What’s the Best Inflation Hedge? Surprise, Surprise — It’s Not Gold or Bitcoin!

Last week, the federal government released a new report on inflation — it’s coming back with a vengeance. Currently, prices are rising at an alarming rate of over 8%. It’s not going away any time soon, with the government deficits and the printing of money kicking into high gear.

How best to protect yourself from inflation?

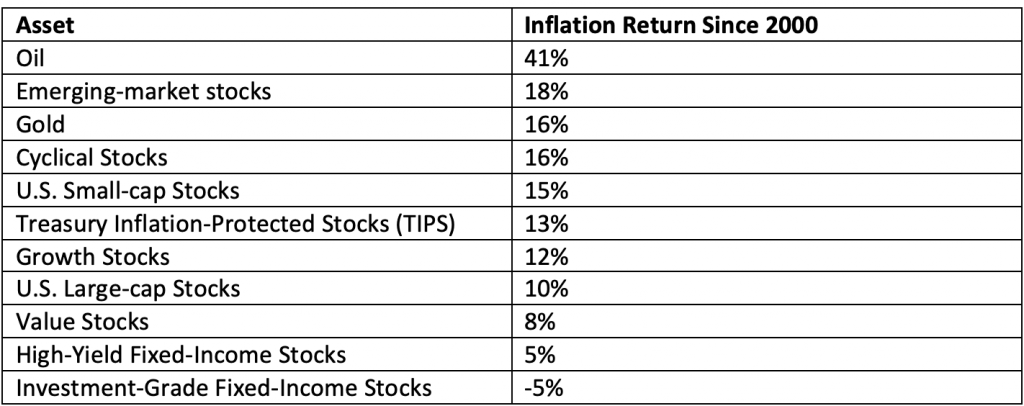

Wells Fargo has released a new report on the best and worst inflation hedges since 2000.

The surprise winner? Oil!

Here are the top winners and losers, based on representative exchange-traded funds (ETFs):

Click here to read the article.

Our recommended energy stocks have proven to be winners. They are beating the market this year by a wide margin.

Gold and mining stocks are usually considered the premier inflation hedge, but they have floundered this year, despite a sharp increase in price inflation.

What’s going on? Answer: a strong dollar, the Fed threatening to raise interest rates and competition from Bitcoin.

It reminds of the great quote from Wendell Brock in “The Maxims of Wall Street” (see www.skousenbooks.com): “Nothing can make the spirit fly higher than finding a bargain when you’re the buyer; and nothing can make the spirit sink deeper than finding it later a whole lot cheaper.” (p. 36)

By the way, Wendell Brock is coming to next month’s FreedomFest.

Our Favorite Tech Fund Invests in the Two Most Successful Tech Firms This Year

Technology stocks are a good inflation hedge, just as the newly formed Nasdaq stocks did well in the inflationary 1970s. While the Dow floundered, the Nasdaq composite index of smaller stocks rose every year from 1975 through 1980.

If you could have purchased the entire Nasdaq market at the end of 1974, your gains by the end of 1980 would have been 238%!

Our favorite technology fund is up 13% this year.

What About Real Estate and Bitcoin?

A surprising omission in the Well Fargo report is real estate. Rental properties and single-family homes can hedge, and even profit, from inflation in three ways:

1) Real estate prices can appreciate.

2) Income from rent grows with the Consumer Price Index (CPI).

3) “Depreciating debt” occurs, whereby the value of the real estate holder’s mortgage payments depreciates.

Bitcoin was not included in the study, since it only got started in 2012. While its performance has been spectacular, it’s too early to tell if it is truly a good inflation hedge or just a speculative bubble.

Want to know more? Join several thousand investors next month for our Global Financial Summit at FreedomFest, July 21-24, at the Rushmore Civic Center in Rapid City, South Dakota.

Our favorite financial gurus will be there to give you the latest advice and overview: Alex Green (Oxford Club), fellow editor Jim Woods (Fast Money Alert), Doug Casey, Van Simmons and independent financial managers Adrian Day, Jerry Bowyer, Rob Arnott and Ron Muhlenkamp (a new speaker — his fund is up 22% this year).

Steve Moore (left) and Grover Norquist (right) will speak at FreedomFest. Image courtesy of Gage Skidmore.

