Danger Ahead: The Billionaires Tax is Just the Beginning

“No working person in America thinks it’s right that they pay their taxes and billionaires don’t.”

— Senator Ron Wyden (D., Ore.)

“The wealthiest private owners must return part of what they own to the community every year [via] a progressive tax on wealth.” — Thomas Piketty, “Capital and Ideology” (2020)

“Double their taxes, triple their taxes! We’ll make them pay.” — King John in Disney’s “The Adventures of Robin Hood”

The radical Democrats continue to come up with new ways to tax and kill the golden goose (entrepreneurship) that made America exceptional.

For more than 100 years, America’s stock market has been the wonder of the world, leading all nations in performance.

But that is about to end if the radical Democrats get their way. Not only do they want to increase the corporate income tax rate from 21% to 26.5%, but they want to impose a 15% minimum “patriotic” tax on wealthy Americans and eliminate the “low” tax on long-term capital gains (23.9% if you hold stock for over a year).

And since investors can avoid capital gains taxes by not selling their appreciated stock for years, the Democrats hope to capture those unrealized billions of dollars by imposing a 40-50% tax on the estimated increase in value of the billionaires’ portfolios every year.

Can you imagine the impact of 700 billionaires forced to sell millions of their publicly traded shares to pay for those taxes in late December or early April?

Or what if they decided to take their companies private to avoid the dreaded tax?

Do Billionaires Really Pay No Income Taxes?

Early this year, an organization called ProPublica issued a report revealing the tax returns of billionaires such as Amazon CEO Jeff Bezos and Tesla CEO Elon Musk, all of which were illegally obtained. Bezos and Musk are the two wealthiest men in the world.

According to the ProPublica report, Bezos paid no federal income tax in 2007 and 2011. But note! From 2014 to 2018, Bezos reported $4.22 billion in income and paid $973 million in taxes.

Moreover, Amazon was one of the fastest-growing companies in America and now employs more than one million workers. I doubt if Amazon would have done as well or created that many jobs under the new draconian tax rules.

Elon Musk reportedly paid no federal income tax in 2018. But again, Musk reported $1.52 billion in income and paid $455 million in taxes between 2014 and 2018.

In sum, Oregon Senator Wyden’s statement is highly misleading. Billionaires do pay a ton in federal income taxes over time.

It’s Only the Beginning

Always beware of new forms of taxation, especially those that apply “only to the super-rich.”

That was the argument in 1913 when Congress passed the federal income tax. “Only the super-rich will have to pay income taxes,” lawmakers said.

The Revenue Act of 1913 imposed a 1% tax on incomes above $3,000, with a top tax rate of 6% on those earning more than $500,000 per year. Approximately 3% of the population was subject to the income tax.

But then World War I came along a few years later, and suddenly the tax rate rose to 80%. Eventually, during World War II, practically everyone was paying a federal income tax that had to be withheld at the source.

If this billionaires tax is imposed, it won’t be long before it will be a millionaires’ tax affecting millions of Americans.

Make no mistake about it: The proposed billionaires tax is a tax on capital and entrepreneurship in this country. It’s a job killer.

Is The Billionaires Tax a Wealth Tax in Disguise?

The billionaires tax on unrealized capital gains is also an indirect way to tax wealth or investment assets.

It is a sinister new tax that allows the government (the IRS) to investigate you at any time and arbitrarily tax you more because “wealth” cannot be precisely measured. How much are those company shares, paintings, sculptures, rare coins and other collectibles worth?

Second, an imposition of a wealth tax is an invasion of privacy. You would be required to list ALL your assets, including coins, jewelry, diamonds, bearer bonds and cash. Hiding anything from authorities could make you a criminal.

This Scottish Economist Warned Us of the Dangers of a Progressive Income Tax

Third, when you adopt a progressive tax, you are at sea without a rudder. What is the best marginal tax rate — 50%, 70% or 90%? It is impossible to choose objectively. I would not be surprised if they raise the tax rate over time.

The Scottish economist John Ramsey McCulloch (1789-1864) said it best: “The moment you abandon the cardinal principle of exacting from all individuals the same proportion of their income or their property, you are at sea without rudder or compass, and there is no amount of injustice or folly you may not commit” (emphasis added).

What is the Ideal Tax Policy?

Both under Republicans and Democrats we have moved far away from a sound tax policy. I’ll be giving a lecture on “What is the Ideal Tax Policy to Maximize Liberty and Prosperity?” at Hillsdale College in Michigan at 7 p.m. in Lane Hall on Thursday, Nov. 11 (Veteran’s Day). Subscribers and the public are welcome to attend.

I make the argument that the “benefit” principle is the only legitimate principle of taxation on which to build a just and prosperous society.

Is there a country that comes the closest to the ideal tax policy? Yes! Hong Kong!

It offers the following:

–Progressive tax 2% to 17%, minus personal exemptions

–Flat tax of 17% over HK$50,000

–Corporate profit flat tax of 16.5%

–Zero capital gains tax

–Zero tax on dividends/interest

–No estate/inheritance tax

–No sales tax

–No hotel tax

–Annual real estate tax is 15%

–Airport departure tax, HK$150

The last time tax law was changed: 1960.

As a result, Hong Kong has gone from Third World to First World in economic performance. (Sadly, it may all come to an end under Chinese Communist rule.)

