Hello, I’m Roger Michalski.

And what I’m about to share is one of the most important financial opportunities I’ve seen in my 20 years as the publisher of Eagle Financial Publications.

First, you should know that over the last two decades, I’ve been blessed to work with some of the best financial pros in the game…

Including the expert who first called Tesla in 2010 when it was trading for about $10 a share…

A retirement expert who has overseen over $42 billion in assets…

And the technology prophet who inspired Moore’s Law.

But perhaps chief among them is the man known as “America’s Economist…

The legendary economic forecaster who has called the tops and bottoms of major investing booms AND busts for almost 50 years.

He called gold’s 50% slide and silver’s 90% collapse in the year 1980.

In 1987, he warned investors to “Get out of stocks now” six weeks before the market’s worst day on record.

In 1995, when others thought the dotcom bubble had peaked, he predicted the Nasdaq would “double and double again” by the year 2000. It did.

In March 2009, he said “Stocks are a screaming buy” the month that the market bottomed. He was right.

And in January 2020, he warned a “Black Swan” event would tank the stock market, two months before Covid sent stocks crashing by 30%.

He’s served as an economic analyst for the CIA…

Met with and advised THREE sitting U.S. Presidents…

Made friends with Milton Friedman, Steve Forbes and Warren Buffett…

And consulted for Fortune 500 companies including IBM and Hutchison Technology.

I’ve had the pleasure to serve as this man’s publisher for the last two decades.

And in that time, I’ve seen him recommend almost 300 100% winners in his most successful strategy…

His name is Dr. Mark Skousen.

I’m sharing all this, so you’ll pay attention and listen closely to what I’m about to say next.

According to Mark…

2024 may be one of the greatest wealth-building opportunities ever.

An opportunity that could help investors double their money again and again over the coming months.

