Better Odds Than Vegas: Penny Mining Stocks!

“Mining stocks can be a gold mine in an up market but a land mine in a down market.” — Mark Skousen (“Maxims of Wall Street,” p. 153)

“You’ve endured the pain, why not enjoy the gain?” — Rick Rule (p. 153)

Gold and silver have suddenly entered a major bull market. Last week, gold hit an all-time high and is racing through $2,000 an ounce. Silver is rising even faster and could finally break its $50 highs of 1980 and 2011.

Precious metals have always been a volatile, high-risk investment, and I’ve counseled investors not to get carried away. They can enter a bear market that can last for more than a decade.

But that’s not the case in 2020.

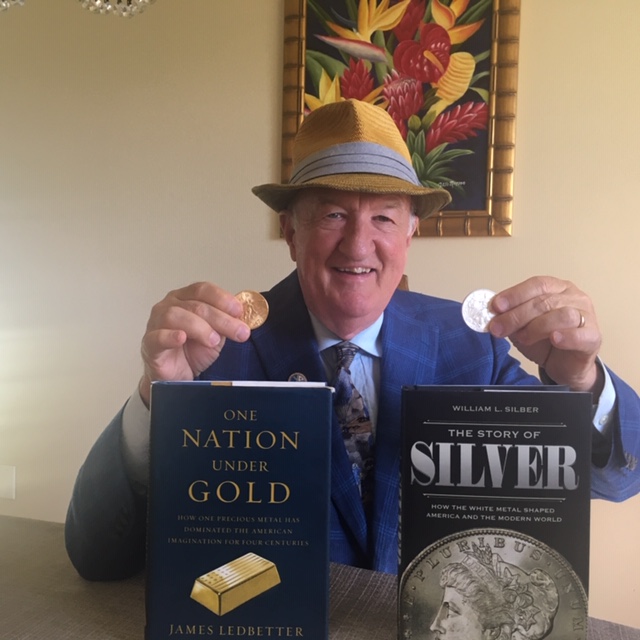

I’ve been a big fan of gold and silver this year. In January, I attended the American Economic Association meetings in San Diego, and picked up copies of two new books on gold and silver. I was convinced that precious metals were in a new bull market. (See photo.)

This week’s edition of Barron’s highlighted the yellow metal. It stated, “There could be more room for gold — and gold-mining stocks — to advance, with inflation-adjusted U.S. rates negative and the U.S. government running enormous deficits.”

And Goldman Sachs wrote, “We have long maintained that gold is the currency of last resort, particularly in an environment like the current one, where governments are debasing their fiat currencies and pushing real interest rates to an all-time low.”

The current environment reminds me of Jim Dines’ favorite line, “Gold is the hitching post of the monetary universe.” (“Maxims of Wall Street,” p. 151).

Goldman Sachs has raised its 12-month gold price target to $2,300 an ounce and warned about the durability of the dollar as the world’s reserve currency.

My Two Favorite Ways to Make a ‘Ten Bagger’ in Gold and Silver

In a teleconference with my subscribers this week, I explained that two of my favorite ways to make a lot of money in the new bull market involve gold and silver.

One way is to purchase out-of-the money call options in mining stocks. We have done this successfully in all four of my trading services and earned returns of 100% to 300% in a month or two.

The other is through penny stocks, but only if you buy them at the beginning of a bull market. One advantage that penny mining stocks have over options is timing. You can buy penny stocks and then wait. Eventually, you can make a lot of money, even if you are wrong in the short term.

With options, you can also make a lot of money, but you have to be right on the timing.

We offer both option trading and a portfolio of penny stocks in TNT Trader. (The market capitalization of these penny stocks is too small to be recommended in Forecasts & Strategies, which has a much bigger readership.)

All three of my penny stocks have soared — but we are still in the early part of the game and more profits are likely. If you want to join us, contact Grant Linhares at Eagle Financial Publications by calling 1-202-677-4492.

Note: We have the penny stocks in our short-term TNT Trader because we know that these penny stocks can lose 70% or more when the bull market ends. As Jeff Phillips says, “Most penny stocks are like burning matches. If you hold them too long, you will get burned.”

‘Maxims’ Book is a Gold Mine for Investors

I devote several pages of advice and quotes on investing in gold and penny stocks in “The Maxims of Wall Street.” See pp. 150-153 of the 7th edition.

I like this quote from Chip Wood, “All that glitters isn’t gold, but the really good stuff is.” (p. 150)

With the help of experts, we’ve found some real winners. Now is the time to get aboard.

Over the past few months, some of my subscribers have bought multiple copies of “The Maxims of Wall Street.” In fact, five people have bought a whole box of 32 copies to give them out to friends as gifts.

“Maxims” is now in its 7th edition, handsomely printed in green and gold and has been endorsed by Warren Buffett, Jack Bogle, Dennis Gartman, Bert Dohmen and many others.

Alex Green just wrote a review, calling the “Maxims” book “a crash course in financial freedom.” He wrote, “A college economics professor, founder of FreedomFest and bestselling author, Mark has spent more than four decades reading, writing, teaching and lecturing about financial markets. Along the way, he has collected a treasure trove of proverbs, slogans, stories and juicy quotes. Skousen provides plenty of stories and commentary to go with these gems and hundreds of others. I found myself chuckling (and occasionally sighing) when I first read this book. And I still refer to it regularly.”

Dennis Gartman said it best: “It’s amazing the depth of wisdom one can find in just one or two lines from your book. I have it on my desk and refer to it daily.”

Jack Bogle, the legendary founder of the Vanguard Group, wrote, “What a treat! It’s great to have all these sayings in a single spot.”

I offer a super bargain price for the “Maxims” book. The first copy is $20, and all additional copies are $10 each. They make a great gift to friends, family, clients and investors.

I autograph each copy, number them and mail them at no extra charge. If you order a box of 32 copies, you pay only $300.

To order, go to www.skousenbooks.com.

Good investing, AEIOU,

![]()

Mark Skousen

You Blew It!

Is Bill Gates a Hero or a Villain?

The Human Progress website recently ranked billionaire and philanthropist Bill Gates, one of the founders of Microsoft, as its “50th and final hero.” To read the tribute, click here.

The Cato Institute, which published the Human Progress website, has done a great job in making the case for optimism in today’s uncertain world.

And I will be the first to admit that Gates and Microsoft have done a great deal of good by creating Windows, even as a monopoly. I admire him for giving stock options to all his employees, resulting in 12,000 ordinary employees, including his company’s secretaries, becoming millionaires. I’ve recommended Microsoft in my newsletter, especially under the brilliant work of the current CEO Satya Nadella.

Unfortunately, the writer ignores Bill Gates’ darker side since he left Microsoft to lead the Bill and Melinda Gates Foundation, the world’s largest charity. Can we ignore his alarmist views on global warming and the pandemic?

What about the Gates Foundation’s massive financing of the World Health Organization (WHO), which kowtows to the Chinese?

Should we turn a blind eye to his numerous meetings with child sex trafficker Jeffrey Epstein or the Gates’ controversial experiments with vaccines?

For an objective look at Gates, click here.

Update on last week’s ‘You Nailed It’ column: Here’s another great story on Olivia de Havilland, Ronald Reagan and their battle with the Communists in Hollywood. John Fund mentions FreedomFest and the Cleon Skousen FBI story. Click here to read.