Can ‘It’ Happen Again?

“We will not have any more crashes in our time.”

— John Maynard Keynes (1926)

All last year a prominent ad ran in Yahoo Finance and elsewhere predicting an “80 Percent Collapse in Stocks.” A lot of Cassandras are wiping the egg off their faces, having predicted another stock market crash, economic depression or a dollar collapse.

None of those prognosticators are coming forward with a mea culpa. No doubt fear sells more than greed.

Today is the 30th anniversary of the stock market crash on Black Monday, October 19, 1987, the worst crash in Wall Street history — the Dow fell over 500 points, or 22.6%, equivalent to 5,000-point drop today. It may be a dim memory for most of you, but for me it was as vivid as yesterday. It happened to be my 40th birthday. (In honor of my birthday this year, the Huffington Post published an interview with some of my economic insights and a timeline of my accomplishments. You can read the interview here.) However, few of my friends on Wall Street were smiling at the party my wife put together that day. One broker friend had a $5 million margin call, and wasn’t sure if his customer was going to make it. (He eventually did.)

I was lucky enough to anticipate this “first-class catastrophe,” as one historian calls it. Six weeks before, I sent out a special alert to my Forecasts & Strategies subscribers with the headline, “Sell all stocks.” This morning, I was live with CNBC’s Rick Santelli to remember the stock market crash from 1987, you can watch the video here.

The Fed and Wall Street Fight Against Another Crash

Can “It” happen again? I’ve never issued a similar “sell all” recommendation since then. That’s because the federal government has put in place several roadblocks to keep a crash from happening again. The government can’t stop bear markets, but can keep an all-out panic from occurring.

After the 1987 crash, the Securities and Exchange Commission imposed circuit breakers that stop trading when the market falls by a certain percentage. Under the current rules, adopted in 2012, market-wide circuit breakers kick in when the S&P 500 Index drops 7 percent (Level 1), 13 percent (Level 2) and 20 percent (Level 3) from the prior day’s close. It requires the markets to stop trading for 15 minutes, or longer.

The federal government also can intervene in the stock market to keep it from collapsing. After the 1987 crash, President Ronald Reagan signed an executive order creating The Working Group on Financial Markets, commonly known as the Plunge Protection Team. It was active in the 2008 financial crisis, although it said it did not buy stocks directly. Germany has a similar agency called the Federal Agency for Financial Market Stabilization.

I wouldn’t go so far as repeating British economist John Maynard Keynes’ blunder when he told Swiss banker Felix Somary in 1926, “There will not be any more crashes in our time.” Three years later in October 1929, the stock market crashed.

But I do think that we are “crash resistant.”

Another major bear market is certainly possible. Right now, stocks are hitting all-time highs due to the Fed’s easy money policies, and benefitting from a lot of lucky breaks in the economy and geopolitics. Interest rates remain at historically low levels, which justifies higher asset prices including real estate. But when real interest rates rise, watch out!

By most historical measures, stock prices are fully valued or even overvalued. I’m sure another bear market is coming. We just don’t know when. While we wait, let’s stay fully invested, but let’s have protective stops in place 20% below current prices. That will protect us on the downside.

Warning from Harry Schultz and Jim Rogers

Investment writer Harry D. Schultz once warned, “Never underestimate the size of a panic, nor the power of politicians.” More recently, commodity guru Jim Rogers told us at this year’s FreedomFest, “If you are not worried, you are not knowledgeable.”

These quotations can be found in the latest edition of “The Maxims of Wall Street.” It contains over 800 valuable quotes on bull and bear markets, crashes and panics, fundamental vs. technical analysis, gold bugs, contrary investing and many short stories and anecdotes.

“Maxims” is now in its 5th edition. Alex Green says it’s a classic, Warren Buffett considers it his favorite quote book, and Dennis Gartman has it on his desk to quote from it in his monthly newsletter. “Maxims” makes a great gift to friends, relatives, brokers and clients.

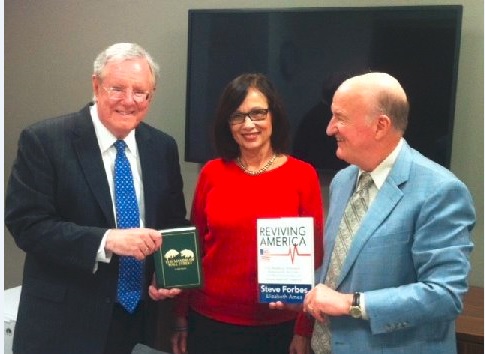

Here’s a picture of Steve Forbes holding my book, “Maxims of Wall Street.” My favorite quote of his: “Everyone is a disciplined, long-term investor… until the market goes down!”

Copies are available for only $20 for the first copy, and all additional copies are only $10 each. I autograph each copy and pay the postage. (For orders outside the United States, add an additional $15.) To order your copies, call Harold at Ensign Publishing toll-free1-866-254-2057, or go to www.miracleofamerica.com.

In case you missed it, I encourage you to read my e-letter from last week about a great way to boost your retirement income.

Upcoming Conferences

New Orleans Investment Conference, New Orleans Hilton, Oct. 25-28: I’ve spoken at this “granddaddy of hard-money conferences” since 1977! This year’s keynote speakers include Fox News host Tucker Carlson, Fox contributor Charles Krauthammer, real estate mogul Robert Kiyosaki and commodity guru Dennis Gartman. For full information, go to http://neworleansconference.com/wp-content/uploads/2017/07/NOIC2017_skousen.html or call toll-free 1-800-648-8411. Be sure to mention you are a subscriber of mine for a discount on the registration fee.

Live Long and Prosper

“A long life may not be good enough, but a good life is long enough.”

— Ben Franklin (Poor Richard’s Almanac)

Turning 70 today made me think of a session we had at this year’s FreedomFest called “Live Long and Prosper: The Possibility of Physical Immortality,” led by Jose Cordeiro, one of the instructors at Singularity University involved in the Methuselah Project. Jose firmly believes that within the next 20 years, the science of life extension will advance so much that we will be able to live forever.

Michael Shermer, editor of Skeptic magazine and a columnist for Scientific American, and science fiction writer and astrophysicist David Brin were Doubting Thomases. “The science is just not there yet,” declared Shermer. Brin is even more critical. He compares the search for eternal life to building another Tower of Babel (Genesis 11), hubris of the worst kind (and look what happened the first time humans tried it).

Brin wrote me, “Living forever? Yeah, we’ve already plucked the low hanging fruit of longevity. None of the things that make mice or flies live longer will do much for us.“ But he held out the possibility that “our grandchildren may make a huge breakthrough… if the [artificial intelligence] let them!”

Me? I’m in good shape. This morning my wife and I had a vigorous bike ride and then I did 40 push-ups. They say that a long life can be achieved if one enjoys the good life — good genes, good marriage, good friends and family, good goals, a good financial condition, a good diet/exercise program and a good relationship with God. With my family, my friends, my books, my conferences and my church, I wake up every day excited about the future.

My goal is to reach my next Fibonacci number. But when it is time to go, I prefer the next life, and the Resurrection!