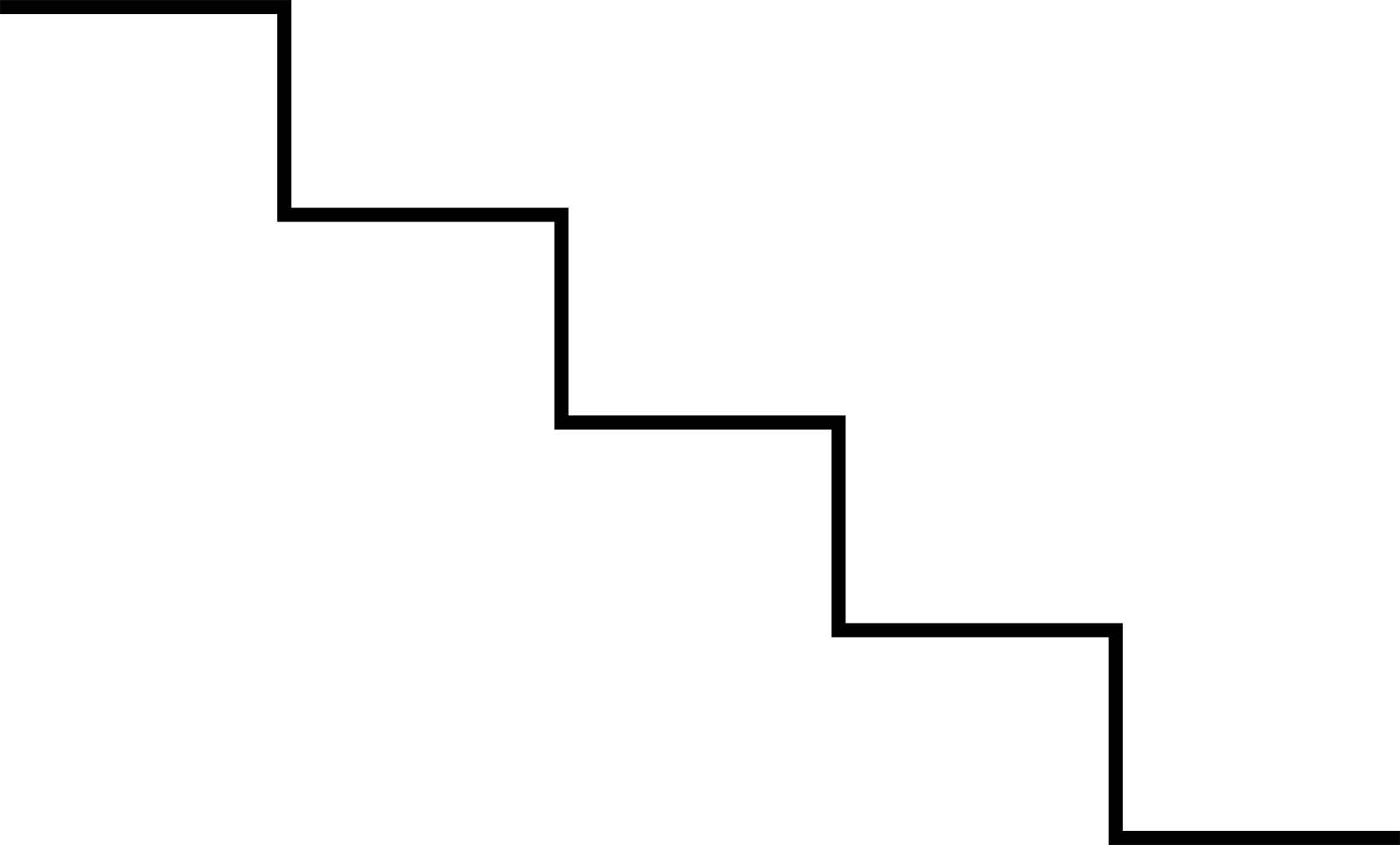

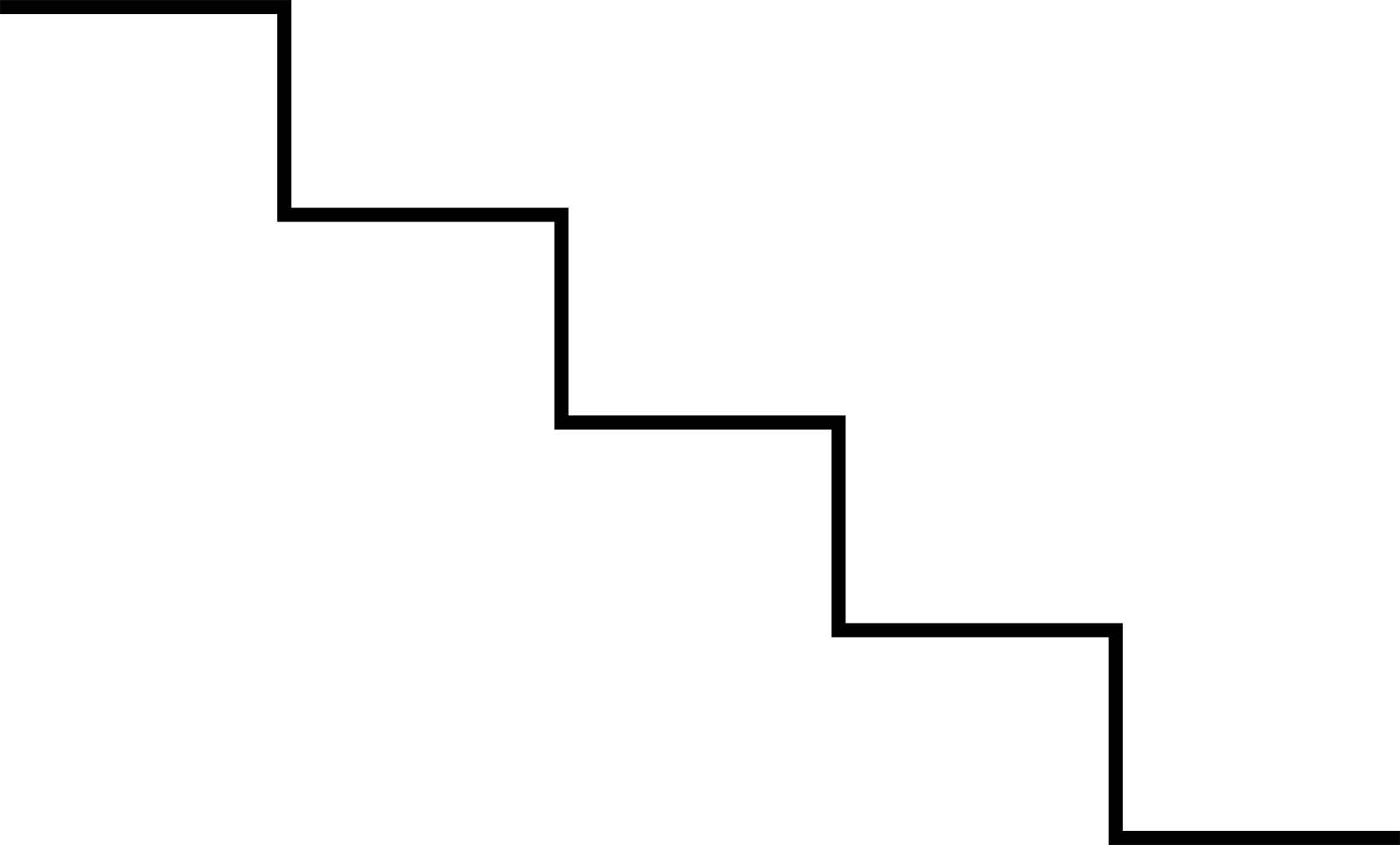

And it’s all thanks to this unusual pattern on the screen below.

This pattern has predicted some of the greatest stock market success stories on record.

It has also forecast some of the stock market’s biggest disasters.

That’s why this message could NOT be more urgent.

This opportunity will cause some investors to lose big…

While others may make a fortune.

And it all comes back to this pattern.

This pattern has only appeared a handful of times over the last 50 years.

When it has, it triggered a “buying panic” that caused certain stocks to go up…

While leaving others stranded behind.

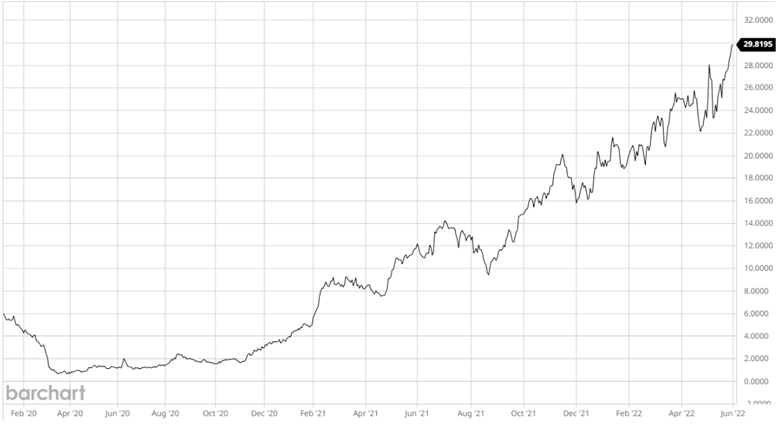

The last time this happened…

Folks had the chance at enormous gains like…

Each in about one year.

Of course, this isn’t the first time that Mark has predicted a buying panic like this.

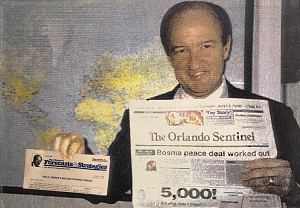

Take a look at this photo.

On this day, November 22, 1995…

On this day, November 22, 1995…

The Dow Jones Industrial Average crossed the 5,000 mark for the first time in its history.

Here you can see Mark holding a copy of the local paper the day that it happened…

Alongside an issue of his award-winning financial newsletter, Forecasts & Strategies, with the headline: “Wall Street’s Record Winning Streak.”

This was just halfway through the dotcom bubble.

And earlier that year, Mark made what was perhaps the greatest prediction of his career when he predicted that the Nasdaq technology index, the beating heart of the technology bubble, would “double and double again” by the end of the decade.

By this point, the index had more than doubled since the start of the decade. And few analysts believed it could go any higher.

A year later, Alan Greenspan, the chair of the Federal Reserve, would warn stocks had entered a period of “irrational exuberance,” not knowing the bull market was just getting started.

But Mark did.

And sure enough…

Investors became gripped by a “panic” that sent stocks soaring higher and higher…

As the Nasdaq went on to double again … and again … and again.

This wasn’t your ordinary kind of panic when stocks tend to go down.

This time, investors who feared missing out panicked into the stock market instead.

And according to Mark, a similar situation is unfolding today.

Nearly 30 years after the Dow hit its historic 5,000-point landmark…

The S&P 500 has now done the same.

We have seen another V-shaped recovery in the stock market.

And just like the recovery a few years ago…

Mark thinks it’s about to send stocks through the roof.

With his help, I believe investors have their best chance to not just double their money, but double it again after that …

Not in years, but in months.

And it all comes back to this pattern I first showed you.

Historically, when it has appeared…

It has caused a select group of investments to go up much higher than normal.

Is it 100% accurate.

Of course not, nothing in investing is.

But it’s close enough to perfect that Mark’s made this connection the heart of this money-making strategy.

And it’s also reliable enough to help investors avoid some of the market’s most damaging losses…

The kind that can derail a retirement — or stop it completely.

That’s why it’s so important to pay attention.

For reasons that will be clear in a moment…

Mark and I believe this buying panic will begin at 2pm ET, Wednesday May 1.

Starting then, we could see a select group of stocks quickly double then double again.

If we’re right, several of them could jump 10% … 20% … or more that exact day.

That’s why I’m asking any serious investor watching this message to remove ALL distractions and listen carefully.

To understand why this opportunity is so big, go back to the last time this pattern appeared in March 2020…

Just weeks prior, Mark made yet another prophetic prediction when he said that year, a “Black Swan” event would bring panic to Wall Street.

Within two months, the Covid-19 pandemic caused a worldwide shutdown — that saw the U.S. stock market collapse by 30%.

Some investors lost big.

But others saw one of the greatest wealth-building opportunities in history.

This time, the Nasdaq doubled over the next 12 months.

But one investor saw an opportunity to double their money again and again…

As their average stock climbed over 300%.

And recently?

This same investor just saw their best month ever.

And the biggest reason all comes back to this pattern.

Who is this mysterious investor who doubled their money twice and is witnessing even better returns today?

It’s none other than America’s most controversial money manager…

Cathie Wood.

Now, to be clear…

Cathie Wood is far from the world’s greatest investor.

In 2022, her flagship fund ARKK lost more than two-thirds of its value.

However, there is no denying her historic performance during America’s last V-Shaped recovery.

From March 2020 to February 2021…

The ARK Innovation ETF climbed 313%.

And as incredible as that is…

Let me show you what MARK was able to do during the same period.

On March 20, 2020…

The stock market was down by 30% and about to commence a historic run-up…

And Mark recommended a trade on a small healthcare company called Quidelortho Corp.

Most people have probably never heard of this company.

But it was about to become one of the biggest stocks of the year.

Within two months of Mark’s recommendation…

Quidelortho Corp. became the first American company to be approved for emergency use of its new Covid-19 antigen test.

After that, the stock exploded higher…

And Mark’s recommendation shot up 472%.

Enough to score over $47,000 in profit on a single, $10,000 investment.

I’ll share how Mark was able to make this prediction in a moment.

But first, it’s important to know that Mark was just getting started.

On May 4, 2020, he recommended a trade on Delta Airlines after it dropped more than 50%.

The stock was wildly oversold.

And Mark called it.

Within a month, the trade more than tripled in value, soaring 263%.

That’s $26,000 in profit in a single month on a $10,000 investment.

And in June of that same year, he recommended a trade on a small gold mining company called El Dorado.

In two months, we saw gains of 161%.

Another $16,000 in profit.

Anyone who invested $10,000 in each of these three trades would have seen gains of $89,000.

And these were far from the only big trades.

And many more.

Does Mark always hit triple-digit winners? Of course not.

