Check Out This Amazing Graph!

——————–Publisher’s Note——————–

Hi, Grant Linhares here, the Trading Services Director for Mark Skousen. I just have a quick reminder for you to note that subscribers like you are in good hands with Dr. Skousen — who’s hit recent gains of 230%… 180%…117%… 137%… 100%… I would also like to remind you that “Winner’s Circle,” a lifetime bundle of all of Mark’s services, is now open. This could really ring in the new year with a string of big trading gains. Simply give me a call at 202-677-4492 today, and I’ll give you your personalized quote to join. But hurry, this offer expires soon!

————————————————————–

“The thing you should keep your eye on is what government spends, because that’s the true tax.” — Milton Friedman

Remember when President Bill Clinton said, “The era of big government is over” in the 1996 State of the Union Address? It was a shocking statement, but I was skeptical when he said it.

That was the year he ran for reelection, and I ended up jogging with President Clinton later that year in San Diego.

During our jog, he told me that he planned to join with the Republicans in Congress to cut the capital gains tax to 20%, which he felt would stimulate investment and create a boom over the next four years — enough to balance the budget!

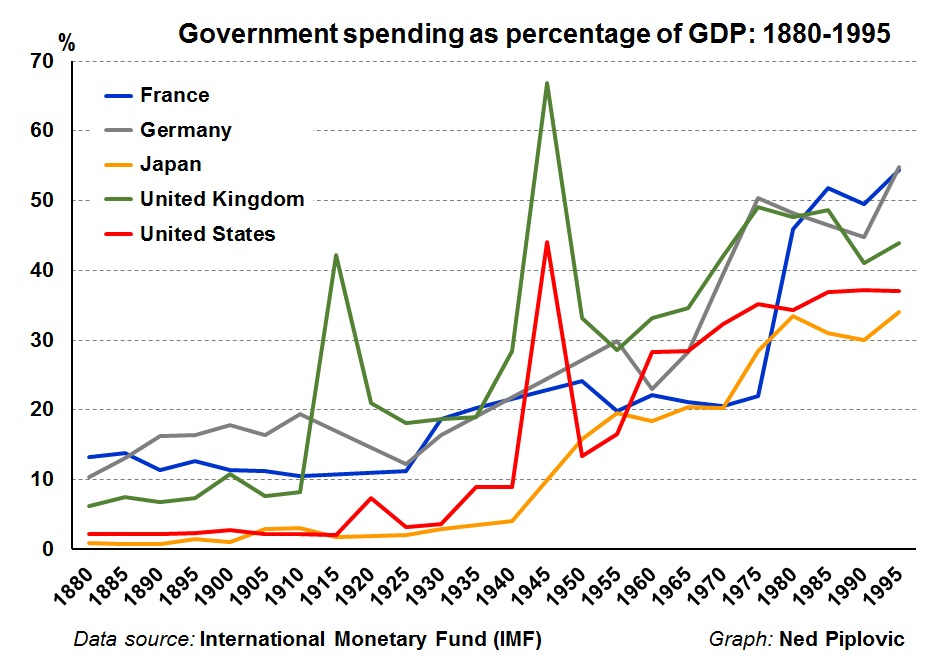

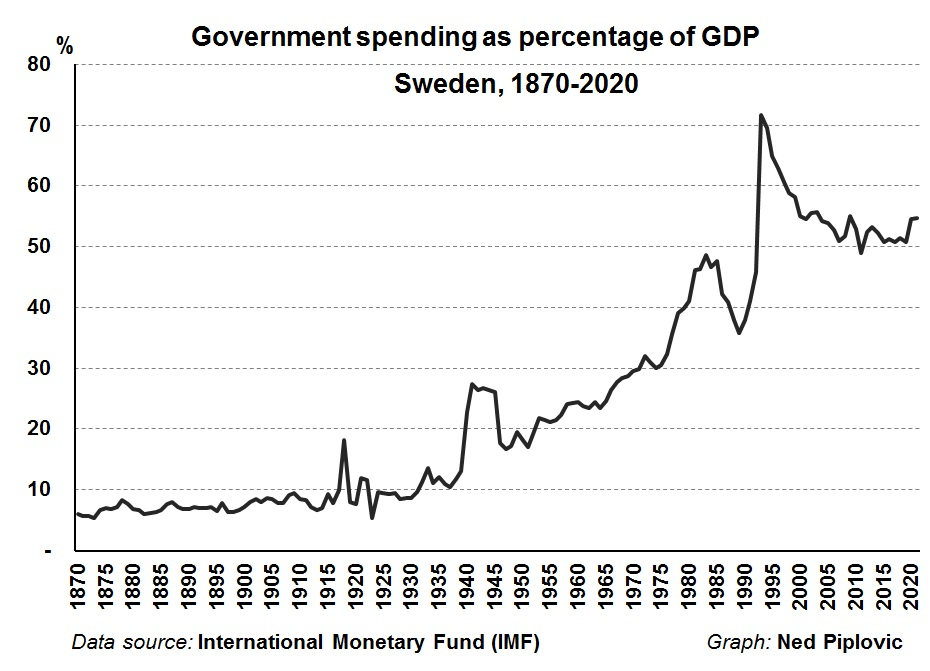

In that same election year, 1996, the Economist published a graph showing the long-term growth of government from the 1880s to 1996. You can see the results in the chart below.

