Milton Friedman’s Blind Spot

“Adam Smith was a radical and a revolutionary in his time — just as those of us who preach laissez-faire are in our time.” — Milton Friedman (1976)

Last week, I was on a panel at the Association of Private Enterprise Education (APEE) meetings in Las Vegas. We were there to review the new biography, “Milton Friedman: The Last Conservative” (New York: Farrar, Straus and Giroux, 2023, 575 pages) written by Professor Jennifer Burns, who teaches at Stanford University. You can buy the book on Amazon.

I also recommend Lanny Ebenstein’s excellent book, “Milton Friedman: A Biography,” written in 2007. It is based on extensive interviews with Friedman before he died. Order it here.

APEE Meeting on April 9, 2024, in Las Vegas. Bottom row: Tom Miller (moderator), Jennifer Burns, David Henderson. Top row: Michael Bordo, Mark Skousen.

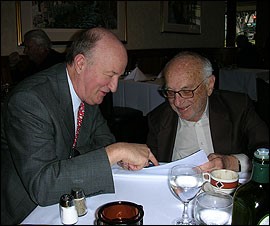

Milton Friedman (1912-2006) and I maintained a friendship and correspondence from the early 1980s until his death on November 16, 2006. In fact, I may have been the last person to have lunch with him at his favorite Italian restaurant in San Francisco, just a few weeks before he died. He had forgotten to shave, but we had a great time together. He had full use of his mind, but he complained that he was losing his eyesight at age 94. “Maybe you’ll live to be 100,” I said. He replied, “I hope not.”

Lunch with Milton Friedman in 2006, a few weeks before his death.

He is one of those people you wish you could meet today and discuss the latest news and economic theories. After his passing, I wrote a tribute to this happy warrior, calling it “My Friendly Fights with Milton Friedman.” In it, I recount the various encounters and debates I had with Friedman over the years. Read it here: My Friendly Fights with Dr. Friedman.

Despite our disagreements, he was kind enough to endorse two of my books that he especially liked: “Vienna and Chicago, Friends or Foes? A Tale of Two Schools of Free-Market Economics” (Capital Press, 2005), in which he said, “We were friends — and foes!”, and my history of thought, “The Making of Modern Economics,” in which chapter 15 on Friedman is called “Milton’s Paradise.” (Available here.)

I’ve written a full review of Burns’s book here.

Did Milton Friedman Have a Blind Spot?

Overall, I’m a big fan. So much so, that I dedicated my “Economic Logic” textbook to him and the Austrian economist Friedrich Hayek. (Find it here.)

But in this article, I want to focus on one of Friedman’s weaknesses, what I might even call his Achilles Heel: His excessive emphasis on the aggregate economy instead of analyzing the various sectors of the economy that might prove to be vulnerable. He seldom examined what I call “the structure of production” or the innerworkings of the economy that might cause a recession or crisis down the road.

Friedman has long advocated a policy he called “rules, not discretion” when it came to monetary policy. He wanted the Fed to adopt a stable “monetarist rule” by increasing the money supply at a low, steady rate equal to the long-term economic growth rate (3-4% a year). Thus, the Fed could be abolished, or reduced to a regulatory banking institution.

However, near the end of his life, he extolled the virtues of Alan Greenspan, the Fed chairman from 1986 to 2006. Price inflation and interest rates gradually declined under Greenspan, despite the switching back and forth from easy to tight money half a dozen times. Friedman said he was impressed with Greenspan’s skill in bringing down inflation and interest rates while still maintaining a “Goldilocks” economy.

Then Came the Financial Crisis of 2008

But Friedman did not live to witness the financial crisis of 2008, a major blight on Greenspan’s legacy. But his co-author and colleague Anna J. Schwartz did (she died in 2012).

Interestingly, Friedman and Schwartz’s famous chapter on the Great Depression (“The Great Contraction, 1929-1933”), taken from their magnum opus, “A Monetary History of the United States, 1869-1960,” (Princeton University Press, 1963), was reprinted in 2007 with a new introduction by Anna Schwartz.

The short work on the Great Depression was brought back just before the financial crisis started in 2008 and after Milton Friedman died. It was perfect timing as we were about to witness the worst economic debacle since the Great Depression.

Yet, Schwartz was oblivious to any evidence of a collapse. In the introduction of the new 2007 reprint, she wrote, “As the federal funds rate moves in a low and narrow range in response to low and stable inflation, volatility of the business cycle and real economy has moderated.”

She couldn’t have been more wrong. The financial crisis that occurred a year later was the worst economic crisis since the Great Depression, causing a collapse in real estate, stocks and major financial institutions. If it weren’t for massive intervention by the Fed and the Treasury, it could have turned into a 1930s-style Depression.