Nobody does, but over the last 19 years, since the service first launched, Mark’s locked in 293 triple-digit winners. He’s averaged handing investors at least 1 triple-digit winner every month for almost 20 years.

I’ll match that track record against anyone’s.

Granted, past performance doesn’t mean future gains, but when you’ve been this consistent, for this long, it’s not hard to be optimistic.

That’s why I believe those who team up with Mark this year stand a chance at the best returns.

Because this time, Mark’s found a way to potentially do even better.

In a moment, I’ll reveal exactly what this strange pattern is…

And why it’s presenting investors with one of the biggest opportunities Mark and I have ever seen.

And it’s largely thanks to an important event that’s about to happen … right now.

Just keep in mind…

Anyone who wants in on this opportunity…

A rare chance at truly life-changing gains in the coming months…

Must take action BEFORE May 1, at 2pm ET.

On that day, we could see several stocks jump 10%, 20%, or more not in days or weeks, but in mere hours.

After that, the potential gains could be cut in HALF.

Please understand…As exciting as the last year has been…

The real action is about to get started.

I don’t need to remind you that stocks just came off a remarkable year.

We saw ANOTHER V-shaped recovery…

Led by a group of stocks known as the “Magnificent 7.”

Microsoft … Amazon … Meta … Apple … Alphabet … Tesla … and of course, Nvidia.

Nvidia took the number one spot in the S&P 500, soaring 237%.

And on average, these stocks more than doubled. It’s been widely reported that virtually ALL of the market’s gains last year came from these seven stocks.

And while that’s true…

None of them were the best investments.

There were at least a dozen stocks that did even better.

Coinbase, the world’s largest crypto exchange, climbed 418%.

Marathon Patent Group, the world’s largest Bitcoin miner, jumped 688%.

Carrolls Restaurant Group, the company behind Burger King — yes, Burger King — shot up 464%.

Dream Finders Home Inc, a national home builder, went up 317%.

Carvana, the online car dealer that almost went bankrupt a year ago, soared 1,058%.

AppLovin, a mobile technology company, sent shares up 258%.

And those weren’t even the best gains.

One of the stock market’s most hated sectors saw gains of 500% … 1,000% … even 1,500%.

And a lot of the stocks in them are still VERY cheap.

I’ll talk more about those stocks in a moment.

Several of them are trading for remarkable discounts.

And they’re just a couple of MANY incredible opportunities that Mark sees right now.

Over the next 6 to 12 months, we could see several stocks double and double again.

And with Mark’s help, the potential gains might be even greater.

You see, while most people know Mark for his accurate “big picture” predictions…

One of his GREATEST gifts lies in predicting rapid, short-term price gains.

For example…

In January 2006, Mark recommended a trade on America’s largest mobile service provider, AT&T.

It’s not the sort of company where you’d expect to see life-changing profits.

But behind the scenes…

AT&T was about to announce one of the largest telecom mergers in history.

Within two months of Mark’s trade…

News dropped that the company was acquiring BellSouth in a massive, $67 billion deal.

AT&T shot through the roof.

And the trade Mark recommended?

It shot up 1,600%.

In 2013, Mark recommended a similar trade on Icahn Enterprises, the company owned by the legendary Carl Icahn.

This time, Mark got in just weeks before Icahn announced a deal with the world’s largest offshore drilling company, Transocean, while oil prices were near all-time highs.

Wall Street loved the news…

And Mark’s trade? It gained 957%.

Then in 2016, a day before Trump was elected to the world’s highest office…

Mark recommended another trade on one of the nation’s largest equipment rental providers, H&E Equipment.

Mark understood that Trump, America’s “Builder in Chief,” was running on a huge infrastructure promise…

And if he won, equipment providers like H&E would skyrocket.

It did…

And within a month, we saw gains of 531%.

These are just some of his best trades…

They’re not all huge winners like these…

But the fact is, you don’t stay in business more than 19 years without being great at it — especially in this industry.

But since Mark and I first launched this service in 2004, it’s delivered a total of 306 double-digit winners, 293 triple-digit winners and 5 quadruple-digit monster gains.

But one of the biggest opportunities I’ve ever seen is fast approaching.

On May 1, Mark and I believe a new wave of “panic” is set to create one of the greatest profit bonanzas of our lives.

Over the coming months, investors will have several opportunities to double their money again and again.

We could see gains of 100% … 300% … even 500% or more.

I don’t say this lightly.

Folks who know me know that I, like Mark, am actually a very conservative investor.

But I also know that moments like this don’t come around very often.

And when they do,

they have to be seized with both hands.

However — and this is important…

Anyone who wants their chance at the BEST gains must buy the right stocks.

Whenever this pattern appears…

A certain group of stocks tend to do much better than others.

In fact, in this environment, the Magnificent 7 might actually be in trouble.

And I can almost say for certain they will not deliver the best gains.

Fortunately, Mark knows the exact place to look.

He’s taken his most powerful strategy…

The very same that has helped him recommend almost 300 triple-digit winners since I’ve known him…

And he has gone to the source.

The very part of the market that tends to do so well whenever this pattern appears.

He’s narrowed everything done to five elite investments.

They’re small. Each one of these stocks is worth $1 billion or less. A small, tiny push could help them quickly double (or more).

They’re cutting edge. They’re doing things that no other company is doing.

And they’re cheap. Every single one of these stocks is trading for $10 or less at the time I’m preparing this message.

But Mark doubts that they will remain that cheap for long.

The market has already started to move in anticipation of this pattern.

And starting May 1, these stocks could begin an enormous move higher.

So, what is this pattern that’s about to cause such a market-stirring “panic” on Wall Street?

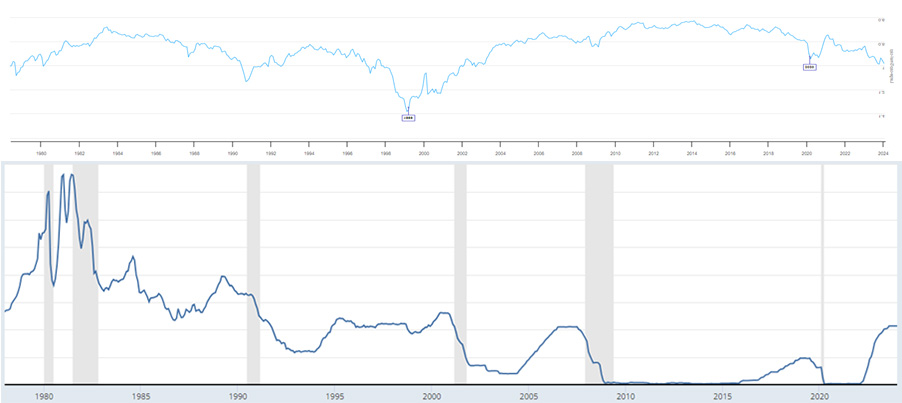

In short, this pattern appears whenever the world’s largest institutional body — the Federal Reserve — makes an important change to its interest rate policy.

When this happens, it can light a fire under the stock market…

Causing some investments to go up in smoke…

While others soar to the moon.

You see, while some of the market’s BIGGEST stocks have recovered to new all-time highs…

Most of the stock market has not.

Despite its 1,000% gain last year, Carvana is still down 85% from its peak.

Zoom, one of the pandemic leaders, is down almost 90%.

Even Tesla, one of the Mag 7 from last year, is down over 50%.

I’m not saying to go out and buy these stocks in particular.

My point is, a lot of stocks still have MASSIVE upside in spite of the market’s gains.

And there’s a very good chance a lot of them are about to go vertical.

And it’s all thanks to this important change coming from the Federal Reserve.

The Fed, as you know, controls the interest rate policy for the world reserve currency — the U.S. dollar.

That makes the Fed the single most powerful organizational body on earth.

Nobody moves the markets more than they do.

And whenever its Chairman, Jerome Powell, takes the stage…

It can create enormous volatility in the stock market.

