Attention, Investors: My Geiger Counter Discovers This Energy Source to be 8,000% More Efficient!

Non-renewal fossil fuels — oil, gas and coal — have proven to be much more efficient than solar, wind, water and other alternative energy sources. Investing in fossil fuels has made us rich.

Meanwhile, the production of “green” energy has to be subsidized. Investing in solar and wind has been much more risky.

Of course, the problem with fossil fuels is air pollution. Fortunately, it’s gradually being solved with better technology. For example, exhaust from cars, trucks and buses has declined dramatically with catalytic converters and other technologies.

But solar, wind and water may not be the best alternative. Not only are solar panels, windmills and electric vehicles (EVs) expensive to build, they take up a lot of space, and have their own environmental footprint.

The use of minerals such as lithium, cobalt and nickel, which are essential for EV batteries, require huge amounts of fossil fuels to mine these minerals and heat them to high temperatures. It is estimated that building a new EV can produce around 80% more emissions than building a comparable gas-powered car. And they are much more expensive to the consumer.

And what about the problem of disposing of batteries, solar panels and windmills when they wear out or become obsolete? It’s a huge environmental problem.

In China, due to heavy government subsidies and mandates, car manufacturers have produced way too many EVs.

Bloomberg recently published a series of photos of vast fields of abandoned electric vehicles parked tightly together and being overgrown by vegetation. These are apparently being found in cities all over China, as a result of the Communist regime’s banning of gas-powered automobiles and overzealous promotions of EVs. Joe Biden, are you listening?

A Better Alternative Energy Source

Fortunately, we have a solution: Nuclear power!

Nuclear fission (the process used to generate nuclear energy) releases far more energy than burning fossil fuels like gas, oil or coal.

How much more efficient? Nuclear fission is nearly 8,000 times more efficient at producing energy than traditional fossil fuels, or for that matter, solar, water and wind.

The construction of average U.S. nuclear power plants required 40 metric tons of steel and 190 cubic meters of concrete per average megawatt of electricity generating capacity. Compare that to a typical wind-energy system, which requires construction inputs of 460 metric tons of steel and 870 cubic meters of concrete.

China and India have been building nuclear plants for years, and even the United States is now more upbeat about nuclear power. The first nuclear power plant in years just became operational in Georgia. Germany is still a holdout, but even they had to extend the operation of three nuclear power plants during last year’s energy crisis.

Energy experts recognize that nuclear power, fueled by uranium, is a superior alternative to wind, solar and other forms of “green” energy.

What about the safety issue? There have been only two major accidents (in Ukraine and Japan) to have occurred in over 18,500 cumulative reactor years of commercial nuclear power operation in 36 countries.

And disposing of radioactive waste has been taken care of: When sealed and packaged to U.S. specifications, radioactive disposal is not dangerous — it is far safer than open wastes from oil or coal.

Demand is Growing for This Commodity

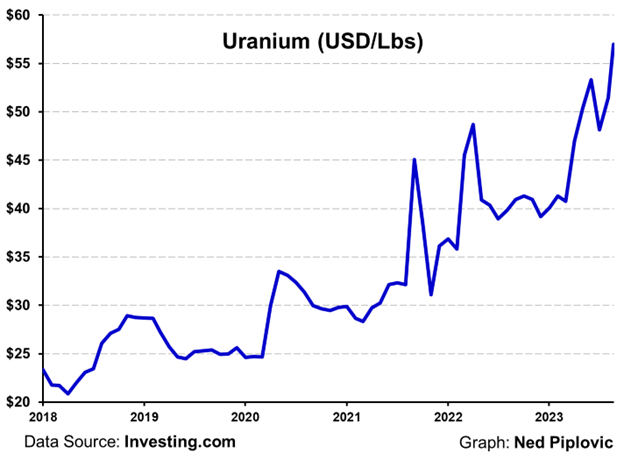

Uranium, the fuel for nuclear power, is in greater demand. It’s one of the few commodities that’s in a bull market and will likely continue to rise even in the face of a recession.

The price of uranium has doubled since 2020, and is up $10 this year to $57 a pound.

Attention, investors! There’s profits to be made investing in the new bull market in uranium.

There are a half dozen companies that are profiting from the uranium play.

Two months ago, we added a uranium producer to my TNT Trader, and it’s already up 22%. For more information on the TNT Trader, go to www.markskousen.com.

And just this week, we added a uranium stock to our Forecasts & Strategies portfolio, and it’s already showing a profit.

