives increasingly attack and smear opponents instead of discussing issues civilly.

Many of us have stopped using left and right political labels and it’s been liberating. See my article on this subject here.

I recommended Richard Rahn’s columns in the Washington Times. He has written some great columns without using left and right. Good for him! See Richard W. Rahn | Stories — Washington Times.

Our keynote speaker for this year’s FreedomFest is Harvard Professor Steven Pinker. We are also planning many new debates, which FreedomFest is famous for. Check out this year’s big show here.

See you there: Home – FreedomFest

P.S. We are excited to invite you to a free, live webinar with George Gilder on Thursday, Feb. 15 at 10 a.m. Eastern Standard Time. In this Startup Investing Masterclass, George is teaming up with Jon Medved, the founder of OurCrowd, to discuss investing in private placements. George and John Schroeter from Gilder’s Private Reserve will be interviewing the CEO of George’s latest AI startup pick… so you’ll be receiving a great startup pick just by attending! Click here now to attend this amazing event.

Good investing, AEIOU,

![]()

Mark Skousen