The Fed is Missing a Key Ingredient for a ‘Soft Landing’

“Don’t fight the Fed — fear the Fed!” — Michael Sincere, MarketWatch (“Maxims of Wall Street,” p. 148)

Last week, I gave the opening lecture at Hillsdale College on “The Genius of Adam Smith” as part of a “Great Economists” conference.

But it was the final speaker who created the most controversy: Nicholas Wapshott, author of the book “Samuelson Friedman: The Battle Over the Free Market,” claimed that Milton Friedman, the great free-market economist, is passé and completely ignored when it comes to today’s hot economic issues.

He may be right when it comes to Friedman’s monetarism — that the money supply matters. Jay Powell, the current Fed chairman, says he no longer looks at the money supply to determine monetary policy.

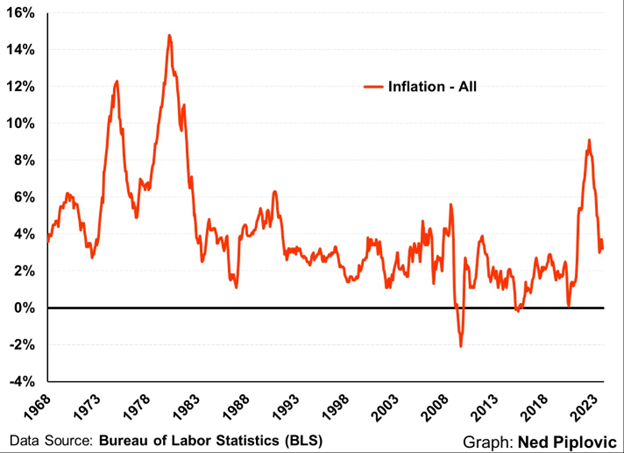

Today, the Fed’s primary tool is interest rates to fight inflation. So far, his policies have worked, and consumer price inflation is coming down, as the following chart demonstrates:

And with Powell’s strategy, the stock market is roaring ahead. (We are fully invested.)

But will his “tight money” policy work in the future? Ah, there’s the rub.

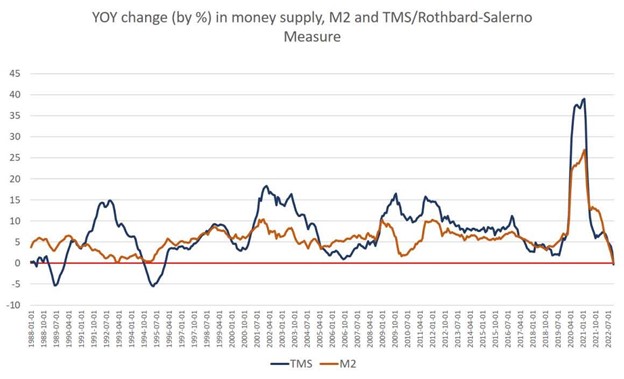

In economics, we learn that monetary policy consists of two parts: the quantity of money and the price of money.

The quantity of money (M2 or M3) should not be ignored, and it is sending out warning signs. As the following chart shows, the broad-based money supply has been extremely volatile since 2020. It ballooned during the COVID-19 pandemic in 2020-21 and has collapsed in 2020-23.

It was the “easy money” policies of the 2020-21 period that caused the return of inflation, and now it’s the Fed’s “tight money” policy that is bringing inflation back down. But it could also cause a deep recession if it continues.

Needed: Friedman’s Monetarist Rule

In order to have a soft landing — stable economic growth — the Fed needs to adopt Milton Friedman’s Monetarist Rule: Increase the money supply at a stable rate close to the long-term economic growth rate of 3-4% a year.

Unfortunately, the Fed is moving in the opposite direction of an unstable “easy money/tight money” policy, what I call the Fed Disaster Plan.

The longer the money supply remains stagnant, the more likely we will see a recession, probably in 2024.

In short, the Fed is perpetuating the boom-bust cycle.

Monetarism is Still Alive

Is Milton Friedman’s program for monetary stability dead? Not by a long shot.

Yesterday, Jeremy Siegel, the Wizard of Wharton, appeared on CNBC and warned investors and policymakers that the “money supply is stagnating” and commercial bank deposits have not grown in three years.

Siegel is a follower of Friedman’s monetarism. So are many supply-siders such as Steve Forbes, John Fund, Steve Hanke and Tim Congdon.

At the end of Wapshott’s lecture, I stood up and objected to his thesis that Friedman is ignored today. I noted that Friedman’s book, “Capitalism and Freedom” is still in all the bookstores… His school choice initiative (EdChoice) is gaining strength in most states… Since 2002, the Cato Institute has awarded the Milton Friedman Prize for Advancing Liberty every two years (valued at $250,000)… There’s still the Becker Friedman Institute at University of Chicago… Many people still celebrate his birthday every year on July 31. And he’s highlighted in my economics books.

C-SPAN Celebrates Milton Friedman This Month!

There’s more proof: This week, C-SPAN is doing a series of interviews on Friedmans’ “Free to Choose” etc., starting with a long interview with Prof. Lanny Ebenstein, who has written a biography of Friedman.

I was also interviewed about Milton Friedman on a CSPAN podcast.

Friedman is Highlighted in My Two Textbooks

Milton Friedman will be long remembered if I have anything to do with it. He was a long-time friend, and I was probably the last person to have lunch with him before he died in 2006. (See photo below.)

I highlight him in both my popular textbooks, “Economic Logic” and “The Making of Modern Economics.”

“Economic Logic” is my free-market textbook. I dedicate the book to Milton Friedman and Friedrich Hayek, the two giants of the 20th century. The sixth edition is hot off the press and will be available for sale at the end of this month. You can order it in advance at www.skousenbooks.com.

“The Making of Modern Economics” is now in its 4th edition and published by Routledge. You will love my chapter 15, “Milton’s Paradise: Friedman Leads a Monetary Counterrevolution.” For more information on my book, go here.

Friedman liked my book so much that he said, “All histories of economics at BS — Before Skousen!”

To purchase a copy at a substantial discount, go to www.skousenbooks.com. It makes an excellent gift for the holidays to students and adults alike. As Professor Doug Irwin (Dartmouth College) states, “The most interesting and lively book on the history of economic thought ever written.” Check it out!

Milton Friedman is dead. Long live Milton Friedman!

Good investing, AEIOU,

![]()

Mark Skousen

You Nailed It!

Wichita Elects a Libertarian Mayor

One of the bright spots in the Nov. 7 elections was the election of the mayor of Wichita, Kansas, the home of Koch Industries. Let’s celebrate.

“I believe in empowering the individual and limited government. I chose to become a Libertarian on my registration because it spoke to who I was.”

Ms. Wu won with nearly 60% of the vote against an entrenched incumbent. She is a 39-year-old Asian immigrant from Guatemala, the first person in her family to graduate from college and a registered member of the Libertarian Party.

Now, she’s the mayor of one of the 50 largest cities in America.

Her issues are better schools, “public safety” and being “more responsible with the money that is being sent to us by taxpayers.”

Reason magazine did a full story and interview with her, which you can find here.