When Will the Bear Come Out of Hibernation?

“If a business does well, the stock eventually follows.” — Warren Buffett, “The Maxims of Wall Street,” p. 144

Despite the record bull market on Wall Street now spanning more than 10 years, the bears are still not licked. They keep coming out with doom-and-gloom predictions.

The latest is from commodity guru and legendary investor Jim Rogers, who was once ranked one of the top 100 investors in world history. He insists that a major bear market is coming.

“Probably sooner than you think,” Rogers said in latest issue of Barron’s.

Rogers warned it could be worse than 2008 (down 50%), worse than the 2000 Nasdaq crash (down 70%), and maybe even worse than 1929-32 (down 90%).

Sounds scary, until you realize that Rogers had been predicting a crash for years.

Now a bear market is always possible, but it’s not likely to happen unless the economy falls apart, like it did in 2008.

There is a strong correlation between the stock market and the economy in the long run. But the relationship is like a rocky marriage — a couple may get separated, but they never get divorced. They eventually reconcile.

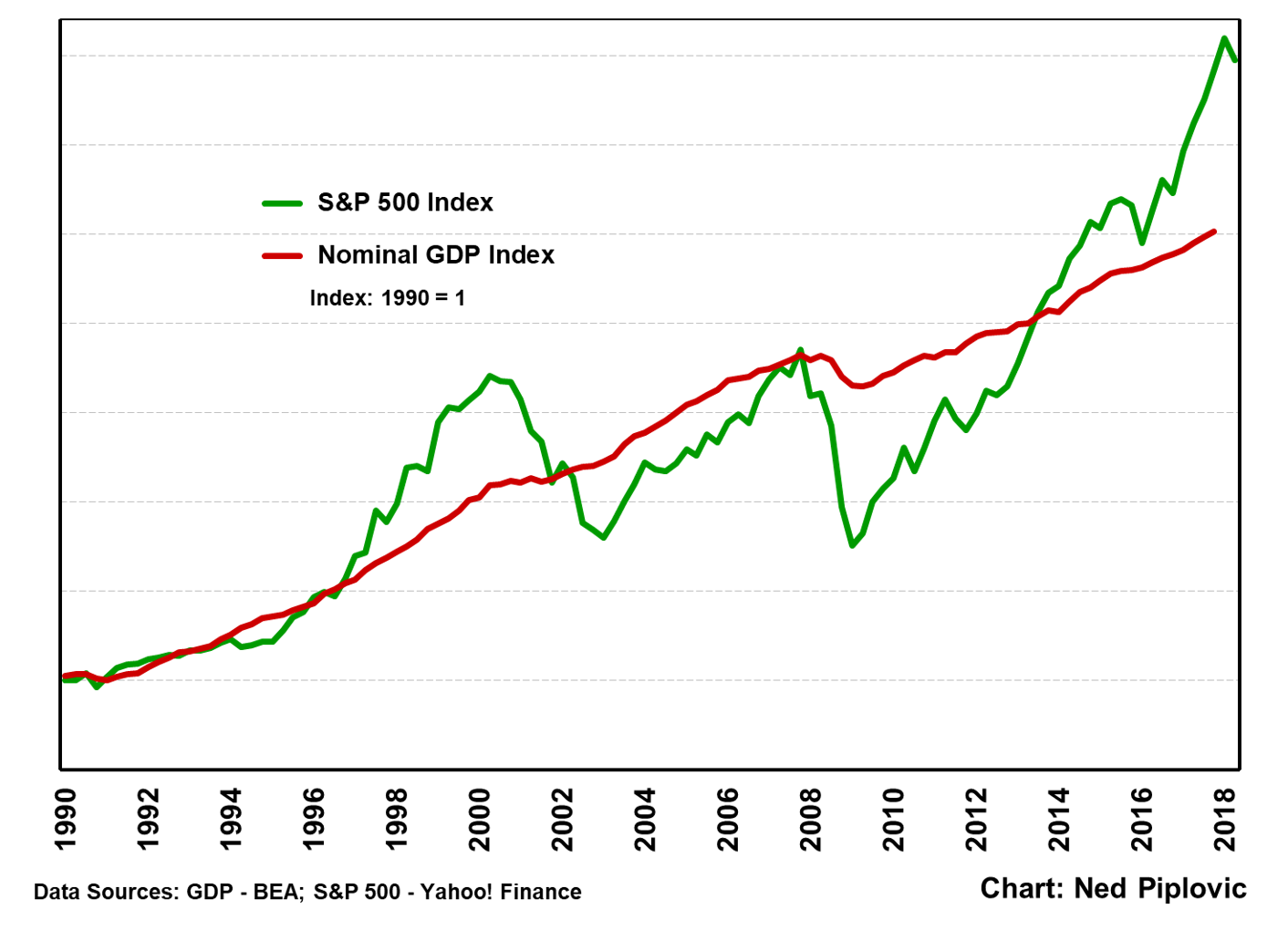

Stocks and the Economy Move Together Over the Long Run

You can see the relationship in this chart showing nominal GDP (Main Street) and the S&P 500 Index (Wall Street):

Of course, the stock market is much more volatile than the economy. However, in the long run, they both rise. It pays to buy stocks and take advantage of the occasional bear markets.

Note that the only times a severe bear market occurred was in 2000-2003 and 2007-09. These time periods were times that the United States was suffering from an economic downturn or recession.

GO, GDP and the Booming Economy

A bear market is not likely to occur at the present time. Last Friday, the U.S. government announced that real gross domestic product (GDP) grew 3.2%, surprising most economists.

