Oil Price Hits Super Bargain — Is Now the Time to Buy?

“Buy when blood is running in the streets.” — Baron Rothschild

Oil, along with gold and other commodities, is going through a selling panic due to the strong dollar (most commodities are quoted in dollars) and a slowdown in China and most of the global economies. The pending nuclear deal with Iran means millions more gallons soon will hit world markets (if the treaty is signed by the Senate, which is a big if). New technologies, especially horizontal drilling, have created an oil glut in the United States. President Obama has not helped. In the name of global warming alarmism, he recently proposed severe restrictions on carbon emissions that could cripple coal and oil production.

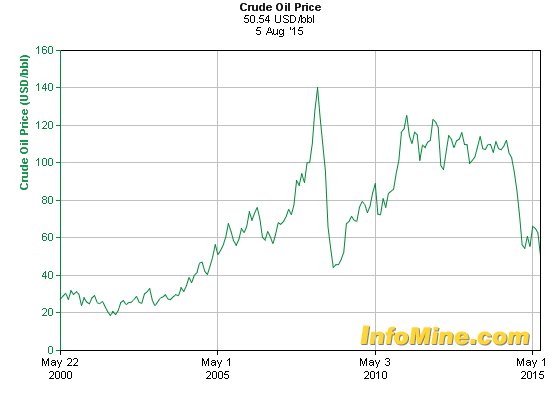

All in all, it has been the worst year for oil and oil stocks since the collapse in 2008-09. See the chart below.

Several independent oil & gas firms that were highly leveraged have cut their dividends, or even suspended them. There’s now talk that the giants Conoco and even ExxonMobil will have to cut their dividends. There was similar talk in 2009, but it never happened. But as I have said in my book “Investing in One Lesson,” “Wall Street exaggerates everything.”

I have several pages of quotations in “The Maxims of Wall Street” on contrary investing, such as:

“Don’t buy what’s hot — buy what’s not.” — Rick Rule

“The time of maximum pessimism is the best time to buy.” — John Templeton

“It is wiser to be early than to be late… A contrary opinion is usually ahead of its time.” — Humphrey B. Neill (the father of contrarian investing)

Judging from the chart, it does appear to be a replay of 2009. Energy stocks look like a screaming buy. We may be early by recommending good quality oil & gas firms like ExxonMobil (XOM) and ConocoPhillips (COP) or our favorite pipeline company (see Forecasts & Strategies). But as Robert Wilson says, “Unless there’s fear in buying a stock, you can’t make big money.”

You Blew It! Hillary Clinton Abandons Bill Clinton’s Economic Policies

Hillary looks to be going down, and the sooner the better. Finally, the Feds are considering a criminal investigation that would allege she deliberately destroyed evidence (her emails) that were of value in national security.

Now, she’s in a war against investors. It was bad enough that President Barack Obama and the Democrats raised taxes on short-term capital gains and dividends to 43.4%, but that’s not enough of their “fair” share. He also raised long-term rates from 15% to 23.4%.

Now, if Hillary Clinton becomes president, she proposes to double the time it takes before you qualify for long-term capital gains to two years, and if you sell a stock, real estate, or assets before two years, you’ll pay taxes of up to 43.4%. She wants to discourage short-term trading, which she calls “quarterly capitalism.” What she doesn’t realize is that short-term trading is a boon to the economy and especially to long-term investors who want a good price when they sell.

What’s ironic is that Hillary is abandoning her own husband’s policies. In 1997, President Clinton signed into law a reduction in the capital gains tax to 20%, resulting in an economic boom in the late 1990s. But Hillary and Bill apparently don’t see eye to eye on a lot of issues.

Hong Kong has the best system — no tax at all on capital gains, dividends or interest. That way, investors are encouraged to save and invest in capital and the future of their country. No wonder they are growing faster than we are.

Even if Hillary somehow wins the presidency, the Republicans ideally will stay in charge of Capitol Hill and keep her confiscatory tax policies at bay.

Upcoming Appearance

O Lecture, Cascade Policy Institute, Portland, Oregon, Aug. 14: Next week, I’m traveling to Portland, Oregon, where I grew up, to attend my 50th high school reunion at Sunset High. The Cascade Policy Institute, a free-market think tank in Oregon, has invited me to give a luncheon lecture on Friday, Aug. 14, at Ernesto’s Italian Restaurant, and has invited my subscribers to attend. I look forward to seeing you there. The topic will be “What Really Drives the Economy? Why are Some Countries Rich and Others Poor?” The answer may surprise you. The cost is only $18, which includes lunch. To attend, go to http://mark-skousen-at-cascade.eventbrite.com, call Steven Buckstein at 1-503-242-0900, or email him at steven@cascadepolicy.org.

In case you missed it, I encourage you to read my e-letter column from last week on Eagle Daily Investor about King Dollar and commodity prices. I also invite you to comment in the space provided below my Eagle Daily Investor commentary.

Good investing, AEIOU,

![]()

Mark Skousen

Presidential Fellow, Chapman University

Wikipedia

Newsletter and trading services

Personal website