Slow GO: Is a Bear Market and Hard Landing Coming?

“Congratulations on your work. It has been a long slog to get the national accounts to introduce innovative measures. This will open up the potential for new insights into the behavior of the economy.” — William D. Nordhaus (Nobel Laurette, 2018), Yale University

Three weeks ago, I stuck my neck out when I wrote an op-ed for The Wall Street Journal with the headline, “Slow GO May Mean a Recession Soon: GDP numbers look great but a leading indicator signals trouble ahead.”

You can read it here.

By GO, I was referring to a little-noticed statistic that the federal government releases every quarter along with gross domestic product (GDP) called gross output (GO), which is the broadest measure of total spending in the economy. Unlike GDP, it includes the supply chain.

I call it the “top line” in national income accounting. (GDP is the bottom line.)

In the article, I stated, “Whenever GO grows at a slower pace than GDP, it suggests a slowdown and perhaps a recession.”

For the past few quarters, that’s exactly what has happened: GO is growing at a slower pace than GDP. In the fourth quarter, real GO grew a percentage less than the 3.4% real GDP rate.

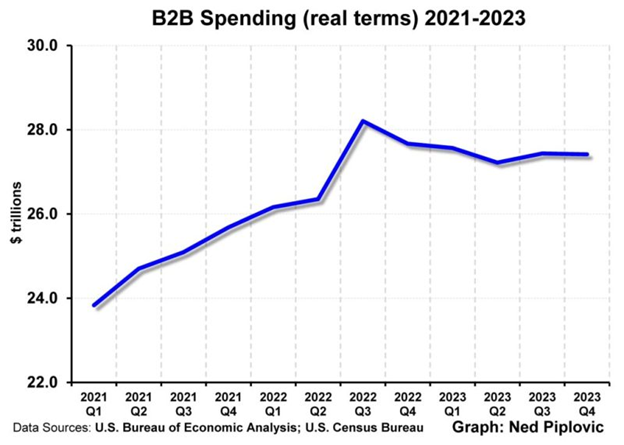

Business-to-business (B2B) spending in particular is a leading indicator. As the following chart shows, it’s been slowing down for over a year and actually turned negative in real terms in the fourth quarter of 2023.

Today’s GDP Number Confirms Stagflation

Today’s GDP numbers surprised economists. The Bureau of Economic Analysis (BEA) announced that real GDP grew only 1.6% for the first quarter — confirming my prediction of a slowdown and stagflation.

As Constance L. Hunter, a forecaster at MacroPolicy Perspectives, warned, “It increases the chances of a harder landing.” And a bear market on Wall Street.

Today’s news vindicated the value of GO (especially B2B spending) as a new forecasting tool.

The Flaw in GDP Reporting

Because the establishment media rely on GDP instead of GO to predict the future of the economy, they make the mistake of focusing on consumer spending, not business activity. It’s a serious flaw in GDP reporting.

For example, today’s New York Times reported, “For now, consumers are ensuring that growth continues. Spending rose at a 2.5 percent rate in the first quarter as low unemployment and rising wages helped shoppers shrug off high interest rates and rising prices.”

The Times warned, “If consumer spending returns to earth, however, the broader economy could be vulnerable.”

The Source of the Myth

The financial press is enamored with consumer spending, based on GDP numbers alone. Since consumption represents 70% of GDP, they naively conclude that “consumer spending drives the economy.”

In fact, retail spending by consumers is a lagging indicator, and is the effect, not the cause, of prosperity. Real economic growth comes from the supply side: productive saving, capital investment and technology.

Almost all of the Conference Board’s Index of Leading Economic Indicators are linked to business activity, such as manufacturing of new orders, the stock market and interest rates.

Even the much-publicized Consumer Confidence Index emphasizes business conditions and the job outlook, not spending on food, entertainment or vacations.

The media makes the mistake of using GDP instead of GO to determine what drives the economy. GDP measures finished goods only and leaves out the value of the supply chain. This is the source of misunderstanding.

GO measures spending at all stages of production, including the supply chain, and is therefore the right way to measure total economic activity. Using GO, it turns out that consumer spending is in only about one third of the economy.

