Winning the Loser’s Game

“What’s shocking is that simply by investing, most people actually make themselves poorer. They’re just shooting themselves in the foot, over and over.” — Richard Bernstein

On Sunday, the New York Times discussed a new study which showed that the average investor loses money in stocks and mutual funds over the long run. Investment strategist Richard Bernstein did a 20-year study on individual investors and found that most of them underperform a money market fund!

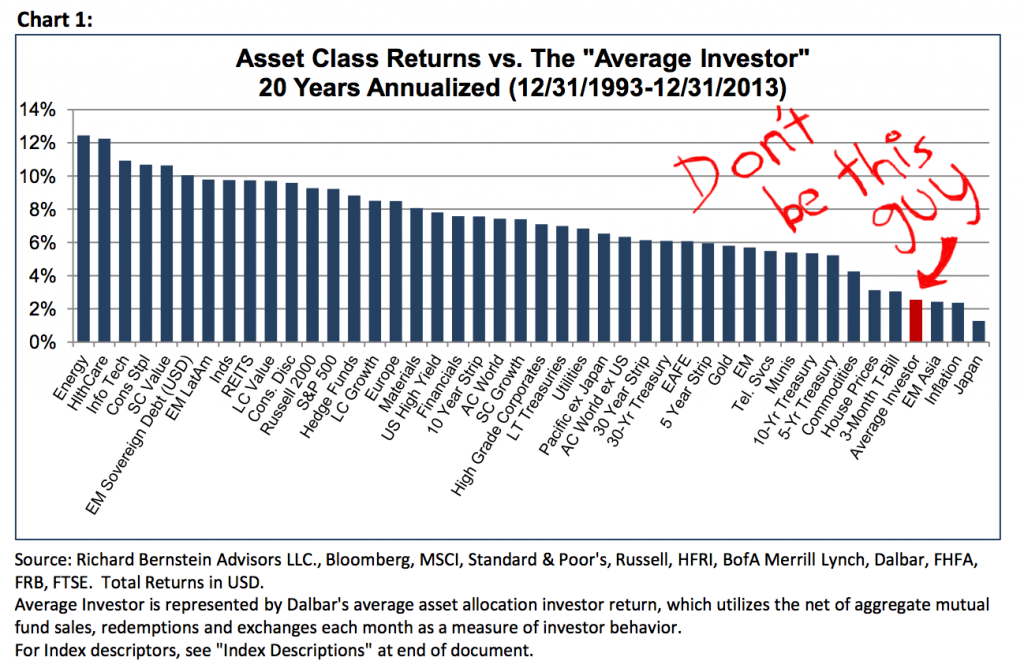

Look at the following chart from Richard Bernstein Advisors:

As you can see, during the 20-year study (from 1993 to 2013), the average investor underperformed a money market fund.

Bernstein concluded by writing, “What’s shocking is that, simply by investing, most people actually make themselves poorer. They’re just shooting themselves in the foot, over and over.”

What’s the reason? Market timing! While they try to outsmart the market, most of them can’t.

The article also said that investors who bought variable stock annuities did better, because the high surrender charges in annuities kept most investors invested for the long term.

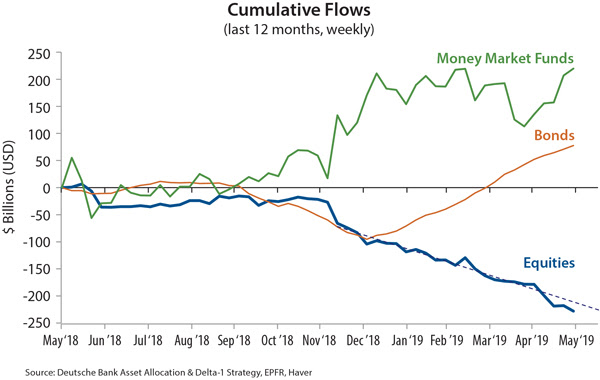

Right now, even as the markets are near all-time highs, investors are skeptical and getting out of the market. As this flow chart shows, investors are moving out of stocks and into money market funds and bonds.

Chart courtesy of Miller/Howard Investments

We are contrarians. My approach at Forecasts & Strategies is to find good companies and hold onto them during thick and thin. In that trading service, I recommend that my readers are 100% fully invested.

