Krugman Alert: Should the United States Adopt the European Model?

Last week, at the invitation of Sheldon Jacobs (a longtime friend in finance and a regular attendee at FreedomFest), I went to see Paul Krugman speak at Westchester Community College, where he spoke before several hundred adults on “The European Welfare States Revisited.” Not very many students were there, but the adults there seemed to be fans of Krugman.

Krugman, pictured with me below, is America’s most famous economist, a Nobel Prize winner and New York Times columnist.

He made several controversial statements in his lecture:

- Chileans “hate” privatized Social Security, which would be a bad idea for the United States. (See “You Blew it” column below.)

- U.S. welfare system is “brutal” and is the smallest among big nations. It needs to move toward the European welfare system, especially free college education for youth.

- There is no clear association between the size of government and economic growth (change in per capita gross domestic product (GDP)).

- European economy is “very scary” right now. Europe’s problems are not due to their welfare state (which is “pretty good”) but their austerity of monetary and fiscal policies. The euro was a “terrible mistake.”

- Since the European Union (EU) officially started guaranteeing loans to troubled EU countries, interest rates have dropped sharply for Spain and Italy.

- Sweden is looking much like Japan these days.

- Japan made the right choice in aggressively expanding money supply, but raising the VAT tax was a “mistake” that stalled their economy.

- Working age population is in sharp decline in Europe and slow decline in the United States.

- America is no longer the land of opportunity, especially for men. Among industrial nations, the United States is the worst in terms of social mobility.

- In the United States, profits are up, wages are down. The solution is a better and bigger welfare state.

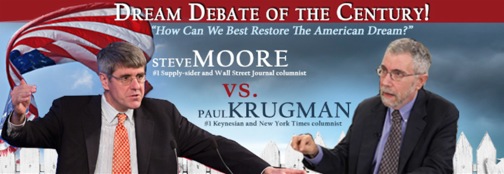

I’m sure Steve Moore at Heritage Foundation has a different view on all these issues. He will be debating Krugman at next year’s FreedomFest. You won’t want to miss it.

Afterwards, I met up with Krugman. He assured me that he tries not to let his political biases affect his economic analysis. As the moderator of the big debate at next year’s FreedomFest, I plan to raise this issue, what academics call “confirmation bias.” He appeared excited about the debate with Steve Moore at FreedomFest. So are we. The differences between the two are huge. As Ben Franklin says, “By the collision of differences, light is obtained!”

You Blew It! Should the United States Adopt Chile’s Pension System?

“Chileans hate their private pension system, and it’s a bad idea for the U.S.” — Paul Krugman

Granted, not everyone in Chile is happy about their privatized pension system and would prefer a government-guaranteed retirement. But a recent study shows the nation’s private retirement accounts provide workers’ pensions that are worth 87 percent of their salaries, 73 percent of that from profits on savings. The story was front-page news in Chile’s largest newspapers, El Mercurio and La Tercera, on Sept. 3, a powerful affirmation of what former Republican presidential candidates Newt Gingrich and Herman Cain called “The Chilean Model” of private retirement accounts.

According to a report by Investor’s Business Daily, the study of 28,000 households by Dictuc, a consultancy affiliated with the Catholic University of Chile, showed that male workers who contributed just 10 percent of their salaries to their retirements for 40 years or more on average earned retirement checks worth about 87 percent of their top salaries. No 401(k) account was needed.

That’s because in 1981 Chile Labor Minister Jose Pinera replaced the country’s bankrupt social security system with this famous system of private accounts.

It redirected workers’ existing social security taxes to a new market-based system of investing choices that let workers make their own decisions in a program run by private companies.

The Dictuc study shows Chile’s private pensions over three decades have yielded returns six times higher than what workers got under Chile’s old social security system — which, by the way, was similar to ours.

The details of the Dictuc study shatter this pernicious myth: Data show workers earn an extraordinary 8.7 percent compound rate of return above inflation over a period of 32 years from the 10 percent of their salaries put away.

With Social Security’s trust fund slated to go bust in 2035, maybe it’s time to start thinking about how the lessons of Chile can benefit American workers, too.

In case you missed it, I encourage you to read my e-letter column from last week on Eagle Daily Investor about what the latest Forbes 400 listing reveals about the American Dream. I also invite you to comment in the space provided below my Eagle Daily Investor commentary.

Yours for good investing, AEIOU,

![]()

Mark Skousen

Presidential Fellow, Chapman University

Wikipedia

Newsletter and trading services

Personal website

P.S. Last week, I had dinner in New York with Donald Smith, one of the country’s most successful hedge fund managers. He shared my concerns about the market, and he thinks that most stocks are expensive based on their book value. He currently has a 25% cash position to preserve his profits, which are substantial this year. One of the few exceptions is mining stocks, which he regards as dirt cheap. Southern Copper is a perfect example.

Don hardly ever speaks at conferences but will join our Dream Team of investors at next year’s FreedomFest. Here’s your chance to meet with one of the top money managers in the country.