Magic GO Metric Reveals Robust Economy and Confirms Bull Market

“National income accounting has long been unfathomably flawed and worse by the decade but Mark Skousen’s introduction of gross output (GO) has been a big step forward in portraying a more total picture of the economy and where and when it’s vulnerable. Kudos to Mark for it being adopted.” — Ken Fisher, CEO, Fisher Investments, member of Forbes 400 Richest List

Last week the federal government released its latest report on gross output (GO), a much broader and more accurate measure of the economy than gross domestic product (GDP). Long advocated in my book, “The Structure of Production,” GO accelerated in the second quarter of 2015, indicating a more robust economy than GDP data reports.

Based on data released last Thursday by the federal Bureau of Economic Analysis (BEA) and adjusted to include all sales throughout the production process, real GO grew by 4.6% in the second quarter of 2015, considerably more than the 3.9% annualized growth rate of real GDP. Adjusted GO reached $39.0 trillion in the second quarter, more than double the size of GDP, $17.9 trillion.

New Study Shows GO a Great Forecaster of Markets

Recently, David Ranson, chief economist at the prestigious H. C. Wainwright Economics, has determined that GO is a much better indicator than GDP in predicting stocks, bonds and gold prices. “GO is better correlated with financial-price movements than most of the other indicators,” he concludes. GO “tends to portray the economy as more cyclical than real GDP does, the recession of 2008-09 as deeper, and the recovery as slower.”

Based on my reading of a growing GO, I expect higher stock prices ahead — and maybe even higher gold prices.

Ranson confirms what I’ve been saying about GDP for some time. “The universal use of real GDP as a measure of the economy’s vitality is subject to misunderstandings, pitfalls, and criticism — especially in the short run. GDP is a direct estimate of the economy’s [final] output, but only indirectly an estimate of its spending, its income, or its use of resources. And it includes only ‘final’ goods and services, leaving out the huge economy that consists of businesses buying and selling intermediate goods to one another.”

Gross output (GO) is an attempt to measure the “make” economy, i.e., total economic activity at all stages of production, similar to the “top line” (revenues/sales) of an accounting statement. In April 2014, the BEA began to measure GO on a quarterly basis along with GDP.

Gross domestic product (GDP) is an attempt to measure the “use” economy, i.e., the value of finished goods and services ready to be used by consumers, business and government. GDP is similar to the “bottom line” (earnings) of an accounting statement, which determines the “value added” or the value of final use.

GO tends to be more sensitive to the business cycle, and more volatile, than GDP. During the financial crisis of 2008-09, GO fell much faster than GDP and, afterwards, recovered more quickly than GDP. Still, it wasn’t until late 2013 that GO fully returned to its 2007 peak. The fact that the adjusted GO is still growing slightly faster than GDP suggests that the economic recovery is ongoing and positive for the stock market.

Business Spending (B2B) Rises Only 1%

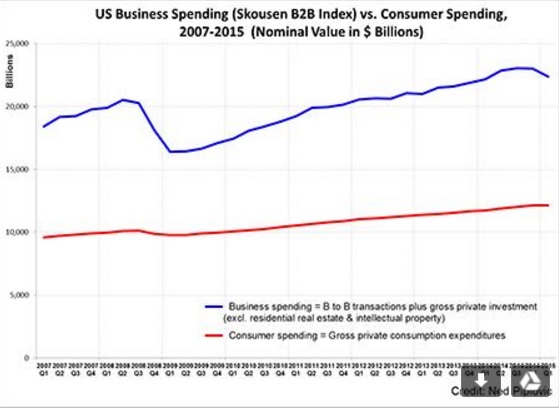

I also have created a new B2B Index based on GO data. B2B activity rose only 1% in the second quarter. According to the new Skousen B2B Index, business spending rose to $22.7 billion in nominal terms, compared to $22.4 trillion in the first quarter. Meanwhile, consumer spending remained stable.