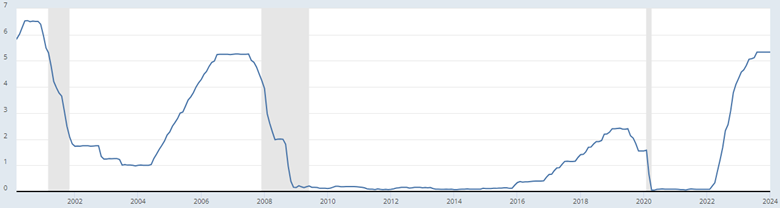

The most famous example occurred in 2008.

But after the crisis, the Fed cut rates to zero and held them there for over a decade.

For most Americans, this was devastating.

Conservative, interest-bearing investments returned next to nothing.

But for Wall Street, it was like catching lightning in a bottle.

Investors had a chance to pick up Apple for just $3 per share.

Since then, it’s climbed over 5,000%.

It’s perhaps the greatest example of what can happen when you have a chance to buy a great stock for so cheap.

But after holding rates still for a decade…

Two years ago, The Fed began to raise them at the fastest pace ever.

And today, they’re just as high as they were before the U.S. financial crisis.

This created a panic … the normal kind … that saw some of the market’s biggest winners quickly lose all of their gains.

Zoom lost all of its pandemic gains. Peloton completely collapsed. And Carvana lost over 97%.

But once it became clear that the Fed was about done, the tide cleared.

Suddenly, the market started to go up.

And while some stocks have recovered…

Most haven’t.

But that is about to change.

Because once the Fed starts to pivot…

As a group, these stocks could all move higher at once.

On May 1, I believe we could see several stocks move 10%, 20%, or more in a day.

Let me be clear…

It doesn’t matter WHEN the Fed is going to cut rates.

It only matters that they will.

And when the first cut seems imminent, Mark and I believe stocks will take off like a rocket.

Now, how can Mark and I be so sure that the Fed is going to cut rates?

Simple…

The Fed stopped raising rates in July.

And they’ve NEVER raised them again after this long of a pause.

Historically, once the Fed has gone five months after a series of hikes with no change, it means that they’re done.

That means the next policy change will be a rate cut.

And not just one … but most likely a series of many…

As illustrated here by this pattern.

This is one of the main reasons why stocks have been racing higher since November.

Once it became clear the Fed was about to hit five months with no change, stocks took off.

But certain stocks took off more than others.

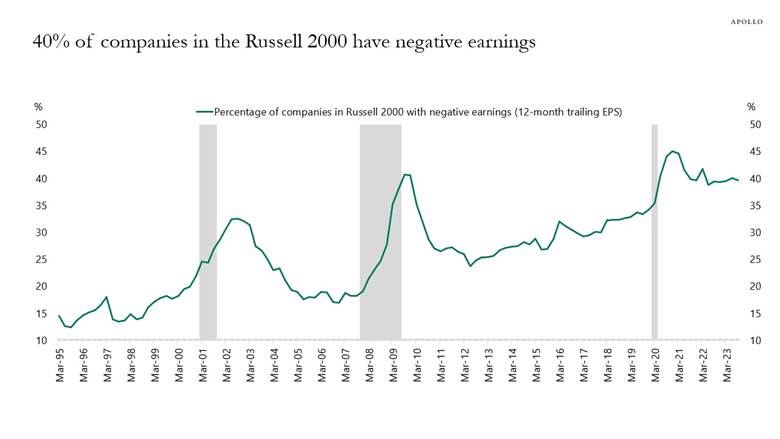

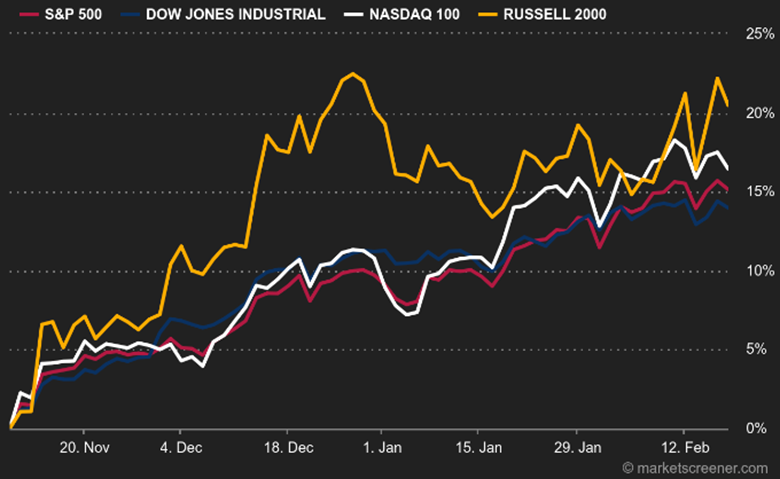

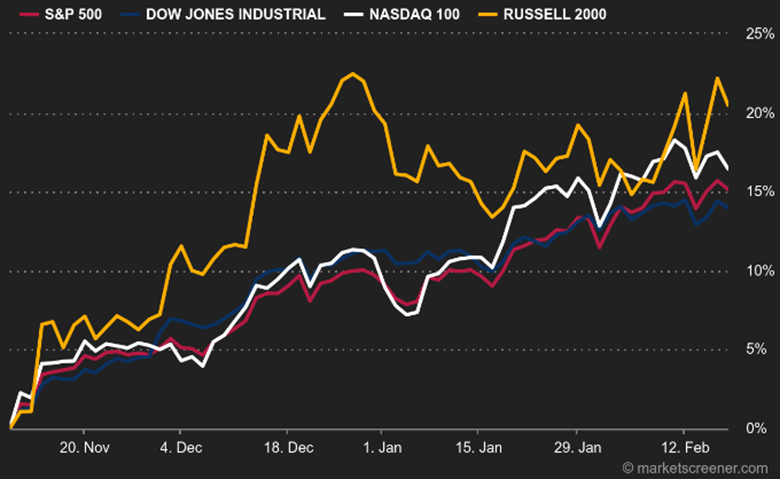

Take a look at the Russell 2000.

It’s an index made up of roughly 2000 “cheap” stocks.

They’re low-priced stocks that tend to be small in size.

Many (if not most) of them are not profitable.

At higher interest rates, they can’t afford to take on more debt.

And the Fed knows this.

The Fed knows that if it keeps rates this high for much longer, it will create a wave of chaos and turmoil across America that forces thousands … literally thousands of companies to go bankrupt.

In fact, a large number of stocks inside the Russell 2000, as much as 40%, don’t make enough money to cover their interest payments.

But that doesn’t mean they’re all going to crash.

Because once the Fed starts to pivot, many of the WORST stocks in America will start to skyrocket.

This is already starting to happen.

Since it became clear that the Fed would pivot…

Stocks in the Russell 2000 have outperformed the rest of the market.

Now let me be clear…

I’m not telling anyone to go out and buy the worst stocks that are out there.

In fact, you don’t have to buy a single stock at all.

Mark will show investors how to double their money again and again, without buying a single share.

There are no guarantees, of course.

However, this situation looks inevitable.

America is $34 trillion in debt.

And the federal budget is roughly $4.5 trillion.

At 5% interest … that $34 trillion comes with a $1.7 trillion annual price tag.

That’s over a third of the federal budget.

And of that $34 trillion in debt?

$8.9 trillion of it is set to come due this year.

Add that to last year’s $1.7 trillion deficit that Joe Biden ran…

And the U.S. Treasury will have to issue over $10 trillion in Treasury bonds in order to cover the debt.

That means the Fed has no choice but to cut rates – and soon.

We simply cannot afford to take on that much debt at these higher rates.

So here’s the deal…

It’s possible we could see the Fed cut rates back to zero percent.

I’m not saying it WILL happen.

But it is absolutely, 100% on the table.

And if that does happen…

It’s possible we could see the worst stocks in America blow past their pandemic highs.

It will mean massive inflation, yes…

But it will also mean enormous gains in the stock market.

After all, historically, stocks are the best defense against rising prices.

Over the last 30 years, we’ve seen the S&P 500 climb from 500 points … to over 5,000.

And when you adjust for inflation? Stocks are still up 400%.

Even in cases of extreme inflation, stocks are the best game in town.

