What is the Greatest Threat to Your Investments Today?

What is your greatest fear when it comes to investing? Is it taxes, inflation, recession, world war, another pandemic or maybe even global warming?

Last Sunday was Constitution Day (Sept. 17), the day 39 brave founders created a new nation that would change the world (see more about the importance of Constitution Day below).

But the celebration was drowned out by a major protest that hit New York. Thousands of protestors, including schoolchildren, gathered in New York City as part of “Climate Week” to call for the complete elimination of fossil fuels (oil and gas) in our transportation system. Leaders of the march included Congresswoman Alexandria Ocasio-Cortez (AOC) and actor Kevin Bacon. The group demanded that President Biden use his executive powers to declare a “climate emergency”.

Talk about hysteria, given that air and water pollution are at all-time lows in America.

Funny, oil prices surged during the week to $90 a barrel.

What about Global Warming?

Grantham, Mayo, Van Otterloo & Co. LLC (GMO) money manager Jeremy Grantham is another alarmist who is bearish on America due to global warming, which he considers the greatest problem we face: “We’ve made our planet unfavorable to life, including homo sapiens.”

“The world is using up its natural resources at an alarming rate.”

“We live on a finite planet. We have finite resources, and we’re running out of good, arable land.”

New York Times: ‘The doomsayers are wrong’!

So, if it’s not global warming and too many people, what is the greatest threat to your investments? Is it taxes, recession, another pandemic? Veteran investment advisor Paul Cabot says our greatest threat is inflation (“Maxims of Wall Street” p. 151).

Wall Street continued to struggle in September, especially technology stocks, in the face of stubborn price inflation and the UAW strike. The Austrian economist Ludwig von Mises was right when he said, “Inflation is never neutral.” Some people benefit, others are hurt. When inflation surges, real wages fall behind and worker strikes are common.

On Wall Street, we learn quickly that inflation is the enemy of the stock market. Whenever inflation surges, stocks tumble and can even enter a bear market, as they did last year. When inflation subsides, stocks do better (this year).

So, if it’s not global warming and too many people, what is the greatest threat to your investments? Is it taxes, recession, another pandemic? Veteran investment advisor Paul Cabot says our greatest threat is inflation (“Maxims of Wall Street” p. 151).

Wall Street continued to struggle in September, especially technology stocks, in the face of stubborn price inflation and the UAW strike. The Austrian economist Ludwig von Mises was right when he said, “Inflation is never neutral.” Some people benefit, others are hurt. When inflation surges, real wages fall behind and worker strikes are common.

On Wall Street, we learn quickly that inflation is the enemy of the stock market. Whenever inflation surges, stocks tumble and can even enter a bear market, as they did last year. When inflation subsides, stocks do better (this year).

Another Enemy of Investing: The Prophets of Doom!

Last week, I received a letter from a subscriber wondering why I didn’t quote billionaire Jeremy Grantham in my “Maxims of Wall Street”.

Grantham considers himself a “value” investor and is constantly warning about bubbles in the stock market, real estate and other assets. He is also a global warming alarmist.

He is also a prophet of doom. It turns out that Grantham has had some good calls avoiding the 2000–2003 tech bust and the 2008–09 financial crisis, when stocks fell 50%.

But he’s not especially good during bull markets, such as the “Mother of All Bull Markets” from 2009 to 2021, when the stock market rose at an annual rate of over 12%.

Grantham’s mutual fund rose only 2% a year during that time because he was largely in cash, waiting for the next crash. In fact, he’s now predicting a 60% crash on Wall Street by the end of October 2023. That’s next month!

The problem is that Grantham may be good at predicting crashes and bear markets, but not bull markets, and his timing is often too early, sometimes by years.

Conclusion: I suggest you follow the advice of financial guru J. Paul Getty, America’s first billionaire: “Businessmen can profit handsomely if they will disregard the pessimistic auguries of self-appointed prophets of doom” (Maxims, p. 112).

Now back to Constitution Day. Here’s my message.

‘Where’s Skousen?’

