Dear Fellow Investor,

In every crisis there are also huge opportunities. And Joe Biden’s trainwreck economy proves it!

Throughout 2022, even as the S&P 500 closed the year down -18.1%, you could have banked gains as high as…

- 86.7% on Amazon (AMZN)…

- 110.3% on Vertex Pharmaceuticals (VRTX)…

- 145% on Xerox Corp. (XRX)…

- 153.6% on DowDuPont, Inc. (DOW)…

- 208.8% on Marvel (MRVL)…

- 225.8% on Asana (ASAN)…

- 258.3% on Super Micro Computer (SMCI)…

- 345.3% on Sonic Automotive (SAH)…

- 367% on Comstock Resources (CRK)…

… to name just a few.

You see, during a struggling economy like we’re seeing today, even the best, most profitable companies often see catastrophic sell-offs in their share prices.

And this economic incongruity is handing investors and traders opportunities for profits not seen since the 2008-2009 banking crisis.

It’s during times like these that you can make 100%, 200%, even 300% profits or more… and I’m not talking about shorting these stocks.

Think I’m exaggerating?

Well, take a look at what happened to America’s most profitable companies.

During the COVID-19 lockdowns, every single one of America’s 10 most profitable companies — including Apple, Alphabet,

Microsoft and Morgan Stanley — fell between 26.5% and 51%, only to skyrocket back up to and beyond their previous highs.

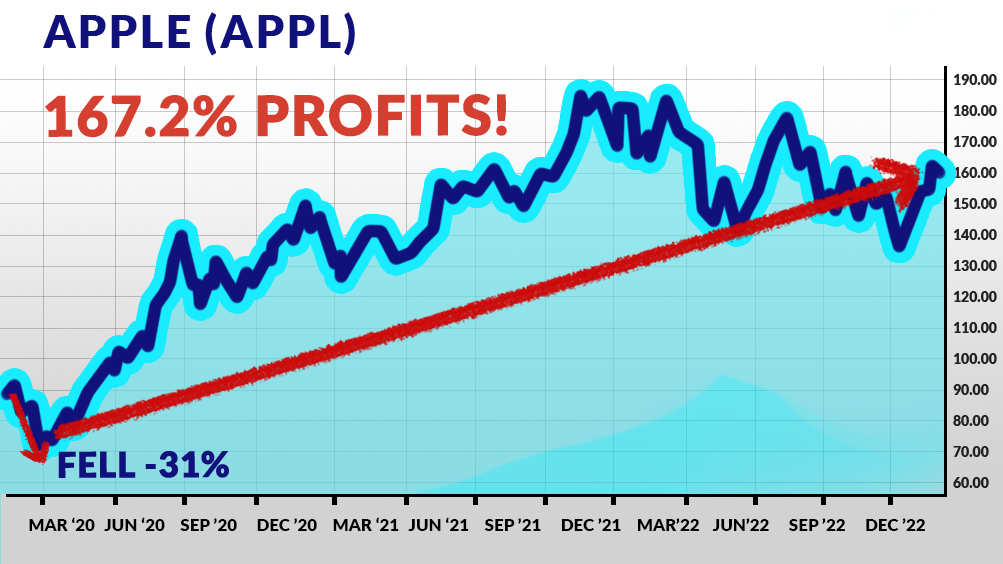

Look at Apple (AAPL).

It fell 31% from its 2020 high of $80 a share all the way down to $55.25.

Yet during the time its shares were taking a beating, nothing had really happened at Apple. It was still making $57.4 billion a year.

Had you scooped up shares of Apple when it tanked during the COVID-19 crisis, you’d have made a tidy profit when it regained its old high of $80 a share…

… and made a killing when the shares soared all the way to $147 in December 2022.

That would have been a profit of 167.2%.

