Mike Rowe Enters the Dirty World of Investing

Recession is Still Threatening

Special Alert: The U.S. economy is resisting recession, but is flashing red: Business spending (B2B) has dropped 9% in real terms over the past two quarters! Today, the federal government (BEA) released first quarter gross output (GO), the top line in national income accounting. GO measures spending at all stages of production. Real GO rose 2.7%, compared to 2.0% in real GDP (the bottom line). Consumer spending is still robust, rising over 6% during the past two quarters, but business spending is floundering. Nominal B2B spending has been flat since September, and in real terms, is down 9%. Recession is still in the near future. I’ll have a press release later today at http://www.grossoutput.com.

Special Announcement: We have some exciting new speakers at this year’s FreedomFest, including RFK, Jr.! See below.

“In choosing a portfolio, investors should seek broad diversification.”– Harry Markowitz, father of Modern Portfolio Theory

Mike Rowe, famous for his “Dirty Jobs” series on TV, is our keynote speaker at FreedomFest, which is less than 2 weeks away (July 12-15, 2023, Memphis, Tennessee). I look forward to interviewing him on stage. Hope to see you there!

I just read his bestselling book, “The Way I Heard It.” It’s a hoot!

In one part of the book, he describes an experience with a money manager.

By the mid-1990s, he’d become a big success as a TV pitchman and host, so much so that he saved up over a million dollars. He handed it over to a friend, who proceeded to lose it all in various schemes. His experience reminds me of a line by Woody Allen: “I’m a money manager. I manage your money until it’s all gone.” (Maxims of Wall Street, p. 88).

It was a bitter lesson for Mike Rowe.

Mike is a college graduate from Towson University, and if he had taken a class in personal finance, he might have encountered the work of Harry Markowitz, the father of Modern Portfolio Theory, who passed away last week at the age of 95.

Markowitz’s advice could have saved Mike a lot of money and heartaches.

Markowitz is a legend in the investment world. He won the Nobel Memorial Prize in economics in 1990, based on a single article he wrote for The Journal of Finance in 1952, called “Portfolio Selection.”

In this paper, he emphasized the importance of diversification of your assets. Don’t put all your eggs in one basket! Better to spread your risk by investing in more than one asset, and in more than one money manager or brokerage account. If a broker or money manager misuses your funds, not all is lost.

