Win in the 7th Year! Joel Osteen’s Positive Gospel Message to Investors

“I believe you are coming into one of your seventh years. The seventh year is when you break free from any limitations that are holding you back.”

— Joel Osteen

Yesterday I met Joel Osteen, the prosperity preacher and TV evangelist from Houston’s Lakewood Church. My wife introduced me to him but I had enjoyed his sermons for a number of years. He’s not your standard hellfire and damnation pastor. He’s always upbeat, telling down-to-earth stories without being overly emotional.

Joel Osteen and I discuss his latest book at a Barnes & Noble bookstore in New York City.

I asked Joel if he ever speaks at investment conferences, and he said that he doesn’t have time to speak at non-religious events. He focuses on his ministry.

But I do think his eternal optimism can apply to us in the investment world. Too often, investors panic when the market suddenly turns down and gets caught up in the pessimistic augurs of the doomsayers who pervade the media these days. Today, I just received an email blast from former Congressman Ron Paul, who is predicting a “collapse” in the dollar within days — “in the fall of 2015.” He and other Cassandras have been scaring seniors over the past 3-4 years by predicting the collapse of the dollar, a stock market crash and a rally in gold.

So far it hasn’t happened, and those who sold their stocks and bought gold have seen their investment portfolio do poorly. Meanwhile, the dollar is strong (making the cover of the Economist this week), stocks have doubled in three years and gold has gone nowhere.

It reminds me of J. P. Morgan’s warning, “He who is a bear on the United States will eventually go broke.”

Investors need to listen more to Joel Osteen’s optimistic sermons on Sunday morning so that they will be less apt to panic on Monday morning. (“Never sell stocks on Monday,” I have been known to say).

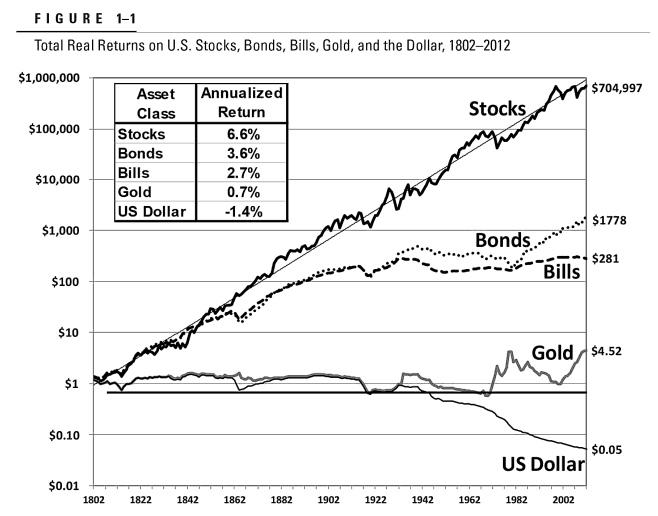

The fact is that for the past 100 years on Wall Street, stocks have risen two-thirds of the time and fallen only one-third of the time. It pays to invest in stocks for the long run. As long as the United States is primarily a free-market economy, the stock market is likely to be the best place for investors to make money.

Joel Osteen talks about the Seventh Year being a time of opportunity. We now are entering the seventh year of recovery from the devastating financial crisis of 2008. Some people are predicting another bear market. We have not seen a serious correction of 20% or more since 2009. Perhaps one is due. When it happens, don’t panic. Look for bargain opportunities. As J. Paul Getty, another optimist about America, said, “Buy sound securities when they are priced low and hold them for the long pull.”

The following chart by Jeremy Siegel demonstrates why stocks are better than bonds, cash or gold over the long run.

Source: Jeremy Siegel, Stocks for the Long Run, 5th ed. (2014)

New Fourth Edition of ‘Maxims of Wall Street’ Is Available — at Half Price!

J. Paul Getty, America’s first oil billionaire, said, “Owners of sound securities should never panic.” That advice certainly applies to today’s uncertain market.

Getty’s quotation and 800 others are included in my classic collection, “The Maxims of Wall Street.” I took some copies with me on the New England cruise last month, and one attendee, John O’Brien of Florida, bought a copy and read it on the cruise. He came up to me and said, “There’s more education in this book than with four years of college!”

I’m happy to announce that we have sold out of the third edition, and I’ve gone back to press with the new fourth edition. The new edition mentions more than a dozen new quotations and authors. For 30 years, I’ve been painstakingly collecting all the wise old adages, proverbs, humor and legends on Wall Street, based on in-depth interviews with old timers, reading rare financial books and my own experiences of more than 40 years in the financial markets. They include famous lines from Warren Buffett (“If you wait to see the Robin sing, Spring may be over”)… J. P. Morgan (“Troubled waters make for good fishing”)… Richard Russell (“In a bear market, the winner is he who loses the least”)… and Steve Forbes (“Everybody is a long-term investor until the market goes down”).

