Beating the Market: Surprise, Surprise, the Monkeys Win!

“A blindfolded monkey throwing darts at a newspaper’s financial pages could select a portfolio that would do just as well as one carefully selected by experts.”

–Burt Malkiel, “A Random Walk Down Wall Street”

On the first day of my “Financial Economics” class at Chapman University, I ask the students to pick one single stock that they think will perform the best. Then, in the spirit of Burton Malkiel’s textbook, “A Random Walk Down Wall Street,” the students individually throw a dart at a page containing a list of 1,000 stocks published in the Wall Street Journal. Whatever stock they hit is included in a “dart stock portfolio.”

At the end of the Spring semester three months later, I average the return of all the stock picks by the students and then by the darts to see if these two portfolios can beat the overall market index. We just finished the Spring semester, and guess who won?

This time, Wall Street was in a bear market. The S&P 500 Index was down 5.9% over this time. The student stock index fell 11.7%, but the dart portfolio was up slightly by an average of 0.5%.

Amazed? Shocked? Surprised? We all were.

However, I was able to explain how the results actually made sense. Why did the students’ index underperform? Because most of the students chose “growth” stocks to maximize their chances of winning. Growth stocks tend to be volatile and do worse during a bear market. (Two years ago, during a bull market, the Chapman students handily beat the market for the same reason.)

It also makes sense that the random dart portfolio beat the market.

A couple weeks ago, I invited the award-winning financial wizard Rob Arnott, president of Research Affiliates, a Newport Beach fund advisor which manages over $200 billion in institutions such as PIMCO, to address our class. He and his colleagues have written some remarkable papers, including one entitled, “The Surprising Alpha from Malkiel’s Monkey and Upside Down Strategies,” published in 2013.

In this article, Arnott and his colleagues describe how they simulated Malkiel’s claim quoted at the top of this column — that an untrained monkey throwing darts a newspapers’ stock pages could craft a successful portfolio just as well as any expert would be able to.

To do this, the authors randomly select 30 stocks from a list of the top 1,000 stocks by market capitalization, weighting each pick equally. They then repeated the process 100 times and examined both the individual year trials and the trials’ average.

The result? Amazingly, on average, 96 of the 100 “monkey” portfolios beat a generic cap-weighted index and outperformed the benchmark index by an average of 1.7% per year.

The reason Arnott and his fellows were able to reach this conclusion — and why my students were able to simulate it — is because if you choose any portfolio of 30 stocks randomly selected from the list of 1,000 stocks, the majority are bound to include mostly smaller companies. Since small companies tend to outperform big companies, Malkiel’s monkey portfolio will be naturally inclined to beat the market. Voila! The monkey dart index wins!

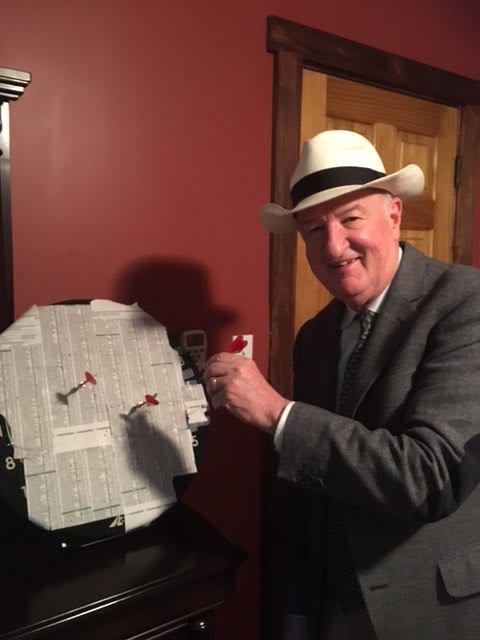

Mark Skousen attempts to simulate Burt Malkiel’s “monkey” portfolio.

Arnott to Attend FreedomFest in July

Good news! Rob Arnott, who the Wall Street Journal calls “the godfather of smart beta,” will be joining us at this year’s Fast Money Summit in Las Vegas, July 11-14, as part of FreedomFest. He and Gary Smith, professor of finance at Pomona College and author of “The Money Machine,” will discuss “Puzzles and Paradoxes in Finance: How to Profit from CRAZY Anomalies on Wall Street.” I will be moderating this most creative panel.

For all the details about the Fast Money Summit, go to https://www.markskousen.com/landing-pages/fast-money-summit/.

Everyone coming to the Fast Money Summit will receive a complimentary copy of “A Viennese Waltz Down Wall Street,” plus a ticket to a private reception to meet with Steve Forbes and John Mackey (CEO, Whole Foods Market), as well as get a free ticket to FreedomFest.

You need to hurry, though, the special room assigned to the Fast Money Summit is almost full (maximum attendance is 500). To sign up and get $100 off the retail price, use coupon code EAGLE100 and register at www.freedomfest.com. Or, call toll-free 1-855-850-3733, ext. 202. Find out why it’s Steve Forbes’ favorite conference. It is less than two months away. Join us!

You Blew It! California Legislators Suffer Sun Stroke

The California Energy Commission (CEC) just voted 5-0 to add some new provisions to the state’s building code. Among them is the requirement that, as of 2020, all new house and multi-family residences of three stories or fewer, along with all major renovations, must have solar panels installed as part of building process. California is the first state to have such a mandate.

The CEC decision will cost between $8,000 and $12,000 to install, to be offset with lower energy bills in the long run. However, has anyone calculated the cost in electricity and air pollution to build these solar panels?

The University of California-Berkeley’s Severin Borenstein sent a letter to CEC Commissioner Robert Weisenmiller arguing that “residential rooftop solar is a much more expensive way to move towards renewable energy than larger solar and wind installations.”

Rooftop solar installations generate energy at anywhere from two to six times the cost of energy from big renewable energy farms. It will increase dramatically the cost of new housing in a state that is already in the midst of a housing crisis.

This decision is taking away consumer choice. Persuasion over force is the sign of a civilized society. If that’s true, we have just become a little less civilized in California.

This is yet another reason to leave the Golden State.