Is Your Success Due to Luck or Skill?

“You didn’t build that.” — President Barack Obama

Next week’s big 10th anniversary FreedomFest will include a number of debates, including Trump debate II…. “Saul Alinsky, Radical Revolutionary or Freedom Fighter”… “Can you Really Beat the Market?”… and “Should We Tax the Rich More?” pitting Steve Moore against Lanny Ebenstein, a professor at the University of California at Santa Barbara.

But for me, the most interesting debate will be “Is Success Due to Skill or Luck?” based on the recent book “Success and Luck: Good Fortune and the Myth of Meritocracy,” by Robert Frank, a professor at Cornell University and a New York Times columnist. Basically, he argues that lady luck is far more responsible for your success than talent and hard work.

The strong implication is that because you really aren’t responsible for your success, your hard-earned salary and profits can be taxed away at a rate as high as 90%.

The debaters are Alexander Green, investment director at the Oxford Club; Larry Elder, radio talk show host from Los Angeles; and Michael Shermer, publisher of Skeptic magazine and columnist for Scientific American. The moderator is Nicholas Vardy, a graduate of Harvard University’s law school who is known in the investment community as the “Global Guru” and the writer of the Smart Money Masters newsletter. I can’t wait for the debate to start.

We all know about friends who have gone to the top schools and have worked hard, and yet somehow fail at life and end up barely surviving financially, while others who dropped out of school ended up millionaires or even billionaires. So is success, that is, financial success, just random? Being in the right place at the right time?

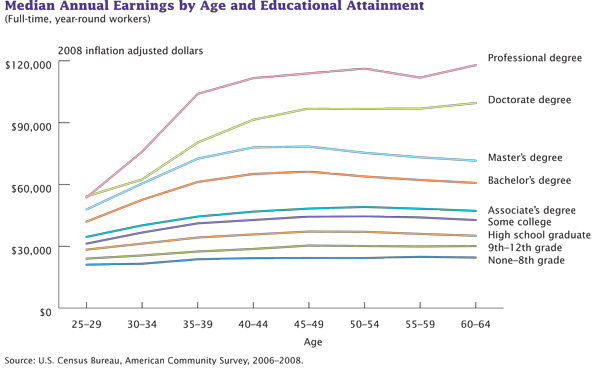

No, I don’t think so. Empirical studies show very clearly a strong correlation between the level of education you obtain and financial success.

From the chart above, it’s clear that a student who goes on to college, or graduate school, does much better than those who only get a high school diploma or drop out. There are always exceptions to the rule, but the evidence is overwhelming that you have better chances of financial success in life if you work hard to get a first-rate education. You make your own luck in life.

Alex Green recently wrote a great column on this subject. Read it here:

http://www.investmentu.com/article/detail/53717/business-investment-success-skill-luck#.WWdzo73bidk.

I hope this debate here encourages you to go to our website, www.freedomfest.com, and join us, or call our toll-free number 1-855-850-3733, ext 202, and sign up for next week’s big show. Use code FS2017 to get $100 off the registration fee. Click on “agenda” and scroll down to see all 300 speakers, panels and debates.

Steve Forbes says it all: “FreedomFest is the Gold Standard of all conferences. I attend all three days!” (By the way, he turns 70 during our conference, and we are honoring his life and ideas at the Saturday night banquet.)

See you in Vegas. Fly there, drive there, bike there, be there!

You Blew It!

Single-Payer Health Care Saves Money?

Robert Frank wrote an op-ed in the New York Times last week called “Why Single-Payer Health Care Saves Money.” He points out that ObamaCare “is an inefficient system” and should be replaced with a single-payer system that will sharply reduce administrative costs, and government agencies can negotiate much better terms with service providers like UnitedHealth Group.

But what Frank ignores is the incredible cost of a single-payer system that allows everyone to get a valuable commodity called “medical care” at no marginal cost — in essence, for free. The taxpayer foots the bill. This is the system in place in England, Canada and most of Europe, often resulting in shortages (long waiting times for surgery, MRIs, etc.) and lack of access to the latest biotechnological breakthroughs that American firms provide.

Professor Frank should know better. He is an economics professor at Cornell and apparently doesn’t understand the accountability or “user pay” principle. When third parties, whether it is the government or insurance companies, pay the entire amount of a medical bill, there is a strong incentive to overuse such valuable services or products. That’s why shortages arise and fraud occurs.

The best solution to the health care debate is the “welfare” principle of economics: You help those who need help but you don’t help those who don’t need help. Most medical services should be decided and paid for by individuals and companies through Health Savings Accounts and insurance products that cover catastrophic illnesses. For those who can’t afford basic medical assistance, a combination of private charities and state-level assistance should be devised. But these welfare services should be means tested, not universal.