I divide the book into various categories: beating the market, diversification vs. concentration, value vs. growth, bulls vs. bears, black swan events… doomsayers and Cassandras… hot tips and inside information… chartists vs. fundamentalists… taxes and tax havens… inspiring “pearls of wisdom” and even a few short stories.

The book has been endorsed by Warren Buffett, Jack Bogle, Dennis Gartman, Alex Green, Richard Band and Bert Dohmen. “Maxims” is nearly 300 pages long. The retail price on Amazon is $24.95, but my subscribers pay only $20 for the first copy, and all additional copies are only $10 each. All are personally autographed and mailed to you for free (I pay the postage). For all foreign orders outside the United States, add $10 per book.

I’m offering this “half-off” deal because I know “Maxims” makes a great gift for friends, relatives, business colleagues, investors, your favorite stockbroker and money manager. Many people order a whole box (32 copies). The price of a box of books is only $300 postpaid. As Hetty Green, the first female millionaire, said, “When I see something cheap, I buy a lot of it!” To order your copies at this super discount, call Ensign Publishing toll-free at 1-866-254-2057 or go to www.miracleofamerica.com/maxims.

You Blew It! Biographer Abandons Free-Market Economists

“Free market capitalism requires substantial progressive income and estate taxation.” — Lanny Ebenstein, “Chicagonomics: The Evolution of Chicago Free Market Economics,” p. 202.

It’s always a sad day in the freedom movement when a scholar abandons his free-market principles. It has happened to a few people in my lifetime, such as Paul Craig Roberts, a former economist for Senator Orrin Hatch, rejecting free trade; and Bruce Bartlett, a staffer for Ron Paul, Jack Kemp and President Ronald Reagan, abandoning supply-side economics.

Now along comes Lanny Ebenstein, biographer of two giants of free-market economics, Milton Friedman and Friedrich Hayek, who uses his latest history book, “Chicagonomics,” to promote his own agenda of progressive taxation on the rich. Prior to this time, his works on Friedman and Hayek were models of first-rate and comprehensive scholarship without imposing his own philosophy.

But that all changed in this latest work on the story of the Chicago school of economics. Apparently living in Santa Barbara, California, a haven of radical egalitarianism, Ebenstein has convinced himself that it’s time to abandon the “extreme” laissez faire views of Milton Friedman and other libertarians and to promote a variety of socialistic proposals to reduce inequality of wealth.

In his conclusion, which strangely is entitled “Current Applications of Chicagonomics,” he lists 13 policies that the United States should adopt. They include imposing a 70% tax on the super wealthy; setting a 77% federal estate tax on estates worth more than $100 million (oddly enough, Lanny refuses to call these rates “confiscatory!”); raising the federal minimum wage by 65% to $12 an hour; encouraging more unions in the private sector; and keeping interest rates “permanently” low. I don’t know a single economist of the Chicago school of Milton Friedman who would support any of these policies.

His list reminds me of a book by his favorite Chicago economist, Henry Simons, called “Economic Policy for a Free Society.” In this ironically titled book, Simons calls for nationalization of the railroads, utilities and other “uncompetitive” industries. Interestingly, according to Milton Friedman, the policy views of Simons and Keynes were the most similar. (See pp. 393-394 of my book “The Making of Modern Economics,” 2nd ed.)

Ebenstein even calls Milton Friedman “a man of the left.” What was Lanny smoking when he wrote that?

It looks like Lanny Ebenstein has abandoned the Chicago school of Milton Friedman and become a Keynesian economist himself. That’s a great tragedy, because the book itself is fascinating and full of stories, interviews and observations worth reading.

In case you missed it, I encourage you to read my e-letter column from last week about the lesson economists can learn from Wall Street. I also invite you to comment in the space provided below my Eagle Daily Investor commentary.

Good investing, AEIOU,

![]()

Mark Skousen

Presidential Fellow, Chapman University

Wikipedia

Newsletter and trading services

Personal website

Upcoming Conference

New Orleans Investment Conference, Oct. 28-31, New Orleans Hilton Hotel

Join me for the “granddaddy of all investment conferences.” Other speakers include Charles Krauthammer, Mark Steyn, Jim Rickards, Marc Faber, Dennis Gartman and Robert Prechter, among many others. Register now to save. Call toll-free 1-800-648-8411, or go to www.neworleansconference.com. Be sure to mention you are my subscriber.