Trump’s Trade War Stalls Bull Market: Will it Get Worse?

“The art of economics consists in looking not merely at the immediate but at the longer effects of any act or policy; it consists of tracing the consequences of that policy not merely for one group but for all groups.” — Henry Hazlitt, “Economics in One Lesson”

Too bad President Trump has apparently not read Henry Hazlitt’s classic book, “Economics in One Lesson,” especially chapter 11 on “Who’s Protected from Tariffs?” Read it here: https://mises.org/wire/who%E2%80%99s-protected-tariffs.

The President has doubled down on his threat to impose tariffs (taxes) on steel, aluminum, solar panels and washing machines. Who knows what’s next?

His chief economic advisor Gary Cohn has left the White House because he lost the battle over tariffs. President Trump was successful in pushing through the business tax cuts, but Cohn didn’t want to be tainted by protectionist policies that could cause a bear market on Wall Street and an economic slowdown. Who can blame him?

There’s talk that Larry Kudlow, supply-side economist, CNBC commentator and a long-time friend, will take Cohn’s place, but that is doubtful given that Larry is a strong free trader.

That leaves Peter Navarro, the most dangerous man in the White House. He is currently head of the National Trade Council under President Trump. Navarro is the author of the notoriously anti-trade book, “Death by China.” He blames China for all our ills. The trade deficit is causing us to “lose jobs and factories. We’re giving away our homes, our businesses, our companies, our technologies.” Really?

Over the weekend, the Wall Street Journal reported that former staff secretary Rob Porter — the gatekeeper who determines who sees President Trump — kept Navarro out of the Oval Office. But after Porter was forced to resign, Navarro gained access and made a direct pitch for tariffs to the President. President Trump has made Navarro an assistant in charge of trade policy. We now see the scary results.

Update on Trade War

If Trump had tried to get Congress involved, his proposed tariffs would have never passed. But the imperial presidency is alive and well at the White House. Instead of going through Congress, President Trump is using an obscure 1962 law to impose the new taxes unilaterally based on “national security” concerns. What a joke! Most of our steel imports come from Canada, Brazil and other allies, not China or Russia.

The funny thing is that the steel and aluminum industries in the United States are already profitable. Companies such as U.S. Steel, Nucor and Alcoa are reporting rising revenues. The new tariffs will benefit some 170,000 workers but hurt the 6.5 million workers who are employed by companies that use steel and aluminum.

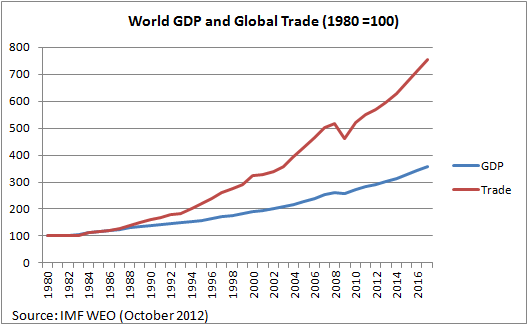

We’ve made great progress over the years to reduce trade barriers and, until now, U.S. and world trade have been growing faster than gross domestic product (GDP). (See chart below.)

Trade (imports plus exports) is around 30% of GDP here in the United States. Overall, it has increased our standard of living. But with the impending trade war, all bets are off. The European Union already has announced plans to retaliate, raising tariffs on Harley Davidson motorcycles and other products. The biggest impact could be on farm products that we export to China.

The Trump rally on Wall Street is stalled. It pays to play it conservatively and maintain a strong position in dividend-paying stocks, and to impose protective stops on more aggressive positions. That’s exactly what we are doing in my newsletter, Forecasts & Strategies. To learn more about my newsletter, click here now.

New Speaker at ‘Fast Money Summit’

Last week, I met with Simon Reeves, a former floor trader of the American Stock Exchange and now the CEO of TideRock Financial, a California-based consulting firm to high net worth individuals. He will be speaking at our “Fast Money Summit” at FreedomFest on the important subject of the psychology of investing. His provocative title is “Investing in Insecurities: A Freudian Slip on Wall Street.” He will reveal his extensive research on the effects of childhood traumas on financial decisions and people’s relationship with money. By age seven, did you crave security or variety? Seek love or significance? How much does your first few years of life effect your happiness in retirement? Find out at FreedomFest.

For a summary of all the speakers, debates and panels at the “Fast Money Summit” and FreedomFest, click here.

The early bird discount ends on March 31 — save $200 off the registration fee. To register, click here. You also can call toll-free 1-855-850-3733, ext. 202. Be sure to use the code EAGLE to receive your complimentary copy of my book, “A Viennese Waltz Down Wall Street” and a ticket for a private reception with Steve Forbes!

In case you missed it, I encourage you to read my e-letter article from last week about how you can increase your income for a better retirement.

You Blew It!

The Demise of Oscars and the Academy Awards

Like millions of Americans, I used to love watching the Academy Awards and see one of my favorite films win Best Picture, such as Ben-Hur in 1958, Sound of Music in 1964, the Heat of the Night in 1966, Patton in 1970, the French Connection in 1971 and Rocky in 1975.

But over the past 30 years, fewer and fewer Oscar winners have appealed to me. And in the past few years, I’ve stopped watching entirely. The last time I really enjoyed watching was when Billy Crystal hosted in 1993 and had Jack Palance pull an oversized Oscar and do some one-handed push-ups.

It pretty much has been downhill thereafter. Almost every film I’ve seen is TV-edited, and most did not win best picture.

Gradually in the new millennium, the Academy has proven its growing arrogance by rejecting anything the public likes and favoring the obscure over the popular. The last film to win Best Picture while topping box office charts in the same year was “The Lord of the Rings: Return of the King” in 2003. No wonder viewership of the Academy Awards has fallen to an all-time low. The Academy is becoming irrelevant and far too political. That’s a sad commentary on the state of Hollywood these days.

My wife, Jo Ann, director of the Anthem film festival at FreedomFest, summed it all up with this article, “Why I Won’t be Watching the Oscars.”