The Best Source to Learn about Sound Tax Policy

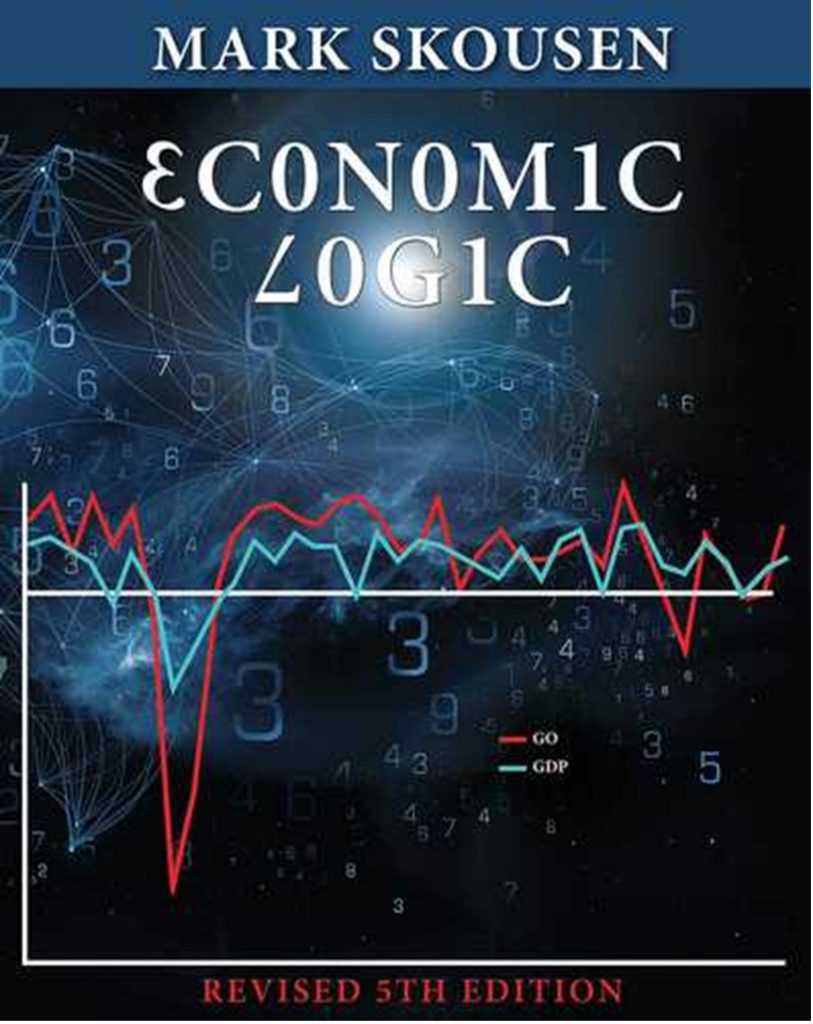

If you can’t make my Hillsdale lecture, I suggest you obtain a copy of my guidebook “Economic Logic,” which contains 28 valuable lessons on taxation, inflation, the business cycle, investing and the fundamental keys to economic growth and prosperity.

Chapter 21, “Government Revenues and Tax Policy,” discusses all of the reasons why the “benefit” principle works to maximize liberty and prosperity, and why other reasons, such as the “ability to pay” principle are dangerous.

It is the only “no compromise” textbook in free-market economics, with in-depth criticisms of all the various forms of socialism, Keynesianism and Marxism.

For information on “Economic Logic,” go to https://mskousen.com/economics-books/economic-logic/

“Economic Logic” is a 708-page quality paperback with 28 lessons or chapters, and it is ideal for college, advanced high school and home-schooled students.

For a special rate of ONLY $35 (28% off the $48.95 list price) with FREE SHIPPING in the United States, go to www.skousenbooks.com.

Too bad the Democrats haven’t learned this statement by Benjamin Franklin: “A virtuous and industrious people may be cheaply governed.”

Good investing, AEIOU,

![]()

Mark Skousen

You Nailed It!

Congratulations to Gov. Ron DeSantis

The following report came out on Yahoo News on Oct. 27.

“Which U.S. state has the lowest COVID-19 rate right now? It’s not California, home of America’s strictest mask and vaccine requirements. Nor is it Vermont, even though 71% of residents there have been fully inoculated — the most in the country.

“No, the state with the fewest daily COVID-19 cases per capita is the same one that recently had more than any other: Florida.”

“And they’ve done it without mask or vaccine mandates,” commented one analyst.

On Saturday night, my wife, Jo Ann, and I met Florida Governor Ron DeSantis for the first time and heard him speak before the Claremont Institute’s annual banquet in Huntington Beach, California.

He made a point of contrasting his state with California. He noted that Florida is ranked the “freest state in the union,” while California is ranked #48 and New York is ranked #50, according to Cato Institute’s “Economic and Personal Freedom Index.” Florida has the lowest tax burden, and California has one of the highest.

According to the governor, 99% of votes in Florida were reported on election night last November, compared to taking a month in California. In Florida, IDs are required to vote, and ballot harvesting (collecting ballots for other voters) is forbidden.

The governor is so popular that for the first time in years, there are now more registered Republicans than Democrats in the state.

Florida’s economy is booming. He said that among last month’s 194,000 new jobs created in the nation, 84,500 came from Florida.

Not surprisingly, DeSantis is leading in the polls to be the next president of the United States. The only person keeping him from the Republican nomination is Trump, but the former president will be 78 in 2024, and DeSantis will be only 48 years old. It’s time for new blood.

I invited Gov. DeSantis to speak at next year’s FreedomFest. “In Florida?” he asked. Actually, it is scheduled for July 13-16, 2022, at the Mirage Hotel in Vegas. But if Vegas has mask and vaccine mandates next year, we may well move FreedomFest to Florida!