A Tale of Two Conferences: New Orleans vs. New York

In the past month, I attended two investment conferences whose approaches to investing are the opposite of one another.

The first one, the New Orleans Conference, occurred before the Nov. 6 election and serves as the annual gathering of gold bugs. I’ve attended and spoken there every year since 1975, so I recall its biggest turnout was right after Ronald Reagan was elected president in 1980.

There must have been over 2,000 people in attendance for that gathering. What surprised me the most was that almost every speaker there, including Jim Blanchard, the conference organizer, was critical of Reagan and didn’t think he would make any difference.

I thought “Reaganomics” would change the world and I said so. It was time to sell gold and silver and buy stocks, bonds and more traditional investments. Needless to say, my prediction was not well received. Although it took two years to be proven right, we’ve had an incredible run ever since 1982.

No matter how long the bull market will last, most speakers at the New Orleans conference predict the beginning of a financial “Armageddon.” Permabears include Doug Casey, Peter Schiff, Rick Rule and Bob Prechter. Even commodity guru Dennis Gartman believed that commodities, except for oil, are poised to do substantially better than “overvalued” stocks. He made the same prediction last year. We shall see.

The problems facing gold, mining stocks and commodities in general are the Fed’s tight money policy and a strong dollar. Under Fed chairman Jerome Powell, the growth of the money supply (M2) is slowing down and interest rates are rising. The 10-year Treasury rate is 3.14%, its highest level in four years.

Using the Austrian structure of interest rates, the yield curve is flattening, but has not turned negative. If we get an inverted yield curve, where short-term rates are higher than long-term rates, we could be facing another recession and bear market.

But this hasn’t happened. Nor has the spread between risky junk bonds and low-risk Treasury bonds widened. Instead, the spread remained stable during the October sell-off.

Baron Investment Conference in New York

The second event was the Baron Investment Conference in New York City. It was held after the Nov. 6 election. It was on Friday, Nov. 9, the anniversary of the fall of the Berlin Wall.

The Baron conference is held annually in November by Ron Baron, a member of the Forbes 400 Richest People in America and a highly successful mutual fund manager. His one-day conference is famous for providing celebrity entertainment at no charge to shareholders. While he invited all comedians (including Mel Brooks and Billy Crystal) this year, the investment part of the conference was no joke.

Are we headed for recession and a bear market? Ron Baron said he didn’t know, and his investment philosophy doesn’t depend on it. For the Baron Growth Fund (BGRFX), he buys quality companies in a growing industry at a reasonable price and holds for the long term.

In his classic book, “How to be Rich,” J. Paul Getty said the same thing: “It is possible to make money — and a great deal of money — in the stock market. But it can’t be done overnight or by haphazard buying and selling. The big profits go to the intelligent, careful and patient investors, not to the reckless and overeager speculator. The seasoned investor buys his stocks when they are priced low, holds them for the long-pull rise and takes in-between dips and slumps in stride.”

Ron Baron’s strategy has worked well, and his managed funds have outperformed the market. (BGRFX is up over 8% this year.)

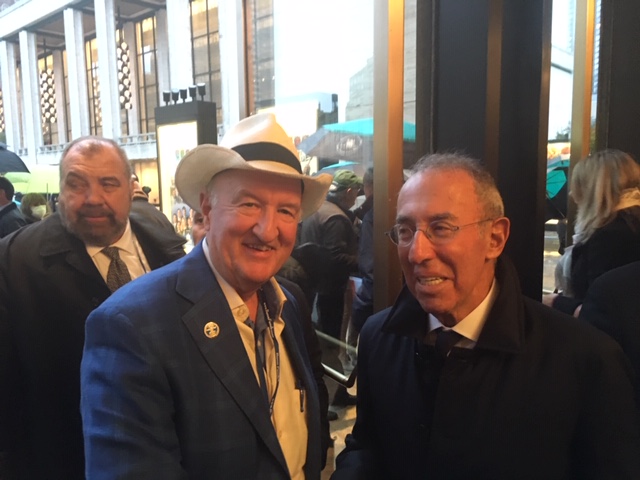

After the conference, I met up with Mr. Baron and asked him what he thought about this historic run on Wall Street. He said that the “Mother of All Bull Markets” benefited from the collapse in stocks in 2008, and that if you took the average stock market performance since 2007, the returns are about average. I looked it up, and the average annualized return since 2007 is 8.2%. Still, not bad!

Good investing, AEIOU,

![]()

Mark Skousen

‘Maxims’ Half-Off Sale for the Holidays

I sold two dozen copies of “The Maxims of Wall Street” at New Orleans. Dennis Gartman told the audience, “I love that book, and keep it on my shelf and refer to it every day. When I’m short half a page in my newsletter, I reach for Maxims and fill in the half page with a pithy quote.”

