“The Fed Disaster Plan” Creates a Financial Crisis

“Now we are facing another alarming trend, what I call ‘The Fed Disaster Plan,’ raising interest rates in a fast and furious fashion, causing a potential recession, a prolonged bear market on Wall Street and perhaps even a monetary crisis in 2023.” – January issue of Forecasts & Strategies.

“There’s always more than one cockroach.” — “Maxims of Wall Street”

Three months into 2023, the monetary/banking crisis is now upon us, as the publicly traded Silicon Valley Bank in California and Signature Bank in New York collapsed and had to be taken over by the Federal Deposit Insurance Corporation (FDIC).

This is the biggest bank failure in modern times since the collapse of Washington Mutual in 2008.

Both banks, with assets over $100 billion, engaged in risky investments, tech startups in California and cryptocurrencies in New York.

Moreover, these bank officials engaged in the DIE culture, bragging about its commitment to “diversity, inclusion and equity.” Signature Bank issued a series of embarrassing “company culture” videos that critics have called a circus, not a bank.

As one critic put it, “The Management Team was basically like the show ‘The Office’. They’d waste money on things like producing parody videos.”

Silicon Valley executives announced in its literature that 45% of the board were women and even cited the number of members who were Black or LGBTQ+.

As Alex Green, chief investment strategist at the Oxford Club, states, “Unfortunately, someone’s gender, orientation or skin color doesn’t make them better at hedging interest rate risks. SVB shareholders learned this week that if you go woke, you really do go broke.”

“There’s always more than one cockroach.”

There may be other institutions in trouble.

The banking crisis is growing. While the Big Four — JP Morgan Chase, Wells Fargo, Bank of America and Morgan Stanley — are fairly safe, experts believe that at least 20 more banks are in trouble.

Indeed, another bank, Silvergate in New York, was declared insolvent over the weekend — the third largest bank failure in recent times. And the banking crisis has spread to Europe, with Credit Suisse now in trouble.

As Dennis Gartman, editor of the Gartman Letter, states, “There’s always a bigger junkyard dog.” (p. 84, “Maxims on Wall Street”).

The fact that the Biden administration felt the need to guarantee all depositors suggests that contagion is a real threat.

FDIC-insured bank accounts up to $250,000, but apparently, 90% of SVB depositors had more than that amount on deposit, mostly tech companies. Treasury Secretary Janet Yellen announced that shareholders and bondholders won’t be bailed out, but has instructed the FDIC to cover all deposits to avoid a spreading crisis.

That’s good news for wealthy depositors, but not a good long-term government policy. As Steve Moore states in his “Unleash Prosperity Hotline”, “Bailouts only reward bad management and often very risky investment strategies that caused the crisis in the first place.” We economists call it “moral hazard.”

How the Fed Engineered a Monetary Crisis

In many ways, the growing banking crisis is a result of the Federal Reserve’s aggressive “tight money” policy after engaging in its “easy money” policies of the previous 10 years.

The Fed is famous for overdoing it in both directions, pushing interest rates too low, and then too high.

This time around, under Jay Powell, the stock of money has stopped growing, and the price of money (interest rates) is going up fast, maybe too fast.

How the Inverted Yield Curve Creates Instability

The Fed’s decision to aggressively fight inflation after engaging in easy money can’t be done without causing real trouble. That’s the central message of the Austrian theory of the business cycle, which I use regularly to make investment decisions.