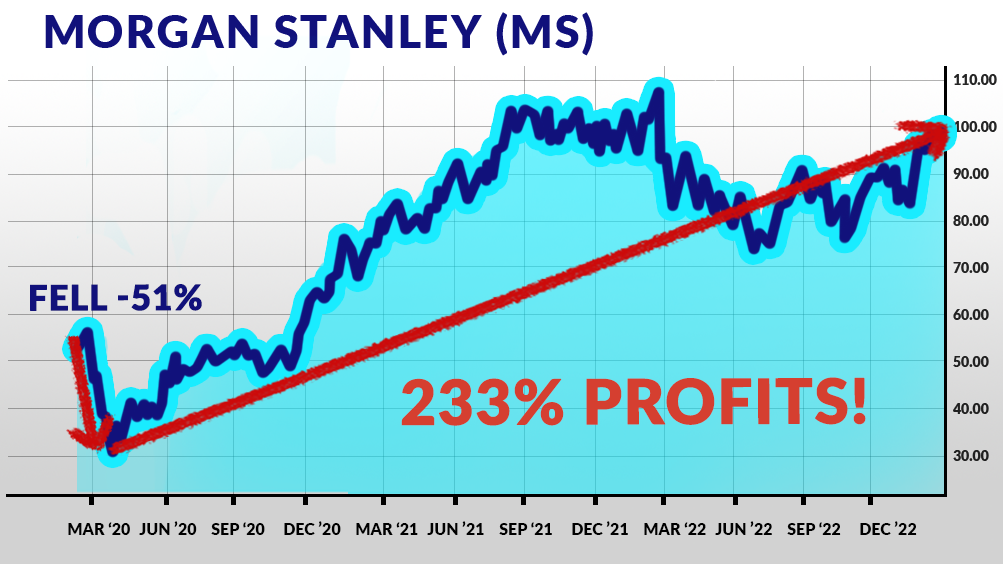

Here’s another example: Morgan Stanley (MS), the wealth management firm that is, with $15 billion in annual net income, the sixth most profitable company in America.

It lost 51% of its share value in the sell-off of early 2020 — falling from $53.69 to just $26.13 per share.

But like these other companies, it continued to make enormous amounts of money — $11 billion in 2020 and $15 billion in 2021.

In March 2020, Morgan Stanley shares started rising again.

If you had gobbled up shares when they were selling for less than $30, you would have rode this rocket to huge gains.

By February 2023, Morgan Stanley was trading at $100 a share.

You could have banked profits as high as 233%, more than tripling your money in less than three years.

You know, if you have enough winners like these, you can really transform your financial future.

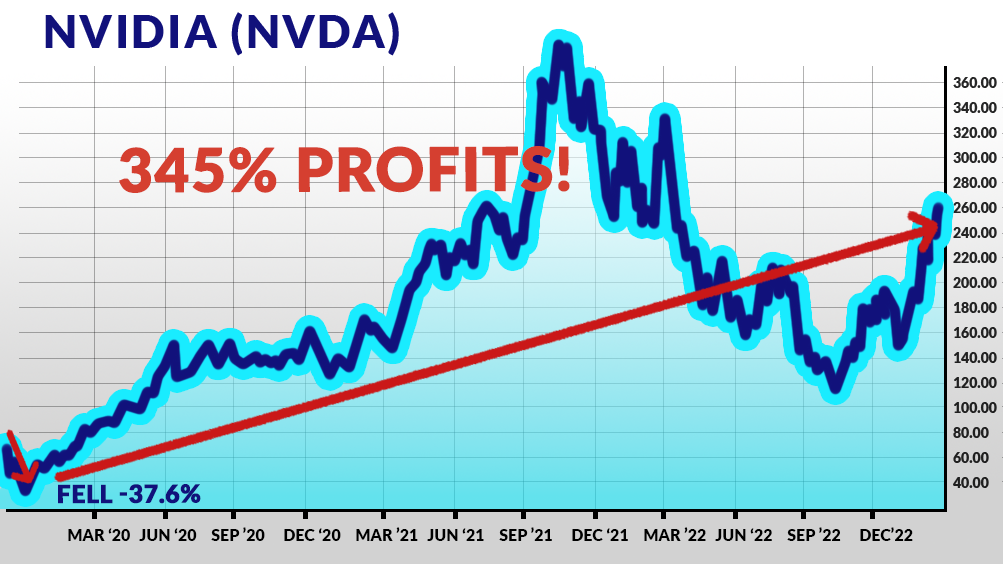

Yet these weren’t even the biggest winners — not by a long shot!

Many boomerang stocks saw far bigger gains — such as Nvidia (NVDA), which soared 345% following its temporary sell-off in 2020…

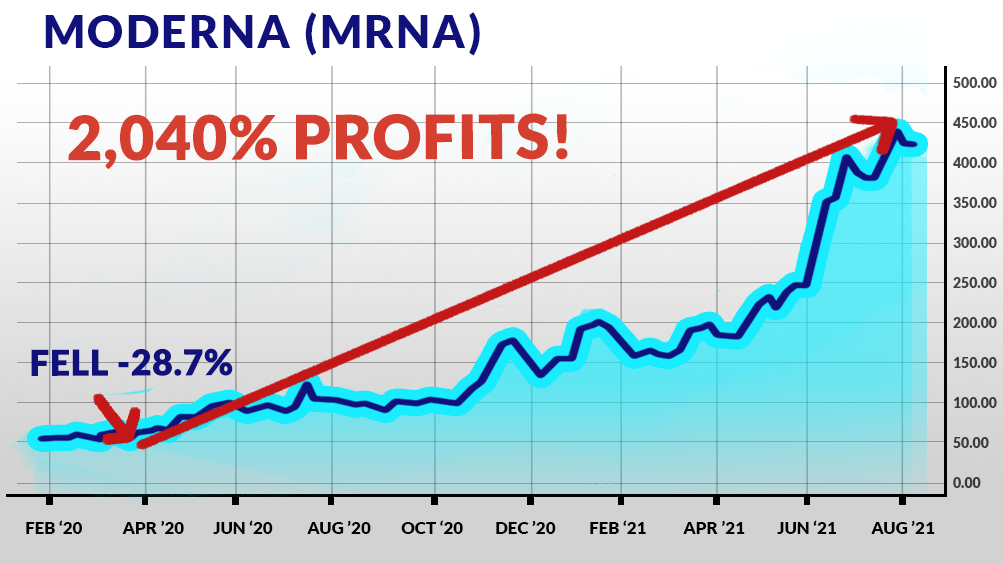

… and Moderna (MRNA), which handed investors profits of 2,040% — or 20 times their money — when shares jumped from a low of $21 in 2020 to $455 in the summer of 2021.

