Does This Bull Market Have Legs?

“Bears make headlines, bulls make money.” — Maxims of Wall Street

Last week, I had a big debate with Jon Wolfenbarger, an investment writer who is super bearish, on the Tom Woods Show. It was a fast-moving debate. Watch the sparks fly here.

Cyclical traders say that, “As January goes, so goes the year.” (“Maxims of Wall Street,” p. 116). It’s known as the January Barometer. According to these technicians, a bullish January means solid profits in small cap stocks and the market in general for the rest of the year.

We’re off to a great start!

Will this new bull market on Wall Street continue? Much of that depends on how severe Jay Powell and the Federal Reserve’s rhetoric will be in the future. Once again, the Fed raised short-term interest rates on Wednesday, Feb. 1, but this time it was by a tepid, 25 basis points.

The market rallied, hoping that the Fed’s tight money policy is largely behind us.

Interestingly, the stock market has moved up after the midterm elections every year since 1942. It may well happen again.

Tesla Stock: You Only Live Twice!

Many subscribers remember how we profited handsomely from the dramatic rise in Tesla (TSLA) by our timely investment in Ron Baron’s Partners Fund in the past couple of years.

Tesla had a remarkable run that delivered an incredible 5,290% over the past ten years. We participated in part of that run through the Baron Partners Fund, which has a huge 49% position in Tesla.

Ron Baron is a big fan of the eccentric, brilliant, volatile and somewhat inscrutable founder and CEO, Elon Musk.

Getting Out Before the Plunge

However, back in June, I could see that Tesla was struggling, so we sold our position in Tesla and the Baron Partners Fund.

When I confronted Elon Musk at the Baron Investment Conference in early November, I quoted Seneca, who said, “There is no genius without a touch of madness,” to which Musk replied, “I like the madness part.”

I followed up with a question comparing Tesla to Mercedes-Benz. At the time, Tesla was selling at 70 times earnings and paying no dividend, while Mercedes-Benz was selling at six times earnings and paying a 9% dividend. I asked Musk, “Why should I invest in Tesla?” You can watch the exchange here: “Why Tesla Is Better Than Mercedes-Benz!”- Elon Musk – YouTube.

In fact, I recommended Mercedes Benz in the Home Run Trader and we are now up over 30%.

Getting Back In

But even bear markets end sometime, and in the case of Tesla, I noted on January 9 Tesla had entered a “super oversold” position. It was a huge contrarian play in a recovering market, and after falling 75%, I figured it was a decent bet, so we recommended buying the stock and some out of the money (OTM) call options.

Reading ‘Maxims of Wall Street’ Made the Difference!

I have a whole section in “The Maxims of Wall Street” on “Bargain Hunting and Contrarian Investing” (about 10 pages). Here are some of the quotes I use to buy oversold stocks:

“Invest at the point of maximum pessimism.” — Sir John Templeton (pg. 43)

“Buy when blood is running in the streets.” — Baron Rothschild (pg. 45)

“Unless there’s fear in buying a stock, you can’t make big money.” — Robert Wilson (p. 49)

Based on gut feelings after being in this business for nearly 50 years, seeing Tesla fall sharply the week before on huge volume and then starting to see Tesla recover, I figured it was an opportune time to buy.

The Tesla stock is now up 55% since we recommended it in the Fast Money Alert, and the call options are up over 300% in three weeks.

‘Lazy Man’s Way to Riches’

In sum, it pays to read regularly and follow the advice of the “old and true adages” from Wall Street veterans contained in “The Maxims of Wall Street,” now in its tenth anniversary edition.

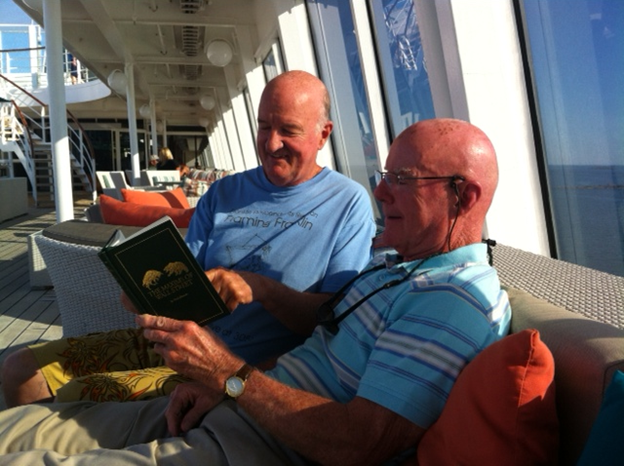

The Maxims has been called the Bible on Wall Street… I like to call it “The Lazy Man’s Way to Riches.” (See me and a friend reading it on a cruise ship below.)

The 284-page book is a bargain! Buy your own copy for only $20, and additional copies for only $10 each. Give them to friends, relatives, clients and your favorite stockbroker. And if you buy a box, you get 32 copies for only $300 per box. You can see why I’ve sold nearly 50,000 copies.

To order, go to www.skousenbooks.com. I autograph and number all copies, and mail them for free inside the United States.

Good investing, AEIOU,

You Nailed it! – The Greatest Tennis Player in the World Stood Up to the Authoritarians

Novak Djokovic, the Serbian tennis pro, came under enormous pressure to give in to the Health Police and Australian government officials to be vaccinated for COVID-19.

But he refused, and he was deported from Australia.

One year after he was deported for refusing the COVID-19 vaccine, Djokovic made history when he returned to Australia to win his 10th Australian Open and 22nd Grand Slam title.

Bill Gates, a fierce defender of mandatory vaccination, was in the stadium and watched him win.

Djokovic is considered the greatest tennis player in the history of the game.

But more importantly, he stood his ground on his personal principles.

Djokovic is an outspoken critic of mandatory COVID-19 vaccination and a defender of bodily autonomy.

In a February 2022 interview, a BBC reporter asked Djokovic if he was “prepared to forgo the chance to be the greatest player that ever picked up a racket, statistically, because you feel so strongly about the jab?”

“Yes, I do,” Djokovic responded. When prodded about why he felt that way, Djokovic stated, “Because the principles of decision-making on my body are more important than any title.”

Good for him! It’s dangerous to give in to the Health Police.