Who Was the Original Gold Bug?

I hope when I get old

I don’t sit around thinking about it

But I probably will

Just sitting back trying to recapture

a little of the gloria.

—Bruce Springsteen, “Glory Days”

The flamboyant and legendary financial guru Jim Dines (1931-2022) died last week. He was 91 years old.

He was a long-time friend, financial writer, technical analyst extraordinaire and free-market advocate. Mr. Dines, as he always insisted on being called, also was a “gold bug.”

In 1989, we arranged for a picture of the leaders of the “Hard Money” movement at Jim Blanchard’s gold conference in New Orleans.

Mr. Dines is on the left holding a wine glass — always the iconoclast. Of the 20 gold bugs in the photo, only seven of us are still alive: Richard Band, Jim Davidson, Doug Casey, Adrian Day, Lew Rockwell, Joe Bradley and myself.

Mr. Dines was one of the first security analysts on Wall Street to recommend gold at $35 an ounce at a time when the President of the United States and Undersecretary of the Treasury, Paul Volcker, swore that they would “never” allow the price of gold to rise.

Mr. Dines was fired from his Wall Street job for recommending gold, so he began to publish The Dines Letter (www.dinesletter.com), independently and defiantly becoming known as “The Original Goldbug.”

I became acquainted with Jim Dines in the 1970s and loved his charts, his commentary on the markets and politics and his willingness to go with the trend, whether he was a bull or a bear.

In the following decades, we shared the podium at many conferences, including Jim Blanchard’s gold conference in New Orleans and the Gold Show in San Francisco. Everyone remembers how he would surround himself with four or five models, which we called the “hard body movement.”

I still remember the time we met at a conference, and I quoted two contradictory lines:

“Don’t think, feel!” — Bruce Lee

“Don’t feel, think!” — Ayn Rand

To which Jim replied, “Don’t think or feel — look!”

That is, look at the chart, which tells all.

I cite that story (p. 100) and 14 other quotations in “The Maxims of Wall Street.” (You can buy your own copy at www.skousenbooks.com for only $20 for the first copy, then all additional copies are only $10 each).

He is the firth-most quoted financial guru, behind Warren Buffett, Ben Franklin, Jesse Livermore and Gerald Loeb. Here are a few of my favorite quotes:

“When falling, dive!” (p. 111)

“The trend is your friend until it ends.” (p. 115)

“It’s easier to row downriver than upriver.” (p. 116)

“If you don’t use your head, you’ll use your feet.” (p. 127)

“When in doubt, stay out.” (p. 128)

“Moves always take longer than expected.” (p. 136)

“Losses are the cost of doing business.” (p. 170)

“Gold is the hitching post of the monetary universe.” (p. 154)

Regarding the last quote, Jim always claimed he was the “original gold bug.” One time, I disputed that, arguing that there were lots of gold bugs before him, including Dick Russell, Col. Harwood and Sir Harry Schultz (who I understand is still alive and may be 100 years old). Jim sent me a five-page, single-spaced letter disputing my views that are still burning in my files.

One thing is for sure, he was original!

We are planning to dedicate the Global Financial Summit room at FreedomFest to Jim. We look forward to dining off his wisdom. Hope you can join us at www.freedomfest.com.

Long-Time Subscriber Recovers a Whole Year (2002) of Forecasts & Strategies

Recently I was going through the back issues of Forecasts & Strategies, which have been published in 1980, and discovered that an entire year’s worth of newsletters had disappeared.

I have no idea how this happened. Perhaps it was because in 2002, I was president of the Foundation for Economic Education (FEE) in New York and misplaced the issues.

So, out of desperation, in my hotline last Monday, I wrote and asked if any long-term subscribers had copies. Lo and behold, I received an email from a long-term subscriber, Henry Woodruff from Golden, Colorado. He had all 12 2002 issues of Forecasts & Strategies and sent them to me.

Henry told me that he has been a subscriber from the beginning (1980), and has been to all FreedomFest conferences, including FEEFest in 2002.

Going over the events of 20 years ago was quite a walk down memory lane. I thought the bear market was over and was recommending the Nasdaq at the beginning of 2002; it didn’t bottom out until a year later (February 2003).

But I was recommending a lot of income stocks such as Aberdeen Asia Pacific Income Fund (FAX) and mining companies such as Freeport-McMoRan Inc. (NYSE: FCX) and my Flying Five stocks.

Plus, I also was recommending a penny stock called Collectors Universe that was selling for 79 cents a share. Within 20 years, it was bought out at $92 a share! I wish I had held on. To quote Mr. Dines, “One of the hardest things in the world is to hold on to your stocks during a bull market.”

I also reported that in the New Orleans conference in November 2002, almost everyone was bearish on the stock market, including Doug Casey, Adrian Day, Ian McAvity, Jack Pugsley, Rick Rule, Dick Russell, Bob Prechter and even John Templeton!

The market bottomed out in February 2003.

According to my report, Bob Prechter was even bearish on gold, which was at $320 an ounce in November 2002. It was in a major bull market. I never could figure out Prechter’s Elliott Wave theory.

The First FreedomFest Was a Hit!

In May 2002, I also produced FEEFest, the precursor of FreedomFest, in Las Vegas. It was a big hit, and we had nearly 900 attendees, including economist and actor Ben Stein, libertarian Charles Murray, author Dinesh D’Souza and international man Doug Casey.