And here’s why this is even better news for us today:

In August 2022, Biden signed his administration’s first and likely only significant piece of legislation, the $739 billion “Inflation Reduction Act” with not a single Republican supporting the bill.

Economists insist the law has done little to reduce inflation and could even make it worse.

The nonpartisan Congressional Budget Office estimates the law is likely to change the inflation rate by less than 1/10 of 1%.

In reality, the law represents a historic giveaway program for progressive climate change activists and a significant escalation in Biden’s war against traditional sources of energy.

In addition, the law allocates $124 billion to the Internal Revenue Service for beefed up tax enforcement and the hiring of 87,000 new agents whom the IRS at one point said must be ready to use “deadly force” against fellow Americans.

Yet, while the law represents a huge setback for working families by doing nothing to address record-high cost of living, it paradoxically could result in windfall profits for investors.

That’s because Biden’s anti-growth economic policies have created HUNDREDS of opportunities like those I mentioned earlier!

- These are companies cashing in big time despite Biden’s trainwreck economy… companies that…

- Have posted record profits year over year and are continuing to make money hand over fist…

- Have little to no debt…

- Consistently pay out dividends that increase every year…

- But whose shares investors can pick up for pennies on the dollar thanks to the struggling Biden economy.

And how do you find companies like these?

Well, that’s the purpose of this brief message.

One of the Most Successful Stock and Option Trading Systems Ever Developed

For more than 19 years now, one of the oldest, most successful trading systems in Eagle Financial Publications’ history has had picks that, on average, DOUBLED investors’ money every month with trades like those above.

This “swing for the fences” home run trading system was developed by our own Dr. Mark Skousen, the CIA-trained Ph.D. economist and world-renowned investment adviser who is also a bestselling author, an acclaimed college professor, a stock and option guru, and, last but not least, a baseball fanatic.

It has had a total of 1020 recommendations, or “at bats,” since it began in 2005.

From those, Mark has closed out 300 triple- and even quadruple-digit winners.

That’s 300 times that the people who use this system have at least doubled their money.

That’s huge.

And doubling your money is the MINIMUM.

Over the years, this system has produced even bigger winners, like:

- 283% on Darden Restaurants

- 375% on MCG Capital

- 457% on Kenmare Resources

- 529% on Intel

- 633% on Alliance Bernstein

- 953% on Valero Energy

- 1,066% on H&E Equipment Services

- 1,287% on Southern Copper Corp.

- 2,058% on Icahn Enterprises

- 2,500% on AT&T

I don’t know about you, but most people are lucky if they double their money once in a single year.

This system does it, on average, 17 times a year, more than once per month on average!

That’s why Mark calls this his Home Run Trader.

Taking Mark’s total of 1020 recommendations and dividing it by the number of closed triple- or quadruple-digit winners (300) gives you 3.4.

So really, Mark has averaged hitting a triple-digit homerun every 3.4 times he recommends an investment or trade (those are Hall of Fame—worthy baseball numbers!).

Even with Mark’s occasional “strikeouts” — that is, stock or option trades that lose some money — his Home Run Trader system has posted an average annualized return of 56.71%.

That’s enough to turn a modest trading account of $20,000 into as much as $189,022.52 in just five years… and into as much as $1.79 million in 10 years.

But I didn’t send you this message today just to brag or talk about the past.

I sent it to you to help you change your future, to lay down the foundation for the retirement of your dreams.

And the best way I can do that is to introduce you to the trading service that can help you at least double your money on average 17 times a year.

How to Make Triple-Digit Profits Even When the Stock Market Is Plunging

Here’s an example of what I’m talking about:

Beginning in April 2022, the stock market as a whole was in free fall, with the S&P 500 plummeting 1,000 points (-21%) throughout May and June.

Yet even as Biden’s economy was unraveling, Mark spotted a huge short-term opportunity in DowDuPont, Inc. (DOW).

Recent supply chain issues had built up demand for the materials and chemicals that Dow provides, giving the company built-in growth for upcoming quarters.

This demand gave Dow a long-term projected earnings growth rate of a whopping 29.9%.

Plus, DOW was selling for only nine times expected earnings this year, compared to a 11.49 price-to-earnings ratio for its industry.

As a result, on April 12, Mark recommended investors buy shares of DOW at $61.53 a share. For more aggressive investors, he recommended they consider buying the DOW June $70 call options for only $0.75 (or $75 for one contract, $750 for 10 contracts).

