My Investors Get a Giant Christmas Bonus – You Can Too!

I hope you all had a wonderful Thanksgiving last week with friends and family. My wife and I drove across America on our way to our new home in California, where we will be teaching at Chapman University.

We headed south through Texas, New Mexico, and Arizona to avoid a series of snowstorms and enjoyed a wonderful Thanksgiving with longtime friends Dave & Jane Phillips in Arizona. Dave is the president of Estate Planning Specialists, one of my recommended agents.

My subscribers always look forward to December and the holiday season. Why? Because my favorite investment pays us a special dividend every Christmas. (It also helps that this investment company is up 34% this year, and pays a generous monthly dividend to boot!)

‘American Dream Checks’

I call the payments “American Dream checks.” My subscribers get paid monthly checks that have kept up with inflation (it has a rising dividend policy), plus the Christmas bonus.

Santa’s gift check will be paid in a couple of weeks, but to qualify, you have to be a shareholder by Dec. 12. You have a week to get on board.

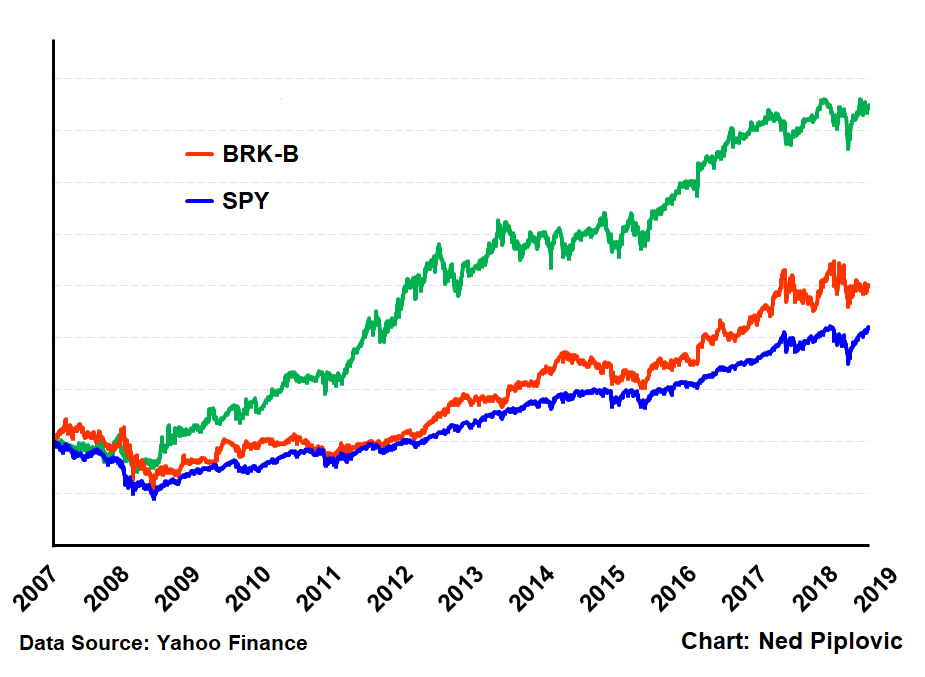

I’ve been recommending this stock for over seven years now. It went public in 2007, right before the financial crisis of 2008, and look how it has performed (it is the green line).

Notice that this investment fund has outperformed both the S&P 500 Index and Warren Buffett’s Berkshire Hathaway since inception in 2007.

And it’s still going strong, up 34% this year. Click here to learn how to collect your first American Dream Check — within the next four weeks.

My Investment Strategy: Sleep Well Growth & Income Stocks

I’ve been writing my newsletter, Forecasts & Strategies, since 1980 — we celebrate my 40th anniversary next year at www.freedomfest.com — and over the years I’ve developed a formula that really works.

It’s called “sleep well investing.” It has three parts:

- Invest in quality companies in growing industries. My companies are all making money.

- They must pay above average dividends.

- They must have a rising dividend policy.

Thus, quality stocks + above average yield + rising dividends = high total return.

Using this formula, my subscribers have beaten the market with less risk.

For more information on subscribing, click here. Or call Grant Linhares 202-677-4492.

A first year introduction to Forecasts & Strategies is only $99.95. Money back guarantee.

Happy holidays!

Good investing, AEIOU,

![]()

Mark Skousen

Looking for the Perfect Gift During the Holidays?