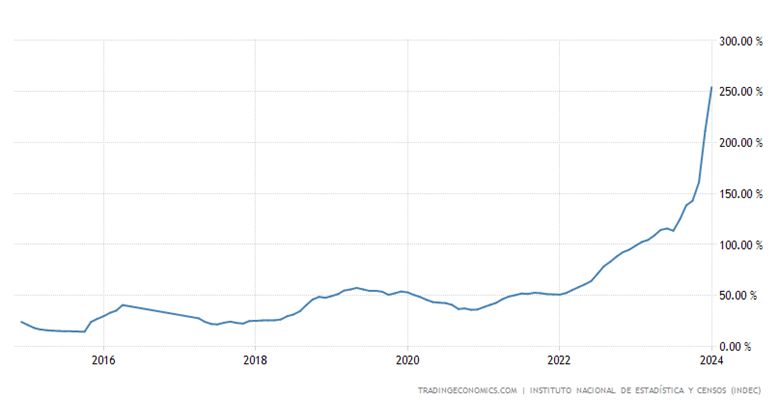

Take a look at what happened recently to the nation of Argentina.

A hundred years ago, Argentina was one of the world’s richest countries.

Eventually, socialist policies forced it to stagnate.

And inflation spiraled out of control.

Four years ago, the inflation rate hit over 50%.

Today, it’s over 250%.

The country fell into such dire straits that the central bank couldn’t raise rates fast enough to tamp down inflation.

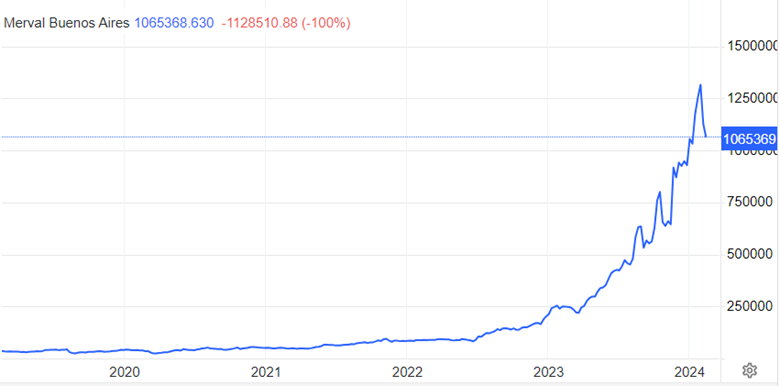

But this doesn’t cause stocks to fall.

Quite the opposite.

The Argentinian stock market doubled again and again many times over.

Over the last four years, it’s up over 3,000%.

My point is, without higher rates, inflation can be very, VERY good for the stock market.

Unfortunately, the Fed may have no choice but to cut rates very soon.

Here’s why this is so important.

It all comes back to debt.

Just as America can’t take on more debt at these higher rates…

The same holds true for the stock market.

Every company, no matter how big or small, issues debt in exchange for a lump sum that they’ll pay back at a later date, plus interest.

However, not all debt is made equal.

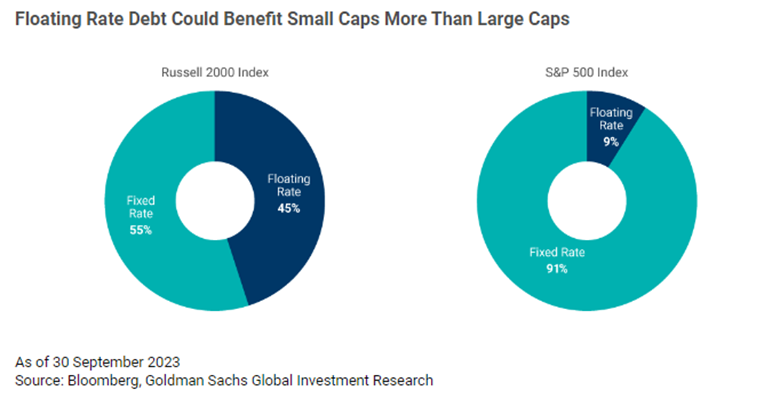

Take a look at this chart.

Stocks in the S&P 500 get the best deal.

91% of the companies in it qualify for debt at a fixed rate.

That means they were able to lock in their loans at a low interest rate — before they started to go up.

As you can see, only 9% of companies in the index are subjected to an adjustable rate.

This is why the S&P 500 has already recovered to new all-time highs.

In the Russell 2000, however…

Nearly half of all companies are subject to what are called floating rates.

This means they pay more anytime rates start to go up.

Only 55% of them quality for loans at a fixed rate.

That means for the last two years, 45% of companies in the Russell 2000 have been forced to pay higher rates on any new debt that they issued.

This is why more than 40% of the Russell 2000 doesn’t make any money.

And it’s why stocks in the Russell 2000 are about to FLY higher.

When the Fed cuts interest rates, investors will panic into the stocks that they had mistaken for dead.

Just look at what happened after the Fed’s FOMC meeting in November…

Jerome Powell, the Fed’s Chairman, gave a signal to the stock market that the rate hike cycle was over.

Over the next two days, the index jumped over 5%.

Two weeks later, it jumped almost 5% in a single day.

And it did it again a week later.

These stocks are now outpacing the rest of the stock market.

This is just what happened as the market realized rate hikes were over.

As we get closer and closer to actual rate cuts…

Mark predicts these stocks will soar higher.

You can already start to feel it.

For the first time in two years…

Greed is overtaking the stock market.

And it stands to benefit small, low-priced stocks more than any other.

Compare Nvidia to a stock like Super Micro Computer.

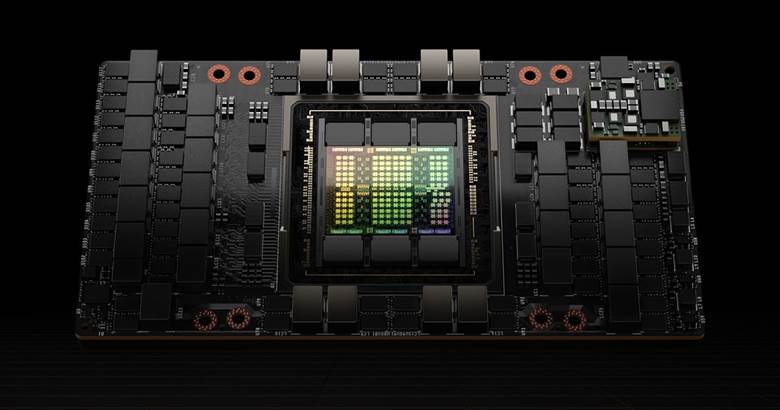

Nvidia has quickly become market’s #1 AI stock.

That’s because its device, the H100, is the most powerful AI chip in the world.

But Nvidia’s computer chips are just one part of the equation.

AI has to quickly sort through large sets of data…

Processed at massive data centers like you see here.

And that’s where Super Micro comes in.

It’s one of the world’s largest producers of high-performance, high-efficiency data servers.

About five years ago, it was a low priced stock trading for around $15 per share.

Since the pandemic, it’s gone up 5,000%.

Yet, it’s still only a fraction of Nvidia’s size.

And now that the Fed’s about to pivot…

These smaller stocks can go up a LOT more.

Case in point…

After closing last year with a bang, Nvidia quickly jumped another 50% to start the new year.

But Super Micro jumped over 250%.

Last year, these stocks were neck-in-neck.

They both went up about 200%.

But now, we’re in new territory where small stocks are winning.

Take a look at Marathon Digital Holdings.

It’s the world’s largest miner of Bitcoin.

In two months, it jumped another 17%. That’s in spite of a large, 50% selloff.

But in that same time, Cleanspark, a company half its size, did four times better.

In recent months, this stock is up over 400%.

This is the sort of environment that we’re in now.

One where stocks that have spent months, if not years on the sidelines are starting to SPRINT higher.

Here’s a perfect example.

Just look at cannabis stocks.

Do you remember back in 2017 and 2018 when these stocks were all the rage?

Tilray jumped about 500% in a month.

Aurora Cannabis went up 3,000%.

And Cronos Group was up over 9,000% at its high.

Since then, these stocks been in a long-term bear market.

Most of them stocks are down over 90%.