Just as Mark expected, the stock went up even as the S&P 500 plummeted.

And while the shares gained a modest amount, the call options went berserk.

They soared from $0.75 on April 12 to a high of $2.15 on May 4.

Anyone who made this trade pocketed 153.6% in just 28 days.

Once he zeroes in on the right trade, Mark’s recommendation usually will come in two parts:

A recommendation for a stock and, for more aggressive traders, a paired option trade to go with it.

Mark trades options because that’s where the biggest profits usually are: A stock may make a move of 5% or 10% in a 60-day period, but an option can see gains of 100% or more in the same time frame.

Here’s another example:

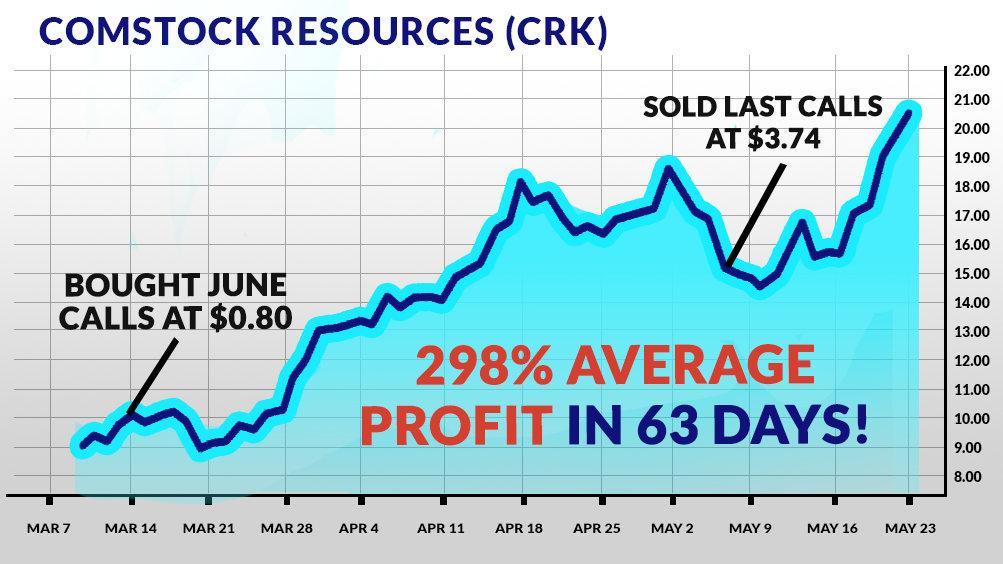

On March 7, 2022, Mark’s home run trading system saw a huge short-term opportunity in Comstock Resources (CRK).

Based in Frisco, Texas, Comstock is a leading independent natural gas producer that is focused on the development of the Haynesville shale in eastern Texas and northern Louisiana.

The company has 5,629 billion cubic feet equivalent (BCFE) in proved reserves, 460 BCFE in annual production and approximately 2,000 high-return drilling locations.

In short, Comstock is a high-quality natural gas play with a proven track record of successfully developing shale reserves — and a dirt-cheap valuation.

At the time, the stock was trading at $9.82 a share. Mark recommended his followers buy the stock at the market — and if they wished, buy the June $12 call options for just $0.80 each (or $80 per contract).

You could have purchased 10 contracts (1,000 shares) for $800 or 20 contracts (2,000 shares) for $1,600.

Compare that with forking over $9,820 to purchase 1,000 shares outright or almost $20,000 for 2,000.

(You can see what a huge difference using call options makes when it comes to how much you risk on each trade.)

So, how did CRK work out?

The stock rose nicely over the next two months, gaining 52.7%.

But the options took off like a rocket: shooting up to a high of $2.74 each from Mark’s initial recommended price of 80 cents.

That was almost quadrupling your money in just 63 days.

You could have turned a $1,600 investment into $6,368 — or $3,200 into $12,736 — in just two months.

And remember, this all happened in March and April 2022, when the stock market was in free fall!

Many investors were losing tens of thousands of dollars… yet investors who made this trade saw profits of 298%.

Here’s another example: Asana Inc. (ASAN).

Based in San Francisco, Asana operates a digital work management platform that allows teams to get work done faster by keeping everyone connected and able to see what their teammates are doing.

Like Slack’s Cinderella story from last year (before it was acquired by another company), Asana is being widely adopted by businesses everywhere due to COVID-19-forced remote working.

And as remote working seems to be taking hold for the long term, Asana is poised to benefit. Sales are growing at a 70% annual rate. And the firm’s subscription model creates strong recurring revenue.

In early February 2022, Mark recommended investors consider buying Asana when it was selling for $48.87 a share, down 65% from its recent high of $141.

At the same time, Mark recommended investors consider buying the May $70 call options for $3.40 (or $340 per contract of 100 shares).

Well, just as Mark anticipated, the stock saw a dramatic jump, soaring 22% to $60 per share in just two weeks.

