Rising Rates, Growing Deficit: Are We Headed for a Bear Market?

Come writers and critics

Who prophesize with your pen

For the loser now

Will be later to win

For the times they are a-changin’.

–Bob Dylan

Since the 2008-09 Great Recession, we’ve seen lower interest rates, minimal price inflation and an improving economy, both here and abroad.

In this “easy-money” environment, we’ve witnessed a robust bull market on Wall Street and a strong real estate market. Both presidents, the Democrat Barack Obama and the Republican Donald Trump, have taken full credit for this recovery.

But now investors everywhere are wondering if the good news can continue in the face of higher interest rates and rising price inflation. The federal deficit is growing rapidly toward $1 trillion in 2019, putting pressure on interest rates.

Even Keynesians agree that the federal government should be running a surplus during good times. The federal budget is out of control, and cannot depend entirely on faster economic growth to bail out Washington’s spendthrift habits. As Benjamin Franklin advised, “No revenue is sufficient without economy.”

The 10-year Treasury rate is rapidly approaching 3% and the 30-year Treasury rate is already at 3.22%. The Fed under the new Chairman Jerome Powell has confirmed that the central bank plans to confirm the bond market’s lead and raise the fed funds rate again this year.

“The robust economy can handle higher rates,” Powell said.

Even price inflation, as measured by the Consumer Price Index, is finally approaching the official Fed target of 2% a year.

But rising rates don’t necessarily mean that Fed is reversing its easy-money policy. Real rates, after inflation, are still low. But what about the supply of money? The Fed is finally selling off some of its quantitative-easing (QE) assets, and the money supply (M2) is definitely slowing down.

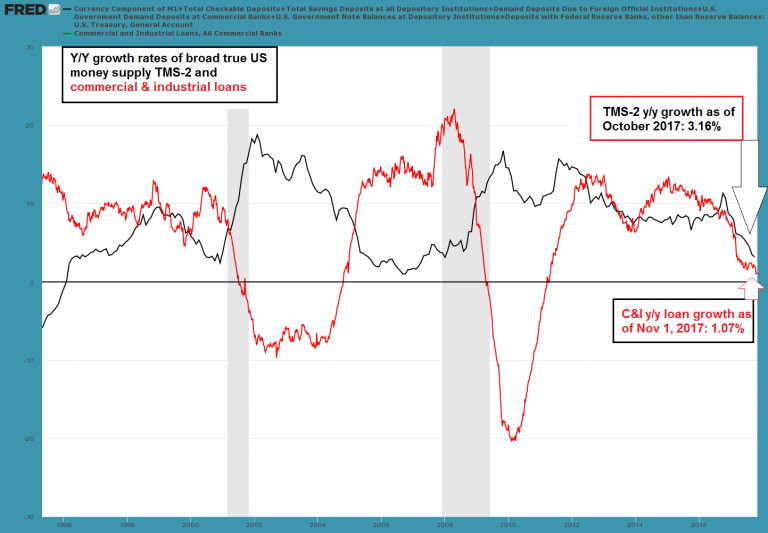

Moreover, if you are watching the broader based “True Money Supply” (TMS) as defined by the Austrian economists, we are definitely headed for trouble by 2019. It is growing at the slowest rate in years. For a detailed report, see http://realforecasts.com/what-does-the-dramatic-deceleration-in-the-growth-of-the-true-money-supply-mean-for-real-estate-investors/.

It’s worth noting that the TMS has been in decline for over a year now, and only recently has there been any trouble on Wall Street. So other factors must be taken into account to justify the end of the bull market.

There are several positive factors that can counter a monetary slowdown:

- The business tax cuts are generating much positive news in the corporate sector.

- We’ve entered a more liberal regulatory environment under the Trump administration.

- New technologies are transforming the way we live.

- The global economy is advancing.

In sum, the outlook has become more cloudy and we could be facing some thunderstorms, but I remain fully invested in good quality stocks for the time being… with my protective stops in place just in case.

In case you missed it, I encourage you to read my e-letter article from last week about whether investors should remain invested or move to cash.

Announcing Special ‘Fast Money’ Summit at FreedomFest

I’m happy to announce a special “Fast Money” Summit as part of FreedomFest, “the world’s largest gathering of free minds,” July 11-14, at Paris Resort, Las Vegas. It will be sponsored by Eagle Financial Publications.

When I announced this “Fast Money” Summit at the Las Vegas Investment Club’s EconoSummit last weekend, 24 investors of the 60 in attendance signed up on the spot! Talk about fast sign-ups!

This summit will focus on all the ways to make money fast in the markets today — cryptocurrencies, cannabis, high technology, mining and Asian and other foreign markets. It will take place in a special “Eagle’s Nest” room at Paris Resort and will last three full days. Roger Michalski will serve as moderator. We will have panels and debates galore. Confirmed speakers and their topics include Jim Woods (co-editor, with me, of Fast Money Alert), Alex Green (Oxford Club and editor of the incredibly successful Momentum Trader), Donald Smith (New York money manager specializing in “deep value” stocks), “Rich Dad” guru Robert Kiyosaki, commodity guru Jim Rogers, Rob Arnott (father of fundamental exchange-traded funds), Adrian Day and Doug Casey (mining experts), Gary Smith (Pomona College) and emerging markets guru Mark Mobius (video), among many others.

As part of the price for the “Fast Money” Summit you will receive three big bonuses: 1. A ticket to attend all sessions of FreedomFest, including speakers George Will, Judge Andrew Napolitano, John Mackey and John Stossel. 2. A complimentary copy of my book, “A Viennese Waltz Down Wall Street: Austrian Economics for Investors.” This is the ideal book for this event, as the Viennese Waltz is a fast-moving dance, and this book reveals how to use the all-important “Austrian theory of the business cycle” to recognize when a boom turns into a bust and a bull market turns into a full-scale bear market. The book is FREE when you sign up for FreedomFest. And 3. A private reception to meet and have a picture taken with Steve Forbes, co-ambassador to FreedomFest.

If you have already signed up for FreedomFest, you will automatically be signed up for the “Fast Money” Summit and will receive a free copy of my book when you register.

Take advantage now of this offer to sign up for the “Fast Money” Summit AND FreedomFest at a special “early bird” discount, $200 off the retail price of $695 per person/$995 per couple. You pay only $495/$795. Use code EAGLE. To register, go to https://www.freedomfest.com/register-now/ or call toll-free 1-855-850-3733, ext. 202. The early bird discount ends March 31. Sign up today!

You Blew it!

Billionaire Business Leaders Say Profit-Making Is Bad in Health Care

“Health care costs are a hungry tapeworm on the American economy.” — Warren Buffett

Warren Buffett (Berkshire Hathaway), Jeff Bezos (Amazon) and Jamie Dimon (JP Morgan Chase) announced Jan. 30 that they are creating a new health care company that will be more universal and cost effective for Americans.

Between the three giant firms, they employ nearly a million workers. Then the three business leaders suggested that this new health care company will be “free from profit-making incentives and constraints.” Say again?

I explain to my students that it’s the profit motive that encourages companies to reduce waste and fraud and become more productive at every level. Profit incentives are just exactly what our health care system needs.

The only time profit is bad is when companies have a monopoly and don’t face competition. That’s the problem today with most big pharmaceutical companies.

John Mackey, CEO of Whole Foods Market, is a consultant to this group and hopefully will explain to them the benefits of competition and the profit motive.