Derek Jeter, Steve Forbes and Me: Gaining an Unforgettable Lesson

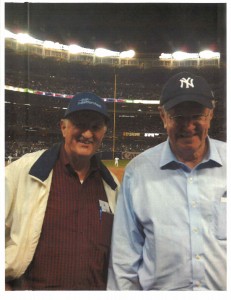

At the invitation of Steve Forbes, I was able to attend Derek Jeter’s last game as a player at Yankee Stadium. Mr. Forbes has season tickets and occasionally invites me to join him. Tickets for the game were selling for $850 and more, and those were bleacher seats, so I felt lucky. The Yankees were ahead 5-2 in the 9th inning when I told Mr. Forbes that I expected the Orioles to score three runs and tie the score, forcing Jeter to bat one more time to win it all in his final time at bat at Yankee Stadium. My prediction came true. Mr. Forbes can verify it. What a night!

I can relate to Derek Jeter. He never won the Most Valuable Player award, but he was a steady, reliable performer during his 20 years with the Yankees and ended up getting five World Series rings. By the same token, I view my 35 years of writing Forecasts & Strategies as achieving steady performance, while never personally ranking #1 in any one year. But over the long run, I have delivered a winning formula for financial success.

Baron Rothbard once confided, “I will tell you my secret. I never buy at the bottom and I always sell too soon.” Nevertheless, he said, “You can have the top 20% and the bottom 20%. I’ll take the middle.” And he was an outstanding success.

David Dreman, the contrarian investor, said that “the investing tortoise beats the speculative hare.” Sure, the speculation may win the Stock Picker of the Year Award, but can he beat the slow but steadily profitable turtle for the long term? Not likely.

Last week, I visited the Museum of American Finance. They’ve been selling my “Maxims of Wall Street” book like hotcakes since I spoke there a few months ago. It really fills a need for investors. They sent me this quote: “’Maxims of Wall Street’ is relevant and lightly satirical. As a specially presented keepsake with valid and humorous contents, it sells itself to everyone who reviews it.”

The “Maxims” Holiday Gift!

“The Maxims of Wall Street” is the best gift you can give this holiday session. It is the closest thing to Wall Street Scripture ever created. The book is printed in classic dark green with gold lettering, plus a ribbon. Now in its third edition, with more than 20,000 copies in print, it’s been endorsed by Warren Buffett, Jack Bogle, Dennis Gartman and Alex Green, among others. The work contains more than 800 adages by such notables as Warren Buffett (“If you wait to see the robin sing, spring may be over”)… J. P. Morgan (“Troubled waters make for good fishing”)… Humphrey Neill (“The public is right during the trends but wrong at both ends”)… Richard Russell (“In a bear market, the winner is he who loses the least”)… and Steve Forbes (“Everybody is a long-term investor until the market goes down”)… Old Timers’ stories like the “trading sardines”… where are the customers’ yachts?… the gold bugs… commodity traders… the origin of “blue sky”… Famous lines from Baron Rothschild, Ben Franklin, John D. Rockefeller, Joe Kennedy, J. P. Morgan, Bernard Baruch, John Templeton, Jesse Livermore, John Maynard Keynes, Ben Graham… Sage advice on beating the market, diversification vs. concentration, value vs. growth, bulls vs. bears… black swan events… day traders… doomsayers and cassandras… plungers and the peacocks… hot tips and insider information… losing money and missed opportunities… Wall Street vs. Main Street… chartists vs. fundamentalists… leverage and debt… privacy and government… taxes and tax havens… inspiring “Rich Man’s Pearls of Wisdom”… and intriguing short stories such as “The Extra-Ordinary Life of Warren G. Hardaway.”

I charge only $20 per copy for my book. But if you order more than one, each additional copy is $10 each. And I pay the postage on all orders! (For all foreign orders, add $10 each.) If you order a box (32 copies), the price is only $300 postpaid. All books are personally autographed. To order, call Eagle Financial Publications at 1-800-211-7661, and mention code MAXIMH to buy individual books and code MARKB to buy a box.

You Blew It! Consumer Spending Causes Economic Growth?

“Household spending generates more than two-thirds of total economic output, so sturdy spending gains should translate into economic growth.”

— Ben Heubsdorf, “Consumer Spending Rises and Inflation Slow,” Wall Street Journal, September 30, 2014, p. A2

The fallacy seems to occur every month, without fail. When the monthly data comes out on retail spending or consumer confidence, the media goes crazy talking about how consumer spending drives the economy, because it represents 70% of the gross domestic product (GDP).

So, I was not surprised to read the following last week in the Wall Street Journal about consumer spending: “Household spending generates more than two-thirds of total economic output, so sturdy spending gains should translate into economic growth.”

Never mind that all studies on economic growth show that it is determined on the supply side — productivity and technological advances (work of Robert Solow, Robert Barro, Greg Mankiw, etc.) — not consumer spending. Consumer spending is the effect, not the cause, of prosperity.

I explain this reality in more detail in my lead editorial in the Wall Street Journal from April 23, 2014.

Starting this year, the federal government is releasing a new macro statistic, Gross Output, which is a much broader measure of economic activity. Gross output demonstrates that business spending (B-to-B transactions) is much bigger than the consumers’ spending.

I wrote to the reporter, and he responded as follows: “I was referring simply to the calculation of GDP growth in the paragraph — personal consumption expenditures are an input and higher PCE would mean stronger GDP growth — and not the underlying, broader question of what drives the economy.”

I responded, “The misunderstanding is created when you equate ‘output’ with GDP. GDP is the value of final output only. If you use Gross Output, the new quarterly measure by the BEA, personal consumption expenditures are less than 40% of ‘output.’ Business spending (B to B transactions) actually makes up over 50% of gross output.”

Hopefully, the federal government will start highlighting Gross Output as a better measure of economic activity, and the media will catch on.

In case you missed it, I encourage you to read my e-letter column from last week about the big debate between Paul Krugman and Steve Moore. I also invite you to comment in the space provided below my Eagle Daily Investor commentary.

Yours for peace, prosperity and liberty, AEIOU,

![]()

Mark Skousen

Presidential Fellow, Chapman University