And now, they’re surging.

Take a look at the AdvisorShares Pure Cannabis ETF.

Its ticker symbol is quite literally “YOLO” — short for “you only live once.”

In four months, it’s up over 50%.

Some might see this and scoff … or even laugh.

Thinking there’s no way the market can go even higher.

But when it comes to big, stock market forecasts…

Mark Skousen is rarely wrong.

And right now…

He’s bullish.

He’s as bullish as he’s ever been.

And according to Mark, we’re seeing a rare chance at once-in-a-lifetime gains.

Just think…

Big, expensive stocks like the S&P 500, the Dow and the Nasdaq all bottomed over a year ago.

But the Russell 2000?

It’s still fresh out of a two-year bear market.

Giving investors have a rare chance to buy low … and sell high.

But only if they act today.

And it all comes back to the Fed.

If the Fed gives ANY cue that they’re about to cut rates…

These stocks can and WILL move, and move quick.

It’s possible we could quickly see the Russell 2000 jump another 5% in a day.

While some of the stocks inside it jump 10% … 20% … or more.

But those who act on Mark’s recommendations will have the chance to do even better.

Just moments ago, I asked Mark to send me a list of his FIVE favorite small, low-priced stocks.

These are the stocks that, in his view, have the chance to double in price over the next 6 to 12 months.

Each stock is worth $1 billion or less.

They’re small, nimble and agile — the type that can quickly double and then double again.

And most exciting of all? They’re all trading for around $10 per share.

I’ve packed these five stocks into a new report that I’d like to send you.

It’s called Panic on Wall Street: 5 High-Fliers to Buy Before They Soar Over 100%.

I’d like to get a copy of this report in your hands right away.

Again, I believe it’s imperative to take action before May 1.

While it looks very unlikely the Fed will lower rates on that date, it does not matter.

As we get closer and closer to the date, investors will anticipate the first, inevitable rate cut and load up on small, low priced stocks before the rest of the market can buy.

There’s simply very little time left to waste.

Very soon, we could see large investors move out of big stocks into the stocks with the most upside.

How do I know?

Because every single time the Fed has cut rates…

Every. Single. Time…

Small, low-priced stocks outperformed large ones by a distant mile.

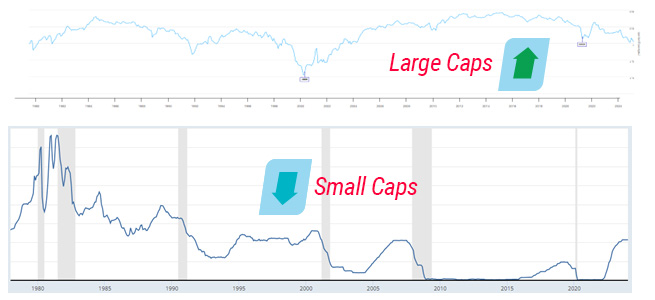

Take a look.

This chart shows how small caps performed versus large caps over the last 50 years.

Every time the Fed prepared to cut rates, small caps won out versus large caps.

By 1979, the economy was racked by double-digit inflation…

And by 1983, the economy fell into two recessions.

But as the Fed started to pivot…

The Russell 2000 outperformed the S&P 500 by 80%.

In the early ‘90s, it happened again.

By 1994, small stocks beat large ones by 50%.

And from 1999 to 2014…

They absolutely dominated.

This time, they won out by 114%.

Even more recently, in 2020, it happened again.

The Fed cut rates…

And small, low-priced stocks outperformed the rest.

Before the pandemic…

Moderna was a small, low priced stock trading for $15 per share.

At its peak, it was $450 per share.

A 3,000% gain.

Or how about United Microelectronics.

In 2020, Taiwan’s oldest semiconductor company was trading for just $2 per share.

During the pandemic, it jumped 500%.

Or look at this…

Paramount Resources.

It’s a small oil and gas company in Canada.

After the pandemic, it collapsed to just 70 cents per share.

Two years later, it was up 4,000%.

Here’s my point…

By the time a stock ends up in the S&P 500, chances at the best gains are gone.

To have a shot at the best gains…

Investors have to be early…

They have to be bold and daring…

And they need to act.

I just showed how, every time the Fed has changed course, the Russell 2000 beat the S&P 500 and beat it big.

It didn’t matter what was going on inside the U.S. economy.

In fact, during each recession over the last 45 years, small caps won out against their larger peers.

And because these stocks are SO cheap…

And because the stock market could crash…

And the economy could enter a recession…

These stocks still have a chance to go up.

For example…

Eight years after the dotcom bubble burst in 2000…

The S&P 500 went NOWHERE.

By the end of 2007, these stocks barely recovered before crashing again.

Over this same period, the Russell 2000 climbed 69%.

To avoid the pain…

And make that GAIN…

Every time this pattern appeared, small cap stocks as measured by the Russell 2000 beat out the “unbeatable” S&P 500.

However, I don’t recommend investing in the Russell 2000 directly.

Again, 40% of the companies in there don’t make any money at all.

Buying the index directly will almost certainly dilute your gains.

And this is where Mark comes in.

He knows how to zoom in and find the best stocks to own.

And while some of the stocks out there are pure garbage…

There are dozens of rock-solid companies with REAL businesses, REAL earnings driven by REAL leaders who know what they’re doing.

How does he find them?

Mark screens the market for companies that meet a select group of criteria.

First, he looks for businesses that are profitable and showing continuous profit growth. At the very least, it needs to have earnings momentum. If the stock has no earnings but earnings are moving the right way, that’s a sign the stock could be gearing up for a large breakout.

It should have strong cash reserves and a modest level of debt.

Mark also doesn’t like to overpay. That’s why he prefers stocks with a low PE ratio.

On the other hand, the stock must have enough buyers to show a moderate level of liquidity. If there are no buyers, the stock isn’t stable. That’s why it must have a firm foundation.

Ideally, there needs to be insider buying.

Insider activity is one of the greatest indicators whether a stock will go up or down.

That’s because insiders usually know something we don’t. In fact, one study found that insiders tend to outperform the stock market by 26-to-1 a month after casting their bets.

And when they sell, stocks typically fall over 5%. That’s why insider activity is one of the most reliable signals there is!

This might be the most important factor: More than anything else, the stock must have strong momentum. When it comes to low priced stocks, Mark likes to buy stocks that are already going up.

This is how Mark was able to identify Quidelortho weeks before it became one of the biggest stocks of 2020.

While most of the market was rolling over, Quidelortho was one of the few stocks that were moving higher.

It had strong momentum … and by targeting the stock while it was moving higher, Mark helped investors score phenomenal gains of 472%.

Lastly, he screens for stocks that meet these criteria and also trade for a low price.

That’s because a low-priced stock can double a lot faster than a large one.

In order for a $5 stock to double in price, it just needs to move $5.

But a $100 stock has to move by $100.

That’s why Mark prefers stocks trading for $15 or less.

Buying low-priced stocks like this gives an investor a huge leg up on Wall Street.

That’s because most large, institutional investors are forbidden from buying stocks that are too cheap.

It doesn’t matter if it has massive earnings, huge profit growth or an all-star CEO.

If it’s too cheap, they won’t buy it.

That’s why buying low-priced stocks is one of the ONLY ways small investors can win out over big Wall Street firms.

Keep in mind, these are just a few of the things Mark looks for.

And while every stock won’t meet every criteria…

If it meets enough, it’s fair play.

For example, Mark won’t turn down a stock with massive insider buying just because it has a large debt load. Maybe it’s taken on debt in preparation for a massive acquisition that helps it corner the market.

There are no hard and fast rules.

There are no “systems.”

The only way to get ahead, is to team up with someone like Mark who knows what he’s doing.

There are people who don’t last 50 months in this business.

Mark’s been at it for nearly 50 years.

And this trading service alone has been around almost 20…

He knows more today than he ever has.

He’s a multimillionaire who could’ve retired years ago.

But he hasn’t … because he loves learning…

And more importantly, he loves sharing his BEST ideas with others.

