Outlook for 2024: Down We GO?

It’s at least conceivable that gross output is a leading indicator of the economy.” — Peter Coy, Economics Editor, NY Times

One of the highlights this year was my gross output (GO) statistic making the Aug. 7 issue of The New York Times: “What GDP’s Cousin Can Tell Us About the Economy.” See it here.

Gross output measures spending at all stages of production and is thus a much more accurate and broader picture of the economy. Unlike gross domestic product (GDP), GO includes the all-important supply chain.

Thus, I see GO more as the “father” of GDP than its cousin, since the Bureau of Economic Analysis (BEA), the federal agency that produces GDP every quarter, starts with GO to re-calculate the accuracy of GDP when it does its “benchmark survey” every five years.

I’m convinced that GO is a leading indicator, since the supply chain (intermediate expenditures) tells us what’s going on in the pipeline in the production of final goods and services.

Indeed, when GO is growing faster than GDP, it’s a good sign that the economy is expanding; when GO is growing slower than GDP, it predicts a slowdown or even a recession.

What is GO telling us now?

The BEA just completed its latest five-year benchmark survey, and today released third-quarter GO and GDP statistics.

Economic Growth Recovers from Its Slowdown…

What did we learn?

First, until the third quarter, GO was in a “slow growth” mode. GO grew at a slower pace than GDP in the first half of 2023.

