A World Turned Upside Down: Are We Heading for Inflation or Deflation?

“It’s a World Turned Upside Down” — Theme of the Ruff Times Convention, 1979.

Back in the late 1970s and early 1980s, I was part of a big debate in the hard-money movement. Were we headed for more inflation ahead or a massive deflationary depression?

I collect rare books from that crisis era. One is “Survive and Win the Inflationary Eighties,” by Howard Ruff, published in 1981. Howard Ruff, the editor of The Ruff Times, made the case for runaway inflation in the 1970s and 1980s. His motto was “Buy Gold, Buy Silver, Buy Swiss Francs!”

Another old book is “The Coming Deflation,” by Vern Myers, an old Canadian miner, published in 1979. He also recommended gold, because he said that gold would do well even in a period of falling prices. After all, didn’t President Roosevelt revalue the gold dollar upward to $35 an ounce in 1934? During a time of severe deflation in the Great Depression, gold stocks skyrocketed.

I once had the idea of forming a softball game at the New Orleans conference of gold bugs. One team would wear “Inflationists” uniforms and the other “Deflationists.” The game never took place because some players couldn’t decide whether they were “inflationists” or deflationists.

The Case for Inflation

We have the same problem today. One can make the case for massive inflation coming our way due to the Federal Reserve cutting interest rates back down to zero and pumping trillions of dollars into the economy through Quantitative Easing (QE) and increasing the money supply.

Then there’s Congress, which is spending money like water and running the deficits up from $1 trillion to $4 trillion or more.

The end result is surely a new round of inflation not unlike the 1970s. That’s why gold is moving back up. I would not be surprised to see gold go over $2,000 an ounce within the next year or two. We’ve been recommending gold and mining companies in my newsletter, Forecasts & Strategies. Both have been very profitable. To sign up, go to www.markskousen.com.

The Case for Deflation: Prices, Interest Rates and Oil Turn Negative!

At the same time, one can make the case for deflation. After all, the Consumer Price Index (CPI) has been disinflationary for decades, along with interest rates. Prices in stores and online are being slashed right and left. Expect the CPI to decline in the next month or two.

There’s a direct correlation between price inflation and interest rates. In the past couple of years, we’ve witnessed unheard of negative interest rates in Europe, and 30-year U.S. Treasury bonds yielding less than 1.2%!

Who predicted that? Almost nobody.

Now came the bombshell on Monday, when the May futures contracts for crude oil actually turned negative. It is like a short squeeze in reverse. Nobody wanted to take delivery of oil, due to excessive supply in the face of sharply reduced demand from the economic shutdown.

An industry-damaging oil production trade war between Saudi Arabia and Russia caused President Trump to urge both sides to negotiate a resolution. The agreed-upon reduction in production has not prevented the spot price for West Texas Intermediate, a key benchmark for U.S. oil, to trade below $15 per barrel to set a 40-year low!

I was surprised that the Federal Reserve didn’t step in and buy the oil. The U.S. central bank is buying everything else, including mortgages, corporate bonds and Treasuries. Why not oil futures? Maybe the Fed did. Oil prices have moved back up since Monday’s May Futures debacle.

In fact, commodities, in general, are falling in price. Copper is down to $2.30 a pound and aluminum has decreased to 66 cents a pound.

‘The Greater Depression’ — Can It Really Happen?

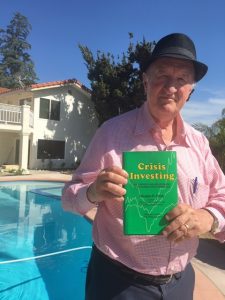

Maybe it’s time to dust off Doug Casey’s “Crisis Investing: Your Profits and Opportunities in the Coming Great Depression,” published in 1979 (and went on to be the #1 bestseller in the early 1980s).

Can things really be this bad?

Since writing that book, Doug has been predicting an even worse “Greater Depression” ever since. For 40 years he was wrong, and whenever he made this prediction at FreedomFest, everyone laughed.

But now maybe his prediction is plausible enough to make people worry. When Doug Casey speaks at this year’s “emergency meeting” at FreedomFest, I’m sure more people will be listening to what he has to say. (For more information on our emergency meeting, go to www.freedomfest.com).

Danger Ahead!

