Don’t Get Mad, Get Even: How Main Street Can Occupy and Profit from Wall Street

“The door to the American Millionaire’s Club is not locked.” — J. Paul Getty, America’s first billionaire

I gave my Presidential Fellow address last night at Chapman University to an enthusiastic crowd on the vital subject, “Main Street vs. Wall Street: The Stock Market as the Best Example of Democratic Capitalism.”

I begin with a short history of how Wall Street has gradually offered better opportunities for the middle class and how low-income earners can participate in the stock market and play the rich man’s game. Since the 1920s, small investors have been able to buy stocks through mutual funds. Then in the 1950s, Merrill Lynch started promoting stocks as a way for the small investor to get rich. In the 1970s, the financial revolution began with Charles Schwab offering the first discount brokerage services.

Today, the commissions on stocks and the fees for mutual funds have dropped substantially and are close to zero. This means that practically anyone can invest with the Rockefellers and the Romneys. My wife and I wrote a book on the subject in the early 1980s, “High Finance on a Low Budget.”

The Roth IRA: Not for the Rich!

Many critics of Wall Street complain that all the breaks and the bailouts went to the fat cats on Wall Street. Not so. The Roth IRA is a great vehicle for the middle class and low-income crowd to invest in the stock market. It allows investments of up to $5,000 a year to earn capital gains and dividends tax-free. Investors then can withdraw their money at retirement without paying any taxes.

The Roth IRA is not available to anyone earning more than $100,000 a year. So it’s a break for the small investor only.

I suggested to the audience that the Occupy Wall Street crowd could buy stocks in all the bailed-out banks, hedge funds and private equity firms to profit from the bailout. I call it the “Don’t Get Mad, Get Even” strategy. I suggested investing in Bank of America (BAC), Goldman Sachs (GS) and even Fannie Mae (OTCBB: FNMA), which has skyrocketed nearly 1,000% in the past year!

In sum, the small investor doesn’t have to sit by idly and see only the so-called 1% highest earners profiting from Wall Street.

Average American is Not Investing in the Stock Market

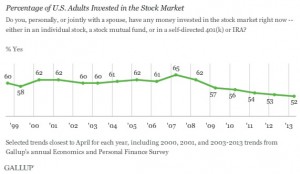

But sadly, the average American is not participating in the rally on Wall Street. According to Gallup, only 52% of Americans are stock market investors, the lowest level in 20 years.

It is time for President Obama and Congress to start promoting IRAs and other investment programs for the middle- and lower-income citizens rather than taxing the rich. All students should take a class in personal finance and learn more about how the stock market works and how to get rich by investing prudently, as well as by encouraging them to save and invest rather than spend and go into debt.

You Blew It! TSA Finally Does Something Good

“Sometimes there’s almost no one in regular lines and we’re all backed up at Pre-check.” — Complaining traveler

At my age, I prefer to travel first or business class. I can afford it, and it feels good to spend my heirs’ inheritance.

One of the benefits lately is that the TSA has made a deal with the airlines to allow first and business class passengers and frequent flyers to use the “pre-check” TSA lines to expedite going through the terribly slow and inefficient security system at the airports. You don’t have to remove your shoes or your computer, and it’s much more streamlined.

TSA officials hope that the experience will encourage more travelers to sign up to become “trusted” travelers. I’m not sure anyone would want to sign up and go through the process, which requires a “big brother” background check and a personal interview with a federal government agent, when they can get the service for free.

Now those who signed up for the TSA Pre-check are complaining about the interlopers.

Frankly, I think the solution is to allow all travelers to go through the simplified system. I just returned from a trip abroad and all of the foreign airports have a simplified system, so why not adopt it in the good ol’ USA? It is sad that the United States is becoming known as the most inefficient security system in the world.

We will be discussing this and other “big brother” issues at this year’s FreedomFest. Come join us!

In case you missed it, I encourage you to read my e-letter from last week on Eagle Daily Investor about how China should prosper in the years ahead. I also invite you to comment about my column in the space provided below my Eagle Daily Investor commentary.

Yours for prudent investing, AEIOU,

![]()

Mark Skousen

Wikipedia

Newsletter and trading services

Personal website

FreedomFest

Upcoming Appearance

Join me for the Las Vegas Money Show, May 12-15, at Caesars Palace. Register free as my guest. My U.S. and Canadian subscribers should call 1-800-970-4355 and mention priority code 034861. I also encourage you to sign up for my subscribers-only private meeting at 1 p.m., Tuesday, May 13, in Forum 21/22, at Caesars Palace. Space is limited for the private meeting, so please sign up as soon as possible. Also check the MoneyShow schedule for my presentations on private equity investing and income investing.