‘How Much of the Economy is Consumer Spending? Actually Only 30%!’

Last week Alex Green, the chief investment strategist of the Oxford Club, wrote an article on the importance of Christmas in the economy and googled the question, “How much of the economy is consumer spending?” The responses came up as 70%.

This is a common response based on a fallacy in the media — that the economy is consumer-driven because 70% of gross domestic product (GDP) is made up of consumer spending. Based on this myth, reporters are always worried that consumers will stop or reduce their spending during the holidays, leading to a massive recession.

It’s a false notion, based on a misconception of what GDP is. It does not measure all economic activity. The reality is that GDP measures only the value of finished or final goods and services and leaves out all the business-to-business (B2B) transactions necessary to bring unfinished intermediate products to final use. Consequently, GDP way overestimates consumer spending and vastly undervalues business investment and spending in the so-called “make” economy.

Fortunately, the federal government (Bureau of Economic Analysis in the U.S. Commerce Department) now produces a broader, more accurate measure of economic activity called gross output (GO). I’ve been the biggest advocate of GO since writing my book, “The Structure of Production,” in 1990. The book is now in its 3rd edition.

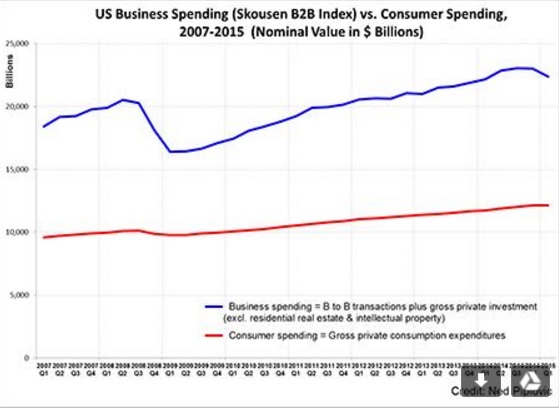

Adjusted GO amounted to $39.0 trillion in 2015, and only $12.2 trillion of it is linked to personal consumption expenditures. That means that consumer spending makes up only 30% — not 70% — of the economy. As much as 60% of economic activity is business spending and investment. See the chart below comparing business and consumer spending.

What drives the economy? As CNBC commentary Larry Kudlow concludes, “Though not one in a thousand recognizes it, it is business, not consumers, that is the heart of the economy. When businesses produce profitably, they create income-paying jobs and then consumers spend. Profitable firms also purchase new equipment because they need to modernize and update all their tools, structures and software.”

Remember that the next time you hear that consumer spending drives the economy.

Thank you, Subscribers!

I end this Skousen CAFÉ with a big thank you to all my subscribers for another profitable year at Forecasts & Strategies. It has not been easy to stay fully invested in the face of a Chinese stock market crash, the slump in oil prices, terrorist attacks around the globe and constant doom-and-gloom predictions. Bull markets climb a wall of worry. But if you have held on, you are ahead of the game.

I’d also like to thank all of you who came to my big FreedomFest show in Las Vegas in July and witnessed the biggest turnout ever (2,500 attendees) and major media coverage. And I do hope you will join us next year at the Global Financial Summit in The Bahamas, March 13-16 (gfs.freedomfest.com), and FreedomFest , July 13-17 (www.freedomfest.com). They’re great places to learn, network and celebrate liberty.

Finally, let me thank all those of you who have ordered and read the new 4th edition of “The Maxims of Wall Street.” There’s a lot of wisdom in those pages. As one subscriber said to me recently, “There’s more wisdom in your book than 4 years of college education!” I’m still taking orders for the holidays: You pay only $20 for the first copy, and all additional copies are only $10 each. All will be personally autographed, and I pay the postage for domestic buyers. I’m offering “half off” because I know “Maxims” makes a great gift for friends, relatives, business colleagues, investors, your favorite stockbroker and money manager. Many people order a whole box of 32 copies. The price of a box of books is only $300 postpaid. For all foreign orders outside of the United States, add $10 per book. To order your copies at this super discount, call Ensign Publishing toll-free at 1-866-254-2057 or go to www.miracleofamerica.com/maxims.

