The Economy is Doing Better Than We Thought

“GDP is like an X-ray of the economy; Gross Output (GO) is like a CAT-scan!” — Steve Forbes

The Wall Street Journal ran my op-ed over the past weekend with the headline: “New Stat Augurs Well for Covid Recovery: Gross output measures business confidence better than GDP. It’s fallen less than in past recessions.”

This is the third time the Wall Street Journal has published my articles on GO. It is a strong supporter because it knows that GO is a good forecaster of where the economy is headed.

The headline refers to last Wednesday’s press release by the federal government’s Bureau of Economic Analysis (BEA). It was a milestone for two reasons:

It was the first time in history that the “top line” gross output (GO), the best measure of total spending in the economy, was released at the same time as the “bottom line” of gross domestic output (GDP). Economists have finally caught up with the accountants and finance people on Wall Street!

During the second quarter, GO fell by about the same amount as GDP (around 9%). This is a big surprise, because business-to-business (B2B) spending usually falls three-to-four times faster than consumer spending during a recession. This time, it didn’t.

As I concluded in my Wall Street Journal article: “That’s good news, suggesting the recovery from this recession will be faster than most analysts thought. The sooner states open up their economies, the faster we will see a return to a dynamic American economy.”

If you want to read my op-ed, go to www.grossoutput.com.

Many people wonder why the stock market has done so well since the March lows. One of the reasons is that businesses have responded quickly to the crisis, and business confidence is positive that the economy can do well once the economy is opened up. Of course, another reason is that Wall Street wants to see another stimulus package in the short term.

Steve Forbes on the GO

After my Wall Street Journal op-ed appeared, Steve Forbes released a three-minute “What’s Ahead” podcast on “Gross Output vs GDP: Which Measure is Better?” — it’s the best summary of GO I’ve ever seen. Click here to watch.

Top Gun Investing!

Personal Note: After writing my WSJ column, I received the following unsolicited endorsement from Greg Fierman, a registered investment advisor and founder of Top Gun Financial. He wrote to his clients:

“GO is a revolutionary concept created by my acquaintance the Austrian economist Mark Skousen to measure the economy better than GDP. Indeed, Mark termed yesterday (Saturday 10/3) GO Day because an editorial of his applying GO to the current downturn appeared in the Wall Street Journal. And Steve Forbes used his podcast to talk about “Gross Output Versus GDP: Which Measure Is Better?”

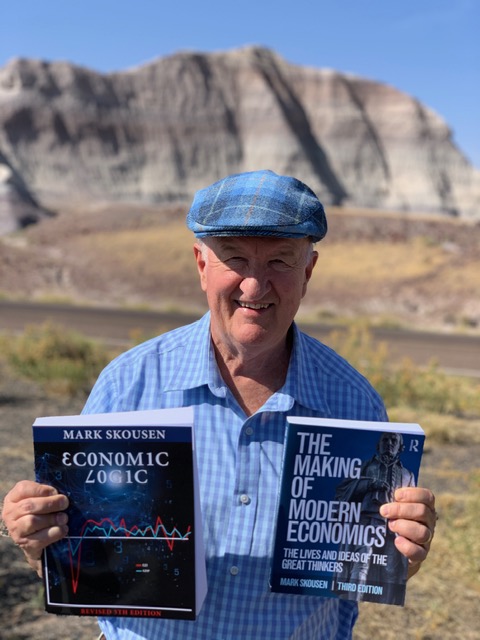

Skousen is a brilliant and prolific economist as well as writer of a popular financial newsletter, Forecasts & Strategies, for decades now. Because of his interest in financial markets, Skousen is an economist obsessed with the real-world applicability of his economic ideas. He has written almost 20 books, including Economic Logic, his brilliant introductory textbook to economics, and The Making of Modern Economics, the best history of modern economics around.

When I was first starting out, I subscribed to Forecasts & Strategies for many years. I am mostly unimpressed with today’s intellectuals and professional investors, but Mark is an exception: his brilliance, breadth and prolific work make him, in my opinion, one of the greatest living economists in the world today.”

Thank you, Greg.

Your editor with his two economics books in the Painted Desert in Arizona.

By the way, if you would like to purchase copies of “Economic Logic” or “The Making of Modern Economics,” go to www.skousenbooks.com. Only $35 each. I autograph each one and mail them to you at my own expense. They also make great gifts to students to protect them from the socialist indoctrination going on in our colleges and universities.

Our Post-Election Summit Is Only a Month Away!

Today, I am cordially inviting you to our private, in-person, “off the record” financial summit sponsored by the Investment Club of America. This confidential meeting will take place on Nov. 6-7 (right after the elections) in an undisclosed location in Las Vegas.

Why is this gathering so secretive? Because our First Amendment rights are being abridged by power-hungry politicians, and we need to maintain a low profile in an era of big government.

We live in dangerous times, in which our freedoms and wealth are threatened as never before. The November 2020 election has become the most important election of the 21st century due to the stark differences between the two parties. Trump and the Republicans are struggling to maintain power in the face of a never-ending pandemic. Their policies of tax cuts, deregulation and appointing conservative justices could be overturned soon.

As it stands today, the election betting odds still favor the Democrats. If the Biden/Harris ticket wins and the Democrats take over the House and the Senate, what will this mean for investors, entrepreneurs and the citizens of America? Will the stock market crash and gold soar?