It’s why he’s published over 20 books on economics and investing … taught at some of the best schools in the country, including Columbia Business School in New York … and given lectures at around 50 colleges and universities including Harvard, Stanford and the University of Chicago.

But my favorite part about Mark is he is truly a jack of all trades.

He’s not just a bestselling author, a university professor and an award-winning macro-economist…

He’s also an expert trader that can help investors quickly get in and get out with big gains.

That’s why I want to do way more than give investors access to Mark’s special report containing the top five low-priced stocks you should buy.

I also want to help investors get access to the strategy that has helped him recommend almost 300 hundred “double your money” trades…

Including massive outliers like…

While those are truly enormous gains, remember, that Mark’s averaged delivering at least one 100% winner per month, for more than 19 years.

Despite all that success…

But Mark is a student of history.

And he knows this time, low priced-stocks are the way to go.

That’s why we’ve made the bold decision to take Mark’s most successful strategy…

The same one that’s helped him recommend almost 300 triple-digit winners since 2004…

And apply it to the stocks with the most upside.

It’s called Low-Priced Stock Trader.

And I believe it is the most exciting and promising research advisory I’ve had the privilege to offer in my 20 years as Mark’s publisher.

The reason being, when you can find a good company for cheap, the results can be out of this world.

MSCI, the global financial company, recently finished a study on this.

They found that small cap stocks typically beat large caps 90% of the time over any given 15-year period.

But when you buy low priced stocks at the right time, the results can be even better.

Ed Clissold, chief strategist at Ned Davis Research, recently said that “small caps are trading at near their steepest discount on record.”

We rarely have moments like this to buy GOOD stocks for so cheap.

According to JP Morgan:

That’s because investors understand you can get better returns overtime when you buy a small, promising company.

But they add:

Think about that. Investors are often willing to overpay to invest in a good company early.

Today, you don’t have to.

Investors can still buy good, high quality stocks for cheap without having to overpay.

In fact, a lot of these stocks are trading at massive discounts.

Take this analysis from Kiplinger:

There’s no other way to say this…

This is a historic opportunity for investors.

It’s been decades … literally decades since we had an opportunity to invest in high-quality, low-priced stocks for this cheap.

And it all begins with the 5 elite investments in Mark’s new special report, Panic on Wall Street: 5 High-Fliers to Buy Before They Soar Over 100%. You’ll find five individual stock recommendations in this special report.

But as mentioned earlier, there is one sector of the market right now that is more discounted than any other.

Some of the companies in this sector are trading for less than their cash value.

However, they’re also some of the few companies that can quite literally create overnight fortunes for investors when they buy at the right time.

I’m talking about biotech.

By their very nature, most biotech companies don’t make any money.

That’s because it can take 10 to 15 years to create a new drug.

And the average price to develop and research each drug costs between $1-3 billion.

Add this to the fact that 90% of new drugs fail their clinical trials — and you might wonder why investors even bother with these stocks at all!

The reason?

People can make more money in this one sector than the rest of the stock market combined.

Consider a stock like Amgen.

It’s one of the largest biotech firms in the world.

Over the last 40 years, it’s returned gains of over 300,000%.

Or take Regeneron Pharmaceuticals.

In the early ‘90s, it was a low priced stock trading for $15 per share.

Each share is worth almost $1,000 today.

Or what about Moderna? During the pandemic, it went from $15 per share to $450 per share in just a couple of years.

That’s 3,000%!

And sometimes, the gains can come overnight.

If a company is developing a drug that passes a clinical trial — or a new treatment gets approved by the government — its share price can quickly skyrocket.

That’s what recently happened with a company called Renalytix.

The company specializes in the diagnosis of kidney disease.

And upon news that the company’s flagship product was up for approval by Medicare…

Its share price jumped 500% in three days!

Or how about Ambrx Biopharma? In 2022, when the company announced positive results for its drug for breast cancer, the stock jumped 1,000% the next day!

And the best performing stock of last year?

It was a biotech company called Soleno Therapeutics.

It soared almost 2,000% — almost 10 times more than Nvidia — and jumped 500% in a single day when the company reported positive results for its drug treating a rare genetic disorder.

The next best stock? It was Ambrx Biopharma again. After its historic 1,000% jump in 2022, last year, the stock posted another 1,369% gain.

And at least five other stocks in this sector posted gains of more than 500%, including Myomo Inc, Applied Optoelectronics, American Coastal Insurance Corp, Immunogen and EyePoint Pharmaceuticals.

Now, with interest rates set to drop, it’s biotech’s moment to shine.

And Mark has found the ultimate opportunity for investors to profit.

It’s a small firm worth less than $500 million trading for just $5 per share.

The company specializes in speeding up the drug discovery process using artificial intelligence.

As mentioned, the drug discovery process is very time-consuming, expensive, and inefficient.

It’s pure trial and error that amounts to just educated guesswork.

But this company has the potential to transform the entire industry.

While AI is the latest buzzword de jour on Wall Street…

This company has been perfecting its process of using AI to develop new drugs for over 10 years.

Now, rather than taking 10 to 15 years to develop a new drug…

It can create one in about six weeks.

This is truly massive…

And big players are starting to notice.

The company recently signed a $250 million deal with a large biotech firm to use its AI technology to identify potential treatments for cancer.

And that’s not all.

The company has secured a second partnership with a leading biotech firm in Europe worth north of $600 million.

Add it up, and the company has inked deals for 10 new drug discovery programs worth nearly $1 billion.

All this from a company that’s worth less than half of that.

And it’s just one of many stocks to be found in Mark’s new special report.

Inside Panic on Wall Street, you’ll discover a second biotechnology firm setting up for another historic run.

This company is revolutionizing the science of gene sequencing.

You’ve probably heard that the first human genome cost almost $3 billion to sequence. This was just over 20 years ago.

Today, it costs less than $1,000.

This low price has invented an entirely new field known as precision medicine — where doctors can prescribe treatments based on an individual’s genetic makeup, not the one-size-fits-all that doctors have used for decades.

$1,000 might not sound that expensive.

But this company thinks it can cut the price by another 90%.

A $100 genome sequence will change human healthcare forever.

And the company appears to be well on its way to making it happen.

Its last innovation improved efficiencies by 1,500%.

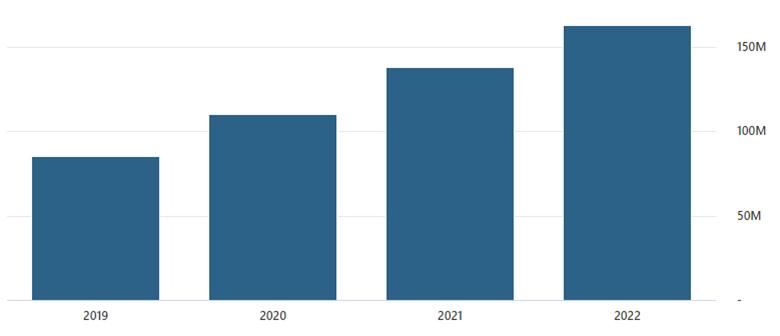

And its revenues are soaring.

Sales more than doubled in the most recent quarter.

And year over year, they jumped over 50%.

And it appears to show no signs of slowing down.

The company says it is targeting a compound annual growth rate of 40-50% through 2026.

The stock is trading for about $5 today. And according to Barron’s, the average price target from 15 different analysts is over $10.

In other words, analysts expect the share price to double.

And that might be conservative.

A recent analysis suggests the company’s intrinsic value puts the stock closer to $15 per share.

Bottom line, this is a rare opportunity to pick up shares of a bold, ambitious, and promising small biotech firm at some of its best prices in years.

Let me quickly go over the three other stocks in my special report.

Inside, there’s a small, $15 stock that runs the largest menswear brand in the world and is considered the global leader in luxury menswear. Mark likes the stock because it’s run by the same family that founded it over 100 years ago, and the stock was recently listed on the NYSE.

The company is leading the charge on the new era of “quiet luxury” — attracting new customers that are 7 years younger, spend 58% more, make 25% more repeat purchases and wait 2.5 times less between purchases. Its loyal customer base may be why the stock suffered zero declines in the 2022 bear market, and is already up over 20% YTD.