Friedman’s (and Keynes’s) Fatal Flaw

This is the flaw in the Chicago (and Keynesian) schools — their macroeconomics is too aggregate to see the malinvestments developing inside the economy, in this case, the real estate boom and bust.

Friedman failed to see the inner workings of the real estate bubble that developed under Greenspan — the subprime and no-doc mortgage loan scandal, the leveraged buying and selling of mortgage securities both here and abroad, the triple-A rating of Freddie Mac and Fannie Mae and the overvaluation of housing values due to Greenspan’s pushing short-term interest rates to 1% in 2004.

As the chief banking officer of the United States, he (and his successor Ben Bernanke) should have known better than to allow these clear violations of the “prudent man” rule in banking. No other nation allowed no-doc and subprime mortgages to individuals who had no business buying a home — not Canada, Australia or France.

As the chief banking officers of the United States, both Greenspan and Bernanke were aware of these shoddy mortgage practices and the high risk involved in leveraged mortgage securities but did nothing about it.

Is the American Economy Depression Proof?

In 1954, Friedman gave a lecture in Stockholm, Sweden, entitled “Why the American Economy is Depression Proof.” He claimed that federal bank deposit insurance, the abandonment of the gold standard, the adoption of a generous welfare state as a “built-in stabilizer” and the Federal Reserve acting as a lender of last resort would keep the capitalist system afloat and end forever-runs on banks and other financial institutions. He came close to being wrong in 2008.

We dodged a “great depression” bullet back then, but one wonders if we are not headed for a worse crisis down the road, given the government’s penchant to overspend, overborrow and promise too much in benefits without paying for them.

I wouldn’t be selling my gold or silver any time soon.

The Austrian School Has the Answer!

I devote a whole chapter of my book, “A Viennese Waltz Down Wall Street” to “The 2008 Financial Crisis: Austrian Response to the Chicago School of Milton Friedman,” and why the most recent crisis won’t be the last. See chapter 8, pp. 67-78.

The book is a 256-page quality paperback with chapters on each of the great Austrian economists, including Carl Menger, Ludwig von Mises, Friedrich Hayek, Joseph Schumpeter and Murray Rothbard.

In addition to my chapter on the Chicago School and the financial crisis of 2008, it has important chapters on Keynes as a speculator, economists who predicted the 1929 crash and the benefits of investing in gold and silver (chapter 17, “A Tale of Two Dollars”).

The price of the “Vienna Waltz” book is only $21. To order, go to www.skousenbooks.com. I autograph each copy. Postage is free if mailed inside the United States. I will do the same for my other books, such as “The Maxims of Wall Street,” “Economic Logic” and “The Making of Modern Economics.”

Dr. Lawrence Hayek, son of Friedrich Hayek, wrote, “Skousen is the only economist I know who I can understand. He writes for the common man!” See for yourself.

Upcoming Conference

Menlo Forum, Menlo Park, California, Saturday, April 20: I will be speaking on “Why Inflation Is Permanent and Growing: What Are the Best Inflation Hedges?”, where I will talk about the outlook for stocks, technology, gold and bitcoin. My wife, Jo Ann, will be joining me to talk about our latest book, “There Were Giants in the Land: Episodes in the Life of W. Cleon Skousen,” and why it was banned in China. We will also give an update on FreedomFest and the Anthem Film Festival. It will be held at the Masonic Hall, 651 Roble Ave., Menlo Park, California, from 9 a.m.-12 p.m. The host is Robert Mish, president of Mish International, a recommended rare coin dealer and a big supporter of FreedomFest. There is a $10 charge for this event (pay at the door), and you need to register by emailing menloforum@hotmail.com.

Good investing, AEIOU,

![]()

Mark Skousen

You Blew It!

Top Law Schools Run Amok

Is this coming to our neighborhood? I’ve been concerned for some time about the radicalism being taught in top law schools around the country, from Yale to Berkeley, in the name of “social justice” and DEI (diversity, equity and inclusion). Now we are seeing the results with this headline:

Law-School Rot Hits Berkeley Dean Close to Home

A few weeks ago, the dean of the Berkley Law School, Erwin Chemerinsky, and his wife Catherine (also a law professor), invited about 60 law students to their home for a pre-graduation dinner.

Several students took the opportunity to attack their school’s supposed support for Israel’s war against Hamas in Gaza and the dean’s alleged “Zionism.” The dean and his wife demanded that the protesters leave, but they refused, and a fight ensued. I guess these law students were never taught the rule of law and private property rights.

Instead, at Berkeley (and other elite law schools), students were indoctrinated with radical anti-Western philosophy, encouraging a vast ecosystem of identity-based student groups.

Instead of diversity and inclusion, they opt for exclusion and discrimination. The Berkeley Journal of Gender, Law and Justice even committed to not publishing pieces by Zionist writers.

Read the whole story here: Law-School Rot Hits Berkeley Dean Close to Home — Literally | National Review