Why I Tore Up Paul Samuelson’s Famous Textbook

Special Announcement about the Economy and the Stock Market: Before getting into today’s Skousen CAFÉ, the federal government released gross output (GO) — the measure of total spending in the economy — for the third quarter. Real GO rose 4% (after inflation), suggesting a slowdown in the economy, compared to the second quarter. However, real GO grew faster than real gross domestic product (GDP) (2.3%). This suggests that the outlook for the economy and the stock market is still positive as we enter 2022. For the full press release, go to www.grossoutput.com.

“I don’t care who writes a nation’s laws or crafts its advanced treatises if I can write its economics textbooks.” — Paul A. Samuelson

In the early 1990s, I wrote a controversial book entitled, “Economics on Trial: Lies, Myths and Realities” that was published by Dow Jones/Irwin (which also published The Wall Street Journal).

“Economics on Trial” was a review of the top ten textbooks in college economics, and after reading them, I concluded that the economics professors who wrote them left much wanting. They promoted the welfare state, deficit spending, progressive taxation, easy money and socialist central planning.

My book bashed most of the textbooks, especially Paul Samuelson’s “Economics”, which was the most successful economics book in history. Since 1948, it has undergone 16 editions and sold over four million copies promoting Keynesian economics.

I sent a copy to Professor Samuelson at the Massachusetts Institute of Technology (MIT). Needless to say, Paul Samuelson was not amused. He wrote back to me, “I am putting your book on a high shelf so that Sadie our retriever will do it no harm.”

In return, as a publicity stunt, I had a picture taken of me tearing up Paul Samuelson’s “Economics” textbook.

The picture attracted a lot of attention, and my book sold over 35,000 copies and became a bestseller. Today, the 1993 edition is a collector’s item.

Buy A Collector’s Edition!

I recently came across a limited number of copies of the original 1993 edition in my garage — eight hardback copies and nine paperback copies, both of which include the notorious picture of me tearing up Samuelson’s book.

If you would like to buy a copy, let me know. I’m selling this collector’s edition for $39 for the paperback and $49 for the hardback — and I will sign and date each copy. When they are gone, they’re gone. To order, go to www.skousenbooks.com.

Paul Samuelson: Bearer of the Keynesian Cross

Paul Samuelson, the MIT wunderkind, was Keynes’s bulldog, just as Thomas Huxley was Charles Darwin’s bulldog in promoting organic evolution.

The British economist John Maynard Keynes turned the classical economics of Adam Smith on its head. Classical economics taught the virtue of saving, balanced budgets, limited government, sound money (the gold standard) and free trade.

During the Great Depression, Keynes turned virtue into vice. During a financial crisis and economic depression, Keynes urged consumers to spend and not to save, he encouraged government to deliberately run a deficit and he implored the state to abandon the gold standard in favor of easy money.

The first edition of Samuelson’s “Economics” book came out in 1948 and created a sensation. It was the first textbook to introduce the new Keynesian model to millions of students (propensity to consumer, paradox of thrift, the multiplier, etc.). He popularized all these countermeasures to stimulate the economy and get us out of a recession/depression.

My Study of Samuelson’s Editions from 1948 to 2009

Samuelson’s influence, for good or bad, was so significant that I have studied his career closely. We’ve corresponded and met a few times during the 1990s.

In 1997, the American Economic Association (AEA) published my article, “The Perseverance of Paul Samuelson’s Economics,” in the Spring 1997 issue of “The Journal of Economic Perspectives.” It analyzed the evolution of Samuelson’s theory and policy recommendations in the first 15 editions of his textbook spanning 50 years.

Brad DeLong, co-editor of the JEP, said, “this [paper] has the potential to be one of the best and most exciting papers we publish in the second half of the 1990s.” You can read it here: The Perseverance of Paul Samuelson’s Economics – American Economic Association (aeaweb.org)

In September 1997, I wrote a column in Forbes magazine about how Samuelson has shifted gradually from being a Keynesian to a classical economist in “Welcome Back, Professor.”

And, in January 1999, I hosted a special session at the AEA meetings in Chicago on “Fifty Years of Samuelson’s ‘Economics’.” In addition to my own, papers were presented by Greg Mankiw (Harvard), David Colander (Middlebury) and Roy Ruffin & Paul Gregory (Houston), with discussants Alan Blinder (Princeton) and Peter Boettke (George Mason).

The Influence of Samuelson

Presidents and congressmen have taken Samuelson’s advice to heart. During an economic contraction, governments around the world always increase spending and run a deficit.

Their monetary policy is pretty clear during a depression/crisis: Stimulate the economy by “injecting liquidity” (the Fed’s favorite term), cutting interest rates and expanding the money supply.

