What Is the Best Way to Make Money FAST?

“Better to get a fast nickel than a slow dime.” — Robert Allen

There have been plenty of opportunities in the past year to make money — a lot of money — and to make it fast.

My newsletter, Forecasts & Strategies, is geared to the long-term investor, but every once in a while, stocks and funds can suddenly take off.

For example, we doubled our money in a no-load mutual fund in six months that invested heavily in Tesla, the electric car company.

Then we doubled our money again in a bitcoin investment in three months.

But those rapid profits are rare, especially in exchange-traded funds (ETFs) and mutual funds.

At investment conferences, people often ask me, “What’s the best way to make money fast?”

It’s high-risk speculation to make huge profits in a short period, but it can be done.

Here are my recommendations:

First, here’s what not to do: Do not fly to Vegas or go to a casino and try your hand at the slots, the roulette wheel, the craps table or even playing poker. The odds are stacked against you.

As I say in “The Maxims of Wall Street,” “Gambling: The sure way to get nothing for something.” (p. 93)

Rather, “Never leave to chance what you can achieve through calculation.” (p. 93)

How to Win in Short-Term Trading

To increase your odds of winning dramatically, I suggest the following.

There are several ways to climb the mountain of fast money. Consider these options:

- Consider buying hot initial public offering (IPO) stocks, but only if you can buy shares at the IPO price from your broker. Otherwise, you often end up paying a premium over the opening bid.

Most IPOs are like burning matches. As a retail buyer, you are last in line and are paying top dollar to get aboard a hot stock.

- Buy exciting new technology stocks. The best strategy is to wait until the stock takes off and then buy in. It’s rare to “buy low and sell high” with these highflyers. Rather, the new way is to “buy high and sell higher”!

- Buy penny mining stocks. In a bull market, in gold, silver and copper, low-priced mining stocks have a good chance of going up 100% to 300%, and maybe even a “ten-bagger” (1,000%). You buy good miners and hold for several years. I’ve started a “Penny Stock Portfolio” in my TNT Trader service if you are interested at www.markskousen.com.

- Cryptocurrencies are the new digital gold; Bitcoin and other alternative currencies are in the midst of a major revolution that combines hard assets with a breakthrough technology through the blockchain.

Options Trading is Hot

Last but not least, more and more investors are using stock options to make money fast. Options are better than futures contracts. To create leverage, you have to put down a small down payment on futures contracts, which means that you can end up owing big money if the underlining commodity goes against you.

Not so with call options. Call options give you the right to buy 100 shares of a stock at a specific “strike” price within a time period (usually three to nine months). You can never get a margin call when you buy call options. You can never lose more than your original investment.

If you buy right, you can make a lot of money fast.

In my own trading services, I’ve seen stocks go up 30%, and the “out of the money” call options jump 200%, 500% and sometimes over 1,000%.

We’ve had a lot of success with options in stocks that are moving fast. There are many risks involved because you have to be right about the direction and timing of the underlying stock. But, when you are right, you can make a ton of money.

That’s why option trading has become the preferred way to win big. Over half of my subscribers to my trading services try their hand at options. (We offer a convenient introduction to option trading made easy.)

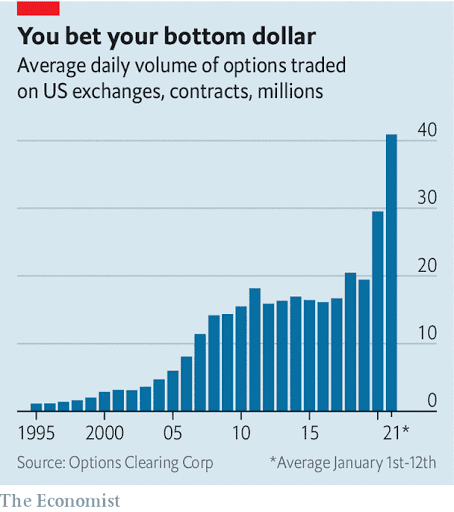

In the most recent issue, the Economist reported that stock options increased more than 50% last year!

See the chart below.

Source: The Economist, January 16, 2021

Quotes from ‘The Maxims’ on Making Money Fast

I have a couple of pages in “The Maxims of Wall Street” on making it big and fast in the market, with such quotes as:

“When we see something that makes sense, we act very fast and very big.” — Warren Buffett (p. 194)

To double your money fast, you have to bet on what people don’t know that’s true. As George Soros says, “To make big money, you have to bet on the unexpected.” (p. 194)

Last year, we bet on the unexpected in TNT Trader — that the dollar would rally. The call options were cheap because nobody thought it would happen. As a result, we made over 1,000% on our money in a few months.

I offer four trading services at www.markskousen.com: Home Run Trader, Fast Money Alert, Five Star Trader and TNT Trader. Try one of them and see how fast you can make money.

This Letter Made My Day

In the past week, I’ve received three unexpected letters. One was from Maz Akram of Miami, Florida, who wrote: “Thank you, Mark, for the inscribed copy of the Maxims. I’ve now ordered eight books and sent them to a bunch of people who have thoroughly enjoyed it. I think — instead of long complicated case studies popularized at business schools — a book like this should be required reading for the MBA students — they will enormously benefit from the contents of this book.”