As the chart clearly demonstrates, Washington is bullish on big government, especially during times of war. After the war, government spending dips, but not for long.

Still, there has to be an end to this madness. Surely Washington will reach its maximum capacity and will experience the law of diminishing returns.

Indeed, based on my interview with President Clinton and his decision to work with Republicans, I thought that big government was about to shrink. For several years, Washington ran a surplus, and government spending fell as a percentage of gross domestic product (GDP). In the year 2000, I spent an evening with House Speaker Newt Gingrich, and he was giddy with excitement about the surpluses that were being built up and what we could do with the extra funds.

Fast Forward 20 Years Later

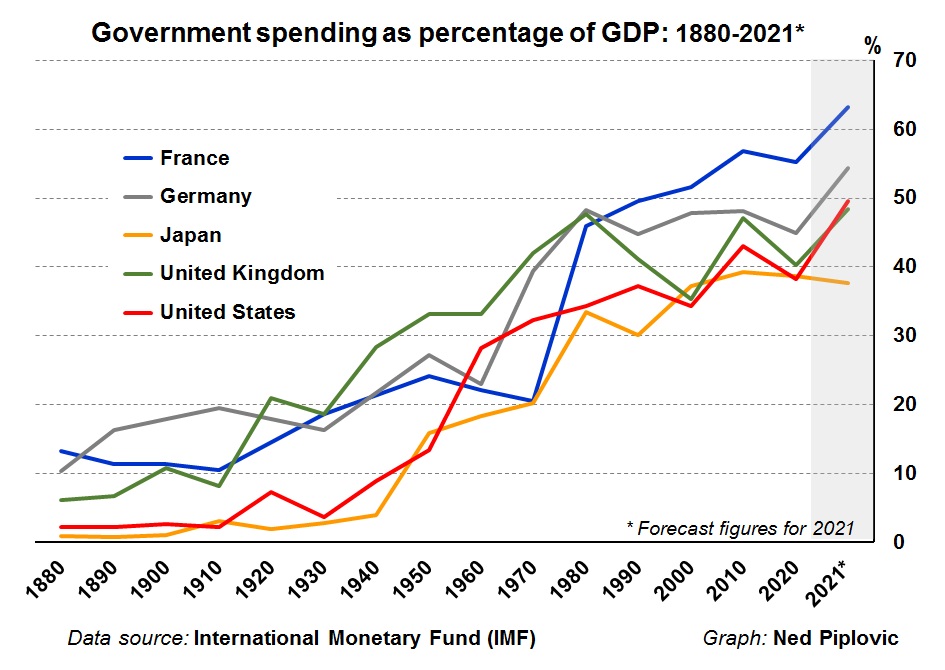

This week, in December 2021, I decided to update the Economist chart and see if we had made any progress in cutting down the size of government.

Here is the shocking chart:

As you can see, spending by Uncle Sam shows no sign of topping out. Government has continued to grow and grow and grow, despite all the efforts undertaken by Republicans and Libertarians to reduce the size of the government.

Despite campaign promises, government (federal, state and local) spending has increased from 35% to nearly 50% of GDP over the past 25 years.

It even grew under Trump, who promised to cut the deficit and reduce the national debt.