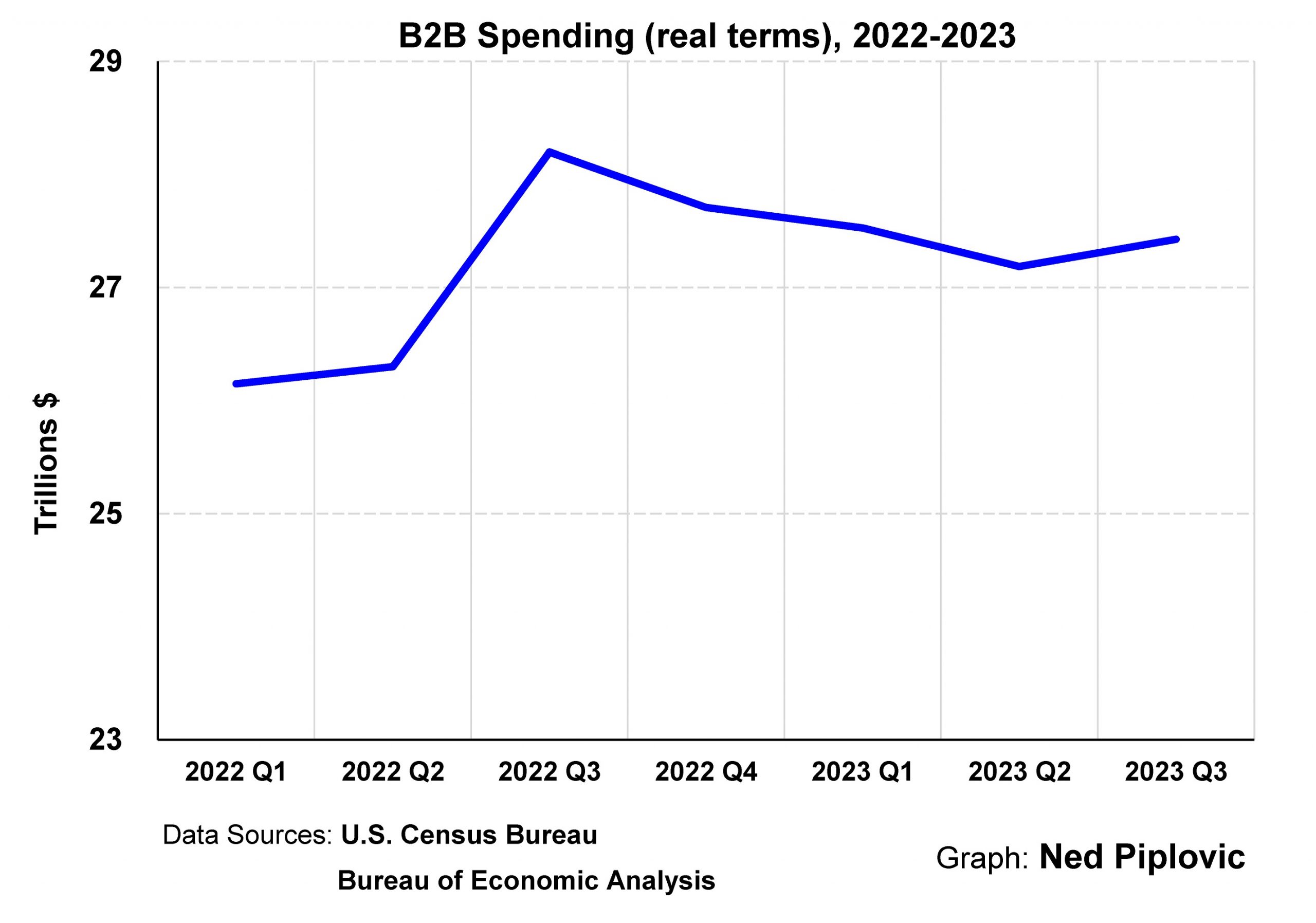

Indeed, business-to-business (B2B) spending actually declined in the second quarter by 3.3%.

Overall, we did not go into an actual recession because consumer and government spending put us into the plus column.

But the third quarter was a surprise: Real GO grew by 3.9% and GDP by 4.9%, substantially more than the previous year, primarily because of robust spending by consumers, business and government. In fact, business spending (B2B) actually rose faster than consumer spending in the third quarter.

Does this mean we can avoid a recession in 2024? It’s possible…

… But All Bets are Off in 2024

What about the fourth quarter and 2024, the all-important election year?

So far, both GO and GDP data suggest we have avoided a recession. But there are warning signs everywhere that the economy could be in trouble in 2024:

- The Conference Board’s Leading Economic Indicators are still negative and have been throughout 2023. Most of the indicators are business related, such as manufacturing.

- Short-term interest rates are higher than long-term interest rates. This inverted yield curve usually predicts a downturn in the economy.

- My own GO figure continues to grow at a slower pace than GDP, not a good sign. Much depends on B2B spending, which is a major predictor of the future. See the chart below.

I’ll have a press release on the latest third-quarter GO later today or tomorrow at www.grossoutput.com.

Can the Fed Stop the Bleeding?

The key factor in the inflation and boom-bust cycle has been the Federal Reserve. Inflation made a comeback after the 2020 Covid pandemic, when the Fed cut rates to zero and dramatically increased the money supply by 40%.

Since 2022, chairman Jay Powell and the Federal Reserve have reversed course, and raised interest rates and stopped growing the money supply.

This tight-money policy has caused the economy to slow dramatically, and even threatened a recession in 2024.

However, in December, the Fed saw the same warning signs I see, and hopes to counter a potential economic contraction and banking crisis by announcing plans to cut interest rates next year.

But it may be too little, too late to keep it from happening. The Fed is famous for overdoing it in both directions — too easy, too long and too tight, too long.

My January Prediction for 2024

Thus, my headline for the January Prediction issue of my newsletter, Forecasts & Strategies:

Investors will face a difficult election year as the world confronts the challenges of the Fed’s tight-money policy, growing deficits, wars and rumors of wars and the possibility of another banking crisis.

We ended 2023 with a bang, thanks to chairman Jay Powell and the Federal Reserve’s decision to hold off raising interest rates, and its promise to cut rates this year.

During last month’s Eagle investment cruise, editor Bryan Perry warned of a second banking crisis hitting in 2024 due to a wobbly commercial real estate loan market. The Fed is worried too, and that’s why its leaders backed off its tight-money policy. But their action may be too little, too late to offset the growing possibility of a recession or banking crisis.

It is also a presidential election year, where the future of the United States is in jeopardy. Will we face another four years of irresponsible and misguided policies, or will a new round of leaders return us to fiscal and monetary sanity? The voters will decide in November, assuming we have election integrity.

Our investment portfolio of tech stocks and commodities (oil, gold and uranium) did well in 2023, but investing will be tougher in 2024.