Gartman said, “It’s amazing the depth of wisdom one can find in just one or two lines from your book.”

The book also has been endorsed by Warren Buffett, Jack Bogle, Bert Dohmen, Richard Band and Alex Green.

Hundreds of valuable Wall Street sayings are found in the one-and-only collection, and they will bring back memories. The book is divided into categories, such as “bulls and bears,” “contrary investing” and “market timing” with more than 800 quotes, proverbs, poems and short stories offering a wealth of insights about investing. It has several sections on “bear markets” and “doomsayers and Cassandras.” It also includes Dennis Gartman’s “20 Rules of Investing.”

As we approach the holidays, “The Maxims of Wall Street” is the perfect holiday gift for your relatives, students, investment friends, stockbrokers, money managers and business colleagues. Buy them by the box and give them out throughout the year.

Stockbroker Rodolfo Milani said, “I find them to be ideal gifts for my best clients. They love it!” The book is beautifully bound in leather-like green with a gold ribbon.

Seize upon a 2-for-1 deal. Buy the first copy for $20 and all additional copies are only $10, and I pay the U.S. postage. Also: If you order an entire box of 32 books, you pay only $300 postpaid.

Hetty Green, the late financier known as the “Witch of Wall Street,” said it best, “When I see something cheap, I buy a lot of it.”

To order, call Harold at Ensign Publishing, 1-866-254-2057, or go to www.miracleofamerica.com. (For orders sent outside the United States, contact Harold at Ensign Publishing for additional charges.)

Cuba is hot as a destination! All cabins aboard the five-star Oceania Insignia for our November 9-16, 2019, cruise (next year) have sold out EXCEPT ours. And we have to turn back any cabins not sold by the end of December. I urge you to sign up now before it’s too late. This week-long trip to Cuba is special — we will be given a private tour in Havana by a free-market economist who actually lives in Cuba and will show us parts of “communist-controlled” Havana that no one else sees. This cruise is not to be missed!

Greg Galloway and I will be speaking on investing. Dave Phillips, president of Estate Planning Specialists, will be talking about estate planning in response to the Trump tax cuts. I also will be giving a talk on the important economic and cultural differences between Latin America and North America.

Plus, my wife Jo Ann, an English professor, will speak on Ernest Hemingway and Cuba. This will be a small private conference with ample opportunity to interact with the speakers and attendees. We’ve already sold over 20 cabins.

Please call Nicole at the MoneyShow (which is organizing the cruise), toll-free at 1-844-225-5838 for a free color brochure, which you can also access here as a PDF. Make your deposit NOW. Cabins are available as low as $2,399 per person/double occupancy, and the price includes airfare from getaway cities, free Wi-Fi and even a $400 shipboard credit. But you must act NOW if you want to join us.

You Nailed It!

Supply-Siders Reveal the Inside Story of ‘Trumponomics’

By Mark Skousen

Editor, Forecasts & Strategies

I just received a copy of “Trumponomics: Inside the America First Plan to Revive Our Economy,” by supply-siders Stephen Moore and Art Laffer. The foreword is written by Larry Kudlow, director of Trump’s National Economic Council.

All three are long-time friends who worked together during the Reagan administration to help create Reaganomics in the early 1980s. So, they are veteran political economists.

All three are Trump supporters, and all three have spoken at FreedomFest, my annual conference in Las Vegas (www.freedom fest.com).

What I like about this book is that it’s not just dry economics, but tells the inside story of how to deal with political leaders during the presidential campaign. For instance, Moore and Laffer say they were skeptical of Trump until they met him. They also state how they pushed the Trump tax cut through in 2017 against strong opposition. They even had to oppose some of their fellow Republicans who wanted to repeal ObamaCare first.

The book also covers one of the most controversial aspects of Trump’s agenda: his trade war with China, Europe and even allies like Canada and Mexico. According to the authors, there’s a method to Trump’s perceived madness. However, the jury is still out whether his negotiations to reduce tariffs between countries will succeed.

The timing might not be the best for this defense of Trump’s economic policies. Certainly, the American economy is not the “greatest in the history of the world,” as Trump recently claimed. The stock market has been in a tailspin recently even though Trump regularly touted it as proof that his policies were working.

Nevertheless, it’s a fun, fast and fascinating read. I urge you to buy a copy for only $16.95 for the hardback on Amazon (43% off retail price of $28.99). Click here to buy it.

My only disappointment is that the book doesn’t have an index. I guess they were in a rush to get the book out.