King Dollar — What It Means to Investors

The dollar has rallied sharply in the past month, continuing a bullish trend since late 2011. It has risen significantly against the pound, the euro, the yen, the Aussie dollar and the Mexican peso lately.

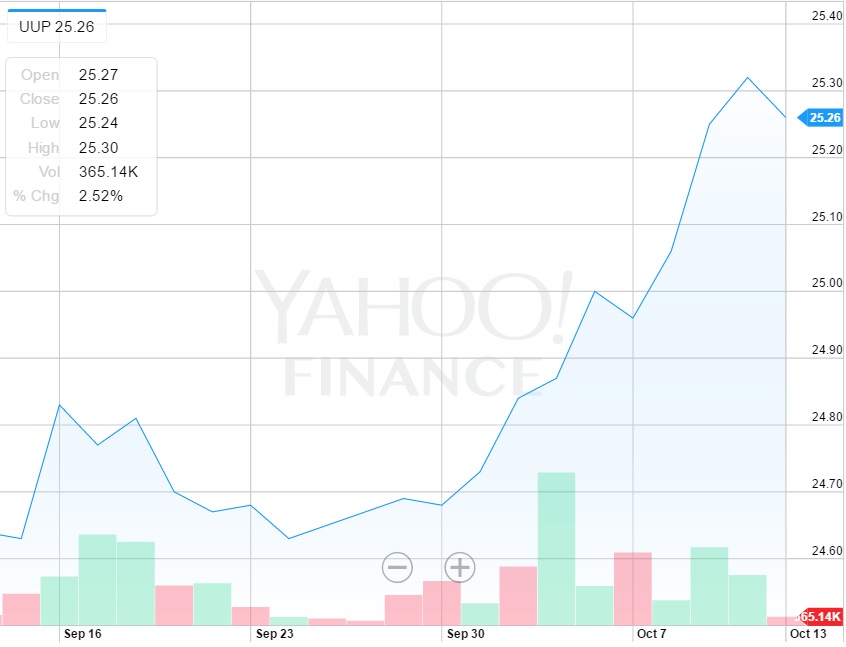

The dollar’s recent rise is reflected in the following chart of the PowerShares DB US Dollar Bullish ETF (UUP).

King Dollar is all the more amazing given that many doom-and-gloomers have been predicting the “imminent” collapse of the dollar. They know not the signs of the times!

There are several reasons for the dollar’s strength:

Europe and Japan are struggling again. After being hit with a $14 billion fine by the U.S. Treasury, Deutsche Bank has come under pressure and its stock has fallen by half. Japan continues to show weakness and is keeping interest rates low. Meanwhile, the Federal Reserve in the United States is threatening to raise interest rates, even as the United Kingdom, Europe and Japan are reducing theirs. Advantage, United States.

Earlier this week, I appeared on CNBC with Rick Santelli, talking about the strength of the dollar, the Fed’s easy-money policy and the continued “strangulation” of the economy by the current and most likely next president of the United States. Watch my three-minute interview here.

The first casualty as a result of King Dollar was the precious metals market. Last week, gold fell sharply to $1,360 an ounce, while silver dropped to $17 an ounce. My Forecasts & Strategies subscribers took profits on their mining stocks. As I like to say, “Never let a profit turn into a loss.”

Is oil next? Actually, the price of oil rose last week to $50 a barrel. Every commodity market responds to its own supply and demand situation, but if the dollar continues to show strength, oil prices could drop, too.

Gross output (GO) and gross domestic product (GDP) both are showing a weak economy and a mild business recession. But will a weak economy derail the bull market on Wall Street? Not necessarily. The stock market is always forward-looking, and I see that the Fed is now unleashing its one final tool to stimulate the economy: printing more money. The broad-based money supply (M2) is now growing at 10% a year, the fastest pace in five years. The Fed is fighting bad fiscal policy of higher tax rates and “strangulation” as a result of Obamacare, Dodd-Frank and Sarbanes-Oxley. It now appears that presidential nominee Hillary Clinton will win in November and, unfortunately, her economic policy positions show that she’s no Bill Clinton.