Much appreciated!

Another letter was from Kevin O’Leary of “Shark Tank” fame. He had a one-word endorsement for my new 10th-anniversary edition of “The Maxims of Wall Street.” See below.

“Wonderful!”

Next to Kevin is my long-time friend, Alex Green, chief investment strategist of the Oxford Club, who wrote the following:

“Wouldn’t it be great if someone collected the wisest thoughts of the world’s greatest investors, men like Jesse Livermore, Baron Rothschild, J.P. Morgan, Benjamin Graham, Warren Buffett, Peter Lynch, John Templeton and others?

“I found myself chuckling (and occasionally sighing) when I first read this book. And I still refer to it regularly. Over my 35-year career, I learned much of this investment wisdom by trial and error. Fortunately, you don’t have to. ‘The Maxims of Wall Street’ is a pithy and indispensable guide.”

Finally, I received the following letter from Greg Zuckerman, special editor of the Wall Street Journal and author of the new book “The Man Who Solved the Market” (billionaire mathematician Jim Simons). “The Maxims is a true treasure, packed with insight, enlightenment and more than a little fun.”

I like this new quote from Jim Simons: “You can make more money successfully predicting a stock than you can a comet.”

And this from Kevin O’Leary: “Getting rich is easy if you follow three rules: spend less, save more, and invest the difference.”

The new 10th-anniversary edition is almost sold out after selling more than 3,500 copies in two months. We will be going back to press soon.

The new edition is special — it’s 282 pages. I’ve added 200 quotes since the first edition came out in 2011.

Cheaper by the Dozen!

I’ve kept the same low price. The new edition retails for $24.95, but if you buy from www.skousenbooks.com, the first copy is just $20, and all additional copies are only $10 each. If you order an entire box of 32 copies, the price is only $300, less than $10 each.

I number and autograph every copy and pay the postage if mailed in the United States (shipping to Canada or other foreign destinations requires additional postage). If you have any special inscriptions, please email Ned at skousenpub@gmail.com.

We ship every day. Order your autographed copy today! Go to www.skousenbooks.com.

Paper on GO and the Austrian Theory of Business Cycle #1 Downloaded Paper in 2020!

Good news! I have just been informed by the publishers that a paper on gross output (GO) and the business cycle was the most downloaded paper in the Quarterly Journal of Austrian Economics last year.

The paper is entitled, “Interest Rates, Roundaboutness, and Business Cycles: An Empirical Study.” The author of the paper, Mark Gertsen, made use of my GO metric to develop his econometric model.

You can read the paper here.

Gertsen concludes that the Fed’s easy-money policies created an unsustainable Austrian-style boom-bust cycle, using annual GO data in 28 Organisation for Economic Co-operation and Development (OECD) countries to make the case.

It looks like another bubble is being created in 2021.

At some point, the boom will turn into a bust. While we wait, we will continue to be invested in stocks, tech, precious metals and bitcoin.

Good investing, AEIOU,

![]()

Mark Skousen

You Nailed it!

Swiss to Hold a National Vote on Banning Lockdowns

Last year, on October 10, 2020, I wrote an article for the FreedomForum called “10 Lessons from 2020.” Read it here: https://forum.freedomfest.com/10-lessons-for-10-10-2020/.

One of them was #7: “Government executives have been given way too much emergency power.”

As a result, we saw governor after governor shut down a healthy economy and destroy jobs, businesses, sports, entertainment, etc. If we are going to give governors emergency powers, it should be limited to 30 or 60 days; after that, they have to get the legislature of the people (via a referendum) to continue these emergency powers.

I am glad to see that the Swiss will be holding a national vote on banning lockdowns. Steve Moore, the editor of Unleash the Economy Hotline, has written:

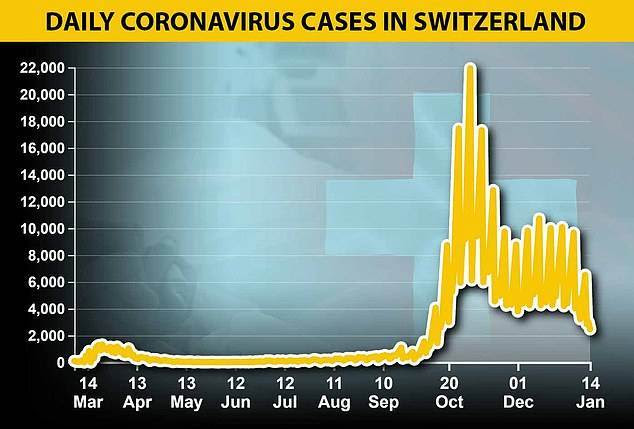

“A grassroots petition drive has set up a national referendum vote to strip government of lockdown authority in June. Switzerland has seen cases consistently decline for the past two months — but faces a new lockdown anyway in the continent-wide panic over the UK variant.”

We’ve always admired Swiss sensibilities and expect the referendum to pass. We wonder whether any U.S. states that have initiative and referendum will take up the idea and put lockdown power directly to a vote of the people.

Let democracy work!