Supply-Side Victory in the White House: Is a Capital Gains Tax Cut Next?

“Free-market capitalism is the best path to prosperity.”

— Larry Kudlow

The battle over the future of the economy and Wall Street can claim a new victory with the appointment of supply-sider, free-trader and longtime friend Larry Kudlow as President Trump’s chief economic advisor. He will head up the National Economic Council, replacing Gary Cohn.

Mark Skousen and Larry Kudlow meet last year at the 100th anniversary of Forbes magazine in New York City.

After a series of market-friendly victories on Capitol Hill, including the gigantic business tax cuts and deregulation of the energy sector, Wall Street’s sizzling bull market has stalled due to President Trump’s anti-trade rhetoric and tax increases on imported steel, aluminum and other products. Europe and China already have threatened to retaliate.

But Trump’s wise choice for economic czar may postpone the budding trade war. Two of Trump’s advisors, Peter Navarro and Wilbur Ross, are protectionist to the core, but Kudlow is a devoted free-trader, and he’s now in charge of economic policy at the White House. Trump says he loves hearing a diversity of opinion, and he’s likely to get it.

Having been on CNBC’s Kudlow & Co. as a regular weekly commentator for nearly two years, I can tell you that Kudlow does not suffer fools gladly. He will not back down if he thinks the president is making a mistake.

The Three Captains of Supply-Side Prosperity

Larry is a hard-nosed advocate for supply-side economics, along with his friends Steve Moore and Art Laffer, who head up the Committee to Unleash Prosperity. Larry is a former advisor to President Ronald Reagan in the 1980s and has been a strong advocate for tax cuts for individuals, businesses and investors, even if it means higher deficits.

Kudlow and his two supply-side friends helped design the Tax Cuts and Jobs Act of 2017. In fact, Kudlow and Moore met with two wayward Republican senators and convinced them to vote for the bill — which barely become law.

All three advisors have spoken at FreedomFest, and Steve Moore will be joining us July 11-14 in Las Vegas to give us the latest scoop on what is happening in the White House.

At the very least, I know that Kudlow is a big supporter of cutting the capital gains tax rate back down to 15%, which was the rate we enjoyed for a few years during the Bush administration. As you may know, the Trump tax cut did not reduce the rate on long-term capital gains. That rate still is stuck at a high 23.9%, thanks to the Democrats and Obama. That’s way too high.

How Would You Like to Pay ZERO Taxes on Your Capital Gains?

Corporate America is enjoying a big tax break starting this year, but tax rates are still too high. The corporate tax rate is now 21%, but individual income taxes can still exceed 35% and capital gains rates are almost 24%.

If you are fed up with these high rates, you might qualify to join America’s new tax haven in Puerto Rico, where businesses pay only 4% corporate tax rate and no capital gains taxes on investments! I call it “The Rich Port [Puerto Rico] Strategy for Tax-Free Profits.” I recently talked with Peter Schiff, chairman of Euro Pacific Capital, and Yaron Brook, chairman of financial advisory firm BH Equity Research and the Ayn Rand Institute, both of whom have moved to Puerto Rico to take advantage of the new tax breaks. They pay no federal taxes, only 4% on their business income and no taxes on capital gains! This is by far the best tax haven for online businesses, professional services, traders and retirees. And you don’t have to give up your U.S. citizenship. All that is required is that you are a resident of Puerto Rico, which means you have to live there at least 183 days a year.

Both Peter Schiff and Yaron Brook will be doing a special session on “The Puerto Rico Strategy for Tax-Free Profits” at our Fast Money Summit at FreedomFest, July 11-14, at the Paris Resort, Las Vegas, and talk about their hands-on experience living and working in Puerto Rico.

I’ve just created this announcement of all the speakers, debates and panels at the “Fast Money Summit,” click here.

You Blew It! Trump Starts a Trade War

“The system of America is universal commerce with every nation; war with none.” — Benjamin Franklin (1778)

Was Donald Trump asleep or skipping class when the professor talked about free trade and how economies grow at the Wharton School at the University of Pennsylvania?

First, let’s discuss the benefits of trade. Benjamin Franklin was right when he said over 200 years ago, “No country was ever ruined by trade.” Let me give you the entire context of his quote (March 1774):

“It would be better if government meddled no further with trade and let it take its course. Most of the statutes, acts, edicts and placards of parliaments, princes and states, for regulating, directing and restraining of trade have either political blunders or jobs obtained by artful men for private advantage under the pretense of public good. In general the more free and unrestrained commerce is, the more it flourishes. No nation was ever ruined by trade.” (Quoted on pp. 300-301 from “The Compleated Autobiography by Benjamin Franklin,” compiled and edited by Mark & Jo Ann Skousen)

I’ve written several reasons why a trade war is bad for the United States and the rest of the world in Skousen CAFÉ. Here’s a good summary of the arguments against tariffs by economist Ramesh Ponnuru, published by the American Enterprise Institute.

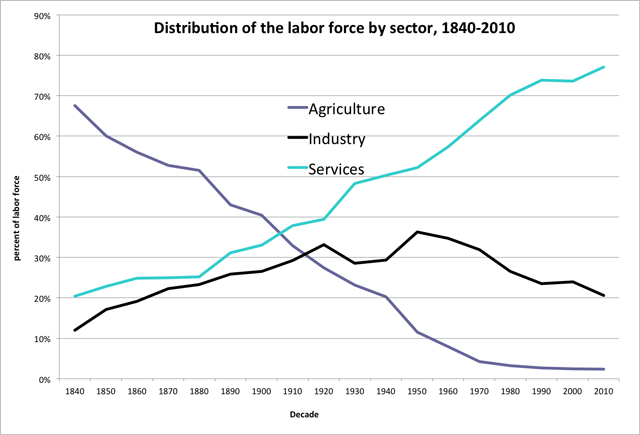

Second, manufacturing is not the “backbone” of America, as Trump claims. The service industry, including finance and information technology, has long replaced industry as the backbone of the American economy. See the graph below.

Source: MinnPost.com

There is a natural trend in every nation’s economic progress. Take the United States for example. As you can see, in the 19th century, we were largely an agricultural nation. Then, in the 20th century, workers left the farms to work in industry and manufacturing. As we enter the 21st century, services, finance and information technology have taken over.

To go back to the backbreaking work of steel and other manufacturing industries, as Trump implies, would be a step in the wrong direction.