You Blew It! Giving Money to the Treasury to Pay Down the Debt is a Waste

The Treasury Department reported that a taxpayer just sent the government a check for $2.2 million to “help reduce the national debt.” The national debt is now at around $19 trillion and rising.

Perhaps it was Warren Buffett, who says that America’s millionaires should pay more taxes.

Another citizen, a New Yorker, told his representative that he hands over $43,357.37 every month to the U.S. Treasury to reduce the debt.

In the past year, citizens voluntarily have sent in nearly $3.9 million outside of paying taxes to help fund the government.

I think this is a big mistake.

I have two reasons. First, it’s transferring savings from the productive private sector to the unproductive public sector. Does anyone think that the government can do a better job with that $3.9 million than private enterprise?

Second, giving money to the government will not necessarily reduce the debt. It actually may encourage the government to spend more money in a reckless manner. Until there actually is a debt limit, there will be no reduction in government spending or the national debt.

What should citizens do with their extra funds? I recommend either keeping the money invested in banks and the financial markets, which can be used to encourage private enterprise and business activity, or giving it to a free-market foundation or think tank such as the Cato Institute.

Several years ago, I suggested that those who don’t need their Social Security check should arrange through their bank to give the funds away automatically to their favorite charity or foundation. I encourage you to read that column to fully appreciate the merits of my point of view.

In case you missed it, I encourage you to read my e-letter column from last week about why the bears are wrong about current market conditions. I also invite you to comment in the space provided below my Eagle Daily Investor commentary.

Good investing, AEIOU,

![]()

Mark Skousen

Presidential Fellow, Chapman University

Wikipedia

Newsletter and trading services

Personal website

Upcoming Conference

Special Announcement: Subscribers to the Skousen CAFE should be happy to know that for the first time in two years, I am hosting the Global Financial Summit, a special private investment seminar, in The Bahamas. The focus will be on “High Income & Fast Money Investing” — combining my two most successful trading services!

My “All Star High Income & Fast Money” experts for this exclusive private meeting will include Alex Green, investment director of the Oxford Club and editor of three trading services (Momentum Alert, Insider Trader and True Value Alert). Alex is rated the #5 best investor according to Hulbert Financial Digest. I’ve also confirmed Martin Truax, vice president at Raymond James, whose “income & growth” portfolio has more than tripled during the past 10 years. He and his partner Ron Miller also have developed a highly successful trading system using “red” and “green” signals to determine when to get in and out of markets (they flashed “sell” in May and now are flashing “buy” — good calls!).

Our keynote speaker will be Steve Moore, the chief economist for the Heritage Foundation and the #1 columnist for the Wall Street Journal, who will speak on “Money & Politics 2016: The Inside Story for Private Investors.”

I soon will be announcing more top experts in portfolio management, tax and estate planning and foreign investing. But I want to encourage you to sign up now and take advantage of our special “early bird” discount — $200 off the retail price for Skousen CAFE subscribers if you register by Dec. 31. The price is only $495 per person/$795 per couple with the discount. And hotel rates at the five-star Atlantis Resort are only $209 per night. We are limiting this private meeting to 200 attendees only. To sign up, call Karen or Jennifer at 855-850-3733 ext 202, email info@freedomfest.com or go to gfs.freedomfest.com.

The dates are March 16-19, 2016, at the five-star Atlantis Resort on Paradise Island, Nassau, The Bahamas. This is during high “Spring Break” season, so I urge you to make your flight reservations now.

I soon will be announcing more top experts in portfolio management, tax and estate planning, and foreign investing. But I want to encourage you to sign up now and take advantage of our special “early bird” discount — $200 off the retail price for Skousen CAFE subscribers if you register by Dec. 31. The price is only $495 per person/$795 per couple with the discount. And hotel rates at the five-star Atlantis Resort are only $209 per night. We are limiting this private meeting to 200 attendees only. For more information, and to sign up, go to gfs.freedomfest.com, or call Valerie at 1-855-850-3733.