In sum, the solution to a recession/crisis is simple: Aggressively expand fiscal and monetary policy.

They learned it all too well from Samuelson.

There Was Only One Problem (Actually Three!)

The Keynesian solution worked in the short term. Stimulated by easy money and government checks sent out to businesses and consumers, the economy recovered and the stock market boomed.

But the Keynesian/Samuelson solution came at a high price: Once the economy recovered and full employment was restored, inflation and deficits became a permanent feature, and that meant slower economic growth. There’s no free lunch!

According to the Keynesian/Samuelson model, that wasn’t supposed to happen. Once the economy recovered to full employment, Keynes and his followers advocated a return to the classical model — increasing savings, eliminating wasteful spending, adopting a balanced budget or even running a surplus.

Instead of fighting recession, the Fed was supposed to fight inflation.

The Keynesian model advocated a “balance wheel” approach — deficits and easy money during the downturn, surpluses and tight money during the boom phase.

In fact, in the early 1990s, Samuelson shifted his position toward classical free-market economics. He said the United States was under-saving and should run budget surpluses. He rejected Soviet-style central planning.

But it was too little too late. As Milton Friedman complained in his classic work, “Capitalism and Freedom,” “Unfortunately, the balance wheel is unbalanced.”

Nobel-Prize-winning economist James Buchanan called it out with the book title “Democracy in Deficit: The Legacy of Keynesian Economics.”

Samuelson was still alive when the financial crisis hit in 2008. He quickly returned to his roots, advocating crude Keynesianism and urging the government to support The Troubled Asset Relief Program (TARP) and other emergency measures.

He did not blame bad government policy for the real estate boom-bust and subsequent financial crisis, the banking authorities encouraging subprime and no-documentation loans by minorities or the artificially low interest rates of the Federal Reserve.

Rather, he blamed his intellectual foes Milton Friedman and Friedrich Hayek: “At the bottom of this worst financial mess in a century is Milton Friedman-Friedrich Hayek libertarian laissez-faire capitalism, permitted to run wild without regulation. Both of these men are dead, but their poisoned legacies live on.” (Tribune Media Services, October 15, 2008).

The Bankruptcy of the Keynesian Model

What about today? Is the Keynesian/Samuelson “balance wheel” model still used? Here we are back to full employment, yet we are suffering from labor shortages, and the federal government is predicting a deficit of up to $3 trillion! Under the standard Keynesian model, we are supposed to be running surpluses during full employment.

Paul Samuelson isn’t around anymore to answer this question. He died in 2009. But, it appears to me that the Keynesian/Samuelson model is no longer in force. It is bankrupt.

Three Graphs Illustrate the Keynesian/Samuelson Legacy

Here are three simple graphs that explain the fallout from Keynesian economics as taught in Samuelson’s textbook:

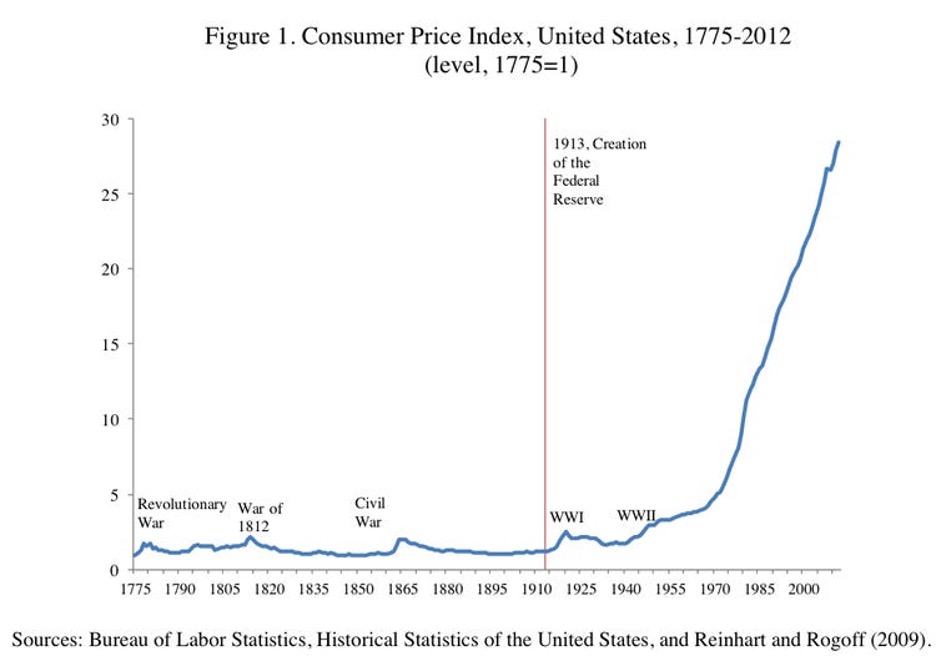

Graph #1: Permanent Inflation Since World War II

As you can see from the graph above, price inflation remained subdued until the end of World War II. It rose during wartime, but after the war, inflation went down.