My Meeting with Harry Markowitz

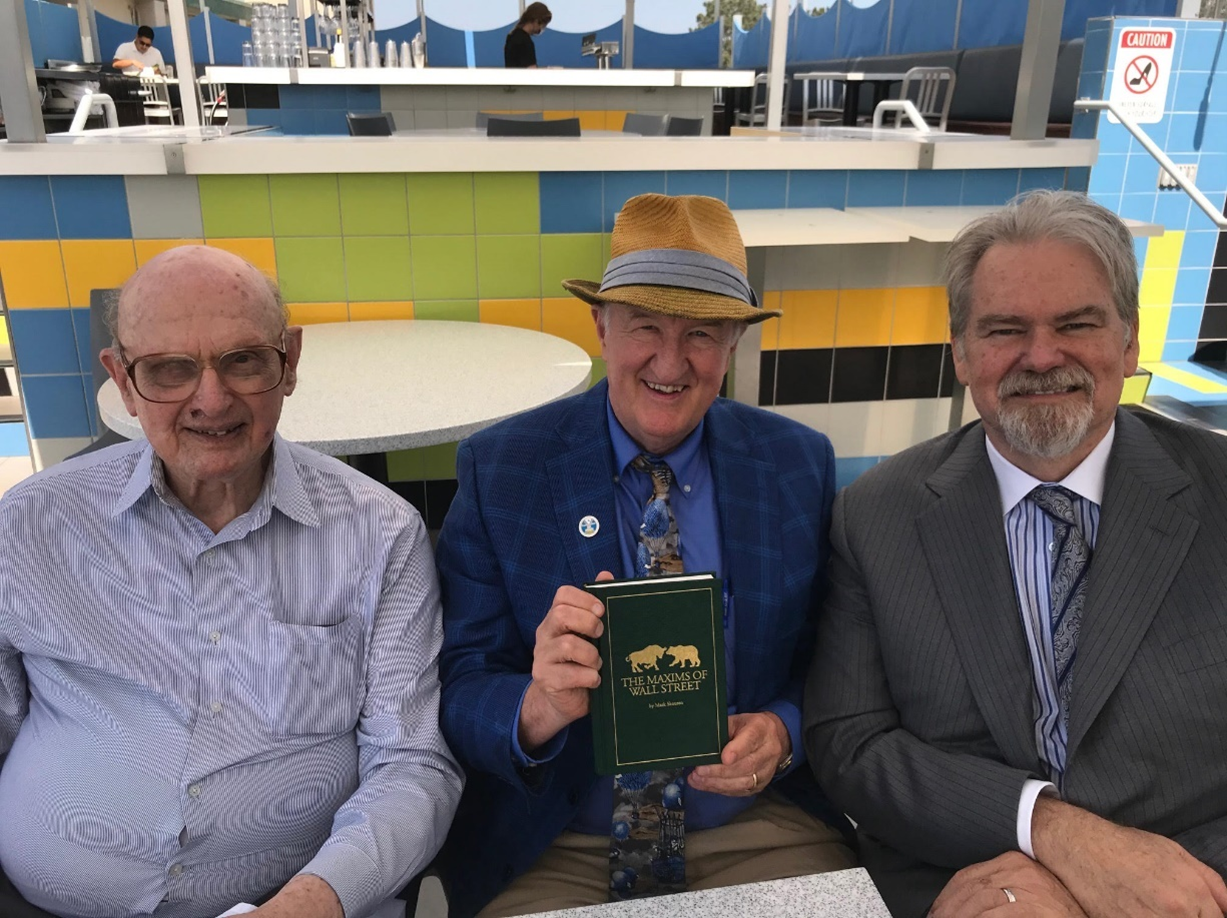

In 2020, during the Covid-19 scare, I had the supreme experience of having lunch in La Jolla, California, with Harry Markowitz.

The lunch was arranged by Rob Arnott, a successful financial consultant who is known as “the godfather of smart beta.” He is also a strong advocate of value investing and has been a featured guest speaker in my classes at Chapman University and FreedomFest.

Mark Skousen (center) holding a copy of “Maxims of Wall Street,” pictured with Harry Markowitz (left) and Rob Arnott (right).

Two Vital Principles of Modern Portfolio Theory

Since Markowitz wrote his trailblazing paper in 1952, economists have improved upon his work. Today, financial advisors argue in favor of two principles of modern portfolio theory.

- Diversify your portfolio. Choose among several accounts (mutual funds, money managers and brokers) and invest in a variety of investment assets (stocks, bonds, real estate, gold, etc.) to reduce your chances of losing money. This strategy doesn’t necessarily mean you will beat the market, or even match it, every year. You may go several years underperforming the market. It takes patience to work.

- Beware of greed. Too often, people who are suddenly successful in their careers are caught up in various high-risk ventures. They see dollar signs and are blind to the dangers involved in non-traditional investments, such as pre-IPO private placements, penny mining stocks, small cap technology plays and offshore investment strategies.

I recommend you invest at least half your money in a broad-based index fund like the SPDR S&P 500 ETF Trust (NYSE: SPY) or the Schwab 1000 Fund (SNXFX). You won’t beat the market, but then again, you won’t underperform either.

With the rest of your money, you can try picking individual stocks, gold, real estate, mutual funds or investing through active money managers. You take your chances.

I also recommend you dollar-cost average in your tax-deferred 401(k) or IRA. Add to your account on a regular basis via automatic investment plans from your employer, bank or brokerage account. (Dollar-cost averaging is the best way to go.)

As Burt Malkiel, author of “A Random Walk Down Wall Street: The Time-Tested Strategy for Successful Investing,” notes, the benefit of dollar-cost averaging is that when stocks are down temporarily, you end up buying more stock, and when the stock market recovers, you get more bang for your buck.

Markowitz’s No. 1 Investment Now Is Not Gold, But…

In my meeting with Markowitz and Arnott, I brought up gold as a possible noncorrelated investment that often moves opposite to the stock market, and thus would be a good diversification. Gold has held up well over the long run. But I was surprised to learn that gold doesn’t interest Markowitz.

Instead, he favored California real estate. He had a condo on the beach, and took advantage of rising demand and cheap mortgage rates. In the three years since our meeting, his real estate investments have done a lot better than gold.

Markowitz was amazingly alert for a man who was 92 years old. He was born in the year Babe Ruth hit 60 home runs — 1927! He was two years old when the stock market crashed in 1929. He has lived through it all — World War II, the go-go years of the 1960s, the inflationary ’70s, the 1987 stock market crash, the dot-com boom and bust, the longest bull market in history (2009-2021) and the 2020 pandemic.

What Is the Most Important Lesson of Investing?

Markowitz survived and prospered throughout most of the 20th century and part of 21st century. Near the end of our luncheon, I asked him what he thought was the most important lesson of investing.