We continue to be 100% invested in quality companies that pay high-and-rising dividends. This “margin of safety” strategy has served us well, as we have beaten the market this year.

In case you missed it, I encourage you to read my e-letter column from last week on why Americans actually want Keynesian economics. This article, and many other past Investor CAFE columns, can be found on StockInvestor.com. I invite you to follow it on Facebook and Twitter.

Upcoming Conference

Global Guru Jim Rogers Predicts Collapse of British Pound, Will Address FreedomFest

In the early summer, legendary investor and fund manager Jim Rogers predicted that the British pound was heading for collapse after Britain voted to exit the European Union. The pound actually has been in sharp decline since 2008, when it was selling for more than $2. Now it’s down to $1.24, and could head lower. Rogers is also worried that Deutsche Bank will go broke, causing more headaches in Europe.

Rogers is one of the most successful investors ever, having achieved a 30% annualized return on his investments over the past decade. He was one of the first to recognize the new bull market in gold in the early 2000s. Clearly, it is worth listening to him.

My grandson Luke makes me laugh during 2014 in Singapore when he asks Jim Rogers to give advice to “small investors.”

I am happy to announce that Jim Rogers has agreed to speak at next year’s 10th anniversary celebration of FreedomFest, July 19-22, 2017, at Paris Resort in Las Vegas. Other financial experts coming to speak at FreedomFest include Nicholas Vardy (The Global Guru), Alex Green (Oxford Club), Adrian Day and Doug Casey. Keynote speakers confirmed include William Shatner, Robert Frank (New York Times columnist), Deirdre Nansen McCloskey (top economist and author), Conrad Black (Canada’s top publisher) and, of course, our co-ambassadors Steve Forbes and John Mackey. For more details, go to http://freedomfest.com.

This is going to be our biggest and best FreedomFest ever, so now is the time to plan a trip to Vegas in July. We are expecting a record turnout, so I encourage you to sign up now and take advantage of our “early bird” discount — save $100 over the registration fee — which ends on Jan. 15.

Our registration page is now up and running, so go to http://freedomfest.com/register-now/. You also can register by calling our toll-free number 1-855-850-3733, ext. 202, and talking to Jennifer, Amy or Karen. Call today!

You Blew It!

President Obama’s Unfinished Business

“I am proud of what my administration has accomplished these past eight years.” — President Barack Obama

Earlier this month, President Obama was invited to write a guest column for The Economist on “The Way Ahead: Unfinished Business in Economic Policy.”

In his essay, the president said he is happy with his economic policies, especially leading America out of the Great Recession. He claims, “Wages have risen faster in real terms during this business cycle than in any since the 1970s.” I’ve yet to find an economist who agrees with that statement.

Even if it is true, I’m not sure Obama had much to do with it. The fact is that the Federal Reserve did more to get us out of the slump than any fiscal policy to come out of Washington in the last eight years. Obama raised taxes and increased stifling regulations (Obamacare and Dodd-Frank) during his years in office. “We don’t begrudge success,” he wrote, but his policies have taxed and strangled successful entrepreneurs.

The Economist criticized the president’s essay for “barely mentioning the stifling role of regulations in deterring investment, dampening productivity growth and dulling innovation.”

President Obama is going to leave office with $20 trillion in national debt, a weak economy and a legacy of overregulation and excessive taxation.

Sadly, the next president, most likely Hillary Clinton, may not have the guts to confront the challenges of the 21st century — unfunded pension liabilities, heavy long-term debt, excessive regulation, a lousy public education system, criminal injustice and oppressive taxation.

Ben Franklin once said, “A virtuous and industrious people may be cheaply governed.” Unfortunately, government is anything but cheap these days. Where are the virtuous and industrious people to make it cheap again?