Business spending is bigger (over 60% of GO) and much more volatile than consumption, as this chart demonstrates:

As economist Larry Kudlow concludes, “Though not one in a thousand recognizes it, it is business, not consumers, that is the heart of the economy. When businesses produce profitably, they create income-paying jobs and then consumers spend.”

The media will continue to be misguided until it recognizes GO as the “top line” in national income accounting, and not just GDP.

Part of the problem is the government itself. The Bureau of Economic Analysis at the Commerce Department, which releases GO and GDP data every quarter, buries GO data under the title “GDP by Industry” and makes it difficult to find on the BEA website (www.bea.gov).

Moreover, GO comes out two months after the GDP release. The BEA staff is working hard to reduce that time lag. Their long-term goal is to release both GO and GDP at the same time, just as publicly-traded companies release sales and earnings every quarter.

Celebrating 10 Years of GO

It’s now been 10 years since GO became an official statistic along with GDP. It was a watershed event. A news release on Friday, April 26, 2014, by the Bureau of Economic Analysis at the U.S. Department of Commerce prompted a press conference, an op-ed in The Wall Street Journal and the printing of a third edition of my book, “The Structure of Production.”

At the BEA press conference, BEA director Steve Landefeld said, “Gross Output provides an important new perspective on the economy and a powerful new set of tools of analysis, one that is closer to the way many businesses see themselves.”

Steve Hanke, professor at Johns Hopkins University, stated at the time, “Now, it’s official. With Gross Output (GO), the U.S. government will provide official data on the supply side of the economy and its structure… GO provides a clearer, more comprehensive picture of the economy… Contrary to what the standard textbooks have taught us and what that pundits repeat ad nauseam, consumption is not the big elephant in the room. The elephant is business expenditures.”

It took nearly a quarter of a century for the government to recognize GO’s critical importance. Starting with my work “The Structure of Production” in 1990 and “Economics on Trial” in 1991, I introduced the concept of Gross Output as a macroeconomic statistic, not to replace GDP, but to supplement it as a broader measure of total economic activity. In these works, and later in my own textbook, “Economic Logic” (published since 2008), I made the case that we needed a new statistic beyond GDP that measures spending throughout the entire production process, not just final output, and it needed to be updated on a timely basis. GO is a move in that direction.

Many Economists Endorse This New Macro Statistic

In the past 10 years, much progress has been made in introducing GO, including endorsements from top economists, including three Nobel prize winners.

Dale Jorgenson, Steve Landefeld and William Nordhaus wrote the following in “A New Architecture for U.S. National Accounts”: “Gross output [GO] is the natural measure of the production sector, while net output [GDP] is appropriate as a measure of welfare. Both are required in a complete system of accounts.”

Steve Forbes is a big fan: “This is a great leap forward in national accounting. Gross Output, long advocated by Mark Skousen, will have a profound and manifestly positive impact on economic policy.”

He uses this metaphor: “GDP is the X-ray of the economy; GO is the CATscan.”

GO has been reported in the New York Times, Barron’s, Forbes magazine, and CNBC (mainly on Rick Santelli’s Exchange).

The editors of The Wall Street Journal are true believers: They’ve published four of my articles on GO.

I issue a press release every quarter when GO data is released. See my website: www.grossoutput.com.

Private forecasters such as David Ranson, CEO of HCMR, Inc., and Jerry Bowyer, president of Bowyer Associates, use GO in their economic models.

Half Way There, and More to GO

But overall progress has been slow, especially the American Economic Association (AEA) and the economic textbooks. The AEA has yet to publish papers on GO or have a session at its annual AEA meetings.

Only a handful of textbooks include GO in their latest editions. Sean Flynn, a professor at Scripps College (Claremont) and the primary writer of the McConnell Brue Flynn “Economics” wants to integrate it into its national income accounting chapter, but is facing resistance from academics who are averse to adding GO.

Most textbooks don’t list GO in the glossary. But there’s hope: Last year, GO finally made it into the Concise Encyclopedia of Economics.