The bull market is just beginning, so jump on board.

GO on the Go

Good news. In addition to my gross output (GO) making the New York Times two weeks ago, GO finally made it into an economics Encyclopedia, edited by David Henderson: Gross Output — Econlib. The announcement was made on Tyler Cowen’s popular website, “Marginal Revolution.”

I’m coming to Miami

I will be speaking at the Economic Club of Miami on Sept. 14, 2023, 5:30 — 7:30 pm:

Location: Miami Dade College Wolfson Campus, 300 NE 2nd Avenue, Room 2106, Miami, FL, 33132

Price is $25 for the entrance fee. To register, go to An Analysis of America’s Market Economy on Adam Smith’s 300th Birthday Tickets, Thu, Sep 14, 2023 at 5:30 PM | Eventbrite

Join Me at My Favorite Investment Destination: New Orleans!

I always look forward to the New Orleans Investment Conference, to be held this year on Nov. 1-4 at the Riverside Hilton Hotel. It is the granddaddy of investment conferences, especially for gold bugs, and I have attended every year since 1976! New Orleans is my favorite town to visit, with great jazz, a cultural haven and the world’s best restaurants.

Presenters at this year’s conference include keynote speaker Matt Taibbi. He was one of the favorites at FreedomFest in Memphis, speaking about his expose of Twitter censorship and the future of free speech on social media. Other speakers include Peter Schiff, Jim Stack, Brien Lundin, Robert Prechter, Mary Anne and Pamela Aden, Rick Rule, Adrian Day, Jim Rickards and the Real Estate Guys Robert Helms and Russ Gray.

To sign up, go to this link. Or call 1-800-649-8411 and be sure to mention you are a subscriber.

P.S. I was just on the Ben Shapiro Show last week, talking about the possibility of a recession in 2024, and Ben said, “Mark Skousen’s book, ‘The Making of Modern Economics,’ is the best book in economics that I have ever read.” To order your copy at a discount (only $35) go to www.skousenbooks.com. I autograph each copy and mail it at no extra cost if mailed inside the United States.

P.P.S. Come join me and many of my Eagle colleagues on an incredible cruise! If you book before Sept. 29, you’ll receive a spend-as-you-wish $250 ship board credit! In addition, this is all-inclusive — meals, drinks and even the excursions are included in your one-time price! We set sail on Dec. 4 for 16 days, embarking on a memorable journey that combines fascinating history, vibrant culture and picturesque scenery. Enjoy seminars on the days we are cruising from one destination to another, as well as dinners with members of the Eagle team. Just some of the places we’ll visit are Mexico, Belize, Panama, Ecuador and more! Click here now for all the details.

Good investing, AEIOU

![]()

Mark Skousen

You Blew It!

The One Question Not Asked at Last Night’s Republican Debate

Last night, the Fox News reporters asked a lot of questions to the eight Republican candidates running for president in 2024 — it should have been nine with Larry Elder — including a question about UFOs.

But it would have been interesting to see how the eight candidates would respond to the question, “Do you support ethanol subsidies?” Most gasoline in the United States contains at least 10% ethanol — made from corn — thanks to a tax credit of 45 cents per gallon of pure ethanol the oil companies blend with gasoline.

Most economists object to this subsidy to Big Agriculture, which raises the price of gasoline as well as the price and volume of corn use, and is hurtful to the environment.

Since all eight of the candidates campaign in Iowa, a farming state, most candidates favor the ethanol subsidy. It’s politics as usual. Few stand for principle.

Senator Ted Cruz is an exception. He won the Iowa primary in 2016 despite opposing farm subsidies in general and ethanol in particular. Bravo for him!

President Donald Trump, ever the politician, supported farm subsidies in 2016.

Vivek Ramaswamy, the up-and-coming maverick candidate, promises to “tell the truth” and not play the political game. So, I was disappointed when I saw that he came out in favor of the ethanol tax credit.

He knows it’s bad economics, and said so: “The true best answer, which is consumer choice at the pump, no subsidies, no minimums or anything else, that’d be the best choice.”

But then he says he supports the ethanol subsidy as a “second best choice.” He explains: “And so, I think that what we have is a second-best approach that meets the reality of the present, which is to say that, where we are, in terms of the minimum fuel blend standards are approximately where the market would have been. That’s the approximation that we’ve made. And that’s why I’m supportive of it.”

In other words, he knows what the best policy is, but he won’t support it for political reasons.