Is the Golden Age of Investing Over? Yes for Bonds, No for Stocks!

For the past week, I’ve been on my first Forbes cruise in the Caribbean with more than 150 investors.

Speakers not only included me but also billionaire Ken Fisher, Fox Business hosts David Asman and Elizabeth MacDonald and energy expert Mark Mills. On the “Forbes on Fox Live!” panel, we debated whether the Trump rally would continue into 2017. Ken Fisher, the longest-running Forbes columnist (33 years), remains bullish: “Joyless bull markets last long,” he said. He thought we were in the middle innings.

But Fisher also noted that according to the Presidential Election Cycle, when a Republican is elected, stocks do well during the election year, but poorly in the first year of a new administration.

The Stock Market Trader’s Almanac states, “war, bear markets and recessions tend to start during the first two years of a new president’s term.”

But nothing is written in stone, and there are always exceptions. President Trump is certainly hoping to avoid a recession and bear market. Corporate tax cuts and deregulation should encourage economic growth. Protectionism and a trade war can only make things worse. We may get a combination of both. I warned the audience that Trump was doubling down on his protectionist rhetoric by threatening companies that move abroad.

Ken Fisher and I share deep skepticism regarding the financial terrorists who warn of an “imminent” collapse in stocks, the dollar and the economy. A 20% correction in the market is possible, and even likely, in the next year or two, but not a full-blown collapse.

Is the Golden Age of Investing Over?

We also discussed with the Forbes crowd whether the golden age of investing is over or not. The stock and bond markets have soared since 1982, when President Ronald Reagan’s supply-side policies kicked into place. It has been a remarkable run for the bond market, lasting an incredible 32 years.

But finally, the bond rally has run out of steam, especially after the November election. The yield on 10-year Treasuries rose from 1.83% to 2.34%. In addition, 30-year mortgage rates have jumped to more than 4.1%. The belief is that a Trump administration will increase economic growth, inflation and interest rates.

But for stocks, it’s a different story. If we see 4% economic growth, I would not be surprised to see more profits ahead in 2017 and beyond. Yes, by all traditional measures, the stock market is fully valued and could even be viewed as slightly overvalued. However, if corporate earnings rise sharply, prices could move substantially higher.

So I continue to be fully invested in individual stocks and mutual funds. And we are making substantial profits in our trading services.

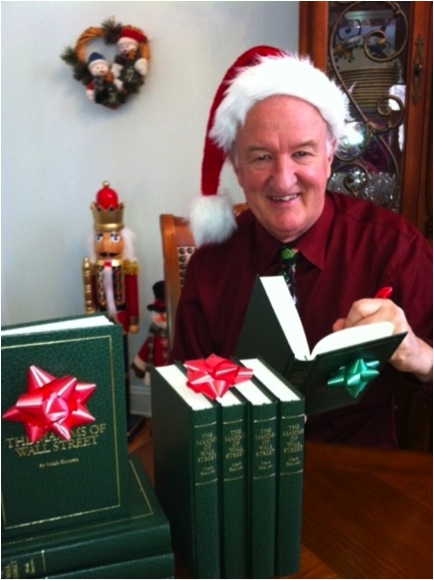

Fifth Edition of “Maxims of Wall Street” Now Available in Time for Christmas

Good news! I’ve sold out of the fourth edition of “Maxims of Wall Street” and have gone back to press. Maxims has sold over 23,000 copies.

The new fifth edition — with many new quotes — is now available and will be mailed in plenty of time for the holidays. I’ve been collecting these quotations for more than 30 years, and I put them all together by category in this new edition. Alex Green (Oxford Club) calls it a classic. It has been endorsed by Warren Buffett, Bert Dohmen and Dennis Gartman (who keeps it on his desk and refers to it regularly).

Amazon sells it for $24.95, but you can buy it directly from me for only $20 for the first copy, and all additional copies sent to the same address cost only $10. Investors like to buy multiple copies as gifts. And I autograph each book and pay the postage to recipients inside of the United States!

It makes the perfect holiday or birthday gift to friends, relatives, business associates and your favorite broker/money manager. In fact, many have purchased an entire box — all 32 copies autographed — for only $300 postpaid to give to their clients and friends. As Hetty Green, America’s first female millionaire, states, “When I see something cheap, I buy a lot of it!”