‘The Renaissance Man’ Discovers Financial Wisdom!

My wife and I just finished our Eagle cruise to Latin America. One of the speakers, Jim Woods, my co-author of the Fast Money Alert, described perfectly the attitude on Wall Street nowadays with his favorite financial maxim: “Bulls love to run, bears love to grumble.”

Last week, Jim wrote in his popular column, “The Deep Woods” the following:

“I’ve always felt that a collection of wisdom from the best brains in that industry has been most special to me. And on this front, there is no better “how to” anthology than the one by my friend, fellow Fast Money Alert co-editor and brilliant economist, Dr. Mark Skousen.

“The work I am specifically referring to here is ‘The Maxims of Wall Street.’ This is a collection of some of the greatest wisdom ever to flow from the biggest and brightest names on Wall Street. Great investors such as Jesse Livermore, Baron Rothschild, J.P. Morgan, Benjamin Graham, Warren Buffett, Peter Lynch and John Templeton are just a sneak peek at some of the names you’ll discover in this fantastic collection.

“Then, there is profundity from the likes of Ben Franklin, John D. Rockefeller, Joe Kennedy, Bernard Baruch, John Maynard Keynes, Steve Forbes and numerous other luminaries too copious to mention.

“As Mark puts it, ‘For years, I’ve been compiling these financial adages, ancient proverbs and immortal poems found in new and rare financial books and quoted regularly by investors, money managers, brokers and old timers.’

“So, whether this gift of ideas is to yourself or to someone special, you should definitely do everyone a favor and give ‘The Maxims of Wall Street’ to those you value.”

What better gift to give your friends, relatives, clients and your favorite stockbroker than the new 10th edition of “The Maxims of Wall Street?”

I’ve added some 20 new quotes to the new edition.

“Maxims” has been endorsed by Warren Buffett, Jack Bogle, Kim Githler, Alex Green and Bert Dohmen and reviewed favorably by Barron’s.

It makes an ideal gift during the holidays. As Rodolfo Milani states, “I find them to be ideal gifts for my best clients.”

‘Maxims’ at a Super Discount

Despite rising inflation and shipping costs, I’ve managed to keep the price of the new 10th edition to only $21 for the first copy, and $11 for all additional copies. And if you order an entire box (32 copies), the cost is only $327 (around $10 each).

I pay all shipping costs if mailed to any of the 50 states. Plus, I autograph and number each copy. The book is a real keepsake!

To order, go to www.skousenbooks.com.

Upcoming Investment Seminar

Orange County AAII Conference, Saturday, January 20, 2024: If you live in Southern California, please join me for my 2-hour presentation on the outlook for stocks, commodities and real estate, 9-11 a.m. at the Center of Founder’s Village, 17967 Bushard Street, Fountain Valley, CA 92708. Parking is free, but there is a $5 charge for attending this event sponsored by the Orange County chapter of the American Association of Individual Investors. For more information, go to AAII Orange County Webpage. To confirm your attendance, email Stephanie at sdavis388@gmail.com.

P.S. I will be hosting a special subscribers-only teleforum on Dec. 27 at 2 p.m. EST entitled “How to Profit During the 2024 Presidential Election Year.” The event is free but you must register here to be able to attend. Don’t miss out!

Good investing, AEIOU,

![]()

Mark Skousen

You Blew It!

Should Joe Biden Be Impeached?

“The President, Vice President and all civil Officers of the United States, shall be removed from Office on Impeachment for, and Conviction of, Treason, Bribery or other high Crimes and Misdemeanors.”– Art II, Section 4, United States Constitution

After the House of Representatives voted to institute a formal investigation on the impeachment of President Joe Biden, The New York Times reported, “Republicans are pushing forward with a formal investigation even though their yearlong scrutiny of the president and his family has turned up no evidence of high crimes or misdemeanors.”

After the establishment media decided to be “deniers” about wrongdoing of the Biden family, with all of them joining a chorus saying there’s “no evidence,” I saw this political cartoon that really says it all.

Courtesy of Tom Stiglich. http://www.tomstiglich.com/.