Considering the luxury industry represents a sprawling, $1.6 trillion market — and this company is being compared to others more than 100 times its current size, and is even poaching some of the industry’s top executives — the upside here looks truly fantastic.

In his report, Mark also shares one of the largest and most robust ecommerce firms of its kind with over $2 billion in annual revenue. And incredibly, the stock is trading for about 1/3 of its sales for a price of just $10 per share. Considering the stock went up 2,000% during the last bull market — and is currently trading at a 70% discount to its former prices — this looks like another stock that could very easily double.

Before I reveal the final stock in Mark’s special report, let me ask this — do you know what the #1 stock was of the last 30 years?

It’s not Nvidia … it’s not Apple … it’s not Microsoft, Google or Tesla.

Can you guess what it is?

It’s Monster Beverage Corp … the company behind Monster Energy drinks.

30 years ago, the stock was trading for pennies … literally pennies.

And today, it’s up over 250,000%.

That’s enough to turn every $10,000 investment into $25 MILLION.

Imagine that…

Because the final stock in Mark’s report is operating in the exact same space

It’s a beverage company that makes energy drinks, organic teas and soft drinks that are sugar free and have zero calories.

The market for these heavily drink alternatives currently stands at around $20 billion.

By 2028, it’s expected to grow to $50 billion.

And this company is quickly positioning itself as an early leader in the field.

Revenues have steadily improved since the company went public a few years ago.

However, Wall Street has gravely punished the stock and sent shares down by about 90%.

Right now, the company is trading for less than $2 per share and is worth just north of $100 million.

In other words, it’s a great time to buy.

Analysts from Goldman Sachs, Morgan Stanley and Bank of America give the stock roughly a 100% upside.

But the potential returns are far greater.

If the company returns to its IPO share price we could see gains of nearly 1,000%.

Even if it recovers just half of its value, the gains could come in over 500%.

The names and ticker symbols of all five stocks can be found inside Mark’s new special report…

Panic on Wall Street: 5 High-Fliers to Buy Before They Soar Over 100%.

Panic on Wall Street: 5 High-Fliers to Buy Before They Soar Over 100%.

It’s yours if you claim a spot in Mark’s most exciting and ambitious project to date, Low-Priced Stock Trader.

In addition to the five stocks in the report…

In Low-Priced Stock Trader, investors discover a new low priced stock just about every week.

Mark will screen the market for the best low priced stocks he can find.

And after filtering them through his advanced criteria…

He’ll send the BEST stock he sees every week.

We track this portfolio of recommendations online so you can follow along with Mark’s top recommendations.

New members will also receive weekly insights directly from Mark.

For example, Mark recently used this space to alert readers to a position that soared over 500%!

Members also can receive a text alert anytime one of these new updates is online.

Everything is stored conveniently on our secure, members-only website for members to review at their leisure.

The point is — Mark does all the heavy work.

But it’s important to know…

I’ve worked with Mark for 20 years now…

And I have not seen him this excited about a new investment opportunity in some time.

Mark says that buying low priced stocks right now is one of the biggest, most obvious calls he’s made in his nearly five decade career.

At these low valuation and stock prices, every stock Mark recommends will have the potentially to double over the next 6 to 12 months.

But with Mark’s help, investors will have the chance to double their money, again and again.

And they can do it without buying a single share of each stock.

Here’s how…

A few times each month, Mark will recommend a high-probability options trade that will give every investor the chance to double their money in just 30-60 days.

These gains can be truly massive.

Again, just recently Mark recommended a trade that went up over 500%!

He recommended another trade that doubled in about one week.

But big winners like this are nothing new to Mark.

Over the 19+ years this service has been in existence — and as it has evolved — Mark has led investors to 306 double-digit winners, 293 triple-digit gains and 5 quadruple-digit wins trading stocks and options,

Granted, the bigger gains are from options trades, including these…

But the great thing about options is it’s the best of both worlds..

Even though options do carry more risk than just buying stocks, you have less capital at risk initially. your chance at a better return.

They’re cheap to buy. And that’s why the gains can be much larger.

For example…

An option on a $10 stock may only cost about $1.

And for every $1 the stock price goes up? Your option goes up by $1 as well.

The difference is, the stock only went up by a small amount.

But the option doubled in price.

That’s how investors can turn a small, 10% move in the stock into a large, 100% gain.

By that same token, a 50% move can lead to a 500% gain.

And if the stock doubles and climbs over 100%? It’s possible to see a 1,000% gain or more.

The way options work is they’re essentially a contract that gives someone the right to buy a stock for a cheaper price at a later date.

If the stock goes up, the option can be worth many times more what they paid for it.

This gives options traders extreme leverage.

Especially when they’re taking their signals from Mark.

Remember in 2022, when pretty much the entire stock market except for oil and gas stocks were going down?

Early that year, Mark recommended an options trade on a small, low priced oil stock called Comstock Resources.

Within two months, this trade shot up 298%.

Plus, Mark makes it so simple — even for folks who have never traded options before.

Options are just as easy to trade as a regular stock.

They can be made in any online brokerage account.

And these trades can be placed in about 60 seconds or less.

In 2017, he recommended a trade on another low priced stock called Drive Shack.

It runs over 50 golf ranges across the U.S., with innovative, interactive gaming technology that perfectly keeps track of your shots.

In three weeks, Mark saw gains of 308%.

And back before AstraZeneca became one of the world’s largest biotech firms…

In 2014, it was a much smaller, low priced stock trading for around $15 per share.

At the time, the company was in talks to be acquired by Pfizer.

There was plenty of buzz around the stock, and Mark recommended a trade that in two months scored gains of 448%.

I know I sound like a broken record, but I’ve literally seen Mark recommend countless triple digit gains over the years.

And moments like now is when he really shines.

As this pattern triggers a buying panic across Wall Street…

It could send low-priced stocks through the roof.

Mark’s goal is to help members of Low-Priced Stock Trader to get in the very best ones.

And today, we’re opening the doors to this service for the very first time.

But you should know, entrance to Low-Priced Stock Trader isn’t cheap.

This is arguably Mark’s most ambitious research service to date.

And it stands to be one of his greatest.

That’s why, when we release this service to the public at large later this year, a membership will cost $1,995 per year.

However, to celebrate our grand opening…

I’m inviting the first 500 members to join at a greatly reduced price.

Instead of $1,995…

New members will pay just $995.

And I’ll immediately send a copy of Mark’s new report, Panic on Wall Street: 5 High-Fliers to Buy Before They Soar Over 100%.

Just remember…This opportunity couldn’t be more urgent.

These stocks could soon soar in anticipation of the Fed’s pattern.

We have 50 years of price history that proves NOW is the time to buy these sorts of stocks.

Buying the stocks alone could yield returns of 100% or more in the next 6 to 12 months. And that could be just to start.

Plus, with Mark’s high-powered options strategy, readers will have the opportunity to double their or more in the coming year.

In fact, Mark and I are so confident you’ll love becoming a member of Low-Priced Stock Trader, that you’re going to get our 100% satisfaction guarantee.

If for any reason you decide you’re not happy with Low-Priced Stock Trader in the next 30 days…

Just ask us for a refund of your membership fee, and we’ll happily give it to you. But I’m confident there won’t be many refunds. At Eagle Financial, I’ve spent decades building a roster of the world’s most elite financial experts.

Including George Gilder, the greatest technology investor of all time.

Bryan Perry, who called the recent run-up in tech stocks and sports some of the greatest track records I’ve ever seen.

And Bob Carlson, the world’s foremost retirement expert who has overseen over $42 billion in assets.

Bottom line, readers have been making money for years from our Eagle experts, and I’m sure our newest service, Low-Priced Stock Trader will be no exception.

Just keep in mind, once the first 500 spots are gone, I cannot guarantee I’ll ever be able to offer Mark’s work for such a steep discount.

Take advantage of this rare opportunity while it’s still on the table.

I’m Roger Michalski, and on behalf of Dr. Mark Skousen, thanks for joining me today, and I look forward to welcoming you as the newest member of Low-Priced Stock Trader. Enjoy.