To make your purchase, call Harold at Ensign Publishing, toll-free, at 1-866-254-2057. Or go to https://www.miracleofamerica.com/products/maxims-of-wall-street.

You Blew It! It’s Starting in Asia: The War on Cash in India, Now China Introduces a ‘Social Credit Score’

“Where is privacy without financial privacy?” — Robert Kinsman

A few weeks ago, I reported on the fateful decision by the Narendra Modi-led government in India to outlaw the country’s two largest Rupee banknotes as an anti-corruption, anti-terrorist and anti-tax evasion policy to encourage a cashless economy and ultimately to monitor every Indian’s monetary affairs.

So far, the results have not been good. Gold prices in India have skyrocketed, and social unrest has ensued, with long lines at local banks. The wait is two hours or longer to convert the large bills to smaller ones.

As it is, the Rupee 1,000 banknote is worth only about $15 and the Rupee 500 is worth $7.50. What a joke!

But what is happening in India could happen here in America. Larry Summers, former Secretary of the Treasury, and other influential establishment economists have advocated the elimination of the $100 bill and the European €500 in a vain effort to eliminate tax evasion and corruption. Talk about Big Brother.

Speaking of Big Brother, look at what is happening in Communist China. It is beginning to test the creation of a “social credit score” on every citizen to monitor his or her financial, social, political and legal status. Eventually, the totalitarian regime will have a single number to prosecute and discriminate against 1.3 billion people.

Is the United States next? Under the guise of security, the next administration may start to monitor all its citizens based on their political and religious views.

In case you missed it, I encourage you to read my e-letter column from last week about why two financial conferences I’ve attended in the past met different fates.

Upcoming Conferences

O Billionaire Ken Fisher to speak at FreedomFest, July 19-22, 2017, Paris Resort, Las Vegas: I will do a one-on-one interview with Ken Fisher, a member of the Forbes 400 Richest People in America list, at next year’s big show. He will talk about his incredible success as an investment advisor and longest columnist at Forbes magazine. I lasted six years (1995-2000) but he’s written his column for 33 years.

The Year of the Businessman at FreedomFest 2017

O WOW! Forbes Billionaire Ken Fisher and Publisher Rich Karlgaard to address FreedomFest for the first time! Next year will be the 100th anniversary of Forbes magazine, and we’re celebrating. Come join the festivities! B. C. Forbes, Steve Forbes’s grandfather, started the magazine in 1917. We’re going to have a special session on the impact that the founding Forbes had in business and investing with his grandson Steve Forbes and these experts: Ken Fisher holds the record for writing a Forbes column for 33 years, and is now a member of the Forbes 400 Richest List. Rich Karlgaard has been publisher since 1998. It will be their first time at FreedomFest, and you won’t want to miss meeting them.

Also joining us will be top financial gurus Jim Rogers, Doug Casey, Nicholas Vardy, Adrian Day, Alex Green, Dennis Gartman and many more. Keynote speakers confirmed include William Shatner (Hollywood’s entrepreneur), Robert Frank (New York Times columnist), Deirdre McCloskey (top economist and author), Conrad Black (Canada’s top publisher), Marc Eliot (Hollywood’s biographer) on his latest book, “Charlton Heston,” and, of course, our co-ambassadors Steve Forbes and John Mackey. Mackey will be speaking on his new book, “The Whole Foods Diet.” The event is not to be missed! For more details, go to www.freedomfest.com.

This is going to be our biggest and best FreedomFest ever, so now is the time to plan a trip to Vegas in July. We are expecting a record turnout, so I encourage you to sign up now and take advantage of our “early bird” discount — save $100 per person/$200 per couple over the registration fee — which ends on Jan. 15.

Our registration page is now up and running, so go to http://freedomfest.com/register-now/. You can also registered by calling our toll-free number 1-855-850-3733, ext. 202, and by talking to Jennifer, Amy or Karen. Call today!

Join Me for the MoneyShow Orlando

One of my first speaking appearances in 2017 will be at the MoneyShow Orlando, February 8-11, 2017, Omni Orlando Resort at ChampionsGate. Use my priority code, 042311, and mention it when you call 1-800-970-4355 to register.