The chart above demonstrates clearly that business spending is much larger than consumer spending. Consumer spending amounts to about a third of total economic activity, not two-thirds as commonly reported in the media. Business spending represents more than half the U.S. economy.

The GO data and my own B2B Index demonstrate that total U.S. economic activity has picked up, and a recession has been avoided for now. B2B spending is, in fact, a pretty good indicator of where the economy is heading, since it measures spending in the entire supply chain, and it indicates continued modest growth.

I first introduced GO as a macroeconomic tool in my work “The Structure of Production” (New York University Press, 1990). A new third edition has just been released with a new introduction and is now available on Amazon.

Go to Amazon to learn more about “The Structure of Production.”

Nailed It! Avoid Boring People

On Tuesday, my wife and I attended the Reason Media Awards at the Edison Ballroom in New York City. Among the 275 guests was James Watson, recipient of the Nobel Prize in Medicine for his co-discovery of the mapping of DNA in 1953. I met him for the first time at a Milken Conference in Los Angeles.

Watson is a brilliant scientist but has, over the years, made some controversial statements about race and women, causing him to lose his position at Cold Spring Harbor Laboratory in New York and to sell his Nobel Prize medal for $4.1 million in 2014.

His autobiography has a clever title: “Avoid Boring People.” I have an autographed copy. At first it sounds arrogant until you ask the question, “Is boring an adjective or a verb?” As a verb, it means “don’t bore people.”

Another attendee at the Reason dinner was scientist Matt Ridley, author of the new book, “The Evolution of Everything.” He was the keynote speaker. He had a fun line in his talk: “What’s the opposite of diversity? University!” He was referring to the growing censorship and politically correct (PC) activities that are occurring on college campuses these days.

It reminds me of another good line: “What’s the opposite of progress? Congress!”

Upcoming Conference

Special Announcement: Subscribers to the Skousen CAFE should be happy to know that for the first time in two years, I am hosting the Global Financial Summit, a special private investment seminar, in The Bahamas. The focus will be on “High Income & Fast Money Investing” — combining my two most successful trading services!

My “All Star High Income & Fast Money” experts for this exclusive private meeting will include Alex Green, investment director of the Oxford Club and editor of three trading services (Momentum Alert, Insider Trader and True Value Alert). Alex is rated the #5 best investor according to Hulbert Financial Digest. I’ve also confirmed Martin Truax, vice president at Raymond James, whose “income & growth” portfolio has more than tripled during the past 10 years. He and his partner Ron Miller also have developed a highly successful trading system using “red” and “green” signals to determine when to get in and out of markets (they flashed “sell” in May and now are flashing “buy” — good calls!).

Our keynote speaker will be Steve Moore, the chief economist for the Heritage Foundation and the #1 columnist for the Wall Street Journal, who will speak on “Money & Politics 2016: The Inside Story for Private Investors.”

The dates are March 16-19, 2016, at the five-star Atlantis Resort on Paradise Island, Nassau, The Bahamas. This is during high “Spring Break” season, so I urge you to make your flight reservations now.

I soon will be announcing more top experts in portfolio management, tax and estate planning and foreign investing. But I want to encourage you to sign up now and take advantage of our special “early bird” discount — $200 off the retail price for Skousen CAFE subscribers if you register by Dec. 31. The price is only $495 per person/$795 per couple with the discount. And hotel rates at the five-star Atlantis Resort are only $209 per night. We are limiting this private meeting to 200 attendees only. To sign up, call Karen or Jennifer at 855-850-3733 ext 202, email info@freedomfest.com or go to gfs.freedomfest.com.

In case you missed it, I encourage you to read my e-letter column from last week about my surprising discovery at the New Orleans Conference. I also invite you to comment in the space provided below my Eagle Daily Investor commentary.

Good investing, AEIOU,

![]()

Mark Skousen

Presidential Fellow, Chapman University