No longer. What made the difference? The evidence is clear that it was the adoption of Keynesian economics in the post-war period — deficit spending and easy money.

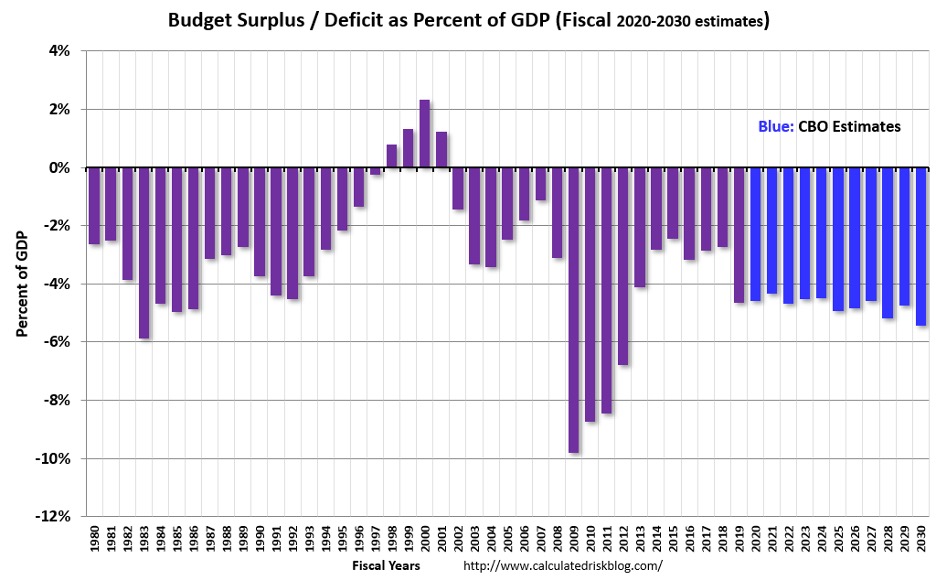

Graph #2: Deficit Spending in Perpetuity

The second graph shows how deficit spending occurs almost all the time now, even during periods of prosperity and full employment. Keynes and his bulldog Samuelson are to blame for providing a theory to legitimize living beyond one’s means.

Without a balanced budget requirement, the backdoor of the barn is left open.

The National Debt Clock is running faster than ever: U.S. National Debt Clock: Real Time (usdebtclock.org) It’s easy to get hooked watching this clock. The national debt has doubled in ten years and is now over $29 trillion.

Once interest rates rise sharply, watch out: A monetary crisis is coming.

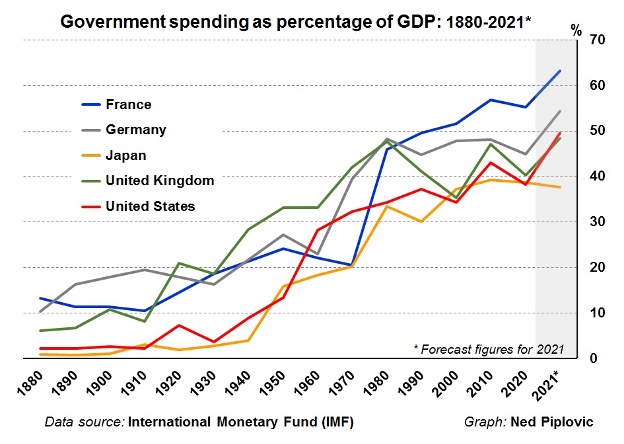

Graph #3: We Are Now Only Half Free

Government at all levels, and in most nations, has continued to grow. The Keynesian/Samuelson model favors the middle ground between the extremes of laissez-faire (small government) and totalitarian socialism (all government).

For them, big government and the welfare state are the ideals. But, as we can see from the graph above, there is no discipline in the Keynesian/Samuelson model to keep big government from getting much bigger.

So far, we have yet to see the law of diminishing returns apply to government spending. Moreover, the Biden administration is wanting to make government even bigger, with larger deficits.

A few countries have temporarily reduced government spending as a percentage of GDP — Sweden, Canada and Hong Kong come to mind. But sadly, they all witnessed a return of big government over the past couple of years.

How to Get Rid of a Bad Textbook? With a Better One!

But I haven’t given up on fighting big government and Keynesian economics, and neither should you. Around the time Samuelson’s textbook went out of print several years ago, I decided to write a “no compromise” textbook on free-market economics to counter the Keynesian model.