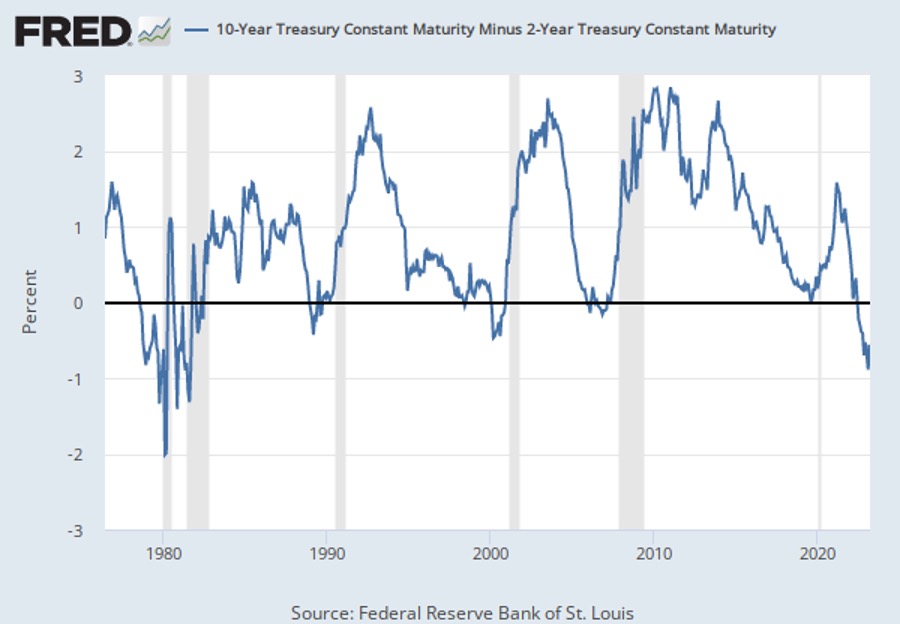

The inverted or negative yield curve, in particular, is an Austrian statistic that warns of trouble. The structure of interest rates matters. As I state in my book, “A Viennese Waltz Down Wall Street: Austrian Economics for Investors”, “a timely indicator of a top of a market is the inverted yield curve, when short-term rates are suddenly higher than long terms.” (p. 46)

The negative yield curve has accurately predicted the bear markets of 2000-02, 2008-09 and the past year, as this chart demonstrates.

In particular, the bond market has fallen sharply after a 40-year bull market. Most institutions such as SVB had a majority of their investments in long-term bonds, which have fallen sharply in the past year.

Instead of worrying about discrimination and global warming, Silicon Valley officials should have switched from long-term Treasuries to T-bills.

To learn more about Austrian economics, click here. My book is available for $20 postpaid at www.skousenbooks.com.

Will the Fed Delay Raising Rates?

The latest monetary crisis may force the Fed to back off its aggressive tight money policy. There’s an old saying, “the Fed tightens until something breaks.” It has happened before. In the summer of 1982, the Mexican banking crisis hit and Paul Volcker reversed course, cut interest rates and expanded the money supply. The economy and the stock/bond markets took off.

Update on Our Investments

Meanwhile, T-bills and money market funds are doing well. For example, Schwab Money Market Fund is currently yielding 4.5%. Many investors are switching to money funds or T-bills rather than risking their funds in the stock market.

Stocks and mutual funds are struggling in the face of the Fed’s tight money policy. The smart strategy is to have a well-diversified portfolio of stocks, mutual funds, ETFs and money market funds that pay above-average dividends.

The government bailout caused stocks to rally temporarily, but there could be more trouble down the road.

Global Financial Summit Addresses the New Monetary Crisis

Understanding the role of government and the Federal Reserve in creating the boom-bust business cycle is essential to be a successful investor these days. We have a great lineup of experts who will help you navigate the latest monetary crisis, including Jeremy Siegel, Burt Malkiel, Louis Navellier, Alexander Green, Addison Wiggins, Steve Forbes, George Gilder, Steve Moore, Art Laffer, John Fund and David Bahnsen. Plus our own editors Jim Woods, Roger Michalski and Paul Dykewicz.

I urge you to join us at the Global Financial Summit at FreedomFest, July 12-15, in Memphis. For our full list of speakers and events, go to www.freedomfest.com.

Special Discount Ends on March 31!

We already have over 700 attendees coming to our big show this July. Our early bird discount ends this month. I’ve arranged another $50 off the early-bird rate for my subscribers. Use code EAGLE50 and register at www.freedomfest.com, or call Hayley at 1-855-850-3733, ext 201.

P.S. Join me for a MoneyShow virtual event where I’ll be on a panel moderated by Roger Michalski, and will be joined by my colleagues Bryan Perry and Jim Woods. In addition, the entire event focuses on investing for income — real estate, master limited partnerships (MLPs), dividend-paying stocks, bonds and more. To sign up for this free event taking place on March 21-23, click here now.

Good investing, AEIOU,

![]()

Mark Skousen

You Nailed it!

Gov. Ron DeSantis’s New Book Hits #1 on Amazon

While I was in Las Vegas last weekend for the EconoSummit, Florida Governor Ron DeSantis was there for his book tour, attracting over 1,000 people. His book came out last week and hit #1 on Amazon.

I am reading the book now and enjoying especially his personal story growing up in Florida and Pennsylvania, going to Yale to play baseball, then on to Harvard for a law degree, then entering the Navy and spending time in Iraq, becoming a congressman and now mayor of the fourth largest state in the union. He just won re-election by a landslide in a state that normally is split down the middle. He can bring people together again in the United States. It’s time for a new generation to take over the country.

I’m not a fan of the “left-right” rhetoric in his book, but otherwise, I highly recommend it, and it is available on Amazon.