Has Warren Buffett Lost His Magic Touch?

“Someone is sitting in the shade today because someone planted a tree a long time ago.” — Warren Buffett

I’ve been a long-time shareholder in Warren Buffett’s company Berkshire-Hathaway and a devoted student to his techniques of making money. I attended the 50th anniversary shareholder meeting in 2015 and have personally interviewed the Oracle of Omaha.

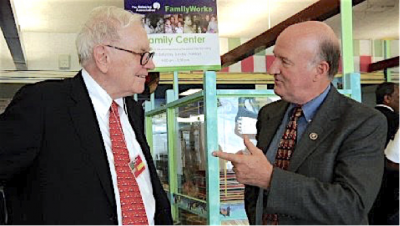

Warren Buffett and Mark Skousen share ideas in New York in 2010.

Buffett has become the third wealthiest person in the world as a result of the unbelievable success of his investment company, Berkshire Hathaway, since its inception in 1965. He has clearly beaten the market for most of the time.

Over the past 54 years, he has outdistanced the S&P 500 (including dividends) 37 times or 68% of the time. BKR-A’s total return, from 1965 to 2018, is 2,472,627% compared to the SPY’s 15,019%.

Despite his 89 years of age, Buffett’s skill has not diminished. In the past 14 years, Buffett’s investment company has beaten the S&P 500 (including dividends) 10 times, versus only three times by the index. That’s a 71% winning rate. See page 4 here.

The compounded rate of return is more than double the stock index: 20.5% a year for Berkshire vs. 9.7% for the S&P 500.

Bear in mind that Buffett has accomplished this remarkable feat by investing in hundreds of public and private companies.

For more than 54 years running, Berkshire Hathaway, Buffett and his partner Charlie Munger have finetuned their competitive advantage of investing. At an early stage, Buffett adopted Munger’s #1 lesson of investing: “A great business at a fair price is superior to a fair business at a great price.” (Quoted in “The Maxims of Wall Street,” p. 36.)

Has Buffett Lost His Magic Touch?

But this year may well be an exception — the S&P 500 is ahead 18%, while Berkshire Hathaway has struggled to make a profit.

What happened? While Buffett has had some big winners, such as Apple, Coca Cola and American Express, his investment company has gone nowhere with bank stocks. Plus, it suffered a big loss investing in the Kraft Heinz Company (down almost 50% since February).

Berkshire also took a hit when a major institutional pension sold most of its position in it a few months ago.

BH also is sitting on a record $112 billion in cash, which has weighed down the stock price.

Finally, Buffett has never been a fan of gold, so he has missed out on a major new bull market in mining stocks.

Buffett Recommends Indexing!

Since 2014, Buffett has been recommending that investors and even his own family members invest in a stock index fund and not count on his investment company to outperform in the future.

The reason? Berkshire is just too big. In his 2014 annual letter to shareholders, Buffett admits that “Berkshire’s long-term gains… cannot be dramatic and will not come close to those of the past 50 years. It is harder to double the market value of a $100 billion company than a $1 billion company.”

Is this the end of a remarkable success story?

Maybe, but let us not count Warren Buffett out quite yet. There have been other times in the past when his investment company has done poorly compared to the stock market indexes. Such instances occurred in 1975, 1984, 1999 and 2009.

I’m still a shareholder.

By the way, normally I don’t share personal investing stories in my column. But recently I “fessed up” to the biggest holding in my IRA in front of a small group in Washington, D.C. For the longest time, this investment was off-limits to regular investors, but that’s all changed. In fact, it’s helped me become a millionaire, and I believe it can do the same for my readers. Click here to watch my “TED Talk” presentation — and get the name of this investment.

Special note: Warren Buffett is a big fan of my classic book, “The Maxims of Wall Street.” He wrote me, “I love your book and plan to steal some of its lines.”

It is the one and only compendium of financial adages, ancient proverbs and worldly wisdom — it has sold over 25,000 copies. Alex Green calls it a “classic.”

Commodity guru Dennis Gartman says, “It’s amazing the depth of wisdom one can find in just one or two lines from your book.”

The “Maxims” book is available for only $20 for the first copy, and all additional copies are $10 each. And if you order an entire box of 32 books, you pay only $300. Plus, I pay postage and autograph each copy. It is the perfect gift for investors, clients, money managers and stockbrokers.

To order, call Harold at Ensign Publishing at 1-866-254-2057, or go to www.skousenbooks.com.

C-SPAN Highlights FreedomFest Speakers and Authors

This week, C-SPAN Book TV continues to highlight sessions and interviews from this year’s FreedomFest, including John Lott participating in the gun rights debate… and my session “Call of the Wild West: Jack London, Rugged Individualist or Socialist?” (4 p.m. EDT this Sunday). Or watch it here now.

Speaking Engagements in September

I have several exciting speaking engagements this month.

On Constitution Day, Tuesday, Sept. 17, I will be returning to the Wisconsin Forum in Milwaukee to address the topic, “Has the POTUS Become a PONTIFF? Power, Political Economy, and the Constitution.” It includes dinner and the price is $68.50. For details, go to http://www.wisconsinforum.org/.

To purchase a ticket, contact Kristina Olkowski-Sayas at executivedirector@wisconsinforum.org.

After my stop in Milwaukee, I’ll be giving some lectures at Hillsdale College in Michigan, including one on Thursday, Sept. 19, on the topic “How Do You Get Rid of a Bad Idea (Democratic Socialism)? With a Better Idea — Democratic Capitalism!”

Finally, on Sept. 26-28, I’ll be appearing in costume as Benjamin Franklin at the Philadelphia MoneyShow: Other speakers include Ken Fisher, Dennis Gartman, Tom Sosnoff and John Buckingham. You can obtain free admission to the MoneyShow as my guest by calling 1-800-970-4355 and by mentioning pass code: 048316

Good investing, AEIOU,

![]()

Mark Skousen

You Blew It!

Bombarded by Seven Hours of Propaganda about Global Warming on CNN!

By Mark Skousen

Editor, Forecasts & Strategies

The media is determined to make global warming a hot campaign issue.

Last night, I watched part of the seven-hour program on CNN — yes, SEVEN hours — on the Democrats’ response to the global warming hysteria.

It was long enough to see socialist Senator Bernie Sanders advocate spending $16 trillion (trillion!) of taxpayers’ money on solving climate change.

Senator Kamala Harris wants to ban all fossil fuel use in 11 years, which will destroy millions of jobs and raise the cost of living dramatically (alternative energy is still very expensive compared to oil & gas).

One Democratic Party candidate claimed that hurricanes now are more frequent and intense, both of which are factually incorrect.

Fortunately, Fox News tried to give a more balanced and fair approach. Heartland Institute geologist Gregory Wrightstone, author of “Inconvenient Facts: The Science That Al Gore Doesn’t Want You to Know” (click here to his book on Amazon), was a guest who gave a less hysterical viewpoint that climate change isn’t the end of the world, not now, or in 11 years as activist Rep. Alexandria Ocasio-Cortez, also known as AOC, and other alarmist Democrats expect.

We plan a hot debate on “Global Warming: How Bad Is It?” at FreedomFest 2020. Can’t wait to find out the facts, the truth and the best policies to deal with this issue.