The Greatest Threat to Your Wealth (No, It’s Not the Government)

“Investigate before you invest.” — Charles Merrill (Merrill Lynch)

“I have always found it profitable to study my mistakes.” — Jesse Livermore

This past week I’ve been in Edinburgh, Scotland, the birthplace of Adam Smith (1723-1790), the father of free-market economics. On June 5, I gave the Adam Smith Lecture at the Panmure House on his 300th birthday.

The Library of Mistakes

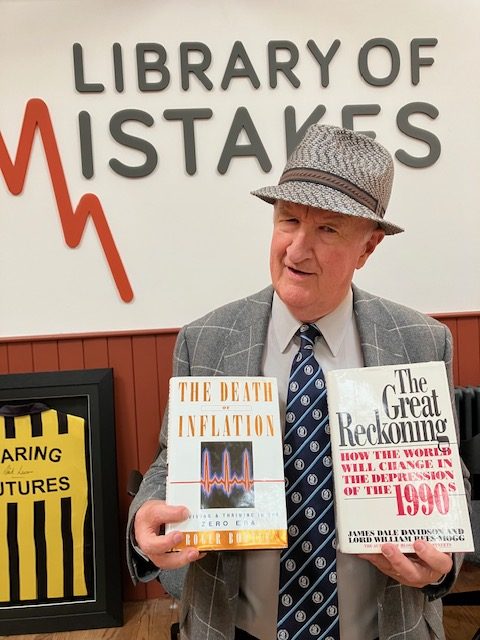

While in Edinburgh, I visited the “Library of Mistakes,” the brainchild of investment advisor Russell Napier. It contains books about financial disasters and crises, highlighting authors who made bad predictions or gave bad advice. There are so many that it fills an entire building!

As you can see from the photo above, I found several books in the Library of Mistakes that made bad predictions. It turned out that inflation was not dead, and the 1990s was a period of prosperity, not depression.

I’m especially wary of books written by the prophets of doom and gloom, such as:

“How to Prosper During the Coming Bad Years” by Howard Ruff (written in 1980, just as Ronald Reagan was elected president and turned the country around).

“The Depression of 1990” by Ravi Batra (the 1990s turned out to be one of the best decades in history.

You May Make Mistakes, but Don’t Make a Big One

As you enter the library, there’s a statement by James Joyce, “Mistakes are the portal of discovery.”

You learn from your mistakes!

I’d add a few additional quotes from “The Maxims of Wall Street:”

“Success can only be achieved through repeated failure.” — Soichiro Honda (p. 167)

“I hate to be wrong. But I hate more to stay wrong.” — Paul Samuelson (p. 32)

“Above all, avoid big mistakes.” — Warren Buffett (p. 168)

The latter advice from the Sage of Omaha is critical to your success.

The government can take 30% of your hard-earned wealth through inflation and taxation, but a bad or fraudulent investment can leave you with nothing. Beware of the money manager who promises too much!

“Dirty Jobs” Mike Rowe Learns the Hard Way

Our celebrity speaker this July 12-15 at FreedomFest is Mike Rowe, the famous “Dirty Jobs” TV personality. You won’t want to miss him in person. Join us at www.freedomfest.com.

Good news! Our full program is now posted! We will have over 200 speakers, panels, debates, etc.: 2023 Featured Speakers & Sessions – FreedomFest

Or view each speaker’s sessions: 2023 Speaker Lineup – FreedomFest

In his autobiography, “The Way I Heard It,” Rowe reveals that he trusted a friend to manage his money after he became successful on TV. It turned out that his friend embezzled his entire fortune, over a million dollars, and lost it all!

As Woody Allen once said cynically, “I’m a money manager. I manage your money until it’s all gone.” (p. 88)

It doesn’t have to be that way. I know many competent, honest money managers, but it’s hard to know for sure how safe your money is. It’s difficult to make the right decision when you are dealing with friends and relatives. The key is to “investigate before you invest,” as Charles Merrill says (p. 85).

For maximum safety, I recommend you invest most of your funds in a stock index fund like the S&P 500 Index through a reputable broker like Charles Schwab. You may lose some money from time to time during a bear market, but you are not going to be defrauded.

You can take greater risk with money managers or individual stock picking, but be sure to diversify. If you lose money to a bad investment or a business fraud, you don’t have to start over.