Earlier this year, I noted that business spending was soaring in 2018, based on the gross output (GO) data coming out of Washington. GO includes the supply chain and business-to-business (B2B) spending in the production process. (For more information, go to www.grossoutput.com.)

Except for the fourth quarter of 2018, business-to-business spending has been booming, and the changes in the supply chain are leading economic indicators.

The corporate tax cuts and deregulation (except for the trade tariffs) are working their magic.

Not surprisingly, the stock market is moving up on the news, especially after the Fed announced that it was postponing raising rates in 2019 amid talk that the Trump trade negotiations with China are going well.

Once again, the financial Armageddon predicted by Jim Rogers and other Cassandras has been postponed. The bulls still are winning, and I see no reason why we should shy away from our approach to be 100% invested in the stock market.

Good investing, AEIOU

Mark Skousen

‘The Babe Ruth of Private Equity’ to Speak

As Forecasts & Strategies subscribers know, one of my favorite high-income investments is Main Street Capital (NYSE: MAIN). Since going public in 2007, MAIN is the best-performing private equity fund in the United States, outperforming such big names as Blackstone, Carlyle Group, KKR or Apollo.

MAIN has beaten the stock indexes, the best private equity firms, and even Warren Buffett.

I urge you to join me at this year’s financial conference at FreedomFest as we meet and hear Vince Foster, chairman and founder of Main Street Capital, as he reveals his secret to private equity investing. I call him the “Babe Ruth of Private Equity.”

Mr. Foster will be speaking on “The American Dream: How You Can Profit from Free-Enterprise Capitalism at Its Best.”

Let’s Roll Out the Red Carpet for ‘The Babe Ruth of Private Equity.’

This will be Vince Foster’s first visit to FreedomFest, and I invite ALL my subscribers to be there and give him a big welcome. Please take time out of your busy schedule to join us at a private reception with Vince Foster on Thursday, July 18, at the Paris Resort, Las Vegas.

Eagle will be hosting our “Wild West on Wall Street” investment conference — in addition to Vince Foster, we have my colleagues, Jim Woods and Hilary Kramer (just confirmed!), who will be doing a special session with me on “Our Top Ten Favorite Stocks of All Time.”

Glenn Beck

I’m also excited to confirm media mogul and firebrand Glenn Beck, who will speak on “Get Ready for the Ultimate Showdown: It’s Either Trump or the New Socialists!” He also will interview Penn Jillette of “Penn & Teller” fame.

Plus, we’ve confirmed Sen. Mike Lee, who is on Trump’s short list to become the next Supreme Court justice.

And business executive Herman Cain, who Trump briefly considered nominating to the Fed board. Cain has a remarkable background. Watch his story here in this two-minute video.

Steve Moore, the president’s choice for Fed board member, also will address us. Also hear author, columnist and talk show host Wayne Allyn Root.

By popular demand, Marc Eliot, Hollywood’s #1 biographer, will return to this year’s show to talk about “Hollywood and the Romantic Ideal of the Old West.” Eliot has written biographies of John Wayne, Clint Eastwood and many other actors who played roles in Western films.

And don’t forget our “Libertarian Duel in the Sun” between Kevin O’Leary of “Shark Tank” and Whole Foods’ John Mackey as they debate “Conscious Capitalism vs Pure Greed.” The sparks will fly.

Sign up today! FreedomFest is filling up fast, and so is our hotel block. The dates are July 17-20, at the Paris Resort, Las Vegas. Use the Eagle50 code to get $50 off the registration fee at www.freedomfest.com, or call 1-855-850-3733, ext. 202.

Join Me for the Seattle MoneyShow on June 15-16

I invite you to join me June 15-16 at the Seattle MoneyShow, where I will be a featured speaker. Click here or call 941-955-0323 to register free as my guest. Remember to use my priority code of 047550. I will give three talks. On Saturday, June 15, I will address How to Make Money in the Current Environment and ETFs vs. Mutual Funds, Why You Need Both! (Plus, My Five Favorites). On Sunday, June 16, I will speak about Finding the Next Big Stock Market Winners. I hope to see you there!

You Blew it!

For the 100th Time: Consumer Spending Does NOT Drive the Economy!

Every time the Commerce Department releases quarterly GDP data, the journalists focus primarily on what retail sales and consumer spending are doing. They almost always repeat the mantra, “consumer spending measures two-thirds of economic activity” or something similar.

This time, it’s the Wall Street Journal that made the blunder in its Saturday (April 27, 2019) edition.

I’ve debunked this myth that consumer spending drives the economy time and time again, but like an old penny or a virulent virus, it keeps coming back.

What’s the error? It is true that consumption represents two thirds of GDP, but GDP does NOT measure either “total economic activity” or total spending in the economy. It measures only final or finished goods and services. It deliberately leaves out a big chunk of economic activity — the supply chain, or business-to-business (B2B) spending.

When you measure spending at all stages of production, which is what my gross output (GO) statistic does, you quickly find out that consumer spending is only about one third of total economic activity. Thus, business spending is much larger than consumer spending.

I blame the textbook writers for this persistent error. They need to have a box pointing out this misinterpretation of GDP. Students do not seem to remember that GDP leaves out the value of the supply chain and thus is not a good measure of either total economic activity or spending in the economy. It measures FINAL output only.

Introducing GO in the textbooks would go a long way toward resolving this issue. Fortunately, some authors are doing this, but not all of them. Sean Flynn, the chief writer of the popular McConnell Brue Flynn “Economics,” has pledged to include GO in the next edition. That’s progress.

Remember, it’s business and the supply side of the economy that causes economic growth: entrepreneurship, savings, capital investment and technological advances. As Say’s law states, consumer spending is the effect, not the cause, of prosperity.