But the options did 10 TIMES better!

The options Mark recommended at $3.40 soared to a high of $11.65. Mark recommended selling off the option positions in stages, so the average net gain was “only” 225.8% in 15 days.

Think about that: Everyone you know is panicking over the stock market being in free fall… and you’re banking 225% in just two weeks.

Of course, Mark also makes money when the market is rising. In fact, a lot of money.

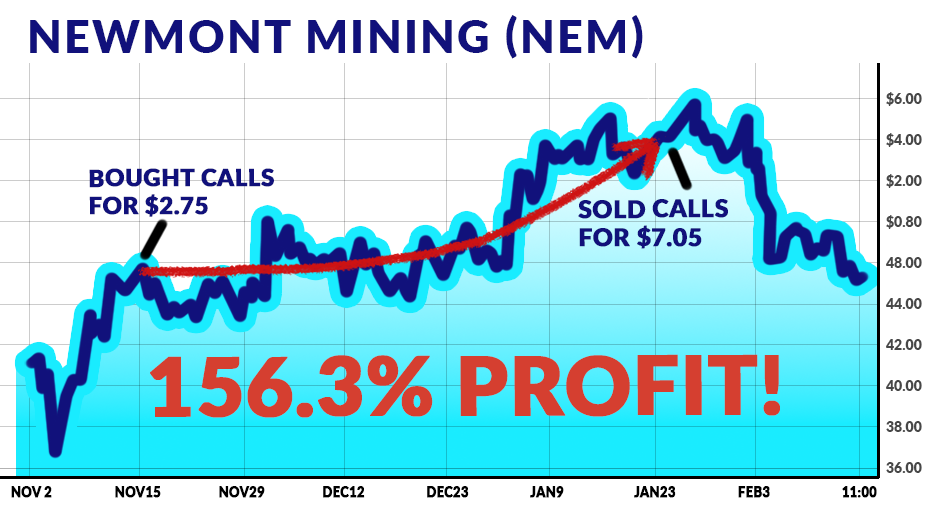

For example, in January 2023 he closed out a trade on Newmont Mining Corp (NEM) that banked 156% gains in 70 days.

With gold stocks inexpensive relative both to their traditional valuations and to the price of gold itself, Newmont had been trending upward. Plus, the shares paid a 4.73% dividend while they were moving upward.

As a result, on November 14, 2022, Mark recommended investors buy Newmont for around $46.51 per share – and consider buying the March $50 calls for only 2.75 – or $275 per contract.

The market had been trending upward since hitting a low in mid-October and Newmont kept inching upwards as well.

The shares hit $47.19 per share on January 23, 2023, when Mark recommended investors take their profits for a modest gain of 2.64%.

But the call options soared!

By January 24, 2023, the Newmont $50 calls were selling for as high as $7.05 – or $705 per contact.

That represented a gain of 156.3% in just 70 days.

Every $2,750 invested in this trade could have turned into as much of $7,050.

I’ll explain in a moment how you can get trades like these for your own account.

But first let me tell you about the genius behind this home run trading system — and how he is able to identify triple-digit opportunities even during a recession and bear market!

40+ Years of Home Run Trading.

As you may know, Mark is the author of more than 25 books on economics and investing, including the bestseller “The Making of Modern Economics,” and a former professor of economics and finance at Columbia Business School.

Steve Forbes, chairman of Forbes Media and editor-in-chief of Forbes magazine, bestowed on Mark a “Triple Crown” in economics for his work in economic theory, history and education.

Mark was also recently named one of the world’s 20 most influential living economists.

But unlike many economists, Mark has always had one foot planted firmly in the real world.

In addition to his theoretical work, Mark has spent decades refining his stock and option system to maximize total returns over time.

Again, I’m sharing all this NOT to toot Mark’s horn but so you can trust him when he tells us…

There’s Never Been a Better Market for Home Run Trades Than Right Now!

The fact is, everyone knows that the slowdown in the U.S. economy, thanks to Biden’s anti-growth policies, has created HUGE opportunities.

Some of America’s most profitable companies are now selling for 50 cents on the dollar or less.

And that means there’s never been a better market for hitting home runs than right now.

Plus, the pent-up demand in the post-COVID-19 economy is real — and many companies are posting record profits.

And the U.S. government and Federal Reserve continue to spend TRILLIONS of dollars on COVID-19 relief, infrastructure and other projects in an effort to jump-start the economy.

Whether you agree with that or not, the fact is all that cash is fueling a rebound in certain stocks.

So how do you locate home run plays like these exactly?

Well, without getting into the weeds, and boring you to death, here’s…

How It Works — Dr. Skousen’s Five-Point Home Run System

After 19 years, Mark has refined his stock and option picking system. I could tell you exactly how he got to this point, but it would be a long story.

So let me cut to the chase.

Basically, Mark only considers stock and option trades that fit the criteria of his five-point home run system.

The more of the five points they actually demonstrate, the stronger the recommendation.

