Two Shocking Surprises from the ‘Twin Towers of Finance’

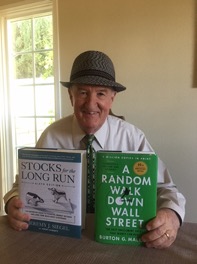

As part of a pre-conference event for FreedomFest, Alex Green (the chief investment strategist at the Oxford Club) and I interviewed Jeremy Siegel, the Wizard of Wharton, and Burt Malkiel, the Profound Professor of Princeton, on their “50 Years on Wall Street” and the lessons they learned.

It was quite an eye-opener.

The interview is now posted on our Youtube channel. You can watch it here.

In the interview, there was plenty of agreement, and disagreements!

Are We Headed for Another Financial Crisis?

Both Siegel and Malkiel spoke at FreedomFest in 2008, right at the beginning of the real estate debacle and financial collapse. Could we see it again? Siegel was more upbeat, saying that the recent banking crisis was over, and commercial banks are in better shape these days.

But Malkiel warned that more financial crises are coming — so be prepared and take advantage. He noted that the panic in the stock market in March 2020, when the lockdown started, offered an incredible opportunity to make money. More opportunities could arise in the future.

A Tale of Two Amazing Graphs

I showed two graphs — one showing the growth of the U.S. stock market over the long run, and one showing the year-to-year changes on Wall Street.

Here’s the graph showing the year-to-year changes:

As you can see, it suggests that Wall Street is chaotic, volatile and unpredictable.

But then, I showed the famous chart from Siegel’s “Stocks for the Long Run.”

This one shows the stock market to be bullish, stable and predictable. What a difference!

The problem is that most of us don’t have the faith to hold on to our stocks during the downturns. As Steve Forbes said years ago, “Everybody is a disciplined long-term investor — until the market goes down!” (Maxims of Wall Street, p. 137). Or, as Mike Tyson said, “Everyone has a plan — until they get punched in the face.” (p. 124)

Here’s another irony that Siegel discovered in his book. In the short run, bonds are less risky than stocks, but in the long run, stocks are less risky than bonds!

Dollar-Cost Averaging Works — Especially During a Bear Market!

Here’s another surprise: Burt Malkiel says that dollar-cost averaging works even in a bear market that has lasted 30 years in Japan. Even though the Japanese Nikkei Index is still languishing below its all-time high of 40,000 in 1990, if you bought a fixed amount of the Nikkei Index every month, you would be profitable!

So, buying a stock index like the S&P 500 works even better. For those of you working, adding to your 401(k) or IRA every paycheck is a gold mine.

American Exceptionalism in Stocks: What is the Root Cause?

I asked the two why the U.S. stock market has outperformed all other country funds by a wide margin, even into the 21st century. I suggested it was not automatic or by divine design, but rather because the United States, more than any other country, has adopted the Adam Smith model of prosperity, what we call free-market capitalism.

Siegel seconded the idea. He noted that every major international corporation comes out of America — Google, Apple, Amazon, Facebook and Microsoft. America attracted the best entrepreneurs from around the world.

But there’s no guarantee it will continue. As Ronald Reagan said, “Freedom [the foundation of entrepreneurship] is never more than one generation away from extinction.”

Can You Beat the Market? If You are Lucky!

In “A Random Walk Down Wall Street,” now in its 50th-anniversary edition, Burt Malkiel is famous for advocating the efficient-market theory, that investors and speculators on Wall Street act so quickly that it’s nearly impossible to beat the market. He is a strong advocate of investing in index funds, and in many ways, he has been proven right.

There are very few professional money managers and active mutual funds that have outperformed the market over the long run. In our interview, I show a chart proving that.

Jeremy Siegel does show that stocks with rising dividends tend to beat the market.

There may be a few other strategies that work. But overall, it’s tough.

Alex Green responded after the interview with the following:

“For starters, you can always count on investors to be self-interested. But rational?

“How rational were investors 23 years ago, when they bid internet and technology stocks to the skies, forgoing sales and earnings for financial metrics like ‘eyeballs’ and ‘web hits’?