If you want to see how easy it is to incorporate GO into the textbooks, see chapters 14 and 15 in my book “Economic Logic,” now in its 6th edition. It’s available at a discount at www.skousenbooks.com.

GO is a Paradigm Shift in Economics

As I see it, economists are just now catching up with accounting and finance, which decades ago adopted a “top line” (sales) and “bottom line” (profits) in its financial statements. Now, in the 21st century, economists can do the same with GO and GDP.

In many ways, GO is a paradigm shift in economics. It’s the missing piece of the macroeconomic puzzle. But as Thomas Kuhn wrote in “The Structure of Scientific Revolutions”:

“Led by a new paradigm, scientists adopt new instruments and look in new places… When the transition is complete, the profession will have changed its view of the field, its methods and its goals.”

You Nailed It!

Tom Phillips, ‘The Godfather of Financial Newsletters,’ R. I. P.

Thomas L. Phillips, my original publisher, died on April 18, 2024, at his home in Southern California after a 15-year battle with Parkinson’s disease. He was 83.

Jo Ann and I visited him in his home a few years ago and he was delighted to see us, showing us around and reminiscing about the photos that chronicled his vibrant and active life before the disease slowed him down to a trickle.

Tom was a long-time friend and business partner and was instrumental in my career. We met frequently at his various homes around the country (Maryland, Virginia, Palm Beach and Southern California) and we traveled together to many destinations. He was always impeccably dressed in a suit and tie, even on a long flight to Asia. (We often joked that his tan line would include the outline of a tie!)

When I resigned as managing editor of “The Inflation Survival Letter” in 1980, hoping to write my own newsletter, Tom offered his services as an up-and-coming publisher. It was his idea to call it “Forecasts & Strategies.” Tom started publishing independent newsletters as part of the new “alternative press” from his garage in Chevy Chase in 1974; his first newsletter was “The Retirement Letter.” Mine was second, and he did an outstanding job of promoting it. At one point in the early 1990s, we served 75,000 subscribers.

Being an economist, I took advantage of the law of comparative advantage. Tom took on most of the risk by publishing, promoting and fulfilling my newsletter; I only had to write the copy every month, and in return, received a guaranteed monthly income plus a quarterly royalty. Over time, he made a lot more money than I did, but took greater risks, and had to deal with the day-to-day issues of marketing, fulfilling and operating a tough business. We both made money, but he made a lot more. I have no complaints and was treated well by our arrangement. It gave me the free time to write books, teach at major universities, live abroad and travel the world with my family.

It wasn’t long before Tom was a publishing behemoth, amassing over one million subscribers through his investment, health and political publications and organizations. He expanded into publishing the weekly newspaper Human Events, the Conservative Book Club and Regnery Books (which published several of my books).

He was widely known as an influential conservative voice in Washington. He introduced me to many interesting characters, including Art Linkletter (host, “Kids Say the Darndest Things”), Pat Sajak (host, “Wheel of Fortune”) and Robert Novak (journalist nicknamed “The Prince of Darkness”).

By 2000, Phillips International had over $350 million in sales and 500 employees. He was famous for celebrating company milestones by treating all his employees to an all-expense trip to Disney World for the 20th anniversary and a Disney cruise for the 25th. As an enlightened capitalist, he treated his employees well.

He was also a generous philanthropist, supporting organizations such as Young America’s Foundation and the Fund for American Studies. He financed the Robert Novak Journalism Fellowship Awards Program. He did his best to see that a future generation of journalists would maintain the high standards of reporting the news in a fair and balanced way.

In 2004, he was again instrumental in the growth of my newsletter, when he agreed to have Jeff Carneal, Roger Michalski and Eagle Publishing take it over.

His success allowed him to build an empire and to own several mansions and a couple of Rolls Royces. Sadly, he wasn’t as successful in marriage, going through two painful divorces. He is survived by four children, Karen and Mark from the first marriage, and Reagan and Parker from the second. He will be sorely missed in the worldwide conservative community and within his personal circle of friends and family.

We will be dedicating a room to him at this year’s FreedomFest. He attended several times and was a fan.

Good investing, AEIOU,

![]()

Mark Skousen