There is Only ONE Guaranteed Way to Financial Success

“Any earner who earns more than he can spend is automatically an investor.” — Gerald Loeb (“Maxims of Wall Street” p. 21)

Last week, I gave a series of lectures at Wabash College, the all-male school in Indiana, and The Citadel, the mostly male military academy in South Carolina.

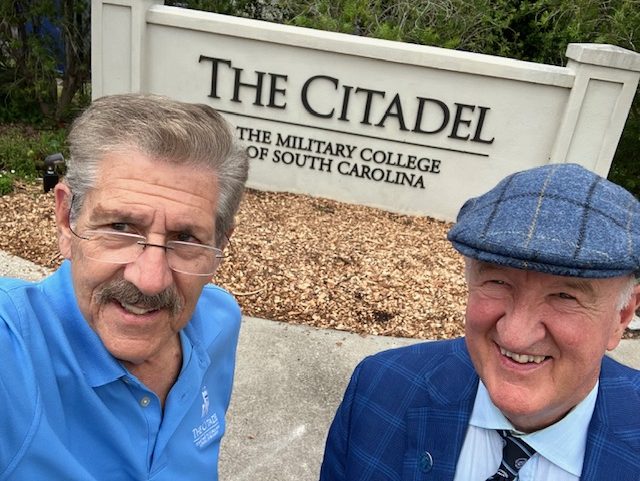

Prof. Richard Ebeling and Mark Skousen at The Citadel.

My topic was “What Drives the Economy: Consumer Spending, Business Investment or Government Stimulus?”

What really caught the attention of the students was when I talked about the theme, “What is the key to your personal financial success?” Nothing gets the attention of students more than their own prosperity after they graduate.

Does Consumer Spending Drive Economic Growth?

I gave them three choices.

- “Spend all you can.” Is the key to financial success a big mortgage, a car payment and an outstanding credit card bill?

Most rejected the “big spending” philosophy of life, and rightly so. Yet, isn’t this exactly what the government does — overspend and run up huge debts?

Earlier, I debunked the idea that “consumer spending drives the economy.” High levels of consumption are actually the consequence of profitable businesses. It is known as “Say’s Law”: consumer spending is the effect, not the cause of prosperity.

And yet, there are businesspeople out there who are enamored with the Keynesian mindset that “what goes around comes around.” If you spend enough money, somehow it will come back to you. But it seldom happens. Don’t think you can spend your way to prosperity, either as an individual or as a nation. I’ve met a few businessmen who are big spenders — they usually end up bankrupt.

Will a Big Salary or High Profits Guarantee You Success?

- “Earn all you can.” When I suggested this second choice, many students raised their hands and supported the thesis that earning more money was the key to success. Having a hard time making ends meet? The solution? Earn more money! A raise or a salary bonus gives you the chance to buy a new car, a new home, a family vacation or put your kids through college.

But I shook my head. Earning more money does not guarantee you success. There are plenty of stories about millionaires who went bankrupt because they spent all their gains and went into debt to the point of no return. Sports figures and entertainers, in particular, are famous for going bankrupt. People such as Mike Tyson, Wayne Newton, Michael Jackson, Larry King and Cyndi Lauper.

If you don’t live within your means, you can run into trouble.

The Real Key: Productive Saving!

- “Save all you can and invest it productively.” The only real way to get ahead and stay ahead is to live within your means, save regularly and invest those savings productively — either in a successful business, the stock market or other investment programs.

