Is There a Better Way To Beat the Market Than Market Timing? Yes!

“Don’t give me timing. Give me time.” — Jesse Livermore (“The Maxims of Wall Street,” p. 137, see www.skousenbooks.com)

During our financial conference at FreedomFest next month (July 21-24), we are having several debates, such as Bitcoin vs. gold, and short-term trading vs. buy-and-hold.

Technical trader Mike Turner will make the case for market timing in an effort to avoid losing money during a bear market. He warns cynically, “Buy-and-hold works if you live long enough, never need money and don’t mind losing 50% or more from time to time.” (p. 139)

True enough, bear markets can be treacherous on Wall Street, and they do occur every 10 years or so.

Mike Turner and your editor Mark Skousen show their fists before their debate, with moderator Roger Michalski in the middle.

Of course, timing the market to get out when the market tanks, and get back in when the market turns around, is easier said than done.

As the late Jack Bogle, founder of the Vanguard Group of Funds, states,

“After nearly 50 years in this business, I don’t know anybody who has [timed the market] successfully and consistently. I don’t even know anybody who knows anybody who has.”

A Better Alternative to Market Timing

That’s not to say a few financial geniuses can’t beat the market over long periods of time. Warren Buffett, Peter Lynch, John Templeton, Alex Green and Ron Baron come to mind.

None of them used market timing to succeed on Wall Street. They developed a systematic approach of finding well-managed companies in burgeoning industries that enjoyed above-average profits in the past and in the future and held on for the long-term.

As J. Paul Getty states, “The seasoned investor buys his stocks when they are priced low, holds them for the long-pull rise and takes in-between dips and slumps in his stride.” (p. 138)

Or as Adrian Day declares, “Good investing is simple: buy a good asset at a good price and hold on it for a good long time.” (p. 198)

I look forward to this debate and hope you will join me.

16 Debates at Mount Rushmore!

My favorite thing to do at FreedomFest is to engage in our big debates, and this year is no exception. You won’t want to miss out on the following debates and panels on July 21-24 at the Rushmore Civic Center in Rapid City, South Dakota:

- Which Four Economists Belong on Mount Rushmore?

Mark Skousen (moderator), Deirdre McCloskey, Steve Moore, Barbara Kolm - Murray Rothbard on the US Constitution: Conceived in Liberty or a Conspiratorial Coup?

Patrick Newman, Mark Skousen, Anastasia Boden, John Norton Moore - Soho Forum Debate: The Purpose of Business Is to Maximize Long-term Profits

Gene Epstein (moderator), Yaron Brook, John Mackey - Is the Global War on Islamic Fundamentalists Worth Supporting?

Ayaan Hirsi Ali, Scott Horton, Abby Blanco-Hall, Daniel Peterson (moderator) - The Great Wall of China Debate:

Li Schoolland, George Gilder, Joshua Phillips (moderator) - Time or Timing: Which is Better, Long-term Investing or Short-term Trading?

Mike Turner, Mark Skousen, Rodolfo Milani (moderator) - Human Civilization: Unavoidable Collapse or a Rising Future Phoenix?

Ed Hudgins, Max Borders, Stephen Hicks, Brad Lips (moderator) - The Big Bitcoin Vs. Gold Debate: What’s the Hedge Currency of the Future?

Adrian Day (moderator), Rich Checkan, Kirk Chisholm, Paul Rosenberg, Eryka Gemma - The Great Climate Change Debate: Is It Real and Does It Matter?

Michael Shermer (moderator), Benji Backer, James Taylor, Marc Morano - Boomer vs. Zoomer: Which Generation Is More Dangerous to Freedom?