The Economist confirmed this trend when it released a cover story titled “The Triumph of Big Government” last week (November 20, 2021).

It looks like the Biden administration wants to make the government even bigger. It’s all quite discouraging, given all the good work that the Cato Institute, Heritage Foundation and the other free-market think tanks have done.

The Consequences of Big Government: Lower Economic Growth

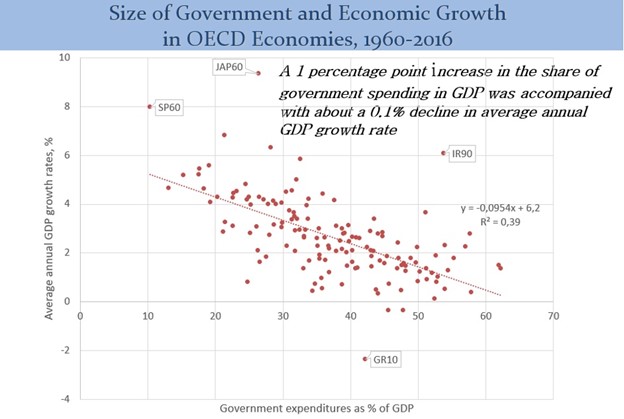

There is a price to be paid when government spending gets out of hand — the economy slows down. Many academic studies have shown an inverse relationship between the size of government and economic growth. See this chart below:

Source: Center for Freedom and Prosperity www.freedomandprosperity.org Reprinted with permission.

For example, the economy of the United States used to grow at a 3% annualized rate, after taking inflation into account. However, the average growth rate has declined to 2% in the past few decades, as government spending has grown.

But There Is Hope!

Three Countries That Fought Big Government and Won (For a While Anyway)

Is there any chance to reverse the trend and keep big government from getting bigger?

There are several examples of countries that have bucked the trend.

For example, Sweden faced a financial crisis in 1991. Interest rates skyrocketed and forced the coalition government to make substantial reforms. It sharply reduced the top tax rates and the complexity of the tax code, privatized its social insurance system, adopted school choice and instituted financial reforms.

As a result, taxes/government spending came down and produced a decade of strong growth. (See Sweden’s chart below.)

Swedish economists, such as Johan Eklund of the Entrepreneur Forum, fear that big government could make a comeback under the new prime minister, who favors an expansive federal budget and the “old” welfare state model.