Nathaniel Branden said it best: “I feel an electricity here that I haven’t felt in years!”

That spirit continues at FreedomFest today, 20 years later. In honor of the first national convention, Ben Stein is making an encore appearance at this year’s festival July 13-16, 2022, at the Mirage Hotel & Casino, Las Vegas.

He will appear on stage with Art Laffer to debate the question, “Is the Laffer Curve Voodoo Economics?” and “Should the Rich be Taxed More?”

This debate will be anything but boring! Can’t wait.

THIS JUST IN! I am happy to announce that entrepreneur and former Democratic presidential candidate Andrew Yang will appear on stage with libertarian Larry Sharpe to discuss the future of the two-party system and Yang’s universal basic income idea. Yang left the Democratic Party to start the Forward Party. He is most famous for advocating the Universal Income Plan to give every adult American $1,000 a month. The sparks will fly!

We have more than 200 speakers at this year’s big show, with keynote speaker John Cleese, the British actor, producer and author; Kennedy, host at Fox Business, as our emcee all three days; a full three-day investment conference; the Anthem film festival; and our first Libertarian Comedy Fest… Plus, Steve Forbes, reporter Glenn Greenwald and financial gurus Jim Roger, Alex Green, Jim Woods, Adrian Day, Doug Casey and Van Simmons.

For all the details on our speakers, panels and debates, go to www.freedomfest.com. Use code Eagle100 and you pay only $499; you can also have up to three additional guests for $399. And students pay only $149.

Or call Hayley at 1-855-850-3733, ext. 202, to register by telephone.

We already have more than 1,100 paid attendees, not counting speakers and exhibitors.

Good investing, AEIOU,

![]()

Mark Skousen

You Blew It!

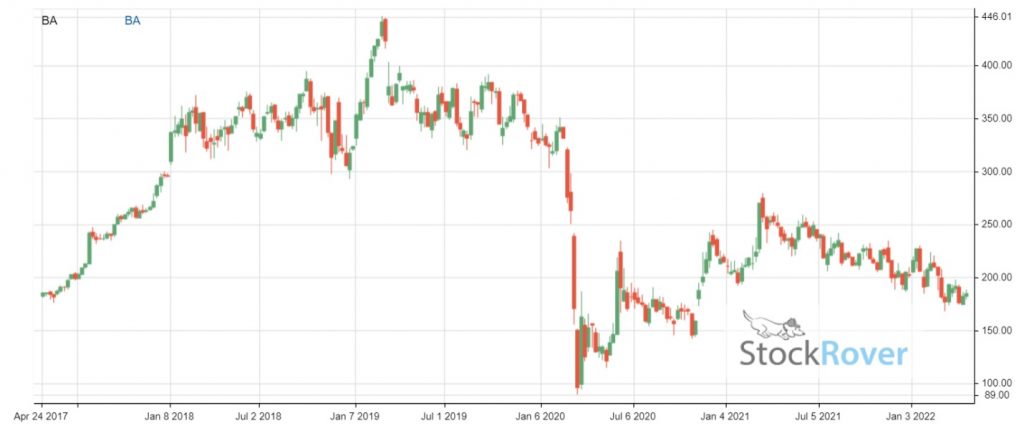

How Boeing Destroyed Its Reputation

“It takes 20 years to build a reputation and five minutes to ruin it.” — Warren Buffett

Last week, I watched on Netflix (NASDAQ: NFLX) the new documentary, “Downfall: The Case Against Boeing.” You can watch the trailer by clicking here.

PBS also did a special on the Boeing 737 MAX fiasco called “Boeing’s Fatal Flaw.” Click here to watch.

For years Boeing had a reputation for building modern and safe 700 series aircraft, such as the 707, 727, the gigantic 747, the 777 and now the 737.

But in 1997, it merged with McDonnell Douglas and the corporate culture shifted to cutting costs and pushing the share price higher.

Boeing was losing market share to France’s Airbus and tried to turn the company around in 2017 with the introduction of the 737 MAX, which had a larger, more efficient engine than earlier versions of the 737. The new jet was extremely popular, and the share price soared.

However, in its bid to expand too rapidly, Boeing added a new feature called the Maneuvering Characteristics Augmentation System (MCAS for short) to help pilots handle the larger engine size in the 737 MAX. But to save time and money, Boeing officials decided not to tell their customers’ airline pilots and concealed “material information” from the Federal Aviation Administration (FAA) about the operation of the 737 MAX and tried to cover up their deception.

In 2019, two 737 MAX planes crashed and a combined 346 people died.

Boeing executives blamed the crashes on the pilots, but it turned out to be a defect in the MCAS. After being charged with fraud, Boeing settled and pay more than $2.5 billion in penalties and compensation. For two years, all Boeing 737 MAX jets were grounded, until the problem could be fixed. Now, they are back in the air.

Still, Boeing’s stock has not recovered. Who knows how long it will take to regain its reputation and its financial status?

Chart generated using Stock Rover. Activate your 2-week free trial now.

Today, more than ever, business leaders need to read John Mackey’s “Conscious Capitalism,” and apply a stakeholder philosophy that is win-win for customers, workers, suppliers and investors. You can read a description of the book and order it online by clicking here.