“Freedomfest is a BLAST! I’ve gone every year for the last 10 years. Wouldn’t miss it this year. Neither should you.” — Steve Moore, Heritage Foundation

“FreedomFest is C-PAC for adults. I attend every year.”– Grover Norquist, president, Americans for Tax Reform

Special Private Reception for Subscribers Is Almost Full!

Remember, subscribers to my newsletter and trading services get a 2021 American Eagle silver dollar and a signed copy of “The Maxims of Wall Street” at our special Eagle Financial Publications private meeting at FreedomFest. The room at the historic Alex Johnson Hotel (where Ronald Reagan and five other presidents have stayed) is limited to 250 subscribers and we are almost full.

So far, 2,138 people have signed up for the big show. Be one of them, and see we have a record turnout this year.

To join us, go to www.freedomfest.com, or call Hayley at 1-855-850-3733, ext. 202, to register or get more information. Use the EAGLE50 code to get $50 off. We’ve added a new room block, but it’s filling up.

FreedomFest is less than a month away. Act now. Fly there, drive there, bike there, RV there, be there.

Hope you all have a wonderful 4th of July celebration. Because July 4th is on a Sunday, the markets will be closed on Monday.

Good investing, AEIOU,

![]()

Mark Skousen

You Blew It!

Canada Closes Its Borders for No Good Reason

We received a call from a Canadian couple who said that they had to cancel coming to FreedomFest. They wanted to attend “the greatest libertarian show on earth,” but the Canadian authorities have decided to close the border to all “non-essential” travel.

Which raises an interesting question: Why were the Canadian and Mexican borders closed in 2020 and 2021, while the borders between states remained open?

Even now, while Americans can travel or move freely between states from coast to coast, they cannot travel to and from Canada and Mexico.

Did the pandemic suddenly stop at the borders?

The reason is simple to explain, but often involves a principle taken for granted by American citizens: The United States Constitution does not allow state governors to close their borders to adjacent states. Countries can do it, but not states.

None of the 50 states can keep you from visiting, moving or working in another state. They cannot keep you from transferring money, capital or goods to another state. They cannot require a passport for you to enter their state. They cannot impose any import or export duties between states.

The only exception is for the inspection of fruits and vegetables, something California does.

It’s All in The Constitution

Section 9 and 10 of Article I of the U.S. Constitution is clear:

“No Tax or Duty shall be laid on Articles exported from any State.

“No Preference shall be given by any Regulation of Commerce or Revenue to the Ports of one State over those of another: nor shall Vessels bound to, or from, one State, be obliged to enter, clear, or pay Duties in another.

“No State shall, without the Consent of the Congress, lay any Imposts or Duties on Imports or Exports, except what may be absolutely necessary for executing it’s inspection Laws.”

And Article 4, section 2, states:

“The Citizens of each State shall be entitled to all Privileges and Immunities of Citizens in the several States.”

Finally, the 14th Amendment states:

“No State shall make or enforce any law which shall abridge the privileges or immunities of citizens of the United States; nor shall any State deprive any person of life, liberty, or property, without due process of law; nor deny to any person within its jurisdiction the equal protection of the laws.”

That’s why we are called the United States of America. This uniting of the 50 states economically is a major reason why America leads the world.

Recently, European nations have attempted to imitate our success with the creation of the European Union, sometimes called the “United States of Europe,” along with a single currency, the euro — to create a large free-trade zone of money, labor and capital.

Does the Constitution Limit or Expand State Powers?

On the other hand, Article I, Section 8, grants extremely broad powers to Congress — to print money, expand credit, level taxes and import duties and declare war. You can drive a truck through section 8.

As George Washington allegedly said, “Government is a dangerous servant and a fearful master.”

At next month’s FreedomFest, we are going to have a debate on “The Constitution: Conceived in Liberty or Conspiratorial Coup?” Three scholars will debate libertarian Murray Rothbard’s controversial contention that the Constitutional Convention of 1787 was a power grab to dramatically increase the state’s control of the new nation.

Professor Patrick Newman, a fellow of the Mises Institute, will argue in favor of Rothbard’s thesis, that James Madison called the Convention to secretly expand the power of the state. He will be followed with commentary by legal authorities John Norton Moore (University of Virginia) and Anastasia Boden, senior attorney for the Pacific Legal Foundation.

I will be moderating this panel.

You won’t want to miss it, along with dozens of other debates, panels and speeches on all kinds of subjects. This is what makes FreedomFest so different from other conferences. To join us, go to www.freedomfest.com.