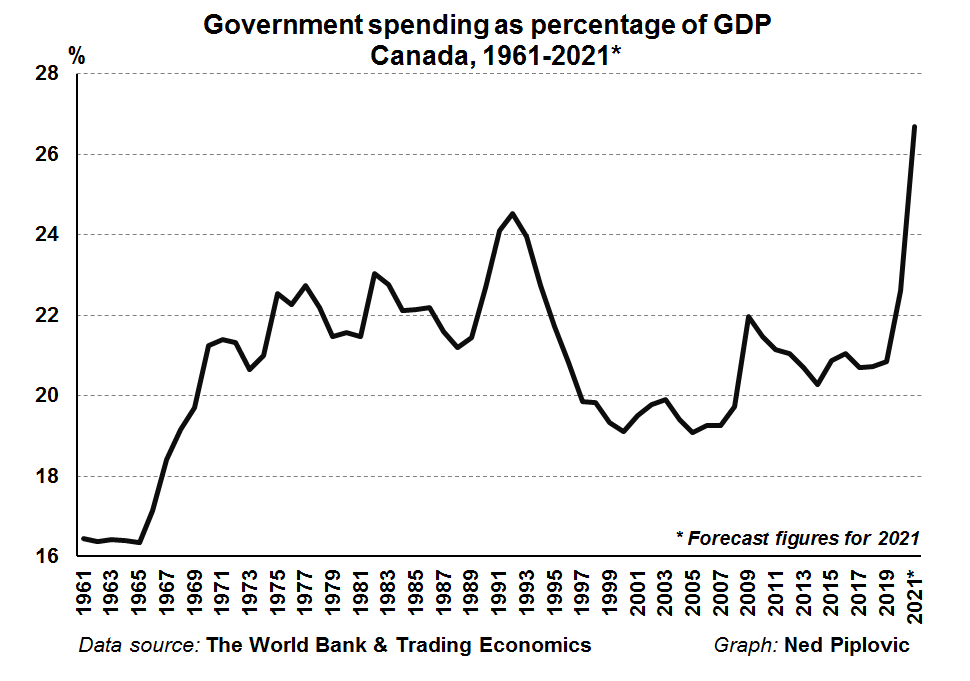

Canada is another example that faced a fiscal crisis (caused by a falling Canadian dollar, high federal deficits and a bloated government) in 1994. The Conservative Party of Canada complained that the government had become a leviathan, while the Liberal Party of Canada complained that too much of the government’s budget had to be used to pay interest on the debt instead of on domestic programs. So, they joined forces, slashed the budget and cut taxes (reducing the corporate tax rate to 12%), so that within two years, they had faster economic growth and a smaller government.

It was a huge success for the next dozen years, although big government has made a big comeback after the Trudeau administration locked down the Canadian economy in 2020-21.

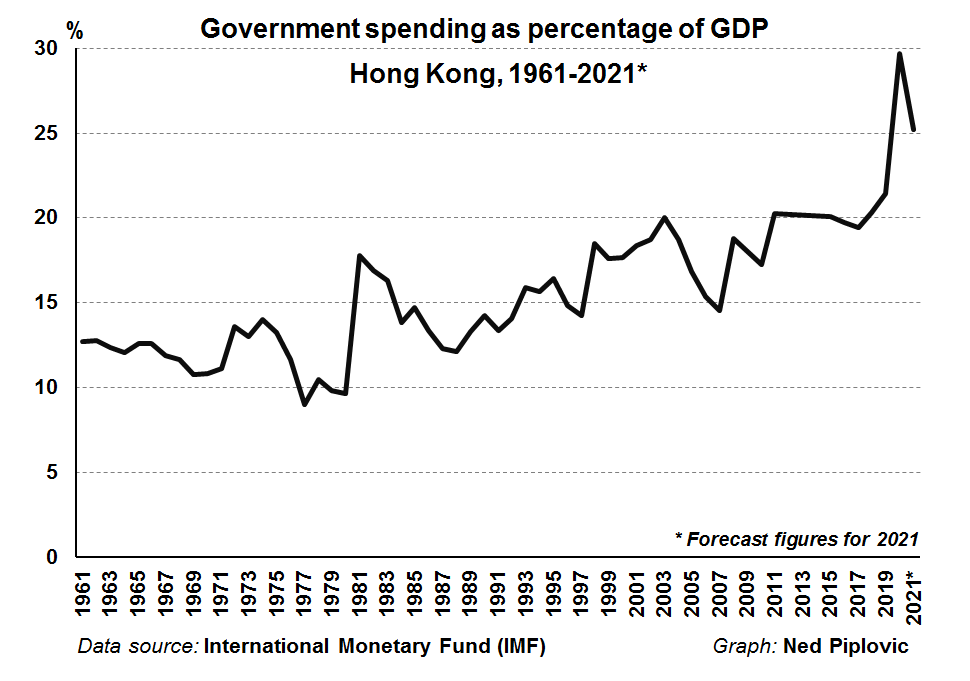

Hong Kong Had Cheap Government — Until the Chinese Took Over

Our final example is Hong Kong, which maintained a relatively small government when the British ruled.

From 1961 through 1997, the average government spending in Hong Kong was 13.1% of GDP.

After the Chinese took over Hong Kong in 1997, however, government spending as a percentage of GDP has climbed to 19.1%.

Eternal vigilance is the price of liberty!

Excessively high government spending and lower economic growth spells trouble for the U.S. stock market. Double-digit-percentage returns in the future may be tougher to achieve.

Good investing, AEIOU,

![]()

You Nailed It!

R.I.P. Wilbur Smith, Novelist Extraordinaire

I saw that the great South African novelist Wilbur Smith has died at the age of 88.

Years ago, I read his books Gold Mine, Diamond Hunters and Dark of the Sun.

Gold Mine was made into a movie starring Roger Moore… and Dark of the Sun starred Rod Taylor and Jim Brown. I loved them all.

If you’re a gold bug, you will especially enjoy Gold Mine. It is also available as an audiobook.

A few years ago, he came out with his memoir, which is called Leopard Rock: A Life of Adventure.

We will dedicate a room to Wilbur Smith at next year’s FreedomFest. He was partial to the colonial empires, but also rejected apartheid and considered Nelson Mandela a hero.