Home Run Point #1:

Earnings, Earnings and More Earnings!

The first criterion Mark uses to identify home run opportunities is earnings — and more specifically, Positive Earnings Surprises.

You see, he recommends buying shares and options on a stock as momentum is building.

As analysts raise expectations for the next quarter, both investment types can take off.

Even a small 5% to 10% rise in a stock’s price can result in a 50% to 100% increase in a corresponding option.

Positive Earnings Surprises usually open the floodgates for institutional buying.

Recent examples include the 460% Mark’s followers bagged on Valero Energy Corp., the 306% they made on Brinker

International and the 149% earned on Cisco Systems, just to name a few.

Home Run Point #2:

History of Rising Dividends

Along with earnings, Mark likes to see companies sharing the wealth with their shareholders. That’s why his second criterion in picking stock and option trades is a history of rising dividends.

A lot more goes into this calculation than many people realize: whether a company is vital and growing… how well its products are selling… how fast earnings and cash flow are multiplying… and whether the company can continue to maintain a high level of profitability.

Mark takes a hard look at all these factors to see whether a company’s history of dividends is sustainable and likely to continue to rise going forward.

And if that’s the case, he moves onto the next criterion when considering a stock or option trade:

Home Run Point #3:

Heavy Insider Buying

Third, Mark looks at what he calls “heavy insider buying.”

He contends that while insiders SELL stocks for any number of random reasons — such as buying a house or paying college tuition — they generally BUY shares only when they know the company is going to do better than expected.

Mark likens this to stealing the other team’s signals in baseball… and it’s all perfectly legal!

In most cases, insider buying can tell you whether a stock is likely headed up or down. If a CEO or top executive is NOT buying more shares of their company stock, that can be a sign that they know something the public does not know — and it’s not good news.

On the other hand, heavy insider buying can point to something big coming down the pike.

It’s an indicator that Mark uses to its full potential, bagging 531% on H&E Equipment Services, 529% on Intel Corp., 380% on Medical Properties Trust and 209% on Crown Castle International.

Home Run Point #4:

Wall Street Upgrades

The fourth criterion that Mark looks for when identifying potential home run plays is what he calls “Wall Street Upgrades.”

It may sound obvious, but many technical traders ignore this basic fundamental trading tenet.

They can’t see it because they are looking only at charts. They are not looking at the bigger fundamental picture as a whole.

You see, when major investment banks put out a “strong buy” or “outperform” rating, billions in institutional money almost always flow into these stocks — and that flood of cash pushes the stock price higher.

Analysts upgrade the stocks, institutions pile in, it gets reported in the press and the stock prices rise.

Sadly, the little guys miss out on the profits because they come in too late.

However, thanks to the extensive research done by Mark and his staff, he is able to make a recommendation to buy before the analysts make their upgrades.

Wall Street upgrades played a crucial role in many of Mark’s home run recommendations, including 200% on AbbVie Inc., 173% on Trinity Industries, 161% on Eldorado Gold Corp., 152% on Zynga Inc. and 104% on Entertainment Properties.

As you can see, Wall Street upgrades can be a very profitable indicator to use when investing in stocks and options.

Yet, there is one more factor he considers…

Home Run Point #5:

Takeover Rumors

The fact is, nothing makes a stock pop faster and an option turn into a four-bagger than a takeover bid, whether or not it comes to fruition.

As a result, Mark’s home run trading system also screens for stocks that are merger and acquisition candidates.

This is where his worldwide army of contacts, built up over decades, really comes in handy, as they help him separate fact from fiction… and move on the opportunities that aren’t just rumors.

Powerful Combination That Identifies Winner After Winner!

The more of these five home run points a company exhibits, the stronger the recommendation will be…

That’s how Mark’s home run trading system identifies the very best stock and option trades with the highest probability of success — even during a bear market.

Here’s another example of how it works: Super Micro Computer, Inc.(SMCI).

Super Micro Computer is a manufacturer of high-performance web servers and storage systems.

It has a history of earnings surprises, is rated a “strong buy” by Wall Street analysts and has seen its net earnings before interest and taxes increased by SEVEN since 2019, from $96 to $700 million.

As a result, Mark recommended buying SMCI shares on October 24, 2022, when they were selling for around $ $63.20 per share.

At the same time, he also recommended his followers consider buying the February $70 call options for the low price of only $4.85 — or $485 per contract.

The stock shot up 32.9% over the next 42 days, from $63 a share all the way to $84.

But the options did almost EIGHT TIMES better, more than tripling investors’ money in the same period.

The call options rose from $485 per contract to an average of $1,738 per contract by November 28, 2022, when Mark recommended taking profits.

That was a gain of 258% in just 35 days.

A modest investment of $2,425 would have grown into $8,690 — and $4,850 would have grown into $17,380.

This is what the home run trading system has done for 19 years running, helping investors average one “home run” (triple-digit gain) every four trades.