Above all, I urge you to become educated about investing. Everyone should learn this lesson: “The business of investing is not the same as investing in a business.” The stock market is a unique creature, and the more you know about it, the better your chances of success.

Why ‘The Maxims of Wall Street’ Will Make You a Better Investor

That’s why I urge every subscriber to own and read a copy of “The Maxims of Wall Street.” I don’t say this to enrich myself — I don’t make much money on these books. I sell them at a substantial discount and pay the postage. I’m more interested in educating you about the benefits and risks of investing in the stock market and other investment assets.

My book is the first to collect all the sayings on Wall Street (over 800 and counting), and it has been endorsed by Warren Buffett, Jack Bogle, Dennis Gartman, Bert Dohmen and many other financial experts.

Alex Green of the Oxford Club says, “Mark Skousen has collected a treasure trove of proverbs, slogans, stories and juicy quotes. He provides plenty of stories and commentary to go with these gems. I found myself chuckling (and occasionally sighing) when I first read this book. And I still refer to it regularly.”

And Kim Githler, president of the MoneyShow, says, “It’s my favorite book. Every quote is a lesson in history.”

“Maxims” is the ideal source for Wall Street wisdom. Alex Green calls it a “classic,” and Dennis Gartman keeps it on his desk for frequent reference. I know some investors who keep it on the night stand and read a couple of quotes every day.

Now in its 10th anniversary edition and with nearly 50,000 copies in print, it is the ideal gift for friends, relatives, clients, stockbrokers and money managers. The first copy is only $20, and all additional copies are only $10 each. I number and autograph each copy and mail them free if you live within the United States. To order, go to www.skousenbooks.com.

Good investing, AEIOU,

![]()

Mark Skousen

You Blew it!

Who are the Top “Worldly Philosophers”?

Recently, Harvard economist Greg Mankiw was asked by the Wall Street Journal to list his five favorite “economic primers.”

At the top of his list was Robert Heilbroner’s “The Worldly Philosophers,” which he says is “compelling, even for modern readers.” No doubt, Heilbroner’s title is the best ever conceived, but between the covers, it’s another story. Heilbroner, a long-time socialist, does have a softness in his heart for Adam Smith, but in the end, he clearly favors John Maynard Keynes, Karl Marx and Thorstein Veblen, all interventionists.

What’s ironic is that Mankiw’s second favorite book is Milton Friedman’s Capitalism and Freedom, defender of laissez faire in the 20th century. Why ironic? Because Heilbroner deliberately leaves out Friedman in his list of worldly philosophers, even in his latest editions. In fact, he ignores virtually all references to the laissez faire French, Austrian and Chicago schools.

In the early 1990s, I interviewed Heilbroner for Forbes magazine (see photo):

During the interview, I asked him why he left out Friedman — which Time magazine listed as the second most influential economist behind Keynes in the 20th century — and he said, “I don’t think Milton Friedman made any advances beyond the Adam Smith model.” Seriously?

By the way, here’s what Milton Friedman said about my book “The Making of Modern Economics”: “All histories of economics are BS — Before Skousen!”

M. E. “Mike” Sharpe, the original publisher of my history, told me that my book was destined to replace Robert Heilbroner’s famous work.

Mankiw said that he chose Heilbroner’s Worldly Philosophers because other histories are “bloodless.” Not mine! As John Mackey, former CEO of Whole Foods Market, states, “I’ve read Mark’s book three times. It’s fun to read on every page. I’ve recommended it to dozens of my friends.”

In fact, Greg Mankiw endorsed my book several years ago, saying, “It’s provocative, engaging and anything but dismal!”

“The Making of Modern Economics” is a “tell all” biography of economists, with exciting new insights into the lives of the great economists through new in-depth biographies, revealing an amazing tale of idle dreamers, academic scribblers, occasional quacks and madmen in authority. I do my best to entertain, with provocative sidebars, humorous anecdotes and even music selections reflecting the spirit of each major economist.

Want to know more? Here’s a summary: The Making of Modern Economics — MSKOUSEN.COM

See why Richard Rahn says “The Making of Modern Economics” is “the single best book ever written in economics.”

To purchase a copy at a substantial discount ($35 postpaid), go to www.skousenbooks.com.