“How rational were they 15 years ago, when they put themselves deeply in hock to flip land, rental properties, vacation homes and condos because ‘real estate always goes up’?

“How rational were they when they dumped stocks en masse during the financial crisis of 2008 — with the Dow at 6,500 — and plunked the proceeds into money market funds just as yields reached an all-time low?

“And how rational were they a few years ago when they bid crypto to the moon?

“Investors behave rationally most of the time. But it is certainly not the case that all (or even most) investors behave rationally all the time. And that creates opportunity.”

Alex thinks that investors can pick their battles and “buy when blood is running in the streets,” or get out when “everyone is buying.” Contrarian investing works.

Malkiel responded: It’s easier said than done. It’s often hard to know when the top or bottom has been reached.

He liked my idea of putting the majority of one’s portfolio in an index fund like the S&P 500, and then speculate with the rest in individual stocks. He likes to do it himself.

Most investors like to gamble a little bit with their money. Just don’t go overboard. He also warned investors to be cost conscious: Beware of mutual funds whose expense ratio exceeds 2%!

Should Options and Futures be Outlawed?

I did ask the two what they thought of a statement by Warren Buffett and Peter Lynch, who in the 1990s, said they would support legislation to abolish the futures and options market because of abuse on Wall Street. Both Malkiel and Siegel strongly disagreed, and said that both the futures and options market are a net-balance positive for the economy. Glad to hear it.

The Twin Towers of Finance are Quoted in the ‘Maxims’

Malkiel, 90, and Siegel, 77, are in their sunset years. The latest editions of their books may be their last. My final question I asked both of them was, “What is the most important lesson in life?” Malkiel said, “Humility: Modesty is the best virtue in life and finance.” Siegel said, “Gratitude.” He’s a cancer survivor. I consider both to be dear friends.

I quote them in “The Maxims of Wall Street.” I like this one from Malkiel: “Never buy anything from someone who is out of breath.” (p. 78)

And this one from Siegel: “Dividends are the critical factor giving the edge to most winning stocks in the long run.” (p. 185) See the fascinating story of “A Young Widow’s Lazy Way to Riches” on the opposite page (184).

Our interview was historic — I urge you to take the time to watch it. As Ben Franklin said, “An investment in knowledge pays the best interest” (p. 124).

Time to Buy ‘The Maxims’ and Read it Daily!

Every subscriber should have a copy of “The Maxims of Wall Street.” It’s divided by topic and has a variety of stories to tell. It’s been endorsed by Warren Buffett, Jack Bogle, Kim Githler, Charles Schwab, Alex Green, Burt Dohmen and Dennis Gartman.

It retails for $24.95 on Amazon, but you can buy it for only $20 for the first copy, and all additional copies for only $10 each. Many subscribers buy additional copies for friends, relatives, students, clients and stock brokers. If you order an entire book (32 copies), the price is only $300. I pay postage to mail copies anywhere within the U.S. borders. To order your copy, go to www.skousenbooks.com.

Good investing, AEIOU,

![]()

Mark Skousen

The Philosophy of Martin Luther King Jr.

I recently listened to the new audiobook, “The King: A Life,” a tell-all biography of Martin Luther King Jr., in preparation for this week’s FreedomFest in Memphis, where King was assassinated. He lived a controversial life, full of contradictions. He advocated freedom for all people, especially his race, but then supported the welfare state that destroyed the family unit. As a preacher, he taught fidelity, but frequently had affairs.

However, over all I agreed with his philosophy, that a person should be judged by his character, not by the color of his skin. Unfortunately, our nation is moving away from that principle, and many colleges and universities are now allowing segregated housing. However, last month, the Supreme Court ruled against “affirmative action,” where institutions engaged in prejudice in favor of one race over another.

When I was growing up, my family’s favorite jazz musicians were Earl Garner and the Ramsey Lewis Trio. (I saw a concert with Ramsey Lewis before he died.) It turned out that both were African American, and nobody in my family judged them because their color was different. We just liked their music. That’s the way it should be.