Of course, Mark also gets a few “base hits” along the way, such as the solid 68.7% profit his followers bagged in 28 days on Ovintiv Inc (OVV) in June 2022…

… or the 91.3% gains they made in a month in August 2022 on Plains All American Pipeline LP (PAA).

But then there are times when the term “home run” doesn’t adequately describe the mega-winners Mark’s picks sometimes produce.

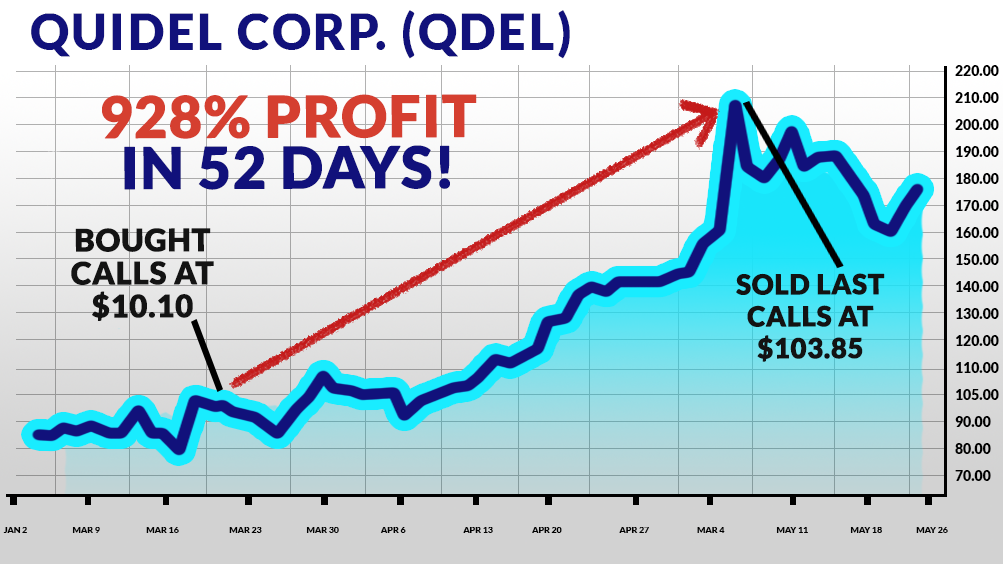

Like the 925% profits his followers bagged in May 2020 on Quidel Corporation (QDEL).

Mark recommended Quidel in March 2020, after the big COVID-19 sell-off. His home run trading system had flagged it as an outstanding play and he knew the downturn was due solely to COVID-19-related panic.

Mark recommended Quidel shares when they were selling for $88.83 each — and at the same time he also recommended buying the June $100 call options for $10.10 each ($1,010 per contract).

Well, he was right on the money: The COVID-19 sell-off turned into the biggest bounce-back in recent stock market history.

QDEL shares doubled in value (up 107%), rising from $88.83 when Mark recommended them to $184 per share by May 13.

And as you might expect, the call options went berserk.

They rose from $10.10 per contract to $103.85 per contract by May 11, when Mark recommended closing the position.

If you had held on to those calls until the end, you would have made an eye-popping 928% return in just 52 days.

Enough to turn every $5,000 invested into $51,925 — and every $10,100 into $103,850.

That is what we call a “grand slam”!

Of course, you never HAVE to play the options Mark recommends. That’s entirely up to you.

However, by accepting a little more risk to trade options, you can tap into the same system that has helped traders rake in 100% gains every four trades on average.

But don’t take my word alone on this.

Here’s what some of Mark’s subscribers have to say about his recommendations in Home Run Trader and other services:

Kenneth M. of Rancho Mirage, California, wrote to say:

Jackie T. of Gardnerville, Nevada, is also delighted with the results she has had:

Ruth B. of South Haven, Michigan, wrote to tell us:

Here’s how you can join successful traders like these and cash in on Mark’s “out of the park” mega-winners…

Start Hitting Your Own

Moonshot Home Runs Today

All it takes is joining the long list of winners who are part of Mark’s Home Run Trader advisory service.

Simply put, it’s his best and biggest moneymaker of all.

When I say “best,” I’m talking in terms of longevity — 19 years and counting for this system.

And when I say “biggest moneymaker,” I mean this trading system has knocked out the most triple- and quadruple-digit winners of any of his services by far.

As I said before, 300 home runs (100% gains or better) out of 1020 recommended trades at last count — since 2005.

That averages out to more than 17 money-doubling, triple-digit winners each year.

Think for a minute about what that means…

Over the past 19 years, subscribers to Home Run Trader have made money through the…

- Biden recession and bear market

- COVID-19 crisis and lockdowns

- 2008 financial meltdown

- 2000 dot.com crash

- Longest bull market in history

- Sharpest monthly drop ever (March 2020)

- Record highs for the markets

With this kind of track record of success, it’s not hard to see why the system has been around for almost two decades.

It works.

It works when the market is down. It works when the market is up. And it works when the market’s anywhere in between.

Yet at this point, you may be thinking…

Why Haven’t I Heard of This Before?

