The Day Milton Friedman Gave Investors Bad Advice!

“The economy and the stock market are two different things.”

–Milton Friedman (“Maxims of Wall Street,” p. 157)

After Milton Friedman won the Nobel Prize in Economics in 1976, he suddenly enjoyed fame and fortune. He was constantly in demand and appeared on several popular TV shows, such as Phil Donahue.

He once appeared on Dinah Shore’s talk show alongside journalist Shana Alexander and comedian Phyllis Diller.

These were the Jimmy Carter years, and Dinah Shore asked him how an average investor could protect his money in a time of rising inflation. Friedman’s advice was succinct: “Spend it.”

That TV appearance brought him more mail than he’d ever received.

The TV series “Free to Choose” made Friedman an even bigger hit in 1980. He told the producer, Bob Chitester, “People are calling me from all over the world asking me to invest their money.” The Friedmans had to change their phone number and relist it under Rose’s maiden name.

I can see why Milton Friedman was uncomfortable. Being an expert on the economy is not the same as being a financial advisor. He earned a Ph.D. in economics, not finance — cousins in the academic realm, but distant cousins in real life.

Telling investors to spend their savings was poor advice, even during times of inflation. Friedman himself didn’t follow his own counsel. He invested his Nobel Prize funds in real estate. He and his wife bought a beautiful apartment overlooking San Francisco Bay. (See photo)

Your editor meeting with Rose and Milton Friedman in their San Francisco apartment.

During the inflationary seventies, there were plenty of non-traditional inflation hedges to invest in, such as gold and silver, art and collectibles and real estate.

Granted, the traditional markets in stocks and bonds did poorly during the 1970s, including blue-chip Dow stocks, the so-called Nifty Fifty, Treasury and government bonds and fixed income. All failed investors during the 1970s.

But small-cap growth stocks did very well after the 1973-74 bear market. The Nasdaq rose 60% from 1974 to 1980.

Don’t get me wrong. I’m a big fan of Milton Friedman as an economist, and wrote a glowing chapter called “Milton’s Paradise,” in my history of the great economic thinkers, “The Making of Modern Economics.” He endorsed my book with this clever line: “All histories of economics are BS — before Skousen. His book is lively, accurate, and a sure bestseller.” (To order, go to www.skousenbooks.com).

We were good friends, and I was probably the last person to have lunch with Milton at his favorite Italian restaurant before he died in late 2006.

But every man must know his limitations, and Friedman was not comfortable giving personal investment advice.

Like Friedman, I have a Ph. D. in economics, but I specialize in applying economics to the real world of high finance and general investment advice. Wall Street investing and Main Street economics are not the same.

Friedman’s Favorite Poem

Milton Friedman’s favorite poem was written a hundred years ago, in 1920, by Rudyard Kipling. It is entitled, “Gods of the Copybook Headings.”

The poem refers to the proverbs or maxims often drawn from sermons, almanacs and scriptures extolling virtue and wisdom that were printed at the top of the pages of notebooks used by British school children.

The students had to copy the maxims repeatedly, by hand, down the page. The exercise served as a form of moral education and penmanship.

Kipling’s first stanza reads:

As I pass through my incarnations in every age and race,

I make my proper prostrations to the Gods of the Market Place.

Peering through reverent fingers I watch them flourish and fall,

And the Gods of the Copybook Headings, I notice, outlast them all.

Kipling (and Friedman) bemoaned the fact that we no longer teach aphorisms to students or adults.

But Kipling and Friedman would be happy to know that the age-old wisdom and timeless truths of the “copybook headings” are alive and well on Wall Street.

Stockbrokers, money managers and old-timers are famous for quoting financial adages, ancient proverbs and immortal poems such as “Sell in May and go away and don’t come back ’til Labor Day,” or “Nobody is more bearish than a sold-out bull.”

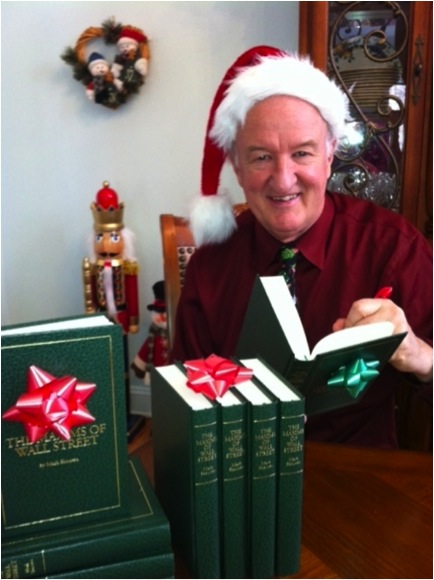

In the early 1980s, I started collecting these timeless sayings, and in 2011, I published the first edition in a handsome volume in dark green leather and gold lettering with a ribbon.

“The Maxims of Wall Street” has become a bestseller, having sold over 35,000 copies through seven editions.

Now the 10th-anniversary edition is hot off the press, ready for the holidays.

“Maxims” is the Closest Thing to Wall Street Scripture

The “Maxims” contains:

Over 800 adages by such notables as Warren Buffett (“The stock market can go from green to red without stopping at yellow”)… J. P. Morgan (“Troubled waters make for good fishing”)… Humphrey Neill (“The public is right during the trends but wrong at both ends”)… Richard Russell (“In a bear market, the winner is he who loses the least”)… and Steve Forbes (“Everyone is a disciplined, long-term investor… until the market goes down!”).