How do you counter a bad idea? With a better idea!

My “Economic Logic” textbook teaches students and adults about free-market capitalism in 28 easy lessons. It’s now in its 5th edition.

It even has a chapter on financial capitalism via the stock and bond markets (#13). It also has a whole chapter (#22) on Keynesian economics and its negative impact on society. If you want to know what’s in the rest of the book, go to Economic Logic – MSKOUSEN.COM

I’ve met numerous subscribers and students who have read my book. Here are their endorsements:

“Your book converted me to free-market capitalism. It changed my life.” — Kai Ahburg, Harvard graduate

“Eureka! Skousen has done the impossible. Students love it! I will never use another textbook again.” — Harry Veryser, University of Detroit-Mercy

“Better than any book out there! Skousen presents real business economics in a clear, provocative and logical fashion.” — Ian Mackechnie, University of Wales

“Perfect for any economics student — designed to maximize learning while minimizing monotony. Simple, direct and comprehensive.” — K. Au, Homeschool instructor

“My college econ classes, filled with perplexing theories like the paradox of thrift, GDP and Keynesian fiscal policy, were completely refuted by this excellent free-market textbook. Students, if your professors don’t use this text, get it for yourself so you can really understand the concepts of sound economics.” — Amazon review

“Skousen begins this book with a profit-loss income statement to demonstrate the dynamics of the real-world economy. No other textbook does this. He is the spiritual heir of Adam Smith, harking back to a time before mathematicians took over economics.” — Steve Forbes

Most economics textbooks cost over $100 each. My textbook, “Economic Logic,” retails for $49 but you pay only $35 if you order it from www.skousenbooks.com. I autograph each copy and mail it for free if you live in the United States.

Order it today. You can make a difference.

Guess Who’s Coming Back to Speak at FreedomFest? ‘Anyone, Anyone?’

That’s right, Ben Stein and Art Laffer! In the famous scene in “Ferris Bueller’s Day Off,” Ben Stein plays the boring teacher who refers to the Laffer Curve as “voodoo economics.” To watch that memorable one-minute scene, go here.

Of course, his appearance at FreedomFest will be anything but boring!

In 2002, Ben Stein was our keynote speaker at FEEFest, the precursor to FreedomFest. Now, 20 years later, he will make his second appearance… and he has agreed to debate Arthur B. Laffer, one of the founders of supply-side economics and inventor of the famous Laffer Curve. They will appear together on stage at FreedomFest 2022 to debate the question, “Should the Rich Pay More in Taxes? Is the Laffer Curve Voodoo Economics?”

After the debate, Ben Stein will host a luncheon on the topic: “Rich and Famous: My Life in Beverly Hills and Hollywood.”

Get $50 Off the Early Bird Special — It Ends on Jan. 1!

The dates are July 13-16, 2022, at the Mirage Hotel & Casino (our first time there).

Make plans now to attend the “greatest libertarian show in earth” by registering at www.freedomfest.com. Or call Hayley at 1-855-850-3733 ext. 202.

Our early bird special is $399 per person, but you can get $50 off that if you register between now and Jan. 1 using the code EAGLE50. You pay only $349, which is a super bargain. Register today!

Let me wish you all a very merry Christmas this weekend.

Good investing, AEIOU,

![]()

Mark Skousen

You Blew it!

The Chile Model of Prosperity is Dead

Last Sunday, this “student activist,” Gabriel Boric, was elected president of Chile, age 35, by a wide margin, 56-44%:

Attribution: Biblioteca del Congreso Nacional de Chile.

Despite all our good efforts to fight Marxism and Liberation Theology in Latin America, the Chicago Boys’ Chilean Model is dead. No good deed goes unpunished.

Boric plans to end the private pension system that Chile is famous for… and raise taxes on the rich and major corporations… and may nationalize some industries.

In 1973, in response to the economic chaos and instability under Marxist Salvador Allende, General Augusto Pinochet engaged in a military coup. Within years, the Chicago boys of Chile were put in charge of the economy. They cut taxes and regulations, adopted sound money and privatized social security and other industries. They were influenced by Milton Friedman at the University of Chicago.

The Chile Model was a big success. See the amazing graph at Is the United States Becoming a Banana Republic? – Mark Skousen.

But the Chileans were convinced that inequality of wealth and income was a serious problem in Chile, and unwisely voted for a radical Marxist whose party is in coalition with the Communist Party of Chile.

Looks like the Milton Friedman era in Chile is over…

Will Chile go the way of Argentina, or worse, Venezuela? I hope not, but it looks scary.

In liberty, AEIOU.