It’s not for lack of trying. We’ve been trying to get the word out for 19 years. And you can see why from the track record.

But Mark is an economist and a teacher by trade, so he never seeks the spotlight. That makes it tough for regular investors like us to hear about him…

Even if his Home Run Trader has churned out at least one 100% winner every month on average the whole time…

Does it work like that every time?

No, sometimes it takes more than a month to double your money, but usually it’s more than worth the wait…

- Like the 156.7% gains in 53 days on Cross Country Healthcare (CCRN)…

- Followed by the 345% gains in 31 days made on Sonic Automotive (SAH)August 2022.

- Or the 367% gains in 63 days made on Comstock Resources (CRK) in May 2022.

It’s hitting streaks like this that make me confident in Mark’s Home Run Trader system.

So confident, in fact, that I’m willing to make you this outrageous guarantee…

SPECIAL ONE-TIME OFFER:

Home Run Trader’s Slugger’s Guarantee: Hit 17 Home Runs This Year or I’ll Give You $1,995

That’s right.

Because Home Run Trader has averaged 17 triple-digit winners a year for 19 years…

Because Home Run Trader has knocked a whopping 300 triple-digit winners out of the park since it began in 2005 and…

Because Home Run Trader has helped investors at least DOUBLE their money every month on average…

As the publisher, I feel 100% confident making you this promise:

If you give Home Run Trader a try, I promise that you’ll have the opportunity to close out at least 17 triple-digit winners over the coming year.

If you don’t, I’ll give you $1,995 out of my company’s coffers for you to use as you wish — on any of Mark’s services.

You can use the cash to get a second year of Home Run Trader or to get an entire year of any of his other elite trading services: Fast Money Alert, 5-Star Trader or TNT Trader.

Whichever you choose, you’ll get it free… on me… for a full year.

I don’t make this offer lightly. I don’t relish handing over $1,995 if I don’t have to.

I’m just that confident… that after 19 years of consistently churning out triple-digit winners, Mark’s amazing Home Run Trading system will keep right on doing it.

And as I said earlier, today’s market couldn’t possibly be better for taking a shot at life-changing gains… and for swinging for the fences on your trades.

However, this guarantee does come with one condition…

Because I’m promising you 17 triple-digit winners over the coming year — and because the instant you accept this offer, you’ll get access to every one of Mark’s current stock and option trades — I can’t offer you the usual 30-day test-drive or trial run of this service.

It wouldn’t be fair to our existing paid subscribers.

If I did, I know that some people would take advantage of it, just to get a look at Mark’s current portfolio, get those trades and then quit.

I’m not saying you’d do that, but you’d be surprised how many people would…

So that’s why I came up with this special offer: I’m willing to put my money on the line… so you will give Home Run Trader a fair try for a year.

One other thing…

We can’t take everybody who wants to join at this time.

I wish we could, but in order to maintain the same success Mark has had for the past 19 years, we can only take on 100 new traders for this offer.

Plus, that’s the only way I’ll feel comfortable with my $1,995 guarantee offer. That’s $200,000 of my company’s money on the line.

By limiting it to just 100 new members, we can ensure our concierge, staff and customer support services will still maintain their standard level of excellence.

So I urge you to seriously consider this rare opportunity.

It may be quite some time before the service will be opened up to the public again — not until every one of those 100 new traders is comfortable with the service, making trades and, most importantly, reaping the profits.

So don’t wait. Click the button below to become a member of Dr. Mark Skousen’s elite VIP trading service, Home Run Trader.

Join the team that’s doubled its money every four trades on average for the past 19 years and start the clock on your own guaranteed 17 triple-digit winners in the next year.

If that’s still not enough to convince you to give Home Run Trader a shot, here’s what WILL convince you:

If you act right now — that is, in the next 10 minutes — you can claim one of the 100 available spots… and I’ll also GIVE you an instant $1,000 cash rebate.

So, for you, the one-year price of Home Run Trader is only… $995.

That’s an entire year at more than 50% off the regular price of $1,995.

Plus, you’ll still get my slugger’s promise of 17 triple-digit winners in the next year…

And you’ll still get the full $1,995 value of the performance guarantee.

I can’t do better than that.

To claim your $1,000 instant cash rebate, get the 17 triple-digit winners promised and lock down one of the 100 new

Home Run Trader slots while they’re still available, click the button below now.

Please don’t delay. Don’t “think it over.”

Step up to the plate now.

The fact is, this same special offer is being made now to Mark’s closest followers — people like you.

But soon it will be going out to a MUCH bigger audience and then perhaps even to the larger financial investing world.

So I can’t say for certain just how long these 100 new member slots will be available. But not for long, I’m sure.

To make sure you get yours, click the button below.

Sincerely,

Roger Michalski

Publisher, Eagle Financial Publications

P.S. Remember, this special guarantee offer won’t last, so grab one of the 100 available slots, collect the $1,000 instant cash rebate and enjoy the 17 triple-digit winners over the coming year.