Larry Sharpe, Carla Gericke, Hannah Cox, CJ Pearson, Stephen Kent (moderator) - Busted: Is Criminal Justice Permanently Broken? Congressman Justin Amash, Sheriff Richard Mack, Catherine Bernard, Hannah Cox, Matt Kibbe (moderator)

- The Technological Singularity: Will Future Tech Free Us or Destroy Us? Terry Easton, Lauren Postler, Max Borders

- Exiled on the High Seas: A Debate on the Continuation of the Jones Act:

John Fund (moderator), George Landrith, Ken Schoolland - Walls and Cages: Can We Build a Humane Immigration Policy that Solves the Border Crisis? Doug Casey, Antonella Marty, Cal Thomas, Ken Schoolland, Jan Jekielek (moderato)

- The Catholic Church: Pro and Con: Doug Casey, Gary Richied, Dan Peterson (moderator)

- The Mock Trial: Did the Pandemic Justify the Lockdown? With Tom Woods (judge), Catherine Bernard, Michael Shermer, Steve Moore

Plus, FreedomFest will feature Gov. Kristi Noem, actor Dennis Quaid, Grover Norquist, Larry Elder, J. P. Sears, Dave Rubin… all the free-market think tanks… the 10th-anniversary Anthem film festival… and the 40th-anniversary celebration of my newsletter at the historic Alex Johnson Hotel.

We already have over 2,100 attendees signed up for this year’s big show. We expect a record turnout and could sell out.

Take advantage of the “greatest libertarian show on earth” by signing up at www.freedomfest.com, or by calling Hayley at 1-855-850-3733, ext. 202. Use the code EAGLE50 to get $50 off the registration fee.

We just added a new group of hotel room blocks, so I recommend you act now to avoid being disappointed.

Good investing, AEIOU

![]()

Mark Skousen

You Blew It!

Will Excessive Private Debt Be the Cause of the Next Financial Crisis?

Recently, I received a review copy of a new, beautifully illustrated “Business History of the United States,” by Richard Vague, a highly successful entrepreneur, banker and philanthropist from Philadelphia.

He has written several books including one in 2014, entitled “The Next Economic Disaster: Why It’s Coming and How to Avoid It.”

His thesis is that private debt, not public debt, is the source of financial crises and the business cycle in America. He wrote, “Current debates about economic crises typically focus on the role that public debt and debt-fueled public spending play in economic growth. This illuminating and provocative work shows that it is the rapid expansion of private rather than public debt that constrains growth and sparks economic calamities like the financial crisis of 2008.”

Private debt may have indeed been a source of instability in the past, but this time it might be different.

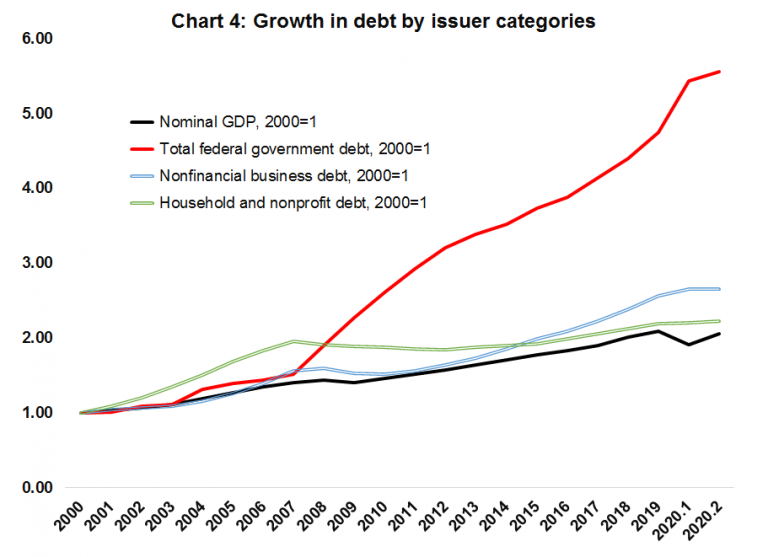

Recently, the American Enterprise Institute (AEI) published this chart.

Source: American Economic Institute (AEI)

It clearly shows how private individual and corporate debt is not a problem in the United States, but public debt is. It demonstrates how irresponsible the government has become. Someday, we are going to pay the price for this reckless Keynesian policy.