The Incredible Shrinking Stock Market

“The number of publicly traded U.S. stocks available to investors is plumbing new lows, even as their prices brave new highs.” — Barron’s (February 24, 2014)

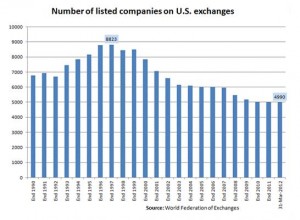

The Wilshire 5000 Stock Index is supposed to be the ultimate measure of the U.S. stock market, but in reality there are now only 3,666 stocks in the index. Back in 1998, it contained 7,562 stocks. The employment participation rate isn’t the only number in decline.

There are a lot of reasons for this decline. The number was artificially high during the dot-com boom of the late 1990s. Since then, the dot-com boom collapsed and mergers/bankruptcies/delistings have exacted a toll. Foreign exchanges have drawn away a few U.S. listings. Companies are buying back their shares in record numbers.

But the main culprit has to be excessive and unnecessary government regulation, like Sarbanes-Oxley and Dodd-Frank.

The enactment of the Sarbanes-Oxley Act in 2002 and Dodd-Frank in 2009 imposed expensive burdens on public companies and made it almost prohibitively expensive to go public. The initial public offering (IPO) market has gone from robust to anemic, despite a recent increase. Many IPOs are done across the border in Canada or overseas. Many publicly traded companies have decided to call it quits and go private, avoiding the excesses of “Sarbox.” Most recent examples include Dell, H. J. Heinz, Mervyn’s, Levi Strauss and Jo-Ann Fabric and Craft Stores.

The Fed is also responsible. By keeping interest rates near zero, zealous private equity players are making it easy for companies to raise money without going through public compliance.

You Blew It! The Terrible Snow Storm that Never Was

There are two old sayings that apply to this last weekend:

“Climate is what you expect, weather is what you get.” and “You can predict the climate, but not the weather.”

Last weekend, the national weather service and the media predicted a huge storm that had a “100%” chance of dumping rain and then up to a foot of snow in the New York City area.

I was scheduled to speak before the New Jersey chapter of the American Association of Individual Investors (AAII) on Monday, the day the “guaranteed” snow storm was to arrive. So the host canceled the meeting.

Guess what? Not only was there no snow, but no rain either. It was just another cloudy and cold day in New York. It turned out that the storm hit the Washington D.C.-Philadelphia area but never made it to New York.

Two lessons come from this story: Meteorology is still a very imprecise science. And you shouldn’t change plans for sure until you know for sure what is going to happen.

Economists predicting the future of the economy should also be aware that they are even more imprecise and uncertain of the future than weathermen.

In case you missed it, I encourage you to read my column from last week’s Eagle Daily Investor about how to determine history’s greatest economist.

In liberty, AEIOU,

![]()

Mark Skousen

Wikipedia

Newsletter and trading services

Personal website

FreedomFest

Upcoming Appearance

O FreedomFest, July 9-12, Planet Hollywood: The Washington Post calls it “the greatest libertarian show on earth,” and we’re planning the biggest show ever. Co-ambassador Steve Forbes will be there all three days. Join more than 200 speakers and exhibitors. We also plan a full three-day investment conference with Alex Green, Bert Dohmen and many others, as well as the popular Anthem film festival and a mock trial on American foreign policy. The “early bird” special to sign up ends March 15, so register today at www.freedomfest.com, or call Tami or Donna at 1-866/266-5101.