Old Timer’s stories like the “trading sardines”… where are the customer’s yachts?… the gold bugs… commodity traders… The origin of “blue sky”…

Famous lines from Baron Rothschild, Ben Franklin, John D. Rockefeller, Joe Kennedy, J. P. Morgan, Bernard Baruch, John Templeton, Jesse Livermore, John Maynard Keynes and Ben Graham…

All quotations are divided into categories, with sage advice on beating the market, diversification vs. concentration, value vs. growth, bulls vs. bears… black swan events… day traders… doomsayers and Cassandras… plungers and the peacocks… hot tips and insider information… losing money and missed opportunities… Wall Street vs. Main Street… chartists vs. fundamentalists… leverage and debt… privacy and government… taxes and tax havens… inspiring “Rich Man’s Pearls of Wisdom.”

Providing A Shortcut to Financial Wisdom

The book has been endorsed by Warren Buffett, Jack Bogle, Dennis Gartman, Barron’s and many others.

Alex Green, chief investment strategist of the Oxford Club, wrote the following last month:

“Wouldn’t it be great if someone collected the wisest thoughts of the world’s greatest investors, men like Jesse Livermore, Baron Rothschild, J.P. Morgan, Benjamin Graham, Warren Buffett, Peter Lynch John Templeton and others?

“As a matter of fact, someone has, my good friend and colleague Dr. Mark Skousen. His book ‘The Maxims of Wall Street’ is a crash course in how to survive and profit in today’s volatile markets.

“A college economics professor, founder of FreedomFest and bestselling author, Mark has spent more than four decades reading, writing, teaching and lecturing about financial markets. Along the way, he has collected a treasure trove of proverbs, slogans, stories and juicy quotes.

“I found myself chuckling (and occasionally sighing) when I first read this book. And I still refer to it regularly. Over my 35-year career, I learned much of this investment wisdom by trial and error. Fortunately, you don’t have to. ‘The Maxims of Wall Street’ is a pithy and indispensable guide.”

New 10th-Anniversary Edition Released in Time for the Holidays

Last week my grandson, Luke, and I drove to Chicago to pick up the new 10th-anniversary edition of “The Maxims of Wall Street,” hot off the press. Then we drove to a suburb of Cleveland and delivered 175 copies to Carver Financial Services, whose president, Randy Carver, is a big fan. He’s a broker with Raymond James. Randy plans to give them to his clients as a holiday gift.

Kelley Drumm, marketing director at Carver Financial Services, and I admire the new 10th-anniversary edition of “Maxims”

I can’t deliver every copy in person, but I will be mailing out copies this week and next, in time for Christmas and the holidays.

In fact, there’s still time to order your own copies — for yourself and your investor friends, neighbors, clients and favorite brokers. Order as many copies as you would like — I offer a special discount when you order more than one copy — half off!

The new edition is special — it’s 282 pages. I’ve added 200 quotes since the first edition came out in 2011.

Cheaper by the Dozen!

I’ve kept the same low price. The new edition retails for $24.95, but if you buy from Skousen Books, the first copy is just $20, and all additional copies are only $10 each. If you order an entire box of 32 copies, the price is only $300, less than $10 each.

As Hetty Green, America’s first female millionaire, said, “When I see something cheap, I buy a lot of it.”

To order, go to www.skousenbooks.com.

I number and autograph every copy and pay the postage if mailed in the United States (shipping to Canada or other foreign destinations requires additional postage). If you have any special inscriptions, please email Ned at skousenpub@gmail.com.

We ship every day. Order your autographed copy today! Go to www.skousenbooks.com.

And let me know if you want a special inscription as a gift to others. I’ll be glad to oblige.

Here’s to a very merry Christmas and a happy prosperous New Year.

Good investing, AEIOU

![]()

You Nailed it!

A Tribute to Walter Williams, My Kind of Teacher

Walter Williams was my kind of economist — witty, intelligent, a great teacher and spot-on when it came to most issues. He never retired. In fact, he died of a heart attack at age 84 right after teaching his class at George Mason University.

He was a professor at George Mason University for 40 years, and the author of a dozen books, including “The State Against Blacks” (1982) and “South Africa’s War Against Capitalism” (1989), his case against apartheid.

His remarkable story is told in his autobiography, “Up from the Projects.” He grew up poor in the housing projects of Philadelphia, fought racism when he joined the U.S. Army, was once a one-time cab driver and eventually earned a doctorate in economics from the University of California, Los Angeles.

Here’s a short tribute from Reason magazine: https://www.youtube.com/watch?v=GwpNqQn8Lyo.

We tried to get Walter to speak at FreedomFest in Vegas, but after 9/11, he simply refused to fly anywhere. He said getting patted down by the TSA reminded him too much of the Jim Crow days when the police would pat down blacks.

We are planning to dedicate a room in honor of Walter at next year’s FreedomFest.

Here are some great quotes:

“Prior to capitalism, the way people amassed great wealth was by looting, plundering and enslaving their fellow man. Capitalism made it possible to become wealthy by serving your fellow man.”

Here’s Williams’ roadmap out of poverty: “Complete high school; get a job, any kind of a job; get married before having children; and be a law-abiding citizen. Among both black and white Americans so described, the poverty rate is in the single digits.”

“The intact black family survived the evils of slavery, segregation, and Jim Crow laws, but it couldn’t survive the welfare state.”

My only beef with Walter was his talk on college campuses, “I Love Greed,” where he used the term “greed,” instead of “self-interest” to promote free-market economics and trade. That set back the freedom movement, which turned off young people especially. Sorry, Walter, but greed is not a virtue. Greedy capitalists take advantage of people in commerce, resulting often in a “win-lose” situation. Greedy investors often lose money because they get greedy at the top of the market. Greed landed Bernie Madoff in jail.

Walter needed to read John Mackey’s book “Conscious Capitalism”!