There’s good reason why the “Sage from Omaha,” Warren Buffett, considers my book “The Maxims of Wall Street” the perfect gift during the holidays for friends, investors, clients, students, money managers and stockbrokers.

I presented a copy to Charles Schwab last month, and he was happy to receive it. “I’m always anxious to learn more,” he said.

It’s fun and educational to read on every page. The book is divided by topics, such as growth vs. income, contrary investing, bargain hunting, the pros and cons of gold, etc. Plus, it includes lots of stories about J. P. Morgan, Joe Kennedy, Bernard Baruch and Jesse Livermore.

“Maxims” is the one and only compendium of financial adages, ancient proverbs and worldly wisdom — it has sold over 28,000 copies. Alex Green calls it a “classic.” It has been endorsed by Warren Buffett, Jack Bogle, Kevin O’Leary and Dennis Gartman, who said, “It’s amazing the depth of wisdom one can find in just one or two lines from your book.”

You can get an autographed copy for only $20 — and all additional copies are only $10 each. If you order an entire box of 32 books, you pay only $300. Plus, I pay postage and autograph each copy that is mailed within the United States.

If you order NOW, I’ll mail them right away — guaranteed to arrive before Christmas.

To order, call Harold at Ensign Publishing, toll-free 1-866-254-2057, or go to www.skousenbooks.com.

Upcoming Conference

Join Me for the Orlando MoneyShow, February 6-8, 2020, at the Omni Orlando Resort at ChampionsGate.

I will be speaking Thursday, Feb. 6, 9:30 a.m. about My Most Important Forecast & Strategy: When Will the Mother of All Bull Markets End? On Feb. 7, I will talk at 5:30 p.m. about The Best Offense Is a Good Defense: How to Beat the Market with My Five Favorite ‘War’ Stocks!

Other investment experts who will be speaking include Bob Carlson, Hilary Kramer and Bryan Perry. Register by clicking here or call 1-800-970-4355 and mention my priority code of 049278.

You Nailed it!

Chicago Economist Gets It: Bull Market on Wall Street Driven by Entrepreneurs, not Consumers

The news is out: U.S. shoppers went on a buying frenzy over the Thanksgiving weekend. Online purchases hit a record high, up 14% from last year, and even retail store sales rose 4.2%.

The Wall Street Journal immediately reported that consumers are keeping the economy alive. “U.S. shoppers have been the economy’s driving force over the past two quarters as business investment declined.”

But wait! The media bemoaned the fact that holiday buying season is short this year due to Thanksgiving coming a week late.

Fortunately, some financial economists know better. One is Brian Wesbury, chief economist at First Trust Chicago, who wrote earlier this week a great column, “Don’t Worry about the U.S. Consumer.”

Wesbury uses my gross output (GO) statistic to discuss the holiday robust sales and to refute the myth that consumer spending drives the economy. It’s a beautifully written article on how business is a far more important catalyst for economic growth than consumer spending (Say’s Law).

As he states, “it’s important not to let all the media attention on consumer spending distort the view of the way the economy really works. People can’t consume something until it’s been produced.

“Yes, according to conventional statistics consumer spending is 68% of gross domestic product (GDP). But GDP doesn’t count all economic activity; it uses the sales value of all [finished] goods and services (consumption and investment) to estimate production.

“By contrast, economy-wide ‘gross output’ includes not only business-to-consumer sales and investment but also what is not included in GDP, which is intermediate business-to-business sales, as well. Consumer spending is only 38% of economy-wide gross output. In other words, consumer spending is a much smaller part of total economic activity than GDP suggests.

“That’s why, as much as we like to see solid numbers on consumer spending, we see this as an effect, not a cause, of our bounty. The primary cause is the innovation and risk-taking of entrepreneurs. Which is why, if you want to know when the next recession is going to start, you need to pay careful attention to the environment for innovation and risk-taking, not how much people are spending.”

You can read it here:

https://www.ftportfolios.com/Commentary/EconomicResearch/2019/12/2/dont-worry-about-the-us-consumer

As Steve Forbes wrote me, “Your disciples are growing. Go GO!”

I should add that the latest second-quarter GO data show that the economy is recovering. To see my latest press release, go to https://www.grossoutput.com/2019/10/29/u-s-enjoys-a-modest-recovery-no-recession-in-sight/.