Arnie vs. Jack: Who Was the Better Investor?

Originally published May 28, 2020

“I’d rather win one big tournament in my entire life than make the cut every week.” — Arnold Palmer (p. 163, “Maxims of Wall Street”)

I’ve played golf most of my life and have always enjoyed the sport once I stopped keeping score!

I especially remember the invitation I received from a member (and subscriber) to play at the famous Augusta National Golf Club, where they play the Masters. I can never forget when I sat in President Dwight D. Eisenhower’s chair at dinner.

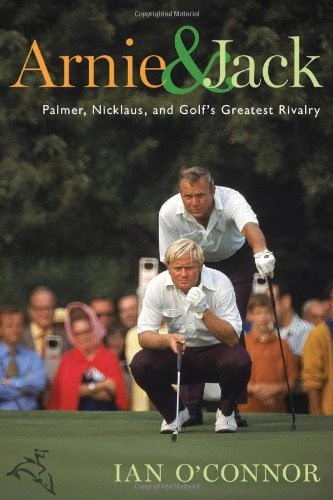

I just finished reading a fascinating story of one of the greatest rivalries in sports. Arnold Palmer and Jack Nicklaus went head-to-head during the 1960s and 1970s.

Palmer was the more popular of the two because of his humble background (he was the son of a greenskeeper) and his plain-spoken charisma.

Palmer won four green jackets at the Masters and seven major titles. He also did more than anyone to popularize the game of golf.

Nicklaus is considered the greatest golfer of all time, as he won 18 major championships, three more than Tiger Woods, and is both the youngest and the oldest golfer to win the Masters in Augusta.

Palmer, “the King,” was 10 years older than Jack, “the Golden Bear,” so the rivalry didn’t last long. However, it remained intense even after their playing days were over.

From an investor’s point of view, Palmer and Nicklaus couldn’t have been more different, both on the golf course and in business.

Palmer was aggressive and became famous for taking risky shots to come from behind and win a tournament. He hardly ever played it safe, and that cost him a few contests.

Nicklaus was a more conservative and steady performer who had remarkable skills of concentration. Other players constantly complained about how slowly Jack played the course.

Playing the Market: Which Approach Wins?

When it comes to managing your portfolio, which style is better?

The unemotional Nicklaus approach is probably better suited for most investors than the high-risk gambling style of Palmer.

The conservative investor will engage in dollar-cost averaging. He or she will also invest in index funds and not panic during a crisis.

But then all work and no play makes Jack a dull boy.

As George Soros says, “If investing is entertaining, if you’re having fun, you’re probably not making any money. Good investing is boring.”

Sorry, George, but I am more in Arnie’s Army as I love the high-risk stakes of speculating in individual stocks, timing the market and occasionally profiting big. Investing must be exciting to keep my interest.

I do keep most of my investment portfolio in index funds, well-managed mutual funds and exchange-traded funds (ETFs). But I like to speculate with some of my money. It makes for good conversation at cocktail parties.

They Take an Opposite Approach in Business, Too

Interestingly, Arnie’s and Jack’s approach to golf were totally different from their approach with regards to business.

Palmer’s businesses were conservatively managed by Mark McCormick. He built a fortune worth around $875 million from endorsements, appearances, licensing and course design fees. Even after his death, his businesses earn $40 million a year.

It is a different story with Jack Nicklaus. His business endorsements and financing of golf courses turned into a fiasco. At one point, he owed more than $100 million and considered filing for bankruptcy until he worked out a deal with the banks.

In sum, the game of sports is not the same as the game of business. Just because you are successful in one doesn’t mean you will be successful in the other.

The same is true for businesspeople. My #1 lesson is: “The business of investing is not the same as investing in a business.” Many a successful business person can end up bankrupt by taking foolish chances on Wall Street.

The above quotes from Arnold Palmer, George Soros and myself are taken from the new 10th Anniversary Edition of “The Maxims of Wall Street.”

Dennis Gartman said it best, “It’s amazing the depth of wisdom one can find in just one or two lines from your book. I have it on my desk and refer to it daily.”

Jack Bogle, the legendary founder of the Vanguard Group of funds, wrote, “What a treat! It’s great to have all these sayings in a single spot.”

A subscriber and I enjoy reading quotes from the “Maxims” on a cruise ship.

I offer a super bargain price for the “Maxims.” The first copy is $20, and all additional copies are $10 each. I autograph each copy, number them, and mail them at no extra charge. If you order a box (32 copies), you pay only $300.

To order. go to www.skousenbooks.com.

You Nailed It!

Legacy of a Bipartisan Politician: Former Gov. Pete DuPont Changed the World for the Better with a 90% Approval Rating!

“He rescued his bankrupt state during two terms as governor by applying classic Reagan conservatism: cutting taxes, deregulating, restraining spending and expanding economic opportunity.” – John Fund

Today’s tribute goes to a lifelong politician from the state of Delaware. No, I’m not talking about President Joe Biden.

Former Delaware Gov. Pete du Pont passed away on Saturday at the age of 86. He left behind a unique legacy — turning around a debt-ridden state into the envy of his neighbors, and he accomplished this goal by working across the aisle with complete public support.

He left his job as the heir apparent to the DuPont chemical company, went to Harvard Law School and won a Congressional seat for three terms.

Then, he decided to run for governor in 1976. The New York Times reported, “The state was deep in debt, its tax base was shrinking and its unemployment and tax rates were among the nation’s highest. No governor in 20 years had survived more than one term.”

Pete won the election, and soon wisely struck a deal with the Democrat-controlled legislature. This brought real change.

Gov. Pete Dupont. Image courtesy of Delaware Public Archives.

The New York Times wrote, “He signed into law two income tax cuts, the first in Delaware’s modern history and a constitutional amendment that limited government spending and future tax increases. He also recruited talented professionals for top state posts, and he pursued new businesses for the state with generous tax incentives and deregulation to set the stage for prosperity.”

He was reelected in 1980 with 71% of the vote. He put Delaware on the map as a financial paradise, especially for credit card companies, by eliminating usury restrictions. A law intended to attract two banks and 1,000 jobs to Delaware eventually drew 30 banks to the state, creating 43,000 financial service jobs.

When he left office (due to term limits) in 1985, the state’s economy was humming, with unemployment down to 7% from a high of 13%. The top tax rate had been cut in half, and the state’s budgets had been balanced during every year of his tenure. Even the Democrats praised his performance.

Pete du Pont set his heights higher by running for president in 1988, but he lost out to George Bush. He would have been smarter to run against Joe Biden in the Senate.

He spent his remaining years advocating many initiatives that would make America great again, including school choice, privatization of Social Security, replacing the welfare program with a “workfare” system and enacting major expansion of the Earned Income Tax Credit. I recommend you read John Fund’s tribute here.

Has any other governor ever gotten a 90% approval rating while in office? Not even FDR or Reagan did that while they served as governor of their respective states. It is truly amazing to see a political leader bringing people together, even though it is something we seldom see today. I agree with John Fund. We need more quiet, bipartisan and influential statesmen like Pete du Pont.

I met Pete only once or twice during the Benjamin Franklin family reunion in 2006. He was the most gracious person in the room. Ben

Franklin would have been proud!

We will be dedicating a room to Pete du Pont at this year’s FreedomFest. I urge you to join us at www.freedomfest.com.