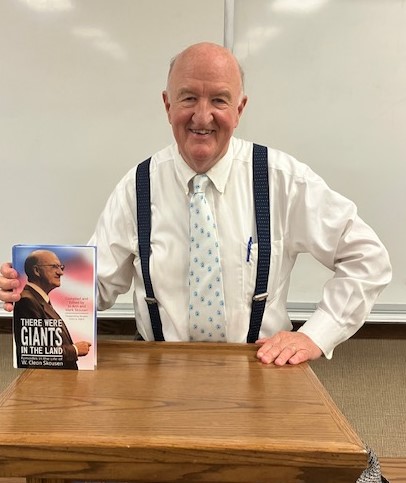

In our new book, “There Were Giants in the Land,” there’s a story about J. Edgar Hoover, the demanding FBI director, yelling, “Where’s Skousen?” when one of Hoover’s assistants made a clerical blunder at Washington DC headquarters. During the late 1930s era, my uncle, W. Cleon Skousen, was the “indispensable” communications director for the FBI, but at the time Cleon was on annual leave.

When Hoover found out he demanded, “Get this other fellow out of there and bring back Skousen!”

A few years later Cleon was in charge of communications at FBI headquarters when Japan attacked Pearl Harbor on December 7, 1941.

Who Will Lead Our Nation Now?

Today we face a much bigger crisis in America — with growing threats of runaway inflation, union strikes, crime, inequality, voter fraud and even potential world war — and a nation never more divided since the Civil War.

My uncle died in 2006, but it’s time to bring back W. Cleon Skousen, “a giant in the land” who was one of the Greatest Generation. And that’s exactly what my wife and I have done in compiling and editing his voluminous private journals into a new book.

At the height of his career, as an FBI special agent, BYU professor and founder of the Freemen Institute, he was a crusader extraordinaire — he wrote bestselling books on communism, the Constitution and the Bible that sold millions of copies, and he gave thousands of speeches on the threat of Communism and our Constitutional rights to standing-room-only crowds.

As Dan Peterson writes, “It’s difficult to overstate how big a name W. Cleon Skousen was when I was growing up in California. His influence continues to echo into the twenty-first century.”

You can see why our book was banned in China; Communist China wants to crush the defenders of liberty. Read the story here: Our New Book is Banned in Beijing! – Mark Skousen.

It’s time we resurrected the spirit and vision of W. Cleon Skousen. As former Black Panther Eldridge Cleaver said, “We need a thousand Skousens to change America!”

You can order your copy today at www.skousenbooks.com. The book is 544 pages long and has lots of inspiring stories, words of wisdom and photographs. The price is only $34.95 for hardback, and I pay for shipping and handling.

Good investing, AEIOU,

Mark Skousen

You Nailed it!

‘Just One Rule of Conduct’ at Wabash College

By Mark Skousen

This week, I spent a few days at Wabash College in rural Indiana, an all-men’s college (one of only two left in the country), to give some lectures on Say’s law and gross output (GO), representing Chapman and the Doti-Spolgi Chair of Free Enterprise.

My lectures were sponsored by the Stephenson Institute for Classical Liberalism, headed up by Daniel D’Amico. They had plenty of my books on hand for the students to read, including “The Making of Modern Economics” and “The Maxims of Wall Street.”

I’ve always wanted to visit this small liberal arts college because it was here in 1955 that Milton Friedman gave a series of lectures (hosted by economist Ben Rogge) that later became the bestseller, “Capitalism and Freedom”.

Prof. Daniel D’Amico and me in front of a portrait of Benjamin Rogge.

It’s a beautiful campus for 900 students who have maximum freedom but agree to live by “just one rule of conduct” that they call the Gentleman’s Rule:

“The student is expected to conduct himself at all times, both on and off campus, as a gentleman and a responsible citizen.”

Indeed, the students I met were all well-dressed and well-behaved. The majority belong to fraternities, but they don’t allow hazing.

And they are being taught free-market economics, a tradition that began with Benjamin Rogge and his colleague John Van Sickle a generation ago.

Rogge was a beloved and dynamic professor at Wabash for many decades and was a big fan of Adam Smith. I met him a couple of times and remember his lively style as a speaker.

I came across this provocative quote from Ben Rogge:

“The dishonest man will survive longer in college or the ministry than he will in the business world.”

Sad but true!

My visit renewed my faith in the future of America.