I follow the advice of J. Paul Getty, who said the following in “How to Be Rich:”

“It is possible to make money — and a great deal of money — in the stock market. But it can’t be done overnight or by haphazard buying and selling. The big profits go to the intelligent, careful and patient investors, not to the reckless and overeager speculator. The seasoned investor buys his stocks when they are priced low, holds them for the long-pull rise and takes in-between dips and slumps in stride.” (Quoted in “The Maxims of Wall Street,” Sixth Edition. To order, go to www.skousenbooks.com. The price is only $20 for the first copy and $10 for all additional copies.)

Beware of Technical Traders!

I’m a big fan of tech stocks, but not technical trading! As Jesse Livermore once said, “I need time, not timing.”

Many technical traders had anticipated the severe bear market late last year and made money. However, they have struggled to get back into the market. Thus, while they did get out before the temporary fall, they missed out on a huge rally as the S&P 500 has soared 17%. Those investors seem to be waiting for the indexes to hit new highs before getting back into equities.

While I find charting useful, I focus primarily on the fundamentals of a company and the outlook for the economy. As Sir John Templeton once told me, “You have to be a fundamentalist to really make money in the markets over the long run.”

Technical traders and chartists suffer from a fundamental flaw: As Austrian economics has taught us, the stock market is not mechanical; it is based on human actions as well as the buy-and-sell decisions of individual investors and institutions. Humans are neither machines, nor are they mere animals. Since they adjust quickly to new information or a new environment, they change their strategy from time to time.

Admittedly, computers make 80% of all trades on the exchanges these days. However, their programs are based on human development. As Paul Tudor Jones said, “No machine is better than a man with a machine.”

That’s why mechanical systems that have been “back tested” for years eventually stop working and need to be revised.

As one technical trader wrote recently, “Frankly, this ‘new’ phase of the market has required me to look more closely at our tried-and-true rules of timing when to get into and out of the market. These rules have performed extremely well in real-world trading and for over 80 years of rigorous back-testing. But we are experiencing a market that is totally unlike any market in history.” (emphasis added).

You can’t always look backward into history to determine how to invest in the future. History does repeat itself, but never in the same way. Mark Twain once said, “History may not repeat itself, but it often rhymes.” I say, “Never bet against the market.”

Upcoming Conference

Philadelphia MoneyShow, Sept. 26-28, Philadelphia 201 Hotel: I’ll be making a special appearance dressed as Ben Franklin!

Other speakers include Ken Fisher, Dennis Gartman, Tom Sosnoff and John Buckingham. You can obtain free admission to the MoneyShow as my guest by calling 1-800-970-4355 and by mentioning pass code 048316.

Good investing, AEIOU,

![]()

Mark Skousen

You Blew It!

Does Chick-fil-A Really Lose $1 Billion a Year in Sales by Closing on Sunday?

By Mark Skousen

Editor, Forecasts & Strategies

The headline in Business Insider was, “Chick-fil-A Loses Out on More than $1 Billion in Sales Every Year by Closing on Sunday.”

According to Wall Street sources, the chicken chain earned $10.46 billion in American system-wide sales in 2018, despite being closed every Sunday.

Missing out on 14% of possible open business days likely cost the chain more than $1 billion. Although McDonald’s does not disclose traffic by day, there is evidence that the weekends are particularly busy. This means that it may post 15% of its sales on Sunday.

If Chick-fil-A has a similar traffic pattern, Sundays could bring in sales of at least $1.2 billion.

Chick-fil-A founder Truett Cathy is a devout Christian who does not believe in working on Sunday.

“Closing our business on Sunday, the Lord’s Day, is our way of honoring God and showing our loyalty to Him,” Cathy said.

He continued, “My brother Ben and I closed our first restaurant on the first Sunday after we opened in 1946, and my children have committed to closing our restaurants on Sundays long after I’m gone. I believe God honors our decision and sets before us unexpected opportunities to do greater work for Him because of our loyalty.”

But wait! The restaurant chain may actually benefit from the unique policy.

John Hamburger, the president of Franchise Times (yes, that’s his real name), concluded that the company’s policy encourages higher sales during the week.

“Being open six days a week provides benefits to both the operators and the customers,” Hamburger said. “The owner-operator gets the time off. Being closed on Sunday conveys a sense of caring and community to the customers. Being private means they can do the right thing, not the expedient Wall Street way of doing things.”

Additionally, for customers, the knowledge that they can’t get Chick-fil-A on Sundays helps drive them to visit the chain when it is open.

God works in mysterious ways. The success of Chick-fil-A, despite staying closed on Sundays, could be one of them.