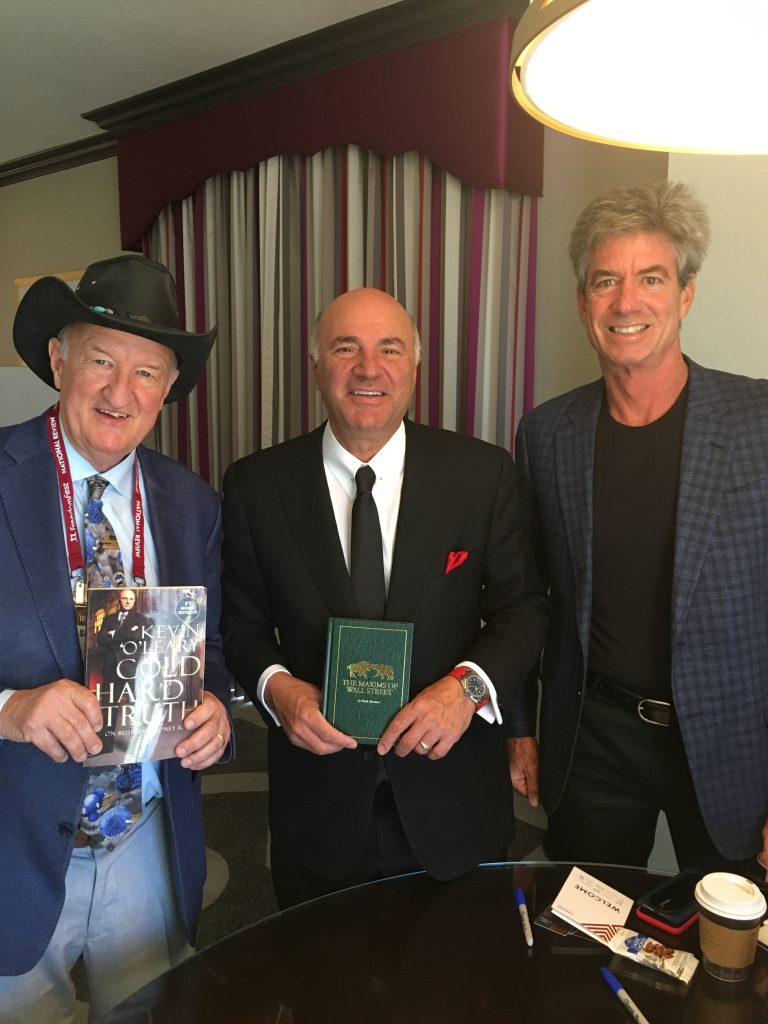

Mark Skousen, Kevin O’Leary and Alex Green at FreedomFest.

Kevin O’Leary of Shark Tank fame said it best: “Getting rich is easy if you follow three rules: spend less, save more and invest the rest” (“Maxims of Wall Street” p. 26).

The students all took notes. Their question was, “Where to invest one’s savings?”

You have several choices. You can invest your savings in a bank account, but that’s not going to earn you much.

You can invest in a new business venture — many members of the 400 richest people in America got started that way. But it’s high risk. Over 90% of all small businesses fail within five years.

You can invest in specialty areas such as rental properties, collectibles or penny stocks with various levels of risk.

Or you can invest regularly in the stock market, buying individual stocks or a stock index fund, depending on your level of risk taking.

I’ve tried all these formulas for financial success, and each one may appeal to you. But for the majority of savers/investors, perhaps investing your 401k or IRA in a stock index fund may be the safest way to earn a fortune.

Start by Becoming Educated

I recommend you invest some time in educating yourself in the business of investing. A good starting point is to read “The Richest Man in Babylon,” by George Clason.

I quote it on p. 24 of “Maxims.”

“In old Babylon there once lived a certain very rich man named Arkad. Far and wide he was famed for his great wealth. Also, was he famed for his liberality. He was generous with his charities. He was generous with his family. He was liberal in his own expenses. But nevertheless, each year his wealth increased more rapidly than he spent it.”

Why? Because, Arkad said, ‘A part of all you earn is yours to keep.’”

Then start investing — you’ll learn fast what to do and what not to do.

Second Book to Read: The Maxims of Wall Street

The second book to read is “The Maxims of Wall Street”, my collection of all the great sayings, adages and worldly wisdom by the financial gurus.

Every subscriber should have a copy. The price is only $20, a bargain (the retail price is $24.95). And I make it easy to buy additional copies for your friends and family members. Only $10 to buy another copy or two. Some even buy an entire box of 32 copies — the price is only $300. I pay postage if mailed in the United States.

By the way, I’m being forced to raise the price of the next edition due to increased costs of printing and postage. So, if you want a copy of the 10th anniversary edition, now is the time to buy it. Go to www.skousenbooks.com.

Good investing, AEIOU,

Mark Skousen

Upcoming Conferences

Orlando MoneyShow, Oct. 29-31, Omni Orlando Resort at ChampionsGate, Florida: On Sunday, Oct. 29, I’ll be the keynote speaker at the Orlando MoneyShow. My topic is “Adam Smith Makes Two Prophecies about America: One Bullish and One Bearish,” followed by a breakout session, “The Fed Disaster Plan: Beating Tight Money in 2023 with My Five Favorite Growth and Income Investments.” Other speakers include Charles Payne (Fox Business), Jon and Pete Najarian (CNBC), Steve Moore, George Gilder, Bryan Perry, and Dave Phillips. My subscribers can get 20% off the registration at www.moneyshow.com or by calling 1-800-970-4355. Be sure to reference my discount code, SPKR20.

You Nailed it!

‘The Funding Founder’ Richard Viguerie Turns 90!

“It is incredible the quantity of good that may be done in a country by a single man who will make a business of it.” — Benjamin Franklin

Last week, I attended a gala celebration of an old friend, Richard Viguerie, the founder and chairman of the American Targeting Association, who turned 90 years old on Saturday, Sept. 23.

He is best known as the premier promoter of direct-mail advertising for politically “conservative” causes.

We share common interests in politics, religion and direct-mail advertising, which has gradually shifted to online advertising.

In his remarks, Richard acknowledged his “co-producer” since the inception of his direct-mail operation: Benjamin Franklin, who was, of course, the first Postmaster General, and my ancestor!

Several years ago, I sent Richard one of my favorites of Franklin’s quotes, “It is incredible the quantity of good that may be done in a country by a single man who will make a business of it.”

He is also a fan of Franklin’s motto, “Early to bed, early to rise, makes a man healthy, wealthy and wise.”

Richard has even written a book on healthy living, and he tries his best to stay active through exercise and diet.

His goal is to imitate the Old Testament prophet Moses: “And Moses was a hundred and twenty years old when he died: his eye was not dim, nor his natural force abated.” — Deuteronomy 34:7

If anyone can do it, Richard can. He wakes up every morning ready to go.