We’re engaged in a highly risky experiment — to see if we can survive an economic collapse, which is a high price to pay for fighting the new coronavirus that originated in Wuhan, China. The government is doing everything it can to cushion the fall, but no bailout is large enough to make up for a collapsing business world.

As I stated last week in Skousen CAFÉ, quoting Shlomo Maital, the former professor at MIT Sloan School of Business:

“The health and wealth of a large number of individual businesses — small, medium and large — determine the economic health and wealth of a nation. When they succeed, managers create wealth, income and jobs for large numbers of people. When they fail, working people and their families suffer. It is businesses that create wealth, not countries or governments. It is business that decides how well or how poorly off we are.”

We are facing severe financial and personal challenges. We’re especially vulnerable because the local, state and federal governments didn’t have their house in order when the crisis hit. All levels of the government seemingly are over their heads in debt, with no rainy-day fund to back them up. Public pension funds could collapse at any time.

Your investment portfolio is at risk. The market has recovered a bit but is still subject to unexpected economic fallout.

You can protect yourself by buying gold, selective tech stocks and other defensive investments. But even if you make money, not everything is going to be rosy. As the late American libertarian Jack Pugsley said, “Being a millionaire on the Titanic is no victory.”

The Calming Influence of the ‘Maxims of Wall Street’

The quote above from Warren Buffett reminds me… the demand for my “Maxims” book has been strong during this crisis. I’ve received several letters lately from investors who have said that reading quotations from “The Maxims of Wall Street” has been comforting in these trying times when the market is gyrating like crazy. I’ve been around the markets since the 1970s and have witnessed firsthand the thrill of victory and the agony of defeat. It never gets easy.

As Steve Forbes has said, “Everyone is a disciplined, long term investor… until the market goes down!” (quoted in the “Maxims,” p. 134)

And consider this quote from Wendell Brock: “Nothing can make the spirit fly higher than finding a bargain when you’re the buyer. And nothing can make the spirit sink deeper than finding it later a whole lot cheaper.” (p. 35)

Paul Getty advised, “Owners of sound securities should never panic.” (p. 112)

And benefit from this quote by Alexander Green, “It’s tough to catch the train after it has left the station.” (p. 176) He considers my book a “classic.”

And last, but not least, Dick Russell offered the famous line, “In a bear market, the winner is he who loses the least.” (p. 109)

If you want a copy of the new 7th edition, go to www.skousenbooks.com, or call Harold at Ensign Publishing at 1-866-254-2057. You’ll be glad you did. The price is only $20 for the first copy and $10 for all additional copies (they make great gifts). If you buy a box of 32 copies, the price is only $300. As the late businesswoman and financier Hetty Green was famous for saying, “When I see a bargain, I buy a lot of it.”

I know subscribers who have a copy on their nightstand. It is a good source of wisdom for everyone who is staying at home these days. As Dennis Gartman has said, “It’s amazing the wisdom one can gain from just one line in your book. I read it every day.”

Good investing, AEIOU,

![]()

Mark Skousen

P.S. I was pleasantly surprised and honored by the following announcement by the Center for Individualism.

You Nailed it!

The Swedish Model — the Best Solution to the Pandemic?

By Mark Skousen

“Yet, in holding scientific research and discovery in respect, as we should, we must also be alert to the equal and opposite danger that public policy could itself become the captive of a scientific-technological elite.” — President Dwight D. Eisenhower’s Farewell Address (1961)

Sweden is an outlier in the reaction of nations to the new coronavirus that originated in Wuhan, China, and has spread throughout the world. The Swedish government decided to take a more balanced approach to attacking the virus without closing down the country.

Instead of closing borders, schools, bars, gyms and businesses like its neighboring countries and the United States, Sweden took a riskier approach by exposing most of its citizens to the virus to build immunity quickly.

Sweden did close the universities and major public sporting and entertainment events, but otherwise, life pretty much went on as usual. As a result, Sweden has a relatively high number of infections and deaths, but now the country’s chief epidemiologist says the Swedish strategy appears to be working and the “herd immunity” could be reached in Stockholm in a matter of weeks.

If you want more detail on the Swedish approach, I recommend you to watch Johan Norberg’s commentary: https://www.youtube.com/watch?v=IoGp9vgeGRc&t=499s.