He hesitated, so I suggested one of my favorite quotes from “The Maxims of Wall Street”: “Wall Street exaggerates everything.”

Both he and Arnott nodded in agreement. “That’s why diversification is so important,” stated Markowitz. “It reduces the risk.”

They were both intrigued by my new edition of the “Maxims”, and we spent the rest of the time reading, smiling and commenting in response to various quotes from the book.

Here are some of their favorites…

“Psychology is probably the most important factor in the market — and one that is least understood.”

— David Dreman

“You can’t worry and hit home runs.”

— Babe Ruth

“Know value, not prices.”

— Arnold Bernard

“Take calculated risks, but don’t be rash.”

— Gen. George Patton

Markowitz especially liked this one from Charles Allmon: “I’m not a bull. I’m not a bear. I’m a chicken.”

He was delighted to receive an autographed copy of my book.

Arnott Buys a Box of “Maxims”

Arnott was so impressed, that he decided to buy an entire box (32 copies) and gave them out to his best clients.

I also offer a super bargain price for the “Maxims”. The first copy is $20, and each additional copy is $10. “Maxims” makes a great gift for friends, family, clients and investors.

I autograph all copies, number them and mail them at no extra charge to U.S. addresses.

To order, go to www.skousenbooks.com.

Dennis Gartman said it best: “It’s amazing the depth of wisdom one can find in just one or two lines from your book. I have it on my desk and refer to it daily.”

Alexander Green says, “It’s a classic!”

Three Presidential Candidates Come to FreedomFest

The excitement is mounting for FreedomFest, starting in less than two weeks (July 12-15) in Memphis, Tennessee. We are a highly influential conference, and are now attracting major presidential candidates. We just confirmed Robert F. Kennedy Jr., who is running for President on the Democratic ticket. Steve Forbes says, “It will be standing room only for him! It will be real shot in the arm.” Kennedy is gaining fast support as an alternative to Joe Biden as the Democratic nominee. There will be major media coverage for RFK’s speech.

Vivek Ramaswamy will speak Thursday night (same as Mike Rowe), RFK Jr. will speak Saturday at noon, and Larry Elder will be our keynote banquet speaker.

We have over 300 speakers, 150 exhibitors and over 2,000 attendees. To see our entire schedule, go to www.freedomfest.com/agenda. You can also click on each individual speaker to see when they are speaking and on what topic.

Special Event for FreedomFest Investors Only.

Attention, investors! For those of you who sign up for FreedomFest, you will be invited to a live, exclusive one-hour interview with the “twin titans of finance” Jeremy Siegel and Burt Malkiel, set for July 7 at 10:30 am ET. You will also receive autographed copies of their latest editions of “Stocks for the Long Run” and “A Random Walk Down Wall Street,” which you can pick up at the Eagle booth at FreedomFest. First come, first serve. To sign up, go to www.freedomfest.com, or call Hayley at 1-855-850-3733, ext 202.

We’re getting a huge response to a short video of Mike Rowe, the host of the popular “Dirty Jobs” TV series. He has posted this hilarious video promoting FreedomFest. It’s created a lot of buzz. He’s caught the spirit of the conference and plans to attend all three days. “It will be a blast,” he says. Watch it here.

See you there. Fly there, drive there, bike there, be there!

Good investing, AEIOU,

![]()

Mark Skousen

You Blew It!

The Biden Scandal: When Guilty, Deny, Deny, Deny!

Joe Biden and Donald Trump have something in common. When found guilty of malfeasance, their approach is the same: Deny, Deny, Deny!

It was truly a spectacle to watch how Biden’s press secretary responded to questions about Hunter Biden’s meeting with a top Chinese official with his father, Joe Biden, in the room.

For Biden’s press secretary to say with a straight face that “My views have not changed” after Hunter Biden clearly shows that his father, Joe Biden, was involved in an apparent Hunter Biden demand to be paid what appears to be a bribe.

When President Biden was asked by the media if he wanted to reverse his statement in 2020 that he was never involved in any business deals with his son, he said, “No.”

Senator Elizabeth Warren says that “nobody is above the law,” and yet the IRS and the Department of Justice have decided to slap Hunter Biden with a misdemeanor for two years of tax evasion, while black actor Wesley Snipes got nearly three years in federal prison for tax evasion 10 years earlier. Where is equal justice?

The House Oversight Committee found that Hunter Biden was paid around $10 million in shady business dealings with the Chinese and other foreign governments, and was given a large diamond and a sports car. Did he pay taxes on all this? The investigation continues.