Biden & Co. have promised massive tax increases on wealthy entrepreneurs, elimination of the long-term capital gains ‘break’ on stocks, bonds, gold, silver and real estate (with tax rates exceeding 50%).

They have also promised socialistic programs like Medicare for All, free college tuition, a New Green Deal, a wealth tax, severe limitations on free speech, a new Supreme Court, all on top of out-of-control government spending. The Great Suppression has begun!

That’s why we are holding this Post-Election Summit. It is critical to your pocketbook and your way of life.

And to help make sense of it all, we have brought together some of the world’s top experts to discuss the outcome of the November elections. What will it mean in terms of our citizens’ rights to speak out, to run our businesses, to invest, to travel, to assemble and to be left alone?

Will our freedoms and standard of living be curtailed due to new government policies? Will our wealth come under attack with new taxes, inflation and regulation? Will tech and gold continue to be the favorite stocks after the November elections?

We have brought out the best and the brightest analysts in finance, economics and politics to provide their analysis and answer your questions.

The Post-Election Global Financial Summit is an “in person,” face-to-face event — not a “virtual” conference. Due to legal restrictions, attendance at this in-person event will be limited. We urge you to register now and not be disappointed.

The price for this two-day event is $299. There are no discounts and we expect to sell out quickly. To learn more about the conference, go to https://globalfinancialsummit.co/.

After you register, you will be given the name and location of the Las Vegas hotel, and you then can reserve your room and make your travel arrangements. The hotel is only $99 per night, plus tax. There is no resort fee. Parking is free. We arranged a great deal for you!

Special Note: Please do not discuss this conference on social media. This is a private conference by special invitation only. Thank you.

Our Confirmed Speakers for This Event:

Mark Skousen, veteran editor of Forecasts & Strategies and the producer of FreedomFest, will analyze the impact of the November elections on the economy, the dollar, taxes and your wealth. He will give specific recommendations — what to buy, what to sell and what to expect in the next year for stocks, bonds, the dollar, real estate and commodities.

Jo Ann Skousen, associate editor of Forecasts & Strategies and director of the Anthem Film Festival, will discuss her greatest concerns for the future — the protection of the twin pillars of freedom.

John Fund, senior editor of National Review and the nation’s foremost authority on politics and elections, will assess the good, the bad and the ugly coming out of the November elections.

Sean Flynn, an economics professor at Scripps College (Clermont) and principal author of the top economics textbook in the country, will assess the “New Normal” after the elections — how to survive and prosper in an age of higher taxes, growing deficits and more regulations. As the author of “The Cure That Works,” he will update us on the future of health care and the pandemic.

Jim Woods, known as the Renaissance Man, the #1 financial blogger in the world according to Tip Ranks, and co-editor of Fast Money Alert with me, will discuss his favorite investment strategies for 2021.

Hilary Kramer, editor of the popular 2-Day Trader, a talk show host and a graduate of the MBA program at the Wharton School of the University of Pennsylvania, will discuss how the November elections will be a “GameChanger” (the title of her most popular book that was #1 on Amazon this year and was also on the Wall Street Journal bestseller list).

Bryan Perry, editor of the prestigious Cash Machine advisory service, will offer his best post-election investment choices in high-tech and high-income.

Adrian Day, founder of Adrian Day Asset Management and the world’s top authority on global investing and mining stocks, will offer specific advice on the outlook for global investing, the dollar, and commodities, with specific recommendations from blue-chip miners to penny stocks that are likely to double or triple in the coming year.

We just confirmed Barbara Kolm, vice president of the central bank of Austria, who will give us an update on Europe.

More speakers will be added soon and Roger Michalski, publisher of Eagle Financial Publications, will moderate.

Time is short, and now is the time to act if you wish to be part of this historic gathering. Attendance is strictly limited, so sign up today at https://globalfinancialsummit.co/.

You Nailed it

Defying the State Swimming in the Blue Hole of New Mexico

My wife and I are driving across the country to our home in Florida. America is a beautiful country and we have enjoyed stopping at various tourist spots along the way. In recent weeks, we’ve visited Mammoth Lakes and Lake Tahoe in California… Crater Lake in Oregon… Monument Valley in Utah… and the Grand Canyon in Arizona.

This week, on our drive to Florida, we came across one of the most unusual tourist spots in New Mexico called the Blue Hole. The Blue Hole of Santa Rosa is a circular, bell-shaped pool east of Santa Rosa, New Mexico, that is one of the most popular dive destinations in the U.S. for scuba diving and training. The Blue Hole is an artisan well that was once used as a fish hatchery. It’s 81 feet deep.

When we arrived, we were deeply disappointed to discover that the Blue Hole was closed by the imperial state of New Mexico on the lame excuse of the virus scare. How dare people enjoy swimming in the Blue Hole!

The beauty of the Blue Hole was so enticing that we couldn’t resist. We put on our bathing suits and jumped in. Even though the crystal-clear water was around 61 degrees, it was refreshing and invigorating. So much so that other visitors joined in the fun swimming in the Blue Hole. It felt great to engage in a little civil disobedience with another silly prohibition in 2020.

To paraphrase, Wordsworth: Bliss was it in the dawn to be alive, and to be FREE is very heaven.